Bovis Homes Group PLC Further Banking Arrangement Agreed (4372M)

August 27 2013 - 1:01AM

UK Regulatory

TIDMBVS

RNS Number : 4372M

Bovis Homes Group PLC

27 August 2013

27(th) August 2013

Bovis Homes Group PLC

Further Banking Arrangement Agreed

Bovis Homes Group PLC is pleased to announce that it has signed

a further GBP50m commitment as part of its banking deal to provide

the Group with additional financial flexibility.

The Group has signed a GBP50m extension to the GBP125 million

committed revolving credit facility agreed in January 2013 taking

the facility to GBP175m in total. Combined with the three year term

loan of GBP25 million entered into in January 2013, the Group now

has GBP200m of facilities in place. The GBP50m extension, with the

existing syndicate banks, expires in December 2015 with the

remaining GBP125m expiring in March 2017.

As at 30 June 2013, the Group retained a robust balance sheet

with net debt of GBP48 million following significant land

investment in H1 2013. This additional facility gives the Group

improved financial flexibility to take advantage of opportunities

in the consented and strategic land market.

-ENDS-

Enquiries:

David Ritchie, Chief Executive

Jonathan Hill, Group Finance Director

Bovis Homes Group PLC

Tel: 01474 876200

Andrew Jaques, Reg Hoare, James White, Giles Robinson

MHP Communications

Tel: +44 (0)203 128 8756

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUOSVROKAWUAR

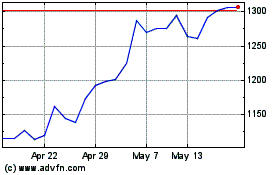

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

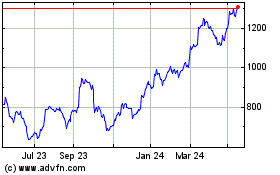

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024