Half Yearly Report -5-

August 23 2010 - 1:00AM

UK Regulatory

| | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Liabilities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Bank and other loans | 10,562 | | 12,797 | | 2,337 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Trade and other payables | 42,050 | | 28,490 | | 23,077 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Retirement benefit | 12,170 | | 11,050 | | 8,910 | |

| obligations | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Provisions | 2,146 | | 1,950 | | 1,700 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Total non-current | 66,928 | | 54,287 | | 36,024 | |

| liabilities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Trade and other payables | 120,800 | | 79,661 | | 87,698 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Provisions | 1,647 | | 1,547 | | 2,164 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Current tax liabilities | 1,500 | | - | | - | |

+-----------------------------+----------+--+----------+--+----------+--+

| Total current liabilities | 123,947 | | 81,208 | | 89,862 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Total liabilities | 190,875 | | 135,495 | | 125,886 | |

+-----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Total equity and | 883,671 | | 758,225 | | 818,452 | |

| liabilities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

These condensed consolidated interim financial statements were approved by the

Board of directors on 20 August 2010.

Bovis Homes Group PLC

Group statement of changes in equity

+----------------------------+-----------+--+---------+----------+----------+--+

| (unaudited) | Total | | Issued | Share | Total | |

| | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| For the six months ended | retained | | capital | premium | | |

| 30 June 2010 | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| | earnings | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| | GBP000 | | GBP000 | GBP000 | GBP000 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Balance at 1 January 2009 | 414,654 | | 60,497 | 157,127 | 632,278 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Total comprehensive income | (9,744 | )| - | - | (9,744 | )|

| and expense | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Deferred tax on other | (19 | )| - | - | (19 | )|

| employee benefits | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Issue of share capital | - | | 17 | 101 | 118 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Share based payments | 97 | | - | - | 97 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Balance at 30 June 2009 | 404,988 | | 60,514 | 157,228 | 622,730 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Balance at 1 January 2009 | 414,654 | | 60,497 | 157,127 | 632,278 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Total comprehensive income | 459 | | - | - | 459 | |

| and expense | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Deferred tax on other | (2 | )| | | (2 | )|

| employee benefits | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Issue of share capital | - | | 6,073 | 53,054 | 59,127 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Share based payments | 704 | | - | - | 704 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Balance at 31 December | 415,815 | | 66,570 | 210,181 | 692,566 | |

| 2009 | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Balance at 1 January 2010 | 415,815 | | 66,570 | 210,181 | 692,566 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Total comprehensive income | (12 | )| - | - | (12 | )|

| and expense | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Deferred tax on other | (2 | )| | | (2 | )|

| employee benefits | | | | | | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Issue of share capital | - | | 37 | 217 | 254 | |

+----------------------------+-----------+--+---------+----------+----------+--+

| Share based payments | (10 | )| - | - | (10 | )|

+----------------------------+-----------+--+---------+----------+----------+--+

| Balance at 30 June 2010 | 415,791 | | 66,607 | 210,398 | 692,796 | |

+----------------------------+-----------+--+---------+----------+----------+--+

Bovis Homes Group PLC

Group statement of cash flows

+-----------------------------+----------+--+----------+--+----------+--+

| For the six months ended 30 | Six | | Six | | Year | |

| June 2010 | months | | months | | ended | |

| | ended | | ended | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| (unaudited) | 30 June | | 30 June | | 31 Dec | |

| | 2010 | | 2009 | | 2009 | |

+-----------------------------+----------+--+----------+--+----------+--+

| | GBP000 | | GBP000 | | GBP000 | |

+-----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Cash flows from operating | | | | | | |

| activities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Profit/(loss) for the | 2,393 | | (6,576 | )| 3,490 | |

| period | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Depreciation | 328 | | 420 | | 769 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Impairment of assets | 247 | | - | | 245 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Financial income | (1,363 | )| (764 | )| (2,304 | )|

+-----------------------------+----------+--+----------+--+----------+--+

| Financial expense | 2,634 | | 6,708 | | 16,375 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Loss/(profit) on sale of | 4 | | (10 | )| 3 | |

| property, plant and | | | | | | |

| equipment | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Equity-settled share-based | (10) | | 97 | | 704 | |

| payment (credit)/expense | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Income tax expense/(credit) | 1,126 | | (2,031 | )| 1,307 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Write-down/(release) of | - | | 8,895 | | (2,664 | )|

| inventories | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Share of results of joint | 30 | | - | | - | |

| ventures | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Add back of profit not | 963 | | - | | - | |

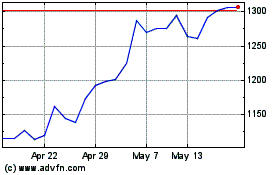

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2024 to Aug 2024

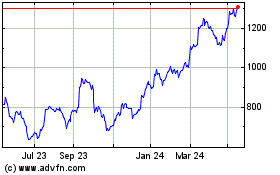

Vistry (LSE:VTY)

Historical Stock Chart

From Aug 2023 to Aug 2024