Half Yearly Report -8-

August 23 2010 - 1:00AM

UK Regulatory

performed were GBP29,575 (six months ended 30 June 2009: nil; year ended 31

December 2009: nil). In addition, a loan of GBP1,450,355 (six months ended 30

June 2009: nil; year ended 31 December 2009: nil) was provided to Bovis Peer LLP

on an annual interest rate of LIBOR plus 2.4%. Interest charges made in respect

of the loan were GBP11,674 (six months ended 30 June 2009: nil; year ended 31

December 2009: nil).

Transactions between the Group and key management personnel in the first half of

2010 were limited to those relating to remuneration, previously disclosed as

part of the Group's Report on directors' remuneration published with the Group's

Annual report and accounts 2009. No material change has occurred in these

arrangements in the first half of 2010.

Mr Malcolm Harris, a Group Director, is a non-executive Director of the Home

Builders Federation (HBF) and was a non-executive director of the National

House-Building Council (NHBC) until 26 June 2010. The Group trades in the

normal course of business, on an arms-length basis, with the NHBC for provision

of a number of building-related services, most materially for provision of

warranties on new homes sold and for performance bonding on infrastructure

obligations. The Group pays subscription fees and fees for research as required

to the HBF.

+--------------------------+----------+-+----------+-+------------+-+

| (unaudited) | Six | | Six | | Year | |

| | months | | months | | ended | |

| | ended | | ended | | | |

+--------------------------+----------+-+----------+-+------------+-+

| | 30 June | | 30 June | | 31 | |

| | 2010 | | 2009 | | December | |

| | | | | | 2009 | |

+--------------------------+----------+-+----------+-+------------+-+

| | GBP000 | | GBP000 | | GBP000 | |

+--------------------------+----------+-+----------+-+------------+-+

| NHBC | 834 | | 291 | | 724 | |

+--------------------------+----------+-+----------+-+------------+-+

| HBF | 68 | | 73 | | 78 | |

+--------------------------+----------+-+----------+-+------------+-+

There have been no related party transactions in the first six months of the

current financial year which have materially affected the financial performance

or position of the Group, and which have not been disclosed.

9 Reconciliation of net cash flow to net cash/(debt)

+----------------------------+----------+--+----------+--+----------+--+

| (unaudited) | Six | | Six | | Year | |

| | months | | months | | ended | |

| | ended | | ended | | | |

+----------------------------+----------+--+----------+--+----------+--+

| | 30 June | | 30 June | | 31 Dec | |

| | 2010 | | 2009 | | 2009 | |

+----------------------------+----------+--+----------+--+----------+--+

| | GBP000 | | GBP000 | | GBP000 | |

+----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Net (decrease)/increase in | (25,281 | )| (6,843 | )| 102,961 | |

| cash and cash equivalents | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| (Drawdown)/repayment of | (8,305 | )| 101,000 | | 118,000 | |

| borrowings | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Fair value adjustments to | 80 | | (103 | )| (337 | )|

| interest rate swaps | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Movement in refinancing | - | | (1,964 | )| (8,270 | )|

| prepayment | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Net cash/(debt) at start | 112,258 | | (100,096 | )| (100,096 | )|

| of period | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Net cash/(debt) at end of | 78,752 | | (8,006 | )| 112,258 | |

| period | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Analysis of net | | | | | | |

| cash/(debt): | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Cash | 89,314 | | 4,791 | | 114,595 | |

+----------------------------+----------+--+----------+--+----------+--+

| Bank and other loans | (10,305 | )| (19,000 | )| (2,000 | )|

+----------------------------+----------+--+----------+--+----------+--+

| Issue costs | - | | 6,306 | | - | |

+----------------------------+----------+--+----------+--+----------+--+

| Fair value of interest | (257 | )| (103 | )| (337 | )|

| rate swaps | | | | | | |

+----------------------------+----------+--+----------+--+----------+--+

| Net cash/(debt) | 78,752 | | (8,006 | )| 112,258 | |

+----------------------------+----------+--+----------+--+----------+--+

10 Circulation to shareholders

This interim report is be sent to shareholders. Further copies are available on

request from the Company Secretary, Bovis Homes Group PLC, The Manor House,

North Ash Road, New Ash Green, Longfield, Kent DA3 8HQ. Further information on

Bovis Homes Group PLC can be found on the Group's corporate website

www.bovishomes.co.uk/plc including the analyst presentation document which will

be presented at the Group's results meeting on 23 August 2010.

Statement of Directors' responsibility

We confirm to the best of our knowledge:

· The condensed set of financial statements has been prepared in accordance

with IAS34 Interim Financial Reporting as adopted by the EU;

· The interim management report includes a fair review of the information

required by:

(a) DTR 4.2.7.R of the Disclosure and Transparency Rules, being an indication

of important events that have occurred during the first six months of the

financial year and their impact on the condensed set of financial statements;

and a description of the principal risks and uncertainties for the remaining six

months of the year; and

(b) DTR 4.2.8.R of the Disclosure and Transparency Rules, being related party

transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the entity during that period; and any changes in the related

party transactions described in the last annual report that could do so.

For and on behalf of the Board,

David Ritchie

Chief Executive

20 August 2010

Independent review report by KPMG Audit Plc to Bovis Homes Group PLC

Introduction

We have been instructed by the Company to review the condensed set of financial

statements in the half-yearly financial report for the six months ended 30 June

2010 which comprises the Group income statement, Group statement of

comprehensive income, Group balance sheet, Group statement of changes in equity,

Group statement of cash flows and the related explanatory notes. We have read

the other information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of financial

statements.

This report is made solely to the Company in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the Disclosure

and Transparency Rules ("the DTR") of the UK's Financial Services Authority

("the UK FSA"). Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the Company for our review work, for

this report, or for the conclusions we have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been approved

by, the directors. The directors are responsible for preparing the half-yearly

financial report in accordance with the DTR of the UK FSA.

As disclosed in note 1, the annual financial statements of the Group are

prepared in accordance with IFRSs as adopted by the EU. The condensed set of

financial statements included in this half-yearly financial report has been

prepared in accordance with IAS 34 Interim Financial Reporting as adopted by the

EU.

Our responsibility

Our responsibility is to express to the Company a conclusion on the condensed

set of financial statements in the half-yearly financial report based on our

review.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410 Review of Interim Financial Information

Performed by the Independent Auditor of the Entity issued by the Auditing

Practices Board for use in the UK. A review of interim financial information

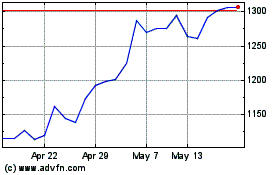

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

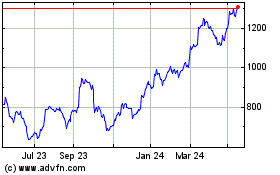

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024