Bovis Homes Group Maintains Solid Sales Rate

November 08 2010 - 1:49AM

Dow Jones News

Bovis Homes Group PLC (BVS.LN), a second tier national British

house building company, said Monday the group has maintained a

solid sales rate for the period from July 1 to Nov. 5 against the

backdrop of a market which continues to be challenging.

MAIN FACTS:

-To Nov. 5, the group has achieved 1,900 home sales which are

anticipated to legally complete during 2010.

-Group currently has over 250 forward sales for legal completion

during 2011, a total which will grow through the remaining eight

weeks of 2010.

-Based on the Group's average number of active sales outlets of

66 for 2010 to date, the group has achieved an average sales rate

per outlet per week of 0.42 homes as compared to 0.37 sales per

outlet per week in the same period of 2009, representing an

improvement of 14%.

-Group has succeeded in achieving sales prices above its

internal target levels during 2010.

-Group expects the average sales price of legal completions in

2010 to be GBP160,000, some 3% ahead of 2009's average sales price

of GBP154,600.

-This, when combined with the initial benefits of construction

cost savings, has generated improvement in both gross profit margin

and operating profit margin.

-Group anticipates that its 2010 operating margin will exceed

the previous year's level of 6.2%.

-Group has acquired a further 1,381 consented plots, of which

92% are located in the south of England, in the second half of the

year to date.

-In total, the group has now added 3,255 consented plots during

2010 at a cost of GBP182 million.

-Land additions to date are anticipated to generate returns in

line with the Group's investment hurdle rates, with revenue of

GBP628 million and gross profit of GBP158 million during their

development period, based on current prices and costs.

-In addition, the group has agreed terms to acquire a further

2,500 plots with many now at an advanced stage in the acquisition

process.

-Net cash position, with GBP14 million of net cash at the end of

October, after land cash payments in 2010 to date of GBP106

million.

-Group anticipates generating net cash inflows during the

balance of 2010 based on the remaining trading activity in the

year.

-Total land cash payments for the 2010 year are expected to be

GBP147 million.

-Group anticipates that its average number of sales outlets

during 2011 will be 76, representing an increase of 15% over

2010.

-Expects market conditions to remain challenging over the coming

months.

-Shares on Friday closed at 350.20 pence.

-By Tapan Panchal, Dow Jones Newswires. Tel +44(0)207-842 9448,

tapan.panchal@dowjones.com

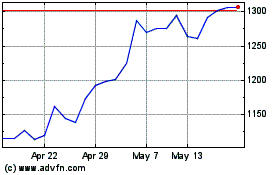

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

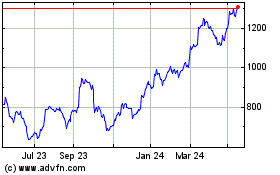

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024