TIDMWCW

RNS Number : 0380I

Walker Crips Group plc

08 June 2011

8 June 2011

Walker Crips Group plc

Preliminary results for the year ended 31 March 2011

Walker Crips Group plc ("WCG", the "Company" or the "Group"),

the integrated financial services group, today announces its

unaudited preliminary results for the year ended 31 March 2011 (the

"period").

Highlights over the period

-- Total revenue up 14% to GBP20.12 million (2010: GBP17.65

million)

-- Net revenue (gross profit) up 12.5% to GBP14.99 million

(2010: GBP13.33 million)

-- Reported profit before tax up 15% to GBP1.75 million (2010:

GBP1.52 million), after payment of the excess 2011 FSCS levy

-- Basic earnings per share up 17% to 3.35 pence (2010: 2.87

pence)

-- Proposed final dividend up 6% to 1.8 pence per share (2010:

1.7 pence per share)

-- WCAM funds under management increased to GBP787 million at

the year end (31 March 2010: GBP630 million; 30 September 2010:

GBP750 million).

-- Non-broking income as a proportion of total income increased

to 52.3% (2010: 50.0%).

Commenting on the results, David Gelber, Chairman, said:

"I am pleased to report a further improvement in the Group's

performance, with a 15% increase in profit before tax over the

period resulting from more buoyant market conditions, the continued

growth in our major business lines and vigilant cost control."

"We expect the first quarter of a new financial year to be

relatively subdued and the current more generally uncertain

short-term view of the economy and markets has impacted upon the

Group's trading in, and our expectations for, the current year.

"However, in the longer term, your Board is confident that the

Group's strong financial position and range of products should

enable it to grow shareholder value."

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Rodney FitzGerald, Chief Executive

Altium Tel: +44 (0)20 7484 4010

Ben Thorne

Tim Richardson

Further information on Walker Crips Group plc is available on

the Group's website: www.wcgplc.co.uk

CHAIRMAN'S STATEMENT

I am pleased to report a further improvement in the Group's

performance, with a 15% increase in profit before tax over the

period resulting from more buoyant market conditions, the continued

growth in our major business lines and vigilant cost control.

As a consequence, basic earnings per share increased by 17% to

3.35p (2010: 2.87p).

In addition, the Group's financial position remains robust with

net assets at the year end of GBP14.7 million (2010: GBP14.6

million) leaving us well placed to fund future growth and withstand

any further volatility in world markets. Cash balances at the year

end were GBP4.3 million (2010: GBP5.7 million) after the payment of

GBP0.96 million (2010: GBP0.93 million) of dividends to

shareholders during the year and the repurchase of GBP139,000 of

ordinary shares into treasury in June 2010. Our cash balances

remain subject to day-to-day variations in client settlement

requirements and related swings in the components of working

capital.

Business Performance Overview

The continued growth in funds under management at our asset

management division, WCAM, to GBP787 million at the year end (31

March 2010: GBP630 million) resulted in increased revenues and

profits in this division.

The investment management division also experienced growth in

fee income. Michael Sunderland, Private Client Director, retired

from the Group after 38 years of loyal service. The Board and staff

of the Group wish him well in his retirement. Chris Kitchenham, who

has worked alongside Michael for many years, was appointed to lead

the team and continue its development plans in readiness for the

changes resulting from the Retail Distribution Review.

Whilst activity levels in the corporate finance division picked

up towards the end of the period, revenues underperformed the

previous year by 14%. Strict cost control minimised the impact to

the division's bottom line. The better conditions witnessed towards

the end of the period leave the division well placed to participate

in any upturn in the small cap arena.

Revenues in the financial services division increased slightly

over the previous year, although additional investment in marketing

and unbudgeted regulatory charges held back the bottom line as the

division positioned itself for future growth.

Walker Crips' Structured Investments business, continued to

build on its strong reputation with professional advisers with the

launch of a number of new products during the period. This

increased output has helped to lift revenues and profits during the

period and presents the Group with scope for further growth.

Dividend

I am pleased to announce that the Group's improved performance

over the year has allowed your Board to recommend an increase in

the final dividend to 1.8 pence per share (2010: 1.7 pence per

share) making a total for the year of 2.74 pence per share (2010:

2.64 pence per share). The increased dividend reflects your Board's

desire to continue rewarding shareholders with a growing income

stream and as a demonstration of their confidence in the future

strength of the Group.

The final dividend will be paid on 22 July 2011 to those

shareholders on the register at the close of business on 17 June

2011.

AGM

This year's annual general meeting will be held as usual at

Armourers' Hall, 81 Coleman Street, London EC2R 5BJ on the 15 July

2011, but will commence at the earlier time of 11.00 am. Coffee and

biscuits will be served for a short while before and after the

meeting.

Outlook

We expect the first quarter of a new financial year to be

relatively subdued and the current more generally uncertain

short-term view of the economy and markets has impacted upon the

Group's trading in, and our expectations for, the current year.

However, in the longer term, your Board is confident that the

Group's strong financial position and range of products should

enable it to grow shareholder value.

D M Gelber

Chairman

8 June 2011

CHIEF EXECUTIVE'S REPORT

Results overview

The relative stability of UK financial markets during the period

provided the environment for further steady progress in Group

revenue and profitability. The 14% increase in revenue was buoyed

by a strong fourth quarter enabling the Group's reported profit

before tax to increase by 15.2%, despite unexpectedly high

Financial Services Compensation Scheme (FSCS) Levies of over

GBP200,000 resulting from the failure of firms in other financial

sectors.

Administrative expenses were closely monitored and the majority

of the 12.1% increase over the prior year related directly to

additional business generated. Investment revenues continued at

levels well below recent years, due to the very low level of global

interest rates.

Fund Management (WCAM)

The repeated success of our fund management division was once

again demonstrated by a 25% increase in total FUM to a record

GBP787 million at year end (2010: GBP630 million). Increasing

institutional investor interest resulted in strong net inflows of

GBP97.5 million during the period which combined with strong market

performance to reach this milestone.

Our senior fund managers continued enhancing WCAM with another

excellent investment performance in the unit trust funds which have

seen considerable organic growth since 2002. During the years in

which the UK growth and Equity Income funds have been under the

management of WCAM, both funds have outperformed over 95% of their

peer group competitors, a remarkable achievement.

Investment Management

The Private Client Portfolio Management business continued to

move forward, delivering an 8% increase in revenue across the

diversified retail client base. A substantial amount of this growth

was fee based with low correlation to market conditions. The

division's services now include more complex derivative

instruments, an active Contracts for Difference dealing service as

well as traditional bonds and equities. Now with offices in both

York and London, funds under management increased by 13% to GBP181

million (2010: GBP160 million).

The division has done much to prepare to meet the industry-wide

Retail Distribution Review (RDR) Level 4 qualification requirement

for broker/portfolio managers. The majority of the team have now

exceeded this minimum by achieving the Level 6 exams well before

the requirements come into place. New products and service

offerings specifically designed to capitalise on the opportunities

arising from the RDR are expected to be launched later this

year.

Our structured investments business, Walker Crips Structured

Investments (WCSI), has continued to grow market share with an

expanding range of innovative products. Total sales through IFA

channels comfortably exceeded last year's results, raising over

GBP50 million in equity linked products.

A strong finish to the financial year in active markets enabled

our traditional advisory and execution-only business to register a

small increase in commission income on better volumes.

Subscriptions into our ISA product increased by 12% year on

year, justifying once again our policy of incubating products for

several years until more lucrative returns can be enjoyed.

The cost of meeting the increasing burden of compliance

continues to put pressure on profitability, exacerbated further in

the period by events outside our control such as those leading to

the exceptionally high FSCS Levy.

Wealth Management

Our innovative Financial Services and Pensions Management

division continues to be driven by focused management and advisers,

who provide a committed, premium service to a predominantly

regional client base.

Once again, the RDR implementation process is well in hand with

the vast majority of advisers already qualified to the RDR required

standard.

The flagship SIPP (Self Invested Personal Pension) product

showed strong growth after a targeted marketing drive. In addition,

the SSAS (Small Self Administered Scheme) is being marketed to

small corporate and family controlled companies in need of

dedicated pension services.

SIPP plans at year end numbered 279 (2010: 250) and funds under

administration at the year end were up 18% at just over GBP82

million (2010: GBP70 million). SSAS plans under administration

amounted to GBP204 million (2010: GBP200 million).

The joint venture with a provincial firm of accountants

providing Wealth Management services to their client base enjoyed

its most profitable year since formation in 2007.

Corporate Finance

The Corporate Finance division made a small loss during another

challenging year, despite the number of retained clients increasing

to 13 and costs remaining strictly monitored. The division is

encouraged by an active pipeline for the current year.

Staff

I would like to thank all our personnel for their efforts this

year, in particular the account executives, many of whom are faced

with the difficult task of studying and re-qualifying under the

RDR. Our back and middle office staff unwaveringly demonstrated

loyalty and commitment despite the austerity pressures of the past

two years.

Liquidity

The current level of cash resources within the business remains

more than sufficient for working capital purposes and provides

adequate headroom even when faced with volatile business flows.

Great emphasis is placed on the credit risk of the banking

institutions with whom we place funds, with financial stability

taking greater priority over rates of return.

Going Concern

The Group continues to have a robust financial position. Having

conducted detailed forecasts and appropriate stress-testing on

liquidity, profitability and regulatory capital, taking account of

possible adverse changes in trading performance, the Board has

sufficient grounds to believe the Group is well placed to manage

its business risks adequately and that it will be able to operate

within the level of its current financing arrangements and

regulatory capital limits, which includes a GBP3 million overdraft

facility. Accordingly, the Board continues to adopt the going

concern basis for the preparation of the financial statements.

Outlook

Overall trading activity in the opening weeks of the new

financial year has been quiet, reflecting current economic

uncertainty.

Whilst this may impact short term performance, your Board

believes that the Group is well positioned to capitalise on

improvements in its markets over the longer term.

R A FitzGerald FCA

8 June 2011

Walker Crips Group plc

Consolidated Income Statement

Year ended 31 March 2011

2011 2010

Notes GBP'000 GBP'000

Revenue 4 20,122 17,648

Commission payable (5,132) (4,320)

Gross profit 14,990 13,328

Share of after tax profits

of joint ventures 11 -

Administrative expenses (13,295) (11,862)

Operating profit 1,706 1,466

Investment revenues 50 60

Finance costs (1) (3)

Profit before tax 1,755 1,523

Taxation (539) (474)

Profit for the year attributable

to equity holders of the

company 1,216 1,049

Earnings per share

Basic 3 3.35p 2.87p

Diluted 3 3.27p 2.80p

Walker Crips Group plc

Consolidated Statement of Comprehensive Income

Year ended 31 March 2011

2011 2010

GBP'000 GBP'000

Loss on revaluation of available-for-sale

investments taken to equity (137) (98)

Deferred tax on loss on available-for-sale

investments 61 27

Deferred tax on share options (4) 3

Net loss recognised directly in equity (80) (68)

Profit for the year 1,216 1,049

Total comprehensive income for the year

attributable to equity holders of the company 1,136 981

Walker Crips Group plc

Consolidated Statement of Financial Position

31 March 2011

Group Group

2011 2010

GBP'000 GBP'000

Non-current assets

Goodwill 5,121 5,121

Other intangible assets 461 576

Property, plant and equipment 767 868

Investment in joint ventures 34 23

Available for sale investments 1,183 1,320

7,566 7,908

Current assets

Trade and other receivables 35,847 30,245

Trading investments 720 451

Deferred tax asset 26 -

Cash and cash equivalents 4,281 5,655

40,874 36,351

Total assets 48,440 44,259

Current liabilities

Trade and other payables (33,207) (28,963)

Current tax liabilities (568) (494)

Bank overdrafts - (72)

Deferred tax liability - (99)

(33,775) (29,628)

Net current assets 7,099 6,723

Net assets 14,665 14,631

Equity

Share capital 2,470 2,470

Share premium account 1,626 1,626

Own shares (312) (173)

Retained earnings 5,387 5,134

Revaluation reserve 820 896

Other reserves 4,674 4,678

Equity attributable to equity holders

of the company 14,665 14,631

Walker Crips Group plc

Consolidated Statement of Cash Flows

Year ended 31 March 2011

2011 2010

GBP'000 GBP'000

Operating activities

Cash generated by operations 777 3,733

Interest received 33 28

Interest paid (1) (3)

Tax paid (539) (277)

Net cash generated by operating activities 270 3,481

Investing activities

Deferred consideration payment under

acquisition agreements - (150)

Purchase of property, plant and equipment (218) (83)

Net purchase of investments held for

trading (269) (135)

Dividends received 17 37

Net cash used in investing activities (470) (331)

Financing activities

Proceeds on issue of shares - 27

Purchase of treasury shares (139) -

Dividends paid (963) (928)

Net cash used in financing activities (1,102) (901)

Net (decrease)/increase in cash and

cash equivalents (1,302) 2,249

Net cash and cash equivalents at beginning

of year 5,583 3,334

Net cash and cash equivalents at end

of year 4,281 5,583

Cash and cash equivalents 4,281 5,655

Bank overdrafts - (72)

4,281 5,583

Walker Crips Group plc

Consolidated Statement of Changes in Equity

Year ended 31 March 2011

Called

up Own

share Share shares Capital Retained Total

capital premium held Redemption Other Revaluation earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Equity as at

31 March

2009 2,464 1,605 (173) 111 4,564 967 5,013 14,551

Revaluation

of

investment

at fair

value - - - - - (98) - (98)

Deferred tax

credit to

equity - - - - - 27 - 27

Movement on

deferred

tax on

share

options - - - - 3 - - 3

Profit for

the year - - - - - - 1,049 1,049

Dividends

paid - - - - - - (928) (928)

Issue of

shares on

exercise of

options 6 21 - - - - - 27

Equity as at

31 March

2010 2,470 1,626 (173) 111 4,567 896 5,134 14,631

Revaluation

of

investment

at fair

value - - - - - (137) - (137)

Deferred tax

credit to

equity - - - - - 61 - 61

Movement on

deferred

tax on

share

options - - - - (4) - - (4)

Profit for

the year - - - - - - 1,216 1,216

Dividends

paid - - - - - - (963) (963)

Purchase of

treasury

shares - - (139) - - - - (139)

Equity as at

31 March

2011 2,470 1,626 (312) 111 4,563 820 5,387 14,665

Walker Crips Group plc

Notes to the accounts

Year ended 31 March 2011

1. The financial information set out in the announcement does

not constitute the company's statutory accounts for the years ended

31 March 2011 or 2010. The financial information for the year ended

31 March 2010 is derived from the statutory accounts for that year

which have been delivered to the Registrar of Companies. The

auditors reported on those accounts was unqualified and did not

contain a statement under s. 498(2) or (3) Companies Act 2006. The

statutory accounts for the year ended 31 March 2011 are yet to be

signed but will be finalised on the basis of the financial

information presented by the directors in this preliminary

announcement and will be delivered to the Registrar of Companies

following the company's annual general meeting.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chairman's Statement and Chief Executive's

report.

The Group has healthy financial resources together with a long

established, well proven and tested business model. As a

consequence, the directors believe that the Group is well placed to

manage its business risks successfully despite the current

climate.

After conducting enquiries, the directors believe that the Group

have adequate resources to continue in existence for the

foreseeable future. Accordingly, they continue to adopt the going

concern basis in preparing the financial statements.

2. Whilst the information as set out in this preliminary

announcement is prepared in accordance with International Financial

Reporting Standards ('IFRS') the announcement itself does not

contain sufficient information to comply with IFRS.

The accounting policies are consistent with those applied in the

full financial statements and are consistent with those of the

prior year.

3. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the financial year

of GBP1,216,000 (2010 - GBP1,049,000) and on 36,301,187 (2010

-36,573,308) ordinary shares of 6 2/3p, being the weighted average

number of ordinary shares in issue during the year.

The effect of options granted would be to reduce the reported

earnings per share. The calculation of diluted earnings per share

is based on 37,147,771 (2010 - 37,470,621) ordinary shares, being

the weighted average number of ordinary shares in issue during the

Period adjusted for dilutive potential ordinary shares.

4. Segmental analysis

For management purposes the Group is currently organised into

four operating divisions - Investment Management, Corporate

Finance, Financial Services and Fund Management. These divisions,

all of which conduct business in the United Kingdom only, are the

basis on which the Group reports its primary segment

information.

Consolidated

Year ended

Investment Corporate Financial Fund 31 March

Management Finance Services Management 2011

2011 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External

sales 13,959 308 2,021 3,834 20,122

Result

Segment

result 606 (64) 197 2,148 2,887

Unallocated

corporate

expenses (1,181)

Operating

profit 1,706

Investment

revenues 50

Finance costs (1)

Profit before

tax 1,755

Tax (539)

Profit after

tax 1,216

Other

information

Capital

additions 195 9 1 13 218

Depreciation 270 12 19 18 319

Balance sheet

Assets

Segment

assets 38,556 358 886 1,378 41,178

Unallocated

corporate

assets 7,262

Consolidated

total

assets 48,440

Liabilities

Segment

liabilities 32,385 37 295 742 33,459

Unallocated

corporate

liabilities 316

Consolidated

total

liabilities 33,775

Segmental analysis (continued)

Consolidated

Year ended

Investment Corporate Financial Fund 31 March

Management Finance Services Management 2010

2010* GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External

sales 12,391 358 1,990 2,909 17,648

Result

Segment

result 644 (44) 301 1,423 2,324

Unallocated

corporate

expenses (858)

Operating

profit 1,466

Investment

revenues 60

Finance costs (3)

Profit before

tax 1,523

Tax (474)

Profit after

tax 1,049

Other

information

Capital

additions 72 4 2 5 83

Depreciation 337 18 38 25 418

Balance sheet

Assets

Segment

assets 33,454 465 1,201 1,369 36,489

Unallocated

corporate

assets 7,770

Consolidated

total

assets 44,259

Liabilities

Segment

liabilities 28,031 38 310 557 28,936

Unallocated

corporate

liabilities 692

Consolidated

total

liabilities 29,628

* Prior year revenue has been re-classified between operating

divisions as determined by clients principal activity, whereas

previously these income streams were split across several

segments.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UBABRAUANRAR

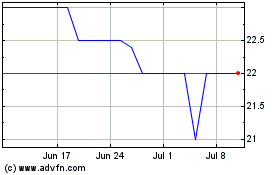

Walker Crips (LSE:WCW)

Historical Stock Chart

From Jun 2024 to Jul 2024

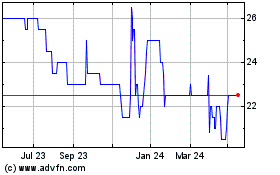

Walker Crips (LSE:WCW)

Historical Stock Chart

From Jul 2023 to Jul 2024