Half Yearly Report

August 23 2010 - 1:00AM

UK Regulatory

TIDMBVS

RNS Number : 4382R

Bovis Homes Group PLC

23 August 2010

BOVIS HOMES GROUP PLC

HALF-YEARLY FINANCIAL REPORT

for the six months ended 30 June 2010

Issued 23 August 2010

The Board of Bovis Homes Group PLC today announces its interim results for 2010.

· Profit before tax of GBP3.5 million (2009 H1: loss before tax of GBP8.6

million)

· Earnings per share of 1.8p (2009 H1: loss per share of 5.5p)

· Revenue of GBP115.6 million (2009 H1: GBP122.6 million)

· Board decision to resume declaring dividends at end of 2010 subject to

continuation of current market conditions

· Gross profit margin of 16.3% (2009 H1: 8.1%) with operating margin at 4.2%

(2009 H1: -2.2%)

· Net cash of GBP79 million (31 December 2009: GBP112 million) notwithstanding

significant investment in consented land

· 1,874 consented plots added to the consented land bank during first half of

2010 at a cost of GBP107 million, with future revenue estimated at GBP373

million and potential gross profit of GBP94 million

· 13,113 plots in consented land bank at 30 June 2010 with potential gross

profit calculated using current sales prices and current build costs of GBP412

million (31 December 2009: 12,042 plots)

· Strategic landholdings of 17,270 potential plots (31 December 2009: 16,363

potential plots) with 567 plots converted to consented land bank in first half

of 2010

· Strong build quality and health & safety performance during a period of

increased production

· Strong customer service standards with 95% 'Recommend to a friend or

relative' satisfaction and 93% 'Overall quality of the new home' satisfaction in

latest Group quarterly survey results

Commenting on the results, David Ritchie, Chief Executive of Bovis Homes Group

PLC said:

"The Group has performed well in the first half of 2010, delivering a solid set

of trading results during a period when the housing market has remained

challenging. In addition, the Group has successfully implemented it near term

land investment strategy. Along with continuing the successful conversion of

its strategic land investments, the Group has purchased a considerable amount of

consented land. In total, the Group has added 1,874 consented plots to the land

bank in the first half of 2010, increasing the land bank to 13,113 consented

plots at 30 June 2010. Further, the Group has terms agreed on an additional

c3,000 plots, many of which are anticipated to be acquired in the second half of

2010.

The Group is well positioned to exploit opportunities to expand, with net cash

in hand at 30 June 2010 of GBP79 million and committed bank facilities of GBP150

million which mature in September 2013 and provide the flexibility to support

the Group's land investment ambitions. The Group has the ability to increase

its output capacity and profitability in the future supported by a larger land

bank across an increased number of housing sites, without reliance on a general

housing market recovery. Reflective of this, the Board has agreed to resume

declaring dividends at the end of 2010 subject to the continuation of current

market conditions."

Certain statements in this press release are forward looking statements.

Forward looking statements involve evaluating a number of risks, uncertainties

or assumptions that could cause actual results to differ materially from those

expressed or implied by those statements. Forward looking statements regarding

past trends, results or activities should not be taken as a representation that

such trends, results or activities will continue in the future. Undue reliance

should not be placed on forward looking statements.

Enquiries: David Ritchie, Chief Executive Results issued by:

Andrew Best / Peter Edsinger

Bovis Homes Group PLC

Shared Value Limited

Tel: 020 7321 5010

Tel: 020 7321 5022 / 5038

Interim Management Report

Overview

During the first six months of 2010, the Group has successfully implemented the

preliminary stage of its consented land investment strategy and has also

improved its profit performance in what has continued to be a challenging market

for new homes. Improved legal completion volumes, combined with robust sales

prices and strong cost control, has provided the base for the profit improvement

whilst incurring a higher level of overheads associated with managing the land

investment strategy.

The Group added 1,874 consented plots to its land bank, representing circa one

year of land supply for the Group, in the first half of 2010. These additions

have an estimated future revenue at current sales prices of cGBP373 million and

a potential gross profit of cGBP94 million. This investment has increased the

consented land bank to 13,113 plots at 30 June 2010 (31 December 2009: 12,042

consented plots), some 7 years of consented land supply when measured against

2009 legal completion volumes. The Group has calculated using current sales

prices and current build costs, that the consented land bank has a potential

revenue of cGBP2.1 billion and a potential gross profit of GBP412 million. The

potential gross profit has been enhanced during the first six months of 2010

through the investment in new land.

Notwithstanding the considerable investment in new consented land, the Group

retained net cash of GBP79 million at 30 June 2010 (31 December 2009: GBP112

million). The Group generated GBP48 million of cash inflow from current trading

in the first half of 2010 and expended GBP82 million on land payments. Looking

ahead, the Group anticipates that it will exit 2010 in a net cash position,

subject only to the extent of cash expenditure for consented land purchases in

the second half of the year.

The Group is positive in its view on future expansion and improved profits. In

addition to continuing the successful conversion of its strategic land

investments, the Group believes that significant value will be created through

investment in consented land at a low point in the housing market cycle. Such

investment now will provide an increase in output capacity for the Group,

measured through an increase in active sales outlets in future years, from which

the Group can deliver increased legal completion volumes at improved gross

profit margins without reliance on a housing market recovery.

Market conditions

The housing market was stable during the first half of 2010, with external house

price indices indicating static prices over this period, and the number of

mortgage approvals for home purchase holding steady at between 45,000 and 50,000

approvals per month. The new homes market remained subdued with restricted

levels of mortgage availability, particularly in the first time buyer market,

limiting the number of transactions and constraining sales price improvements.

In the last few weeks of the half year, after the General Election and the

Budget, the market became more fragile. The Group, therefore, remains cautious

in its expectations of transaction volumes and sales prices in the short term

given the low levels of consumer confidence at this time and the ongoing

challenges in the mortgage market.

Income statement

The Group generated GBP128.5 million of income in the first half of 2010, an

increase of 5% on the comparable period in 2009 of GBP122.6 million. Of this

income, GBP12.9 million has not been recognised in revenue in the financial

statements for the first half of 2010. This is due to the fact that the Group

holds a 50% equity interest in a private rental joint venture (described further

below) into which the Group has sold a portfolio of its new homes. This income

will be recognised as and when the joint venture investment is disposed. As a

result, the Group's reported revenue for the first half of 2010 was GBP115.6

million (2009: GBP122.6 million). The Group chose not to sell any development

land during either the first half of 2010 or the first half of 2009.

The Group legally completed 803 homes in the first half of 2010 (2009: 754

homes). Of these, 762 homes were private, a 3% increase on the comparable

number of 738 private homes in the first half of 2009. The Group delivered 41

social homes (5% of total legal completions) in the first half of 2010, as

compared to 16 social homes (2% of total legal completions) in the first half of

2009.

For private homes legally completed in the first half of 2010, the Group

achieved an average net sales price of GBP163,500, as compared to GBP160,400 in

the first six months of 2009. Taking account of mix and including the reducing

effect on the current year average of the stock sale to the joint venture, the

underlying sales price improvement was around 3%. Overall, including social and

partnership homes, the average sales price achieved by the Group for the six

months ended 30 June 2010 was GBP158,500 compared with GBP159,700 in the first

half of 2009. This decrease reflected the increased contribution from social

housing in the first half of 2010.

The Group achieved a gross margin of 16.3% as compared to a pre exceptional

items gross margin of 16.2% in the first half of 2009 (gross margin of 8.1%

after exceptional items), a slight improvement associated with increased sales

prices more than offsetting the increased land cost arising from the land

inventory provision write back recognised at the end of 2009. At the half year,

lower construction costs have not benefited the margin significantly as they are

more associated with recent build contracts. The income statement benefit from

these cost savings will become more significant in the second half of 2010 and

into 2011 as units built under these contracts are legally completed.

With the increased level of investment in land acquisition and the related costs

of processing, and given the Group's prudent policy of charging such costs to

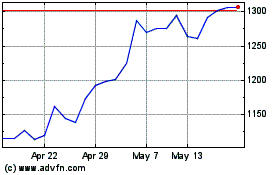

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

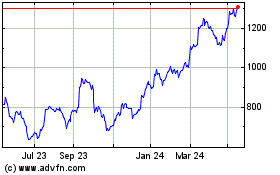

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024