TIDMBVS

RNS Number : 7403L

Bovis Homes Group PLC

10 September 2019

10 September 2019

Continued excellent operational progress delivers record

profits

Bovis Homes Group PLC (the 'Group') is today issuing its half

year results for the six months ended 30 June 2019.

H1 Highlights

- Record profits with profit before tax increasing by 20% to GBP72.4m

- Step up in profitability including 140 basis points improvement in operating margin to 16%

- 15% increase in private sales rate to 0.6 per site per week

despite an uncertain market backdrop

- Further strong improvement in customer satisfaction with Group

trending at 5-star HBF customer satisfaction score for the year to

date

- High quality land acquisitions in the year to date totalling 2,007 plots across 12 sites

- Further strengthened balance sheet with increase in net cash as at 30 June 2019 to GBP102.4m

- Interim dividend up 8% to 20.5p per share reflecting confidence in the business

H1 2019 H1 2018 Change

------------------------------- ---------- ---------- -------

Total completions(1) 1,647 1,580 +4%

Total average selling

price GBP269.2k GBP262.7k +2%

Group revenue GBP472.3m GBP432.2m +9%

Operating margin 16.0% 14.6% 140bps

Profit before tax GBP72.4m GBP60.2m +20%

Earnings per share 43.7p 36.1p +21%

Ordinary dividend per

share 20.5p 19.0p +8%

Net cash GBP102.4m GBP42.8m +139%

Return on capital employed(2) 19.8% 14.5% 530bps

------------------------------- ---------- ---------- -------

Strong outlook for full year

- Continue to develop strategy of controlled volume growth

whilst driving margin and ROCE progression

- Expect to make further good progress against our medium term

targets in the year, with a number already achieved

- Strong sales position with 96% of FY19 total completions and

c.10% of FY20 private units secured

- Further GBP60m of capital to be returned to shareholders in second half

- Well positioned to deliver another strong performance in 2019

Notes: (1) Includes JV completions in the period of 3 (2018:

nil) (2) Return on capital employed has been calculated as the

total operating profit for the 12 month rolling period to 30 June

2019 (GBP186.9m), divided by the average of opening and closing

shareholders' funds, plus net debt or less net cash, excluding

investment in JVs for the 12 month rolling period to 30 June 2019

(GBP942.2m).

Potential combination with Galliford Try's Linden Homes and

Partnership & Regeneration divisions (the "Potential

Transaction")

We have announced today that we have re-engaged in preliminary

discussions with Galliford Try plc regarding a potential

combination between Bovis Homes and Galliford Try's Linden Homes

and Partnerships & Regeneration divisions, and have agreed

high-level terms upon which the Potential Transaction would be

implemented. There remains significant work to be completed before

definitive transaction documentation can be agreed, including

agreement of detailed commercial terms, completion of due diligence

and arranging transaction funding. Further details are included in

a separate statement issued today by the Group and Galliford

Try.

Greg Fitzgerald, Chief Executive commented,

"We delivered an excellent first half performance with a

significant step up in our sales rate, record profits and a further

strengthening of our balance sheet. The Group has transformed over

the past two years and we are consistently delivering high quality

new homes with very high levels of customer satisfaction, as

demonstrated by the significant improvement in our HBF rating over

the past 12 months. The fact that we are now trending at a 5-star

level is testament to the continued hard work and dedication of our

team.

"We are very well positioned for the second half and expect to

deliver another strong performance in the year."

There will be a meeting for analysts and investors at 9:00am

today at The London Stock Exchange, The London Stock Exchange

Building, 10 Paternoster Square, London, EC4M 7LS. The presentation

will be audiocast live on the Bovis Homes corporate website

www.bovishomesgroup.co.uk from 9:00am. A playback facility will be

available shortly after the presentation has finished.

Certain statements in this press release are forward looking

statements. Forward looking statements involve evaluating a number

of risks, uncertainties or assumptions that could cause actual

results to differ materially from those expressed or implied by

those statements. Forward looking statements regarding past trends,

results or activities should not be taken as representation that

such trends, results or activities will continue in the future.

Undue reliance should not be placed on forward looking

statements.

For further information please contact:

Bovis Homes Group PLC

Earl Sibley, Group Finance Director

Susie Bell, Head of Investor Relations 01732 280272

Powerscourt

Justin Griffiths

Nick Dibden

Victoria Heslop 020 7250 1446

Chief Executive's Review

Half year update

The Group reports a strong first half performance with a

significantly improved operating performance and a step up in our

financial results.

The Group's private sales rate increased by 15% in the first

half, operating margin was up by 140 basis points to 16% (2018:

14.6%) and profit before tax increased by 20% to GBP72.4m (2018:

GBP60.2m) - a record level for Bovis Homes. The Group's balance

sheet strengthened further with a net cash position of GBP102.4m as

at 30 June (2018: GBP42.8m).

Building high quality new homes that meet our customers' needs

and expectations remains at the core of our business and I am

delighted the Group's customer satisfaction score continues to

reflect this, now trending at a 5-star HBF customer satisfaction

rating (above 90%).

Over the last two years, we have transformed our build processes

and are proud of the homes we build. Last year we launched our new

'Phoenix' housing range and we saw the first completions from the

range in June this year, with excellent feedback from our customers

and visitors.

Our new Partnerships business has made strong progress with six

of our larger developments now in partnership with Housing

Associations, including the joint venture of Stanton Cross,

Wellingborough with Riverside.

Our strategy remains focused on controlled volume growth whilst

driving profitability and return on capital employed. We are

committed to increasing the supply of quality new homes in the UK

and with the growth of our Partnerships business, see the

opportunity to grow our volumes beyond our 2020 target of 4,000

units p.a.

Operating performance

Strong sales performance

We are pleased to report a 15% increase in our private sales

rate in the first half to 0.60 (2018: 0.52) sales per active site

per week. This reflects a step change in the Group's performance

achieved against a backdrop of ongoing market uncertainty.

Help to Buy remains an important scheme and 25% of total

completions utilised it in the first half. We have also seen a

controlled increase in our use of part exchange, with 9% of

completions on this basis in the period. We maintain very tight

controls around our part exchange stock levels and had held no

properties for longer than three months as at 30 June.

The Group delivered a total of 1,647 (2018: 1,580) new homes in

the half year, a 4% increase, and a total average selling price up

2% to GBP269,200 (2018: GBP262,700). The increase in pricing

reflects an improved geographical spread of sales outlets with

overall underlying pricing broadly flat.

We opened 10 new developments in the first half and expect to

open a total of 24 new developments this year. We are currently

operating from 87 sites and expect this to remain relatively

stable.

High levels of customer satisfaction

Customer satisfaction is a key priority and we are delighted to

report continued improvement in our customer satisfaction rating,

with our HBF score since 1 October 2018 trending at above 90%, the

equivalent of a 5-star housebuilder.

We continue to invest in our customer service and in May

launched our new customer relationship management system 'Keys'. It

is designed to enhance further our customers' 'Bovis Homes'

journey, giving them greater access and transparency throughout the

build, sales and after sales process. As an industry first, our

customers are able to self-report snags and track progress with

24/7 contact.

We were delighted to have recently received the Ministry of

Defence's Gold Award in their Employer Recognition Scheme. Bovis

Homes first signed the Armed Forces Covenant in 2016 and has since

worked to ensure that past and present members of the Forces along

with their families receive outstanding support, from mentoring

placements and trainee programmes to assist military personnel

looking to get on to the property ladder. We are proud to be the

only housebuilder to have achieved the Gold Award status.

Transformation of our build processes

The Group delivered another controlled period end and this is

reflected in the high standard of build quality of our new homes.

We have seen further improvement in our build quality metrics which

are tracking in-line or ahead of industry benchmarks. We have a

high quality team of construction directors and site managers and

have seen a further reduction in site manager headcount turnover to

below 15%. A special congratulations to our six site managers who

were winners of NHBC Pride in the Job Quality Awards this year.

We have launched a programme of initiatives targeting savings

across all areas of build. In particular, we are working closely

with our supply chain to counter build cost inflation and are

introducing group wide specification changes where appropriate. We

have seen build cost inflation running at around 3% to 4% in the

year to date, with some reduction in inflationary pressure seen

recently.

Phoenix housing range

Following the launch of our new housing range, the Phoenix

Collection, in April last year, we have successfully replanned our

owned land bank and implemented build of the new range, with 880

Phoenix designed units currently under construction. We completed

the first new 'Phoenix' homes in June with excellent feedback from

customers. The modern design and open plan living meet today's

customer needs, while the design and specification allow us to

drive efficiency and cost reductions. We expect the Phoenix

Collection to account for c. 15% of our total completions in 2019,

with this percentage increasing rapidly in future years.

Ongoing investment in our business

We continue to invest in our systems and processes to drive

efficiency and best practice across all business areas and to

position the Group successfully for the future. We are in the

process of re-launching the Bovis Homes brand and modernising our

sales and commercial websites, alongside the launch of our CRM,

Keys. We continue to invest in our management reporting system with

COINS, and through Access Systems are investing in our HR

platform.

People

People remain a key priority for the Group and we are delighted

that our investment is reflected in consistently high levels of

engagement and a much reduced level of headcount turn. We have a

full range of training and development programmes, and the first

half saw the roll-out of the final module of our bespoke Leadership

Development Programme.

We continue to support the development of skilled labour within

our industry, in particular with our apprenticeship and assistant

site manger programmes.

High quality land supply

We have excellent visibility on our land supply and have all of

our units for 2020 secured and 79% for 2021. We continue to see

good opportunities in the land market that meet our minimum hurdle

rates and strategy of increasing our proportion of smaller

properties, reducing our average selling price. We expect to

maintain a 3.5 to 4.0 year owned land bank and in the year to date

have acquired 2,007 plots across 12 sites.

We have good momentum on our strategic land and in the year to

date have pulled through 372 plots on three sites from our

strategic land bank. We have also entered into four new option

agreements for a total of 865 plots, with a strong pipeline for the

rest of this year and going into 2020.

Partnerships

We launched our Partnerships business in February this year to

work alongside our operating regions. It brings a less cyclical and

more resilient revenue and profit stream, and reflects our

significantly improved relationships with Housing Associations.

This is a land led strategy allowing us to optimise returns from

our land investment, in particular our larger sites pulled through

from our strategic land bank, and will facilitate better working

capital management.

We have made good progress in the year to date with six

partnership developments now established including our joint

ventures with Riverside Housing Association at Stanton Cross,

Wellingborough completed in April, and with LiveWest at Alphington,

Exeter completed in July.

The partnerships are typically structured such that we transfer

all or part of the land for development, often arising from our

strategic land bank, to a partner or into a joint arrangement. In

the first half, revenue of GBP15.4m (2018: nil) was recognised from

partnership land transactions. Bovis Homes will then develop out

the site for our partner or on behalf of the joint venture. The

partnership land transactions were recognised using the site wide

development margin, in the same way as our standard housing

business.

Strategy update

The Group strategy remains focused on delivering controlled

volume growth while driving margin progression. With the

development of our Partnerships business, we believe the Group has

the ability to drive volumes beyond our medium term target of 4,000

units p.a.

The increased investment in our Partnerships business results in

us now expecting to achieve our ROCE target of 25% by 2022.

On margin, our specific margin initiatives include the roll-out

of our new Phoenix housing range and increasing the use of our

Select extras range. We have also implemented a programme of cost

saving initiatives across all areas of build including working with

our supply chain to counter build cost inflation and Group wide

specification changes where appropriate.

Medium term targets

We have made further good progress against our medium term

targets in the period with a number already achieved

Target Progress to date Timing / outlook

4-star HBF Achieved

customer * Trending at 5-star rating * Maintain 4-star rating

satisfaction

rating

* 4 star HBF customer satisfaction score for 2018

------------------------------------------------------------------ ---------------------------------------------------------------

4,000 Targeted for 2020

completions * 3,759 completions in FY18 * Controlled volume growth from existing structure

p.a.

* 4% increase in completions in H1 19 * Delivery of more than 4,000 new homes p.a. beyond

2020 through investment in Partnerships business

* Launch of Partnerships business

------------------------------------------------------------------ ---------------------------------------------------------------

3.5 to 4.0 Achieved

year * Divestment of sites outside of our core operating * Maintain 3.5 to 4.0 year owned land bank

owned land areas

bank

* Wellingborough and Sherford JVs completed

------------------------------------------------------------------ ---------------------------------------------------------------

Min. 23.5% Targeted for 2020

gross * 70 basis point improvement in gross margin in H1 19 * Margin initiatives underpin 2020 gross margin target

margin to 21.6%

* Programme of cost saving initiatives

* Embedded land gross margin at 24.9% will drive

further improvements over time

------------------------------------------------------------------ ---------------------------------------------------------------

5% admin Targeted for 2019

expense * Effective operating structure in place with continued

as % of investment in process and systems to deliver

revenues efficiency

------------------------------------------------------------------ ---------------------------------------------------------------

Min. GBP180m Achieved

net * Balance sheet initiatives delivered in excess of * Ongoing active balance sheet optimisation and review

cash from GBP250m net cash benefit of capital returns

balance

sheet

optimisation

------------------------------------------------------------------ ---------------------------------------------------------------

25% return Targeted for 2022

on capital * Increase in Group ROCE to 19.8% in H1 19 * Targeting 25% for 2022 reflecting increased

employed investment in Partnership business

------------------------------------------------------------------ ---------------------------------------------------------------

Potential combination with Galliford Try's Linden Homes and

Partnership & Regeneration divisions

We have announced today that we have re-engaged in preliminary

discussions with Galliford Try plc regarding a potential

combination between Bovis Homes and Galliford Try's Linden Homes

and Partnerships & Regeneration divisions, and have agreed

high-level terms upon which the Potential Transaction would be

implemented. There remains significant work to be completed before

definitive transaction documentation can be agreed, including

agreement of detailed commercial terms, completion of due diligence

and arranging transaction funding. Further details are included in

a separate statement issued today by the Group and Galliford

Try.

Enhanced returns to shareholders

The Board is committed to maximising ordinary dividends to

shareholders and for the first half year the interim dividend,

payable on 22 November, will be 20.5 pence per share, an increase

of 8% on H1 2018.

In 2017, the Board stated that it intended that surplus capital

totalling GBP180m or c.134p per share will be returned to

shareholders in the three years to 2020. If the Potential

Transaction proceeds, the GBP60 million of capital return expected

to be paid in 2019 would, subject to shareholder approval, be

returned by way of a bonus issue (the "Bonus Issue") settled at

completion of the Potential Transaction through the issue of fully

paid Bovis Homes shares to Bovis Homes shareholders. The Bonus

Issue would equate to 5,665,723 shares (in aggregate) valued at

GBP60 million based on a Bovis Homes share price of 1059p, being

the closing share price on 9 September 2019.

If the Potential Transaction does not complete, the second

capital return of GBP60m equating to c.45p per share is expected to

be paid to shareholders as a cash dividend.

Market

Despite wider market uncertainty around Brexit, the market

fundamentals remain supportive with high employment levels,

interest rates at historic lows, and good competition in the

mortgage lending market place. Both of the two key political

parties remain committed to increasing the supply of new homes in

the UK and supportive of the housing industry. We are pleased to

have clarity on Help to Buy with the scheme confirmed to 2023.

Outlook

We are very pleased with the significant progress the Group has

made over the past two years and see the operational turnaround as

nearly complete. We continue to invest in the business and are

fully committed to improving further the way we operate, to

adopting modern methods of construction where appropriate, and

ensuring we are best positioned to deliver high quality new homes

to the market in the years ahead.

We have a strong sales position with 96% of total sales for 2019

secured, and c. 10% of private sales for 2020 already secured.

While we are having to work hard in the current market, we are

confident of delivering completions in-line with our expectations

for the year and deliver another strong performance.

Financial Review

Trading Performance

In line with our strategy, the Group delivered controlled volume

growth during the first half of 2019 resulting in a 4% increase in

legal completions(1) to 1,647 (H1 2018: 1,580). This included 616

affordable homes representing 37% of total completions (H1 2018:

35%). Total revenue was GBP472.3m, an increase of 9% on the

previous year (H1 2018: GBP432.2m).

Volume H1 2019 H1 2018

====================================== ============ ============

Private legal completions 1,028 1,030

====================================== ============ ============

Affordable legal completions 616 550

====================================== ============ ============

Total legal completions 1,644 1,580

====================================== ============ ============

JV legal completions 3 -

====================================== ============ ============

Total legal completions including

JVs 1,647 1,580

====================================== ============ ============

Revenue (GBPm)

====================================== ============ ============

Private legal completions 352.3 344.7

====================================== ============ ============

Affordable legal completions 90.2 70.3

====================================== ============ ============

Revenue from legal completions 442.5 415.0

====================================== ============ ============

Other revenue 7.9 10.9

====================================== ============ ============

Partnership land transactions revenue 15.4 -

====================================== ============ ============

Total development revenue 465.8 425.9

====================================== ============ ============

Land sales revenue 6.5 6.3

====================================== ============ ============

Total revenue 472.3 432.2

====================================== ============ ============

Housing revenue from legal completions was GBP442.5m (H1 2018:

GBP415.0m), 7% ahead of the prior year. The average sales price for

our private homes increased 2% to GBP342,800 (H1 2018: GBP334,700)

and our overall average sales price increased by 2% to GBP269,200

(H1 2018: GBP262,700).

Other revenue was GBP7.9m (H1 2018: GBP10.9m) and includes the

release of GBP4.1m (H1 2018: GBP7.9m) in deferred revenue from PRS

joint ventures as we dispose of properties as part of our strategy

to exit these joint ventures.

In February this year we announced the launch of our new

Partnerships Housing Division which is pursuing a land led

strategy, working alongside housing associations to increase output

and deliver best returns from our development land, in particular

our larger, strategic land sites.

Partnership land transactions revenue of GBP15.4m was from three

land sales in the period to housing associations, where Bovis Homes

will develop the land in partnership with the housing associations.

The partnership land transactions were recognised using the site

wide development margin, in the same way as our standard housing

business.

Land sales revenue of GBP6.5m in H1 2019 primarily relates to

the disposal of the final out-of-operating area site in the period

at Penwortham near Preston, realising GBP6.4m of cash and

contributing GBP0.1m in profit.

Construction costs per square foot have increased by 6% over the

last 12 months, reflecting the inflationary impact of labour and

materials that we estimate to be around 3 to 4% during the year, as

well as the geographical mix of product delivered during the

period. This has been partially offset by reductions in our cost

base as we delivered production in a controlled manner, changes in

specification and the under-utilisation of contingency.

Development gross margin was 21.9% in the first half of 2019,

ahead of the 21.2% achieved in the same period in 2018 driven by

the increasing embedded gross margin in our land bank, broadly flat

market pricing and our ongoing operational improvements including

the initial impacts from our margin initiatives.

Total gross profit was GBP101.8m (gross margin: 21.6%), compared

with GBP90.4m (gross margin: 20.9%) in H1 2018.

Operating profit increased to GBP75.8m (H1 2018: GBP63.1m) at an

operating profit margin of 16.0% (H1 2018: 14.6%). Administrative

expenses decreased in 2019 to GBP26.0m (H1 2018: GBP27.3m)

reflecting the Group's efficient operating structure, offset by

higher employee costs and the ongoing investment in new processes,

systems and training. This investment is beginning to deliver

further benefits to our operations which will have a greater impact

in future periods. We note that first half margins are impacted by

the completion profile, and therefore revenue profile, being more

heavily weighted into the second half of the financial year, with

certain costs being equally phased across the year.

The Group delivered a record profit before tax for the six

months ended 30 June 2019 of GBP72.4m, comprising operating profit

of GBP75.8m, net financing charges of GBP2.8m and GBP0.6m of share

in JV losses. This compares to GBP60.2m of profit before tax in H1

2018, which comprised GBP63.1m of operating profit and GBP2.9m of

net financing costs.

Financing and Taxation

Net financing charges during the first half of 2019 were GBP2.8m

(H1 2018: GBP2.9m) reflecting the marginally lower net debt in the

period, a consistent level of commitment fees, and issue costs

amortised, as well as the impact of implementing IFRS 16 in the

period, disclosed in note 9 to the financial statements.

The Group has recognised a tax charge of GBP13.7m at an

effective tax rate of 18.9% (H1 2018: tax charge of GBP11.5m at an

effective rate of 19.1%). The Group has a current tax liability of

GBP14.3m on its balance sheet as at 30 June 2019 (H1 2018:

GBP14.0m).

Dividends

An interim dividend of 20.5 pence per share (H1 2018: 19.0

pence) has been declared and will be paid on 22 November 2019 to

holders of ordinary shares on the register at the close of business

on 27 September 2019. The dividend reinvestment plan, introduced in

2012, gives shareholders the opportunity to reinvest their

dividend.

Net Assets and Cash flow

As at 30 June 2019 net assets of GBP1,073.8m were GBP12.7m

higher than at the start of the year. Net assets per share as at 30

June 2019 were 796 pence (H1 2018: 787 pence).

Investments increased by GBP32.4m since the start of the year,

primarily driven by the investment made into the joint venture with

Riverside Housing Limited for the development of Stanton Cross,

Wellingborough.

Retirement benefit assets increased by GBP9.8m primarily as a

result of higher than expected returns on the scheme's assets and

contributions to the fund in the period. This has resulted in a

pension surplus of GBP11.1m at 30 June 2019 (H1 2018: GBP4.8m).

Inventories decreased during the half year by GBP50.0m to

GBP1,270.0m. The value of residential land, the key component of

inventories, decreased by GBP88.9m. This reflects a relatively

lower level of investment in the first half of the year and the

sale of our Stanton Cross development at Wellingborough into a

joint venture. Other movements in inventories included an increase

in work in progress of GBP38.3m driven by the infrastructure

investment on a number of our new or significant strategically

sourced developments in the first half, including Wokingham, North

Whiteley, and Bishops Stortford. We have also increased the level

of housing work in progress to support our expected higher delivery

volume in the second half of 2019. Our part exchange properties

balance has increased by GBP1.2m, as we make greater use of this as

a sales tool, in a controlled and disciplined manner, with no

properties held for more than three months unsold at the end of the

period.

Trade and other receivables increased by GBP26.8m, driven by

increased balances receivable from housing associations from 31

December 2018. Trade and other payables increased by GBP13.7m,

predominantly reflecting increased accruals and trade creditors

from production offset by GBP43.9m net settlement of land

creditors. Land creditors decreased to GBP249.4m (31 December 2018:

GBP293.3m) representing 32% of our gross land investment and

includes significant balances in respect of longer-term schemes at

North Whiteley and Alphington, Exeter purchased in 2018.

As at 30 June 2019 the Group's net cash balance, which reflects

cash and cash equivalents less bank and other loans, was GBP102.4m

(H1 18: GBP42.8m). Net cash is quoted excluding the lease

liabilities arising on adoption of IFRS 16, the impact of which is

clearly disclosed in note 9 to the financial statements. The Group

started the year with net cash of GBP126.8m and generated an

operating cash inflow before land expenditure of GBP64.7m (H1 2018:

GBP41.5m) and recognised a reduction of GBP36.4m in loans. The loan

reduction arose as a result of the movement of funding from Homes

England into the newly formed joint venture with Riverside at

Stanton Cross, Wellingborough. Net cash payments for land

investment increased to GBP95.9m (H1 2018: GBP81.2m), reflecting

the timing of land acquisitions and reduction in land creditors.

Cash inflows from joint ventures were GBP37.2m (H1 2018: nil),

primarily generated on the sale of land and inventory into the

Stanton Cross, Wellingborough joint venture, and non-trading cash

outflow increased to GBP21.9m (H1 2018: GBP19.3m) with increased

corporation tax payments; payments relating to dividends were

GBP51.1m (H1 2018: GBP43.6m).

We have a committed revolving credit facility of GBP250m in

place which expires in December 2022.

Land Bank

H1 2019 H1 2018

================================= ============== ==============

Consented plots added 1,004 505

================================= ============== ==============

Sites added 8 4

================================= ============== ==============

Sites owned at period end 115 107

================================= ============== ==============

Total consented land bank 16,215 16,107

================================= ============== ==============

Joint venture plots 3,054 -

================================= ============== ==============

Owned land bank plots 13,161 16,107

================================= ============== ==============

Average consented land plot ASP GBP316,000 GBP294,000

================================= ============== ==============

Average consented land plot cost GBP58,000 GBP51,000

================================= ============== ==============

The Group's total consented land bank including joint ventures

was 16,215 plots as at 30 June 2019. Including our share of joint

venture plots (1,527) and assuming our target of 4,000 total

completions p.a., the Group's land bank has reduced to 3.7 years as

at the 30 June 2019, in line with our strategy of maintaining a 3.5

to 4.0 years owned land bank.

The 1,644 plots that legally completed, excluding JVs, in the

year were replaced by a combination of site acquisitions and

conversions from our strategic land pipeline. In the year to date,

we have acquired 2,007 plots across 12 developments. Based on our

appraisal at the time of acquisition, the new additions, on

average, are expected to deliver a future gross margin and ROCE of

at least 25%.

Strategic land continues to be an important source of supply and

the Group had a total of 19,745 plots (31 December 2018: 19,278) at

30 June 2019. During the year to date 372 plots have been converted

from the strategic land pipeline into the consented landbank.

The average selling price of all units within the consented land

bank decreased over the year to GBP316,000, 1% lower than the

GBP319,000 at 31 December 2018, reflecting our strategy of

acquiring land with lower average selling price. The estimated

embedded gross margin in the consented land bank as at 30 June

2019, based on prevailing sales prices and build costs is

24.9%.

Impact of new accounting standards

The Group implemented IFRS 16 'Leases' for the first time from 1

January 2019, applying the modified retrospective approach,

resulting in the recognition of GBP21.8m in right-of-use assets at

30 June 2019, and GBP22.4m in lease liabilities.

The application of IFRS 16 had an immaterial impact on key

metrics for the 6 months ended 30 June 2019.

Principal risks and uncertainties

The Group is subject to a number of risks and uncertainties as

part of its activities. The Board regularly considers these and

seeks to ensure that appropriate processes are in place to manage,

monitor and mitigate these risks. The directors consider that the

principal risks and uncertainties facing the Group remain those

that are outlined on pages 32 to 35 of the Annual Report and

Accounts 2018, which is available from

www.bovishomesgroup.co.uk.

The Group has reconsidered the risks and uncertainties posed by

Brexit, in light of the continued uncertainty in UK politics and

note that we have not experienced any significant change in

customer behaviour, and we do not expect the political situation to

have a material impact on our expected results for 2019. The

mortgage market remains competitive, with the Help to Buy scheme

continuing to assist many first-time buyers to purchase a new build

property as supported by both Labour and Conservative political

parties. A significant proportion of our building materials are UK

sourced and we are in regular contact with our suppliers regarding

material availability, with no significant issues anticipated on

exit from the EU. The vast majority of our workforce, which

comprises both Bovis employees and sub-contractors, is UK domiciled

providing further protection from the impact of Brexit. The Group

has in place processes to monitor and mitigate these risks.

Group income statement

Six months Six months Year ended

ended ended

30 June 30 June 2018 31 Dec

2019 2018

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

================================= ============= ============== ===========

Revenue 472,343 432,223 1,061,396

================================= ============= ============== ===========

Cost of sales (370,553) (341,826) (830,505)

================================= ============= ============== ===========

Gross profit 101,790 90,397 230,891

================================= ============= ============== ===========

Administrative expenses (25,993) (27,276) (56,723)

================================= ============= ============== ===========

Operating profit 75,797 63,121 174,168

================================= ============= ============== ===========

Financial income 466 301 481

================================= ============= ============== ===========

Financial expenses (3,218) (3,225) (6,585)

================================= ============= ============== ===========

Net financing costs (2,752) (2,924) (6,104)

================================= ============= ============== ===========

Share of (loss)/ profit of Joint

Ventures (569) - 5

================================= ============= ============== ===========

Profit before tax 72,476 60,197 168,069

================================= ============= ============== ===========

Income tax expense (13,727) (11,523) (31,499)

================================= ============= ============== ===========

Profit for the year attributable

to ordinary shareholders 58,749 48,674 136,570

================================= ============= ============== ===========

Earnings per share (pence)

================================= ============= ============== ===========

Basic 43.7p 36.1p 101.6p

================================= ============= ============== ===========

Diluted 43.7p 36.0p 101.5p

================================= ============= ============== ===========

Group statement of comprehensive income

Six months Six months Year ended

ended ended

30 June 30 June 2018 31 Dec

2019 2018

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

============================================ ============= ============== ===========

Profit for the year 58,749 48,674 136,570

============================================ ============= ============== ===========

Other comprehensive (expense) / income

============================================ ============= ============== ===========

Items that will not be reclassified

to the income statement

============================================ ============= ============== ===========

Remeasurements on defined benefit

pension scheme 4,418 (2,358) (5,781)

============================================ ============= ============== ===========

Deferred tax on remeasurements on

defined benefit pension scheme (644) 456 1,083

============================================ ============= ============== ===========

Total other comprehensive income

/ (expense) 3,774 (1,902) (4,698)

============================================ ============= ============== ===========

Total comprehensive income for the

year attributable to ordinary shareholders 62,523 46,772 131,872

============================================ ============= ============== ===========

Group balance sheet

30 June 30 June 31 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

==================================== ============= ============= ============

Assets

==================================== ============= ============= ============

Intangible fixed assets 2,104 - 1,079

==================================== ============= ============= ============

Property, plant and equipment 3,064 4,758 2,181

==================================== ============= ============= ============

Right-of-use assets 21,848 - -

==================================== ============= ============= ============

Investments 61,408 7,135 28,992

==================================== ============= ============= ============

Restricted cash 1,747 1,412 1,381

==================================== ============= ============= ============

Trade and other receivables 563 1,426 611

==================================== ============= ============= ============

Retirement benefit asset 11,134 4,783 1,381

==================================== ============= ============= ============

Total non-current assets 101,868 19,514 35,625

==================================== ============= ============= ============

Inventories 1,269,646 1,305,014 1,320,229

==================================== ============= ============= ============

Trade and other receivables 91,351 97,420 64,505

==================================== ============= ============= ============

Cash and cash equivalents 102,397 78,598 163,217

==================================== ============= ============= ============

Total current assets 1,463,394 1,481,032 1,547,951

==================================== ============= ============= ============

Total assets 1,565,262 1,500,546 1,583,576

==================================== ============= ============= ============

Equity

==================================== ============= ============= ============

Issued capital 67,424 67,388 67,398

==================================== ============= ============= ============

Share premium 217,227 216,769 216,907

==================================== ============= ============= ============

Retained earnings 789,140 777,114 776,762

==================================== ============= ============= ============

Total equity attributable to equity

holders of the parent 1,073,791 1,061,271 1,061,067

==================================== ============= ============= ============

Liabilities

==================================== ============= ============= ============

Bank and other loans - 35,807 36,401

==================================== ============= ============= ============

Lease liabilities 17,272 - -

==================================== ============= ============= ============

Deferred tax liability 2,214 1,023 730

==================================== ============= ============= ============

Trade and other payables 97,457 105,233 183,769

==================================== ============= ============= ============

Total non-current liabilities 116,943 142,063 220,900

==================================== ============= ============= ============

Trade and other payables 351,332 277,618 278,706

==================================== ============= ============= ============

Lease Liabilities 5,107 - -

==================================== ============= ============= ============

Provisions 3,825 5,563 4,843

==================================== ============= ============= ============

Current tax liabilities 14,264 14,031 18,060

==================================== ============= ============= ============

Total current liabilities 374,528 297,212 301,609

==================================== ============= ============= ============

Total liabilities 491,471 439,275 522,509

==================================== ============= ============= ============

Total equity and liabilities 1,565,262 1,500,546 1,583,576

==================================== ============= ============= ============

These condensed consolidated financial statements were approved

by the Board of Directors on 10 September 2019.

Group statement of changes in equity

Total

retained Issued Share Total

earnings capital premium GBP'000

GBP'000 GBP'000 GBP'000

====================================== ========= ========= ========= =========

Balance at 1 January 2019 776,762 67,398 216,907 1,061,067

====================================== ========= ========= ========= =========

IFRS 16 application adjustment

at 1 January 2019 63 - - 63

====================================== ========= ========= ========= =========

Total comprehensive income 62,523 - - 62,523

====================================== ========= ========= ========= =========

Issue of share capital - 26 320 346

====================================== ========= ========= ========= =========

Share based payments 833 - - 833

====================================== ========= ========= ========= =========

Deferred tax on share based payments 37 - - 37

====================================== ========= ========= ========= =========

Dividends paid to shareholders (51,078) - - (51,078)

====================================== ========= ========= ========= =========

Balance at 30 June 2019 (unaudited) 789,140 67,424 217,227 1,073,791

====================================== ========= ========= ========= =========

Balance at 1 January 2018 773,255 67,330 215,991 1,056,576

====================================== ========= ========= ========= =========

Total comprehensive income 46,772 - - 46,772

====================================== ========= ========= ========= =========

Issue of share capital - 58 778 836

====================================== ========= ========= ========= =========

Share based payments 707 - - 707

====================================== ========= ========= ========= =========

Deferred tax on share based payments 25 - - 25

====================================== ========= ========= ========= =========

Dividends paid to shareholders (43,645) - - (43,645)

====================================== ========= ========= ========= =========

Balance at 30 June 2018 (unaudited) 777,114 67,388 216,769 1,061,271

====================================== ========= ========= ========= =========

Balance at 1 January 2018 773,255 67,330 215,991 1,056,576

====================================== ========= ========= ========= =========

Total comprehensive income 131,872 - - 131,872

====================================== ========= ========= ========= =========

Issue of share capital - 68 916 984

====================================== ========= ========= ========= =========

Deferred tax on other employee

benefits (113) - - (113)

====================================== ========= ========= ========= =========

Share based payments 1,413 - - 1,413

====================================== ========= ========= ========= =========

Dividends paid to shareholders (129,665) - - (129,665)

====================================== ========= ========= ========= =========

Balance at 31 December 2018 (audited) 776,762 67,398 216,907 1,061,067

====================================== ========= ========= ========= =========

Group statement of cash flows

Six months Six months Year ended

ended ended

30 June 30 June 2018 31 Dec

2019 2018

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

============================================= ============= ============== ===========

Cash flows from operating activities

============================================= ============= ============== ===========

Profit for the year 58,748 48,674 136,570

============================================= ============= ============== ===========

Depreciation and amortisation 3,045 241 905

============================================= ============= ============== ===========

Financial income (466) (301) (481)

============================================= ============= ============== ===========

Financial expense 3,218 3,225 6,585

============================================= ============= ============== ===========

Profit/(loss) on sale of property, plant

and equipment - 68 (450)

============================================= ============= ============== ===========

Equity-settled share-based payment expense 833 685 1,413

============================================= ============= ============== ===========

Income tax expense 13,727 11,523 31,499

============================================= ============= ============== ===========

Share of results of Joint Ventures 569 - (5)

============================================= ============= ============== ===========

Profit on sale of assets from Joint

Ventures (401) - (1,197)

============================================= ============= ============== ===========

(Increase)/decrease in trade and other

receivables (39,697) (21,638) 12,402

============================================= ============= ============== ===========

Decrease/(increase) in inventories 50,847 15,197 (1,891)

============================================= ============= ============== ===========

(Decrease)/increase in trade and other

payables (2,311) (95,989) (15,692)

============================================= ============= ============== ===========

Decrease in provisions and increase

in retirement benefit obligations (8,886) (6,410) (7,042)

============================================= ============= ============== ===========

Net cash generated from/(used in) operations 79,226 (44,725) 162,616

============================================= ============= ============== ===========

Interest paid (896) (1,306) (2,773)

============================================= ============= ============== ===========

Income taxes paid (16,645) (13,437) (29,165)

============================================= ============= ============== ===========

Net cash inflow/(outflow) from operating

activities 61,685 (59,468) 130,678

============================================= ============= ============== ===========

Cash flows from investing activities

============================================= ============= ============== ===========

Interest received 105 221 278

============================================= ============= ============== ===========

Acquisition of intangible fixed assets - - (1,213)

============================================= ============= ============== ===========

Acquisition of property, plant and equipment (2,527) (2,452) (1,876)

============================================= ============= ============== ===========

Proceeds from sale of property, plant

and equipment - - 1,977

============================================= ============= ============== ===========

Movement of investment in Joint Ventures (36,693) 2,423 (20,300)

============================================= ============= ============== ===========

Dividends received from Joint Ventures 4,110 - 1,067

============================================= ============= ============== ===========

(Increase)/decrease in restricted cash (366) - 33

============================================= ============= ============== ===========

Net cash (outflow)/generated from investing

activities (35,371) 192 (20,034)

============================================= ============= ============== ===========

Cash flows from financing activities

============================================= ============= ============== ===========

Dividends paid (51,078) (43,645) (129,665)

============================================= ============= ============== ===========

Proceeds from the issue of share capital 345 859 984

============================================= ============= ============== ===========

(Repayment)/drawdown of bank and other

loans (36,401) 10,598 11,192

============================================= ============= ============== ===========

Net cash used in financing activities (87,134) (32,188) (117,489)

============================================= ============= ============== ===========

Net decrease in cash and cash equivalents (60,820) (91,464) (6,845)

============================================= ============= ============== ===========

Cash and cash equivalents at 1 January 163,217 170,062 170,062

============================================= ============= ============== ===========

Cash and cash equivalents at the end

of the period 102,397 78,598 163,217

============================================= ============= ============== ===========

1 Basis of preparation

Bovis Homes Group PLC (the "Company") is a company domiciled in

the United Kingdom. The consolidated financial statements of the

Company for the six months ended 30 June 2019 comprise the Company

and its subsidiaries (together referred to as the "Group") and the

Group's interest in Joint Ventures.

The condensed consolidated interim financial statements were

authorised for issue by the directors on 10 September 2019. The

financial statements are unaudited but have been reviewed by

PricewaterhouseCoopers LLP, the Company's auditors.

The condensed consolidated interim financial statements do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006.

The figures for the half years ended 30 June 2019 and 30 June

2018 are unaudited. The comparative figures for the financial year

ended 31 December 2018 are an extract from the Group's statutory

accounts for that financial year. Those accounts have been reported

on by the Company's auditors and delivered to the Registrar of

Companies. The report of the auditors was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under Section 498 (2) or (3) of

the Companies Act 2006.

The preparation of a condensed set of financial statements

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amount of assets, liabilities, income and expenses. Actual results

may differ from these estimates.

Judgements and estimates made by management in the application

of adopted International Financial Reporting Standards (IFRSs) that

have a significant effect on the financial statements and estimates

with a significant risk of material adjustment in following years

have been reviewed by the directors and, other than the estimated

half year income tax expense and application of IFRS16, remain

those published in the Company's consolidated financial statements

for the year ended 31 December 2018.

The condensed consolidated interim financial statements have

been prepared in accordance with IAS34 'Interim Financial

Reporting' as endorsed by the EU. As required by the Disclosure and

Transparency Rules of the Financial Conduct Authority, and with the

exception of the changes in accounting policies outlined below, the

condensed consolidated interim financial statements have been

prepared by applying the accounting policies and presentation that

were applied in the preparation of the Company's published

consolidated financial statements for the year ended 31 December

2018, which were prepared in accordance with IFRSs as adopted by

the EU.

As set out on page 124 in the Group's 2018 Annual Report and

Accounts, the following standards became effective for the first

time for the period beginning 1 January 2019 without material

impact on the Group's reported results:

- Amendment to IAS28 'Investments in Associates and joint

ventures', which has not had a significant impact on reported

results or position.

- IFRIC23 Uncertainty over income tax treatments, which has not

had a significant impact on reported results or position.

Also effective for the first time for the period beginning 1

January 2019 is IFRS16 'Leases' which replaces IAS17 'Leases',

requiring all assets held by the Group under lease agreements of

greater than 12 months in duration to be recognised as assets

within the Balance Sheet, unless they are considered to be of low

value (less than GBP3,000 in total payments). Similarly, the

present value of future payments to be made under those lease

agreements must be recognised as a liability. The Group has

reviewed its leasing arrangements and the impact on reported

results are disclosed in note 9.

The directors are satisfied that the Group has sufficient

resources to continue in operation for the foreseeable future, a

period of not less than 12 months from the date of this report.

Accordingly they continue to adopt the going concern basis in

preparing the condensed consolidated interim financial

statements.

2 Seasonality

In common with the rest of the UK housebuilding industry,

activity occurs year round, but there are two principal selling

seasons: spring and autumn. As these fall into two separate half

years, the seasonality of the business is not pronounced, although

it is biased towards the second half of the year under normal

trading conditions.

3 Segmental reporting

All revenue and profits disclosed relate to continuing

activities of the Group and are derived from activities performed

in the United Kingdom.

The Chief Operating Decision Maker, which is the Board, notes

that the Group's main operation is that of a housebuilder and it

operates entirely within the United Kingdom. There are no separate

segments, either business or geographic to disclose, having taken

into account the aggregation criteria of IFRS8.

4 Earnings per share

Profit attributable to ordinary shareholders

Six months Six months Year ended

ended ended 31 Dec 2018

30 June 2019 30 June Pence (audited)

Pence (unaudited) 2018

Pence (unaudited)

=========================== ================== =================== ================

Basic earnings per share 43.7 36.1 101.6

=========================== ================== =================== ================

Diluted earnings per share 43.7 36.0 101.5

=========================== ================== =================== ================

Basic earnings per share

Basic earnings per ordinary share for the six months ended 30

June 2019 is calculated on a profit after tax of GBP58,749,000 (six

months ended 30 June 2018: profit after tax of GBP48,674,000; year

ended 31 December 2018: profit after tax of GBP136,570,000) over

the weighted average of 134,423,488 (six months ended 30 June 2018:

134,856,833; year ended 31 December 2018: 134,555,573) ordinary

shares in issue during the period.

Diluted earnings per share

The calculation of diluted earnings per share at 30 June 2019

was based on the profit attributable to ordinary shareholders of

GBP58,749,000 (six months ended 30 June 2018: profit after tax of

GBP48,674,000; year ended 31 December 2018: profit after tax of

GBP136,570,000).

The Group's diluted weighted average ordinary shares potentially

in issue during the six months ended 30 June 2019 was 134,571,685

(six months ended 30 June 2018: 135,102,116, year ended 31 December

2018: 134,557,450).

5 Dividends

The following dividends per qualifying ordinary share were

settled by the Group:

Six months Six months Year ended

ended ended 31 Dec

30 June 2019 30 June 2018 2018

GBP'000 GBP'000 GBP'000

================================== ============== ============== ============

May 2019: 38.0p (May 2018: 32.5p) 51,078 43,645 43,645

================================== ============== ============== ============

November 2018: 64.0p - - 86,020

================================== ============== ============== ============

Total 51,078 43,645 129,665

================================== ============== ============== ============

The Board determined on 10 September 2019 that an interim

dividend of 20.5p for the first half of 2019 be paid. The dividend

will be settled on 22 November 2019 to shareholders on the register

at the close of business on 27 September 2019. The dividend has not

been recognised as a liability at the balance sheet date.

6 Interest in associates and joint ventures

In April 2019, Bovis Homes Limited entered into a joint venture

at Wellingborough, near Northampton, with Riverside Housing

Limited. As part of the initial transaction, land owned by the

Group was sold into the joint venture, Stanton Cross Developments

LLP. As disclosed in the full year annual report, the Group also

entered into another joint venture at Sherford, near Plymouth, in

December 2018 with Clarion Housing Group. Both Sherford and

Wellingborough developments are in their infancy and are undergoing

significant investment with limited trading; this is reflected in

the share of loss for the period which is primarily driven by

interest costs incurred.

Dividends received relate to the Group's investments in PRS

joint ventures which are in the process of disposing of their

property portfolios.

The carrying amount of equity-accounted investments has changed

as follows in the six months to 30 June 2019:

Six months Six months Year ended

ended ended 31 Dec

30 June 2019 30 June 2018

GBP'000 2018 GBP'000

GBP'000

============================= ============= ========== ==========

Beginning of the period 28,992 8,717 8,717

============================= ============= ========== ==========

Additions 35,821 - -

============================= ============= ========== ==========

Loans made/(repaid) 1,274 (2,113) 20,300

============================= ============= ========== ==========

(Loss)/profit for the period (569) 1,060 1,321

============================= ============= ========== ==========

Dividends paid (4,110) (528) (1,346)

============================= ============= ========== ==========

End of the period 61,408 7,136 28,992

============================= ============= ========== ==========

7 Related party transactions

Transactions between fellow subsidiaries, which are related

parties, have been eliminated on consolidation, as have

transactions between the Company and its subsidiaries during this

year.

Transactions between the Group, Company and key management

personnel in the first half of 2019 were limited to those relating

to remuneration, previously disclosed as part of the Group's Report

on directors' remuneration published with the Group's Annual Report

and Accounts 2018.

Mr Greg Fitzgerald, Group Chief Executive, is non-executive

Chairman of Ardent Hire Solutions ("Ardent"). The Group hires

forklift trucks from Ardent and the total net value of transactions

with this related party were as follows:

Six months Six months Year ended

ended ended 31 Dec

30 June 2019 30 June 2018

GBP'000 2018 GBP'000

GBP'000

=============================== ============== ========== ==========

Rental expenses paid to Ardent 1,302 875 2,059

=============================== ============== ========== ==========

The balance of rental expenses payable to Ardent at 30 June 2019

was GBP202,148 (30 June 2018: GBP4,000; 31 December 2018:

GBP155,000).

Transactions with Joint Ventures

Bovis Homes Limited is contracted to provide property and

letting management services to Bovis Peer LLP. Fees charged in the

period, inclusive of VAT, were GBP15,120 (six months ended 30 June

2018: GBP65,771; year ended 31 December 2018: GBP109,000). GBP6,720

of these fees are outstanding at 30 June 2019 (30 June 2018: nil;

31 December 2018: nil).

Bovis Homes Limited is part of a Joint Venture, IIH Oak

Investors LLP, to invest in private rental homes. As at 30 June

2019 loans of GBP1,616,089 (30 June 2018: GBP1,668,414; 31 December

2018: GBP1,598,319) were in place with IIH Oak Investors LLP at an

interest rate of 6%. Interest charges made in respect of the loans

were GBP47,281 (six months ended 30 June 2018: GBP67,000; year

ended 31 December 2018: GBP118,000).

Bovis Homes Limited is part of a Joint Venture, Bovis Latimer

(Sherford) LLP, to build houses in Sherford. As at 30 June 2019

loans of GBP23,566,947 (30 June 2018: GBPnil, 31 December 2018:

GBP22,256,000) were in place with an interest rate of 5%. Interest

charges made in respect of the loans were GBP242,117 (six months

ended 30 June 2018: GBPnil, year ended 31 December 2018: GBPnil).

Bovis Homes Limited also provides ongoing services to the LLP for

construction, management, accounting, company secretariat, sales

and marketing services; charges made in respect of these services

were GBP99,558 inclusive of VAT (six months ended 30 June 2018:

GBPnil, year ended 31 December 2018: GBPnil).

In April 2019, Bovis Homes Limited entered into a Joint Venture,

Stanton Cross Developments LLP, with Riverside Housing Limited,

with the LLP purchasing the Group's interest in its land and

infrastructure at Wellingborough, near Northampton. Bovis Homes

Limited provides ongoing services to the LLP for construction,

sales and company secretariat support; charges made in respect of

these services were GBP575,809 inclusive of VAT (six months ended

30 June 2018: GBPnil, year ended 31 December 2018: GBPnil).

There have been no other related party transactions in the first

six months of the current financial year which have materially

affected the financial performance or position of the Group, and

which have not been disclosed.

8 Reconciliation of net cash flow to net cash

Six months Six months Year ended

ended ended 31 Dec

30 June 30 June 2018 2018

2019 GBP'000 GBP'000

GBP'000

========================================== =========== ============== ==========

Net decrease in cash and cash equivalents (60,820) (91,464) (6,845)

========================================== =========== ============== ==========

Decrease/(increase) in borrowings 36,401 (10,598) (11,192)

========================================== =========== ============== ==========

Net cash at start of period 126,816 144,853 144,853

========================================== =========== ============== ==========

Net cash at end of period 102,397 42,791 126,816

========================================== =========== ============== ==========

Analysis of net cash:

========================== ======= ======== ========

Cash and cash equivalents 102,397 78,598 163,217

========================== ======= ======== ========

Bank and other loans - (35,807) (36,401)

========================== ======= ======== ========

Net cash at end of period 102,397 42,791 126,816

========================== ======= ======== ========

9 Change in accounting policies

This note explains the impact of the adoption of IFRS 16

'Leases' on the Group's financial statements and discloses the new

accounting policies that have been applied from 1 January 2019.

The Group has adopted IFRS 16 prospectively from 1 January 2019

and has not restated comparatives for the 2018 reporting period, as

permitted under the specific transitional provisions in the

standard. The reclassifications and the adjustments arising from

the new leasing rules are therefore recognised in the opening

balance sheet on 1 January 2019.

9a. Adjustments recognised on adoption of IFRS 16

On adoption of IFRS 16, the Group recognised lease liabilities

in relation to leases which had previously been classified as

'operating leases' under the principles of IAS 17 Leases. These

liabilities were measured at the present value of the remaining

lease payments, discounted using the lessee's incremental borrowing

rate as of 1 January 2019. The weighted average lessee's

incremental borrowing rate applied to the lease liabilities on 1

January 2019 was 2.5%.

2019

GBP000

======================================================== ========

Operating lease commitments disclosed as at 31 December

2018 25,103

======================================================== ========

Discounted using the lessee's incremental borrowing

rate of at the date of initial application (1,287)

======================================================== ========

(Less): short-term leases recognised on a straight-line

basis as expense (156)

======================================================== ========

(Less): low-value leases recognised on a straight-line

basis as expense (1,281)

======================================================== ========

Lease liability recognised as at 30 June 2019 22,379

======================================================== ========

Of which are:

======================================================== ========

Current lease liabilities 5,107

======================================================== ========

Non-current lease liabilities 17,272

======================================================== ========

The associated right-of-use assets for the Group's leases were

measured on a prospective basis, applying the new rules from 1

January 2019. Where relevant, right-of-use assets have been

adjusted for onerous lease contracts at the date of initial

application.

The recognised right-of-use assets relate to the following types

of assets:

30 June 2019 1 January 2019

GBP'000 GBP'000

========================== ============ ===============

Office properties 13,296 14,165

========================== ============ ===============

Show home properties 1,643 1,831

========================== ============ ===============

Site cabins 4,928 5,632

========================== ============ ===============

Office equipment 162 205

========================== ============ ===============

Motor vehicles 1,819 2,150

========================== ============ ===============

Total right-of-use assets 21,848 23,983

========================== ============ ===============

The change in accounting policy affected the following items in

the balance sheet on 1 January 2019:

-- Right-of-use assets - increase by GBP24.0m

-- Lease liabilities - increase by GBP24.6m

-- Provisions - decrease by GBP0.6m

-- Creditors - decrease by GBP0.1m

The net impact on retained earnings on 1 January 2019 was an

increase of GBP0.1m.

Practical expedients applied

In applying IFRS 16 for the first time, the Group has used the

following practical expedients permitted by the standard:

-- the use of a single discount rate to a portfolio of leases

with reasonably similar characteristics

-- reliance on previous assessments on whether leases are onerous

-- the accounting for operating leases with a remaining lease

term of less than 12 months as at 1 January 2019 as short-term

leases

-- the exclusion of initial direct costs for the measurement of

the right-of-use asset at the date of initial application, and

-- the use of hindsight in determining the lease term where the

contract contains options to extend or terminate the lease.

9b. The Group's leasing activities and how these are accounted

for

The Group leases various offices, site cabins, office equipment,

cars and show homes. Rental contracts are typically made for fixed

periods of 1 to 4 years but may be for longer or include extension

options. Lease terms are negotiated on an individual basis and

contain a wide range of different terms and conditions. The lease

agreements do not impose any covenants, but leased assets may not

be used as security for borrowing purposes.

Until the 2019 financial year, leases of property, plant and

equipment were classified as either finance or operating leases.

Payments made under operating leases (net of any incentives

received from the lessor) were charged to profit or loss on a

straight-line basis over the period of the lease.

From 1 January 2019, leases are recognised as a right-of-use

asset and a corresponding liability at the date at which the leased

asset is available for use by the Group. Each lease payment is

allocated between the liability and finance cost. The finance cost

is charged to profit or loss over the lease period so as to produce

a constant periodic rate of interest on the remaining balance of

the liability for each period. The right-of-use asset is

depreciated over the shorter of the asset's useful life and the

lease term on a straight-line basis.

Assets and liabilities arising from a lease are initially

measured on a present value basis. Lease liabilities include the

net present value of the following lease payments:

-- fixed payments (including in-substance fixed payments), less

any lease incentives receivable

-- variable lease payments that are based on an index or a fixed annual rate increase

The lease payments are discounted using lessee's incremental

borrowing rate, being the rate that the lessee would have to pay to

borrow the funds necessary to obtain an asset of similar value in a

similar economic environment with similar terms and conditions.

Right-of-use assets are measured at cost comprising the

following:

-- the amount of the initial measurement of lease liability

-- any lease payments made at or before the commencement date

less any lease incentives received

Payments associated with short-term leases and leases of

low-value assets are recognised on a straight-line basis as an

expense in profit or loss. Short-term leases are leases with a

lease term of 12 months or less. Low-value assets comprise site

equipment and other items less than GBP3,000 in total lease

costs.

10 Further information

Further information on Bovis Homes Group PLC can be found on the

Group's corporate website www.bovishomesgroup.co.uk, including the

analyst presentation document which will be presented at the

Group's results meeting on 10 September 2019.

Statement of directors' responsibilities

The directors' confirm that these condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related-party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

The directors of Bovis Homes Group PLC are listed in the Bovis

Homes Group PLC Annual Report for 31 December 2018. A list of

current directors is maintained on the Bovis Homes Group PLC

website: www.bovishomesgroup.co.uk.

For and on behalf of the Board,

Greg Fitzgerald Earl Sibley

Chief Executive Group Finance Director

10 September 2019

(1) Inclusive of joint venture completions

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SFISSSFUSELU

(END) Dow Jones Newswires

September 10, 2019 02:02 ET (06:02 GMT)

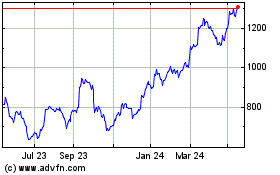

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

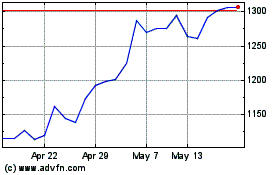

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024