TIDMYCA

RNS Number : 7912V

Yellow Cake PLC

06 December 2023

6 December 2023

Yellow Cake plc ("Yellow Cake" or the "Company")

Unaudited Interim Financial Report for the six-month period

ended 30 September 2023

Yellow Cake, a specialist company operating in the uranium

sector holding physical uranium for the long term , is pleased to

announce its unaudited interim financial report for the six-month

period ended 30 September 2023 ("half-year").

Highlights

-- Increase in Yellow Cake's holdings of physical uranium ("U(3)

O(8) ") from 18.81 million lb of U(3) O(8) to 20.16 million lb of

U(3) O(8) .

-- Increase of 55.5% in the value of Yellow Cake's U(3) O(8)

holdings from USD952.5 million ([1]) as at 31 March 2023, to

USD1,481.4 million[2] as at 30 September 2023, as a result of a

45.1% increase in the U(3) O(8) spot price from USD50.65/lb ([3])

to USD73.50/lb ([4]) combined with the increase in volume of U(3)

O(8) held by Yellow Cake over the period.

-- Increase in net asset value from USD1,035.3 million[5] as at

31 March 2023 to USD1,494.2 million[6] as at 30 September 2023.

Increase in net asset value per share from GBP4.23 per share

(USD5.23 per share) [7] as at 31 March 2023 to GBP6.18 per share

(USD7.54 per share)[8] as at 30 September 2023.

-- Profit after tax for the half-year of USD458.8 million (30

September 2022: loss of USD145.5 million).

-- On 30 September 2023, Yellow Cake took delivery of 1,350,000

lb of U(3) O(8) that it had elected to purchase as part of its 2022

uranium purchase option under its agreement (the "Framework

Agreement") with JSC National Atomic Company Kazatomprom

("Kazatomprom") at a price of USD48.90/lb, or USD66.0 million in

aggregate. The delivery was made at the Cameco storage facility in

Ontario, Canada. The purchase was funded from the proceeds of an

oversubscribed share placing in February 2023, which raised gross

proceeds of approximately GBP61.8 million (approximately USD74.3

million).

-- Subsequent to the period-end, following the completion of a

further oversubscribed share placing on 2 October 2023, which

raised gross proceeds of approximately GBP103 million

(approximately USD125 million) at a price of GBP5.50 per share,

Yellow Cake informed Kazatomprom that it had elected to purchase

1,526,717 lb of U(3) O(8) at a price of USD65.50/lb, at a cost of

USD100.0 million, exercising the entirety of the Company's 2023

uranium purchase option under its Framework Agreement with

Kazatomprom. Yellow Cake expects to take delivery in H1 2024 and on

completion will hold 21.68 million lb of U(3) O(8) .

-- All U(3) O(8) to which the Company has title and has paid

for, is held at the Cameco storage facility in Canada and the Orano

storage facility in France. The Company's operations, financial

condition, and ability to purchase and take delivery of U(3) O(8)

from Kazatomprom, or any other party, have, to date, remained

unaffected by the geopolitical events in Ukraine.

-- Yellow Cake's estimated pro forma net asset value on 4

December 2023[9] was GBP6.58 per share or USD1,799.3 million, based

on 21.68 million lb of U(3) O(8) [10] valued at a spot price of

USD81.45/lb[11] and cash and other current assets and liabilities

of USD12.7 million as at 30 September 2023, plus net placing

proceeds of USD120.6 million received on 2 October 2023 less a cash

consideration of USD100.0 million to be paid to Kazatomprom

following the expected delivery of 1.53 million lb of U(3) O(8) in

H1 2024.

Yellow Cake Estimated Pro forma Net Asset Value as at 4

December 2023 (9)

--------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (10) (A) lb 21,682,318

U(3) O(8) fair value per pound

(11) (B) USD/lb 81.45

(A) x (B)

U(3) O(8) fair value = (C) USD m 1,766.0

------------

Cash and other net current

assets/(liabilities) ( [12]

() (D) USD m 33.3

(C) + (D)

Net asset value in USD m = (E) USD m 1,799.3

------------

Exchange Rate (F) USD/GBP 1.2614

(E) / (F)

Net asset value in GBP million = (G) GBP m 1,426.5

Number of shares in issue less

shares held in treasury ( [13]

() (H) 216,856,447

Net asset value per share (G) / (H) GBP/share 6.58

---------------------------------- ----------- ----------- ------------

Andre Liebenberg, CEO of Yellow Cake, said:

" The uranium price has recently hit a 15-year high, driven by

the same supply-demand characteristics that we have consistently

highlighted since our listing. Specifically, we are seeing higher

demand as nuclear energy is increasingly accepted as the critical

choice to meet our future net zero ambitions. Notably in France, we

have seen plans to reduce nuclear's share of electricity generation

to 50% jettisoned, while China's nuclear capacity target is

expected to increase significantly from previous targets. At the

same time, supply remains constrained despite steadily rising

prices, due in part to operational challenges associated with

mining the commodity, and geopolitical factors, risks that do not

impact Yellow Cake. We have continued to deliver against our stated

strategy to buy and hold physical uranium giving our shareholders

the opportunity for direct exposure to the commodity. Our ten-year

framework agreement with Kazatomprom, which allows us to acquire

USD100 million of uranium every year until 2027, is key to our

investment case. We recently raised funds through an oversubscribed

share placing and purchased a further USD100.0 million of U(3) O(8)

at a price of USD65.50/lb, boosting our holding to nearly 22

million pounds of uranium. We remain very confident in our

strategy, and the long term outlook for uranium."

ENQUIRIES:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

Tel: +44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Canaccord Genuity Limited

Henry Fitzgerald-O'Connor James Asensio

Tel: +44 (0) 207 523 8000

Joint Broker: Berenberg

Matthew Armitt Jennifer Lee

Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Communications Adviser: Powerscourt

Peter Ogden

Tel: +44 (0) 7793 858 211

ABOUT YELLOW CAKE

Yellow Cake is a London-quoted company, headquartered in Jersey,

which offers exposure to the uranium spot price. This is achieved

through its strategy of buying and holding physical triuranium

octoxide (" U(3) O(8) "). It may also seek to add value through

other uranium related activities. Yellow Cake seeks to generate

returns for shareholders through the appreciation of the value of

its holding of U(3) O(8) and its other uranium related activities

in a rising uranium price environment. The business is

differentiated from its peers by its ten-year Framework Agreement

for the supply of U(3) O(8) with Kazatomprom, the world's largest

uranium producer. Yellow Cake currently holds 20.16 million pounds

of U(3) O(8) , all of which is held in storage in Canada and

France.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

Chief Executive's Statement

Overview

Longer-term trends in uranium supply/demand fundamentals

crystallised in a strong rise in uranium prices in the six months

to 30 September 2023. Electricity use is projected to escalate

strongly in the decades ahead as a result of population growth,

development, urbanisation, electric vehicles, big tech data centres

and heavy industry. Nuclear power is increasingly recognised

globally as an essential part of the solution in the context of

decarbonisation goals and energy security.

The list of countries showing positive shifts towards nuclear

continued to grow during the period, including favourable policy

developments, recommissioning idled capacity, constructing new

facilities and extending operating licences. China alone aims to

add nuclear capacity of approximately 90% of the current global

reactor count by 2060. Advanced reactors and small and modular

reactors ("SMRs") continue to make progress towards

commercialisation with strong support from investors and

governments, improving the ease and speed of rolling out nuclear

solutions at reduced cost.

In the face of this projected increased demand, uranium supply

is likely to struggle to keep pace. The World Nuclear Association

reported in September that primary uranium supply met only 76% of

global demand in 2022, a trend likely to remain in place as

existing mines deplete. Upping production at current producers is

not necessarily a simple matter, as seen in technical challenges

and supply chain constraints reported by major producers like

Kazatomprom and Cameco during the period. The concentrated nature

of uranium resources is a further complicating factor in the

context of the Russia/Ukraine conflict and a coup in Niger, which

together affect around 19% of annual uranium production. Concerns

remain about the ability of Kazakhstan, the world's largest

producer of uranium, to supply uranium to the West at volume while

avoiding the complexities of transit across Russian territory.

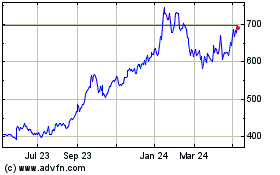

These factors saw the uranium spot price rise by 45% from 31

March 2023 to 30 September 2023 on relatively low volumes. Term

uranium price indicators rose by 30% as nuclear utilities acquired

additional inventory to meet future fuel needs. Increased annual

volumes under newly negotiated term uranium contracts may force

associated prices to rise to incentivise uranium mining

development, placing further pressure on near-term uranium

prices.

Yellow Cake's uranium purchase option under its Framework

Agreement with Kazatomprom is a key asset in our strategy to

provide investors with low risk, low cost and liquid exposure to

the uranium spot price in a publicly-quoted vehicle. Shortly after

period end, the Company raised funds through an oversubscribed

share placing and committed to purchase a further USD100.0 million

(1.53 million lb of U(3) O(8) ) at a price of USD65.50/lb. Yellow

Cake expect delivery to take place in H1 2024, boosting Yellow

Cake's holding to 21.68 million lb of U(3) O(8) . This increased

holding provides shareholders a substantial opportunity to

participate in the continued unfolding of the long-term

supply/demand mismatch in the uranium market.

Global Uranium Market

The uranium spot price rose significantly over the half-year

from USD50.65/lb up to USD73.50/lb, securing gains of more than

45%. Aggregate spot market volumes remained modest during

April-September period with UxC reporting a total of 27.4 million

lb of U(3) O(8) transacted during the six-month period, averaging

slightly more than 4.5 million lb of U(3) O(8) per month.

The Sprott Physical Uranium Trust ("SPUT") was relatively

inactive during April-September SPUT traded at a discount for 95%

of the trading days during the period) with the uranium fund

reporting purchases totalling 459,979 lb of U(3) O(8) during the

six month period, compared to 5.1 million lb in the comparative

prior period. [14]

Total transactional volume in the term market reported during

the period was 92 million lb of U(3) O(8) (excluding multi-year

agreements involving non-utility buyers). Term uranium price

indicators strengthened as a result, with the three-year Forward

Price rising from USD57.00/lb at the end of March to USD75.00/lb at

the end of September. Similarly, the five-year Forward Price

improved from USD61.00/lb up to USD79.00/lb. The long-term price

gained USD8.00/lb from the end of March 2023 from the then-reported

level of USD53.00/lb to USD61.00/lb at the end of the

half-year.

Nuclear Generation / Uranium Demand

In July 2023, China announced that its commercial nuclear power

programme now has 24 reactors under construction.[15] The country's

State Council approved the construction of six nuclear reactors:

units 5 and 6 of the Ningde nuclear power plant ("NPP") in Fujian

Province, units 1 and 2 of the Shidaowan NPP in Shandong Province,

and; units 1 and 2 of the Xudabao NPP in Liaoning Province.[16]

In September 2023, the China Nuclear Energy Association

announced that China's nuclear power sector is expected to supply

10% of the nation's electricity by 2035. Furthermore, China's

installed nuclear capacity is planned to reach 400 GWe by 2060

supplying 18% of China's electricity at that time. Currently, China

has 55 operating reactors (reported capacity 56.8 GWe) with a

further 24 under construction. Twenty-one reactors have been

approved for construction since the beginning of the 14(th)

Five-Year Plan period (2021-2025).[17]

In April 2023, India's Minister of State, Jitendra Singh,

announced that the country's nuclear generating capacity is

expected to reach about 9% of its total installed generating

capacity by 2047. The 47,112 TWh of nuclear power generated in

India in 2021-2022 represented about 3.2% of India's total

electricity generation. India anticipates expanding its current

installed nuclear capacity of 6,780 MWe to 22,480 MWe by 2031, as

ten approved nuclear reactors are constructed, with further units

being built in fleet mode.[18]

In June 2023, India's Prime Minister, Narendra Modi, and US

President, Joe Biden, released a joint statement following talks in

Washington supporting the significant role of nuclear power in

global decarbonisation efforts. The two leaders reported that

negotiations are ongoing between Nuclear Power Corporation of India

Ltd and Westinghouse Corporation for the construction of six

AP-1000 reactors while further discussions are being held regarding

small modular reactors in India.[19]

Japan's Kansai Electric Power Company recommenced operation of

the Takahama-1 reactor in July 2023 and of the Takahama-2 reactor

in September 2023.[20] The units had been offline since 2011. Both

reactors have been granted operating license extensions which will

allow the units to operate for up to 60 years.[21]

During the half-year, the US Department of Energy's Energy

Information Administration released its Uranium Marketing Report

which contains a broad spectrum of data relating to owners and

operators of US civilian nuclear power reactors, nuclear fuel

purchases and usage during 2022. US nuclear utilities purchased a

total of 40.5 million lb of U(3) O(8) during 2022, 13% less than

the 2021 level of 46.7 million lb of U(3) O(8) . The weighted

average purchase price rose from USD33.91/lb in 2021 to USD39.08/lb

in 2022. Principal supply origin countries included Canada (27.4%),

Kazakhstan (24.7%), Russia (11.8%), Uzbekistan (11%) and Australia

(8.9%). Russian-origin uranium acquired by US utilities was

reported at 8.1 million lb of U(3) O(8) in 2020, declining by 41%

over the two-year period. During 2022, 15% of the uranium delivered

in the market was purchased under spot contracts at a

weighted-average purchase price of USD40.70/lb while the remaining

85% was purchased under long-term contracts at a weighted-average

price of USD38.81/lb. At the end of 2022, the maximum uranium

deliveries for 2023 through to 2032 under existing purchase

contracts totalled 223 million lb of U(3) O(8) while unfilled

uranium market requirements for the same period totalled 179

million lb of U(3) O(8) .[22]

Having declared commercial operation of the Vogtle-3 reactor,

the first newly constructed power reactor in the United States in

more than 30 years (31 July 2023), Georgia Power announced the

commencement of fuel-loading at Vogtle-4 effective 17 August 2023.

The unit is scheduled for commercial operation in 4Q 2023 or 1Q

2024.[23]

A joint development agreement has been executed between US

utility Energy Northwest and X-Energy Reactor Company for the

deployment of up to 12 Xe-100 small modular reactors in central

Washington state. The utility anticipates the first Xe-100 module

to be online by 2030 at a site adjacent to the existing Columbia

Generating Station in Richland, Washington.[24]

South Korea is evaluating the country's need for additional

nuclear power reactors in response to increasing electricity demand

resulting from the expansion of data centres, investment in high

technology industries (semi-conductors and batteries) and

escalating utilisation of electric vehicles. The 29(th) Energy

Committee meeting was under the auspices of the Ministry of Trade,

Industry and Energy. Based upon strong Committee support, the

Committee decided to bring forward the initiation of the 11(th)

Electricity Plan addressing the years 2024-2038.[25]

Taiwan's People's Party, the political opposition party, has

stated that if successfully elected in 2024, they will reverse the

country's nuclear phase-out policy which calls for the shut-down of

the two remaining operating NPPs (Maanshan NPP) by 2025, when the

units will have reached the end of their 40-year operating

licenses. Taiwan People's Party Chairman and presidential

candidate, Ko Wen-je, has stated that nuclear power is essential to

the nation's goal of attaining carbon neutrality by 2050.[26]

The Polish government initiated the process to construct a NPP

based on South Korean reactors. PGE PAK Energia Jadrowa SA ("PPEJ")

submitted an application to Poland's Ministry of Climate and

Environment for a decision-in-principal for the construction of the

proposed NPP consisting of at least two APR-1400 reactors to be

built in central Poland. Assuming the approval process leads to a

license to construct and operate, PPEJ plans on commercial

operation by 2035.[27] Poland also issued an environmental permit

for its first NPP which is to be built on the Baltic Coast.

Construction is planned to begin in 2026 with the facility

operational by 2033.[28]

Sweden's Minister for Climate and Environment called for the

Nordic country to construct up to ten new large nuclear reactors

(or the equivalent SMRs) by 2045, to supplement the current

commercial reactor fleet of six reactors (6,937 MWe). The

Minister's comments followed the release of the Radiation Safety

Authority (Sweden) report (9 August) supporting a pre-licensing

review of new reactor designs as well as the development of the

regulatory framework which may be needed for the future expansion

of nuclear power.[29]

Turkey expects to reach agreement with China for its second NPP

to be sited near the city of Kirklareli, in the northwestern area

of the country. The NPP will follow the current NPP being built by

Russia's Rosatom which is expected to enter commercial operation in

2024.[30]

The Italian government established a working group to assess the

restart of the country's nuclear power programme. Historically,

Italy operated four NPPs (total capacity 1,423 MWe). However, a

decision to shut down two remaining reactors was taken in July 1990

in response to the nuclear accident at Chernobyl, following the

earlier closure of the other two reactors. The newly drafted

"National Platform for Sustainable Nuclear" calls for a

multi-agency review of potential technologies and sites.[31]

Nuclear power development in Africa continued to progress. Kenya

announced plans to begin construction of a NPP at coastal sites in

either Kilifi or Kwale counties. The facility is expected to cost

USD3.4-4.1 billion and start construction in 2027.[32] The Ugandan

President announced that Russia and South Korea will construct two

NPPs in Uganda. Agreements have been reached but no date for

construction start was given except for "soon."[33] Nuclear Power

Ghana selected two potential sites for its planned NPP with Nsuban

(Western Region) as the preferred location and Obotan (Central

Region) serving as the back-up. The country expects to select the

reactor vendor by 2030 with construction commencing that year.

Uranium Supply

Cameco Corporation ("Cameco") released the company's Q3 2023

financial results on 30 October 2023. Uranium production increased

to 11.9 million lb of U(3) O(8) for the nine months to 30 September

2023 compared to 6.6 million lb of U(3) O(8) during the same period

in 2022, as the McArthur River/Key Lake Mill facility ramped up

after an extended period of care and maintenance and Cameco's

ownership share of Cigar Lake increased incrementally. Cameco

confirmed its reduced guidance (announced 3 September) for McArthur

River/Key Lake and Cigar Lake production in 2023. Guidance for

production at McArther River/Key Lake reduced from 15.0 million lb

of U(3) O(8) to 14.0 million lb of U(3) O(8) (Cameco's share

reducing from 10.5 to 9.8 million lb of U(3) O(8) ) following

challenges at the Key Lake Mill facility. These related to the

length of time the facility was in care and maintenance,

operational changes, skills shortages and supply chain challenges

affecting availability of materials and reagents.

Guidance for production at Cigar Lake reduced from up to 18.0

million lb of U(3) O(8) to up to 16.3 million lb of U(3) O(8) in

2023 (Cameco's share reducing from up to 9.8 to up to 8.9 million

lb of U(3) O(8) ). Planned production was negatively affected by

technical issues and unplanned maintenance. In addition, the

company is entitled to purchase 4.2 million lb of U(3) O(8) from JV

Inkai (Kazakhstan) during 2023 from planned production of 8.3

million lb of U(3) O(8) at the Kazakh ISR production facility.

Guidance for both McArther River/Key Lake and Cigar Lake 2024

production remained at 18 million lb U(3) O(8) each.

Cameco expects to purchase 11-13 million lb of U(3) O(8) during

the year due to increased 2023 deliveries and to maintain a working

inventory (that total includes existing purchase commitments

including Cameco's share of output from the JV Inkai in

Kazakhstan). Corporate executives talked of "transformative

tailwinds for the nuclear power industry" arising from ongoing

geopolitical events, the global focus on the climate crisis and

energy security concerns[34]. The accompanying news release

referred to "durable, full-cycle demand growth across the nuclear

energy industry" and "the industry's best ever market

fundamentals"[35].

Cameco continued its term uranium and conversion services

contracting strategy, involving nuclear utilities in Central and

Eastern Europe, as Bulgaria executed a long-term purchase agreement

for 100% of the UF(6) needs of the Kozloduy 5 reactor complex. The

agreement, which will be effective through 2033, calls for Cameco

to deliver a total of approximately 2.2 million kg of UF(6) (the

equivalent of about 5.7 million lb of U(3) O(8) ).[36]

Kazatomprom announced the approval of several agenda items

during the company's Annual General Meeting on 25 May 2023. More

than 90% of the votes cast approved a "major transaction", allowing

Kazatomprom to enter into agreements representing more than fifty

percent of the total book assets of Kazatomprom, including the

recently announced long-term uranium sales agreement "and other

transactions for the purchase and sale of natural uranium

concentrates" with China National Nuclear Corporation Overseas

Limited.[37]

In September 2023, Kazatomprom announced its plans for increased

uranium production in CY2025 to 100% of subsoil agreements and

stated that, driven by a strong contract book and already growing

sales portfolio, planned output would reach 79.3-81.9 million lb of

U(3) O(8) in 2025 which would be an increase of around 15.6 million

lb above the currently planned output for CY2024. However,

Kazatomprom warned that geopolitical uncertainty, global supply

chain issues and inflationary pressure could impact the planned

production increase.

On 1 November 2023, Kazatomprom released its third quarter 2023

financial results, including uranium production data. The company

reported total production of 39.8 million lb of U(3) O(8) for the

nine months to 30 September 2023, a slight decrease from the

40.2million lb of U(3) O(8) produced in the prior period.

Kazatomprom's attributable share of production for the nine months

to 30 September 2023 was 17.9 million lb of U(3) O(8) . The

company's average realised price rose by 14% to USD47.81/lb

period-on-period. Production volume for the year (100% basis)

continues to be guided at 53.3 million lb-55.9 million lb, although

the company flagged persistent issues associated with limited

access to certain key materials, such as sulfuric acid, and

uncertainties relating to the Russia/Ukraine conflict as potential

risks to forecast production.[38]

French President, Emmanuel Macron, conducted a state visit to

Mongolia in May 2023. A major focus of the visit was joint

cooperation between the two countries in the area of uranium

exploration and development, specifically the Zuuvch-Ovoo ISR

Uranium Project, which is being evaluated by Badrakh Energy, a

joint-venture of the French nuclear fuel cycle company, Orano

(66%), and Mongolia's Mon-Atom (34%). The project could eventually

produce as much as 8-9 million lb of U(3) O(8) /year at full

capacity, although a development decision is yet to be

taken.[39]

UxC released its annual uranium production summary, "2022 U(3)

O(8) Production Review," on 15 May 2023. Worldwide uranium

production increased 4.9% from 123 million lb of U(3) O(8) in 2021

to 129 million lb of U(3) O(8) in 2022. The majority of the uplift

in uranium output was due to the ramp-up of the Cigar Lake uranium

mine and the restart of the McArthur River uranium mine, both in

Northern Saskatchewan, while the Olympic Dam multi-mineral mine in

Australia contributed a portion of the incremental increase as the

facility exited a major smelter maintenance programme during the

year. Kazakhstan remained the largest producer, reporting 55.2

million lb of U(3) O(8) in 2022 (43% of global production),

followed by Canada with production of 19.2 million lb of U(3) O(8)

in 2022. Namibia produced 14.6 million lb of U(3) O(8) while

Australia produced 12.2 million lb of U(3) O(8) in 2022. Uzbekistan

reported total uranium production of 9.1 million lb of U(3) O(8) .

The five largest uranium producing countries accounted for just

over 85% of total global uranium production in 2022.[40]

The International Atomic Energy Agency ("IAEA") convened its

periodic International Symposium on Uranium Raw Material for the

Nuclear Cycle (URAM-2023) in May 2023. Held at five-year intervals,

this symposium examined a broad spectrum of technical and

commercial factors relating to the availability of uranium for the

nuclear fuel cycle. UxC's Executive Vice President-Uranium

presented a keynote address entitled "Global Uranium Supply and

Demand Dynamics Amid Heightened Geopolitical Risk" which

highlighted challenges to future uranium developments as well as

stating that UxC is forecasting that global uranium requirements

will increase by 62% through 2040. Further, TENEX/Rosatom's

Alexander Boytsov observed that "the era of "cheap" uranium in the

world market is ending."[41]

On 26 July 2023, presidential guards seized Niger's president,

Mohamed Bazoum in a military coup. Niger's uranium production

totalled 5.85 million lb of U(3) O(8) in 2022 (around 5% of the

global total) from the operation of SOMAIR, an open-pit mine owned

by the French company, Orano (63.4%) and Sopamin, a company that

manages Niger's participation in mining ventures (36.66%). The

outcome of this geopolitical event remains unresolved, but Orano

has stated that any interruption in uranium production or transport

would not impact the French nuclear programme due to sufficient

uranium inventories. Two foreign uranium companies yet to commence

operations in Niger, Global Atomic (Dasa Uranium Project) and

GoviEx (Madaouela Uranium Project), reported that their activities

were proceeding as normal.[42]

Nuclear Power Forecasts

The US Nuclear Energy Institute ("NEI") released its report

entitled "The Future of Nuclear Power 2023" which documents the

results of a survey involving 19 NEI utility member companies which

currently operate eighty of the nuclear reactor facilities in the

United States. The survey highlighted that more than 90% of the 80

units surveyed anticipate receiving approval to operate for at

least 80 years (majority of fleet would operate to 2050 or beyond)

and that more than 50% of sites surveyed have a level of interest

or planning for power up rates for their site units. The survey

identified plans for over USD6.0 billion in capital investment

supporting the planned changes to the current operating fleet.

Nearly two-thirds of the respondents indicated that the recent

federal policy developments have resulted in an increased interest

in new nuclear within their companies and half of the respondents

indicated that their companies are considering or actively working

to include new nuclear in the integrated resource plans. Nearly

half of the respondents indicated that they have an interest in

pursuing actions to site or license a new reactor, with the first

applications expected to occur in the next year.[43]

In a statement issued at the conclusion of the recent Nuclear

Energy Forum convened during the G7 conference on climate, energy

and environment, five nations (United States, Canada, United

Kingdom, Japan and France) stated that they have identified

"potential areas of collaboration on nuclear fuels to support the

stable supply of fuels for the operating reactor fleets of today,

enable the development and deployment of fuels for the advanced

reactors of tomorrow and achieve reduced dependence on Russian

supply chains." Furthermore, collaboration on strategic

opportunities in the nuclear fuel cycle will "establish a level

playing field to compete more effectively against predatory

suppliers" while strengthening domestic sectors.[44]

In her opening remarks before the 2023 Nuclear Energy Assembly,

Nuclear Energy Institute President and CEO, Maria Korsnick, stated

that "This is the biggest moment for nuclear energy since the dawn

of the atomic age. Everywhere we look, we see demand

surging."[45]

The International Energy Agency released an update to its 2021

report, "Net Zero Roadmap," which examines various future energy

development scenarios. Under the net-zero emissions (NZE) scenario,

the global energy analysis group now foresees global nuclear power

increasing from the current level (392 GW), reaching 916 GW in 2050

as compared to the original study which concluded the need for 812

GW by 2050.[46]

The World Nuclear Association convened its Annual Symposium in

London (6-8 September 2023). The global nuclear power organisation

released the latest edition of its comprehensive nuclear fuel

markets assessment and forecast "The Nuclear Fuel Report - Global

Scenarios for Demand and Supply Availability 2023 - 2040." The

presentation of the biennial report's conclusions regarding future

uranium availability, stated that "in 2022, only 76% of world

reactors requirements were covered by primary uranium supply. By

[the] mid 2020s, restart of idled capacity is expected, however the

decrease of supply from the presently-known existing mines will

continue due to further depletion of uranium resources" and "in the

long run, intense development of new projects and other unspecified

sources will be needed to fill in the supply-demand gap."

Uranium Market Outlook

The global spot uranium market continues to demonstrate upward

price pressure in spite of relatively modest levels of monthly

transactions. Although there has been a significant reduction in

financial entity buying throughout 2023, near-term demand from

nuclear utilities, uranium producers and trading entities has been

sufficient to elicit further price increases.

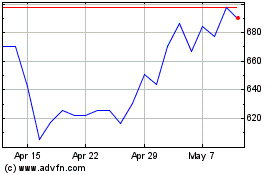

Subsequent to the April-September period, the spot market price

has continued to strengthen, exceeding USD80.00/lb at the end of

November. Factors contributing to that trend include limited

availability of near-term inventory considered as mobile (available

for sale), growing nuclear utility concerns regarding future

production of sufficient uranium to underpin both operating and

planned nuclear reactors as well as geopolitical risks associated

with a number of producing countries such as Russia and Niger.

A growing focus on term uranium contracting will be a

contributing factor to the expected increase in spot market demand

as nuclear utilities acquire additional inventory to support future

fuel needs.

Since the Russian invasion of Ukraine in February 2022, the

threat of restrictions on Russian-sourced nuclear fuel deliveries

into the European Union, United Kingdom and the United States has

persisted. An impediment to those deliveries either through

sanctions or logistical challenges would likely impact the global

nuclear fuel markets and result in further upward price

pressures.

These market factors may continue to prevail and exert upward

pressure on the uranium price, both spot and long-term. As annual

volumes under newly negotiated term uranium contracts increase,

associated prices may need to rise to incentivise necessary uranium

development, placing incremental pressure on near-term uranium

prices.

Andre Liebenberg

Chief Executive Officer

Chief Financial Officer's Report

It is my pleasure to report a number of highlights for the

half-year:

-- Increase in the value of the Company's uranium holdings by

55.5% from USD952.5 million ([47]) to USD1,481.4 million[48], as a

result of the appreciation in the uranium price and an increase in

the volume of uranium held.

-- Increase in the Company's holdings from 18.81 million lb of

U(3) O(8) to 20.16 million lb of U(3) O(8) .

-- 1.35 million lb of U(3) O(8) acquired at a price of

USD48.90/lb, or USD66.0 million in aggregate.

-- Profit after tax of USD458.8 million (30 September 2022: loss of USD145.5 million).

Uranium purchase

Yellow Cake began the period with a holding of 18.81 million lb

of U(3) O(8.) On 30 September 2023, Yellow Cake took delivery of

1,350,000 lb of U(3) O(8) that it had elected to purchase as part

of its 2022 uranium purchase option under its Framework Agreement

with JSC National Atomic Company Kazatomprom at a price of

USD48.90/lb, or USD66.0 million in aggregate. The delivery was made

at the Cameco storage facility in Ontario, Canada. The purchase was

funded from the proceeds of an oversubscribed share placing in

February 2023 which raised gross proceeds of approximately GBP61.8

million (USD74.3 million).

Subsequent to the period-end, following the completion of a

further oversubscribed share placing on 2 October 2023 which raised

gross proceeds of approximately GBP103 million (approximately

USD125 million), Yellow Cake informed Kazatomprom that it had

elected to purchase 1,526,717 lb of U(3) O(8) at a price of

USD65.50/lb, or USD100.0 million in aggregate, exercising the

entirety of the Company's 2023 uranium purchase option under its

Framework Agreement with Kazatomprom. Yellow Cake expects delivery

to take place in the first half of calendar 2024 and on completion

will hold 21.68 million lb of U(3) O(8) .

Uranium-related gain

Yellow Cake made a total uranium-related gain of USD462.9

million in the half-year to 30 September 2023 (30 September 2022:

loss of USD142.0 million).

Operating performance

-- Yellow Cake delivered profit after tax for the half-year of

USD458.8 million (30 September 2022: loss of USD145.5 million).

-- Expenses for the half-year were USD5.7 million (September

2022: USD3.4 million) and comprised:

o USD0.7 million in commissions payable to 308 Services Limited

in relation to the purchase by Yellow Cake of U(3) O(8) (30

September 2022: USD0.4 million); and

o USD5.0 million in expenses of a recurring nature (30 September

2022: USD3.0 million) comprising the following):

-- Procurement and market consultancy fees (holding fees and

storage incentive fees) paid to 308 Services Limited of USD1.5

million (30 September 2022: USD1.6 million) (detailed in note 8);

and

-- Other operating costs of USD3.6 million (30 September 2022:

USD1.4 million). The increase was principally attributable to

higher uranium storage costs, following the expiration of a very

competitive five-year storage contract with Cameco in December

2022.

Yellow Cake's Management Expense Ratio for the half-year (total

operating expenses of a recurring nature, excluding commissions and

equity offering expenses, expressed as an annualised percentage of

average daily net asset value during the period ) was 0.88% (30

September 2022: 0.62%).

Balance sheet and cash flow

The value of Yellow Cake's investment in U(3) O(8) increased by

55.5% during the half-year from USD952.5 million as at 31 March

2023 to USD1,481.4 million as at 30 September 2023, as a result of

the increase in the uranium price from USD50.65/lb ([49]) to

USD73.50/lb ([50]) , combined with an increase in the volume of

uranium held from 18.81 million lb of U(3) O(8) to 20.16 million lb

of U(3) O(8) .

As at 30 September 2023, Yellow Cake had cash and cash

equivalents of USD83.4 million (31 March 2023 USD84.8 million). Of

this, USD66.0 million was applied after the period-end to paying

for 1.35 million lb of U(3) O(8) which was delivered to Yellow Cake

on 30 September 2023.

The Company does not propose to declare a dividend for the

period.

Net Asset Value

Net asset value during the half-year increased from USD1,035.3

million or GBP4.23 per share[51] as at 31 March 2023 to USD1,494.2

million or GBP6.18 per share as at 30 September 2023. Yellow Cake's

net asset value on 30 September 2023, comprised 20.16 million lb of

U(3) O(8) , valued at a spot price of USD73.50/lb[52] and cash and

other current assets and liabilities of USD12.7 million[53] (31

March 2023: comprised 18.81 million lb of U(3) O(8) , valued at a

spot price of US$50.65/lb [54] and cash and other current assets

and liabilities of US$82.8 million [55] ).

Yellow Cake Net Asset Value

30 September 31 March

Units 2023 2023

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (A) lb 20,155,601 18,805,601

U(3) O(8) fair value per

pound (B) USD/lb 73.50 50.65

------------

(A) x (B)

U(3) O(8) fair value = (C) USD m 1,481.4 952.5

------------- ------------

Cash and other net current

assets/(liabilities) (D) USD m 12.7 82.8

------------

Net asset value in USD (C) + (D) USD

m = (E) m 1,494.2 1.035.3

------------- ------------

Exchange Rate ([56]) (F) USD/GBP 1.2207 1.2364

Net asset value in GBP (E) / (F)

million = (G) GBP m 1,224.0 837.4

Number of shares in issue

less shares held in treasury

([57]) (H) 198,156,447 198,104,399

Net asset value per share (G) / (H) GBP/share 6.18 4.23

--------------------------------- ----------- ----------- ------------- ------------

Carole Whittall

Chief Financial Officer

Independent Review Report to Yellow Cake Plc

Conclusion

We have been engaged by Yellow Cake plc ('the Company') to

review the condensed set of financial statements of the Company in

the interim financial report for the six months ended 30 September

2023 which comprise the Condensed Statement of Financial Position,

Condensed Statement of Comprehensive Income, Condensed Statement of

Changes in Equity, Condensed Statement of Cash Flows and the

associated explanatory notes. We have read the other information

contained in the interim financial report and considered whether it

contains any apparent material misstatements of fact or material

inconsistencies with the information in the condensed set of

financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim financial report for the six months ended 30

September 2023 is not prepared, in all material respects, in

accordance with International Accounting Standard 34, "Interim

Financial Reporting" as contained in UK-adopted International

Accounting Standards, and the AIM Rules for Companies.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ('ISRE (UK) 2410') issued for use in the United Kingdom. A

review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

As disclosed in note 2, the annual financial statements of the

Company are prepared in accordance with UK-adopted International

Accounting Standards. The condensed set of financial statements

included in this interim financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting" as contained in UK-adopted International

Accounting Standards.

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that management have inappropriately adopted

the going concern basis of accounting or that management have

identified material uncertainties relating to going concern that

are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Company to cease to continue as a going concern.

Responsibilities of Directors

The interim financial report, is the responsibility of, and has

been approved by, the directors. The directors are responsible for

preparing the interim financial report in accordance with

International Accounting Standard 34, "Interim Financial Reporting"

as contained in UK-adopted International Accounting Standards and

the AIM Rules for Companies.

In preparing the interim financial report, the directors are

responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the Review of the Financial

Information

In reviewing the interim financial report, we are responsible

for expressing to the Company a conclusion on the condensed set of

financial statements in the interim financial report. Our

conclusions, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK) 2410 "Review of

Interim Financial Information performed by the Independent Auditor

of the Entity". Our review work has been undertaken so that we

might state to the Company those matters we are required to state

to them in an independent review report and for no other purpose.

To the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company, for our review

work, for this report, or for the conclusions we have formed.

RSM UK Audit LLP

Chartered Accountants

25 Farringdon Street

London

EC4A 4AB

Date: 5 December 2023

Condensed Statement of Financial Position

As at As at

30 September 31 March 2023

2023

(unaudited) (audited)

Notes USD '000 USD '000

----------------------------- ------ ------------- --------------

ASSETS:

Non-current assets

Investment in uranium 3 1,481,437 952,504

Total non-current assets 1,481,437 952,504

----------------------------- ------ ------------- --------------

Current assets

Trade and other receivables 147 324

Cash and cash equivalents 4 83,401 84,428

Total current assets 83,548 84,752

----------------------------- ------ ------------- --------------

Total assets 1,564,985 1,037,256

LIABILITIES:

Current liabilities

Trade and other payables (70,821) (1,930)

Total current liabilities (70,821) (1,930)

----------------------------- ------ ------------- --------------

Total liabilities (70,821) (1,930)

NET ASSETS 1,494,164 1,035,326

----------------------------- ------ ------------- --------------

Equity

Attributable to the equity owners

of the Company

Share capital 5 2,724 2,724

Share premium 5 660,203 660,203

Share-based payment reserve 6 96 166

Treasury shares 7 (14,061) (14,216)

Retained earnings 845,202 386,449

TOTAL EQUITY 1,494,164 1,035,326

----------------------------- ------ ------------- --------------

Condensed Statement of Comprehensive Income

1 April 2023 1 April 2022

To To

30 September 30 September

2023 2022

(unaudited) (unaudited)

Notes USD '000 USD '000

----------------------------------------- ------ ------------- -------------

Uranium investment gains/(losses)

Fair value movement of investment

in uranium 3 462,918 (142,035)

Uranium investment gains/(losses) 462,918 (142,035)

----------------------------------------- ------ ------------- -------------

Expenses

Share-based payments 6 (14) (18)

Commission on uranium transactions 8 (660) (452)

Procurement and market consultancy

fees 8 (1,469) (1,619)

Other operating expenses (3,582) (1,350)

Total expenses (5,725) (3,439)

----------------------------------------- ------ ------------- -------------

Bank interest income 1,637 35

Loss on foreign exchange (6) (37)

Profit/(loss) before tax attributable

to the equity owners of the

Company 458,824 (145,476)

Tax expense - -

Profit/(loss) and total comprehensive

income/(loss) for the period after

tax attributable to the equity owners

of the Company 458,824 (145,476)

------------------------------------------------- ------------- -------------

Basic earnings/(loss) per share

attributable to the equity owners

of the Company (USD) 10 2.32 (0.79)

Diluted earnings/(loss) per

share attributable to the equity

owners of the Company (USD) 10 2.31 (0.79)

Condensed Statement of Changes in Equity

Attributable to the equity owners of the Company

Share

based

Share Share payment Treasury Retained Total

capital premium reserve Shares earnings equity

Notes USD USD USD'000 USD'000 USD '000 USD '000

'000 '000

----------------------- ------ --------- ---------- ---------- ----------- ----------- -----------

As at 31 March

2022 (audited) 2,544 588,181 122 (11,219) 489,385 1,069,013

----------------------- ------ --------- ---------- ---------- ----------- ----------- -----------

Total comprehensive

loss after tax

for the period - - - - (145,476) (145,476)

Transactions

with owners:

Share-based payments 6 - - 18 - - 18

Purchase of own

shares 7 - - - (2,997) - (2,997)

As at 30 September

2022 (unaudited) 2,544 588,181 140 (14,216) 343,909 920,558

----------------------- ------ --------- ---------- ---------- ----------- ----------- -----------

Total comprehensive

income after tax

for the period - - - - 42,540 42,540

Transactions

with owners:

Shares issued 180 74,072 - - - 74,252

Share issue costs - (2,050) - - - (2,050)

Share-based payments 6 - - 26 - - 26

Exercise of incentive 7 - - - - - -

options

As at 31 March

2023 (audited) 2,724 660,203 166 (14,216) 386,449 1,035,326

----------------------- ------ -------- ----- --------- -------- ----------

Total comprehensive

income after tax

for the period - - - - 458,824 458,824

Transactions

with owners:

Share-based payments 6 - - 14 - - 14

Exercise of incentive

options 7 - - (84) 155 (71) -

As at 30 September

2023 (unaudited) 2,724 660,203 96 (14,061) 845,202 1,494,164

----------------------- ------ -------- ----- --------- -------- ----------

Condensed Statement of Cash Flows

1 April 2023 1 April 2022

To To

30 September 30 September

2023 2022

(unaudited) (unaudited)

Notes USD '000 USD '000

--------------------------------------- ------ ------------- -------------

Cash flows from operating activities

Profit/(loss) after tax for the

financial period 458,824 (145,476)

Adjustments for:

Change in fair value of investment

in uranium 3 (462,918) 142,035

Share based payments 6 14 18

(Gain)/Loss on foreign exchange 6 37

Interest income (1,637) (35)

Operating cash outflows before

changes in working capital (5,711) (3,421)

--------------------------------------- ------ ------------- -------------

Changes in working capital:

Decrease/(increase) in trade and

other receivables 178 (177)

Increase in trade and other payables 68,906 600

Interest received 1,637 35

Cash generated from/(used in)

operating activities 65,010 (2,963)

--------------------------------------- ------ ------------- -------------

Cash flows from investing activities

Purchase of uranium 3 (66,015) (132,688)

Net cash used in investing activities (66,015) (132,688)

--------------------------------------- ------ ------------- -------------

Cash flows from financing activities

Share buyback programme 7 - (2,997)

Net cash generated from/(used

in) financing activities - (2,997)

--------------------------------------- ------ ------------- -------------

Net decrease in cash and cash equivalents

during the period (1,005) (138,648)

Cash and cash equivalents at the

beginning of the period 84,428 153,136

Effect of exchange rate changes (22) (65)

Cash and cash equivalents at the end

of the period 83,401 14,423

----------------------------------------------- ------------- -------------

Notes to the Condensed Interim Financial Statements

For the period from 1 April 2023 to 30 September 2023

1. General information

Yellow Cake plc (the "Company") was incorporated in Jersey,

Channel Islands on 18 January 2018. The address of the registered

office is 3(rd) Floor, Gaspé House, 66-72 The Esplanade, St Helier,

Jersey, JE1 2LH.

The Company operates in the uranium sector and was established

to purchase and hold U(3) O(8) . The strategy of the Company is to

invest in long-term holdings of U(3) O(8) and not to actively

speculate in short-term changes in the price of U(3) O(8) .

The Company was admitted to list on the London Stock Exchange

AIM market ("AIM") on 5 July 2018.

On 22 June 2022, the Company's shares were admitted to trading

on the OTCQX, the highest tier of the US over-the-counter

market.

On 26 September 2023 , the Company incorporated a wholly owned

subsidiary, YCA Commercial Ltd, in Jersey, which had no assets,

liabilities or operations as at the reporting date and has

therefore not been consolidated in these condensed interim

financial statements.

2. Summary of significant accounting policies

Basis of preparation

The unaudited condensed interim financial statements for the six

months ended 30 September 2023 have been prepared in accordance

with International Accounting Standard 34 "Interim Financial

Reporting". This report should be read in conjunction with the

Company's annual financial statements for the period ended 31 March

2023, available on the Company's website (www.yellowcakeplc.com),

which were prepared in accordance with UK-adopted International

Accounting Standards ("IFRS"). The audited financial information

for the year ended 31 March 2023 is based on the statutory accounts

for the financial year ended 31 March 2023. The auditors reported

on those accounts: their report was unqualified and did not contain

statements where the auditor is required to report by

exception.

The accounting policies adopted and methods of computation

followed in the condensed interim financial statements are

consistent with those applied in the preparation of the Company's

annual financial statements for the year ended 31 March 2023 and

are expected to be applied to the Company's annual financial

statements for the year ending 31 March 2024.

The unaudited condensed interim financial statements do not

constitute statutory accounts within the meaning of Section 105 of

the Companies (Jersey) Law 1991.

New and revised standards

At the date of approval of these condensed interim financial

statements there are no new or revised standards that are in issue

but not yet effective that are relevant to the financial statements

of the Company.

Going concern

The Directors, having considered the Company's objectives and

available resources along with its projected income and expenditure

for at least 12 months from the date of approval of the condensed

interim financial statements, are satisfied that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Accordingly, the Directors have adopted the

going concern basis in preparing these condensed interim financial

statements.

The Board continues to monitor the impact of the conflict in

Ukraine and sanctions imposed against Russia and Belarus on the

Company's activities, the uranium industry and the world

economy.

After taking into account the Company's cash balance of USD84.4

million at the period-end, the net placing proceeds of USD120.6

million received by the Company on 2 October 2023 and its post

period-end commitments to settle the USD166.0 million of U(3) O(8)

purchases, the Company considered that, as at 5 December 2023, it

had sufficient working capital to cover operating expenses for at

least twelve months before it would need to raise additional funds.

The Company has no debt or hedge liabilities on its balance sheet.

In the absence of other sources of capital, the Company can

reasonably be expected to realise a portion of its investment in

uranium to raise working capital if required.

Investments in uranium

Acquisitions of U(3) O(8) are initially recorded at cost net of

transaction costs incurred and are recognised in the Company's

statement of financial position on the date the risks and rewards

of ownership pass to the Company, which is the date that the legal

title to the uranium passes.

After initial recognition, investments in U(3) O(8) are measured

at fair value based on the daily spot price for U(3) O(8) published

by UxC LLC.

IFRS lacks specific guidance in respect of accounting for

investments in uranium. As such the Directors of the Company have

considered the requirements of International Accounting Standard 1

"Presentation of Financial Statements" and International Accounting

Standard 8 "Accounting Policies, Changes in Accounting Estimates

and Errors" to develop and apply an accounting policy. The

Directors of the Company consider that measuring the investment in

U(3) O(8) at fair value provides information that is most relevant

to the economic decision making of users. This is consistent with

International Accounting Standard 40 Investment Property, which

allows for assets held for long-term capital appreciation to be

presented at fair value.

Critical accounting judgements and estimation uncertainty

The preparation of financial statements requires management to

make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances. Revisions to accounting estimates are recognised in

the period in which the estimate is revised and in any future

periods affected.

The resulting accounting estimates will, by definition, seldom

equate to the related actual results.

Accounting estimates

In preparing these unaudited condensed interim financial

statements the Directors have not made any significant accounting

estimates.

Judgements

The Company receives regular tax advice and opinions from its

advisors and accountants to ensure it is aware of and can seek to

mitigate the effects on its tax position of, changes in regulation.

While the Company stores its uranium in storage facilities in

Canada and France, the Company does not carry on business in either

of these jurisdictions. The Directors have considered the tax

implications of the Company's operations and have reached judgement

that no tax liability has arisen during the period (year ended 31

March 2023: USD nil).

3. Investment in uranium

Fair value

USD '000

------------------------------- -----------

As at 31 March 2022 (audited) 916,717

---------------------------------- -----------

Acquisition of U(3) O(8) 132,688

Change in fair value (142,035)

Sale of U(3) O(8) -

As at 30 September 2022

(unaudited) 907,370

---------------------------------- -----------

Acquisition of U(3) O(8) -

Change in fair value 45,134

Sale of U(3) O(8) -

As at 31 March 2023 (audited) 952,504

---------------------------------- -----------

Acquisition of U(3) O(8) 66,015

Change in fair value 462,918

As at 30 September 2023

(unaudited) 1,481,437

---------------------------------- -----------

The value of the Company's investment in U(3) O(8) is based on

the daily spot price for U(3) O(8) of USD73.50/lb as published by

UxC LLC on 30 September 2023 (31 March 2023: USD50.65/lb).

As at 30 September 2023, the Company:

-- had purchased a total of 22,826,515 lb of U(3) O(8) at an average cost of USD30.98/lb;

-- had disposed of 2,670,914 lb of U3O8 at an average selling

price of USD40.23/lb that had been acquired at an average price of

USD21.01/lb, assuming a first in first out methodology; and

-- held a total of 20,155,601lb of U(3) O(8) at an average cost

of USD32.30/lb for a net total cash consideration of USD651.1

million, a ssuming a first in first out methodology.

Acquisition of uranium

On 30 September 2023, the Company took title to 1,350,000 lb of

U(3) O(8,) acquired as part of its 2022 uranium purchase option

under its Framework Agreement with Kazatomprom, at a price of

USD48.90/lb for a total consideration of USD66.0 million. Payment

occurred after 30 September 2023.

The following table provides a summary of the Company's

investment in U(3) O(8) as at 30 September 2023:

Quantity Fair Value

Location lb USD '000

------------ ----------- -----------

Canada 19,855,601 1,459,387

France 300,000 22,050

Total 20,155,601 1,481,437

------------ ----------- -----------

As at 31 March 2023:

Quantity Fair Value

Location lb USD '000

------------ ----------- -----------

Canada 18,505,601 937,309

France 300,000 15,195

Total 18,805,601 952,504

------------ ----------- -----------

4. Cash and cash equivalents

Cash and cash equivalents as at 30 September 2023 were banked in

a variable interest account with full access. Balances at the end

of the period were USD 83,087,030 and GBP 257,264, which is, in

total, equivalent to USD 83,401,072 (31 March 2023: USD 84,428,484

equivalent).

5. Share capital

Authorised:

10,000,000,000 ordinary shares

of GBP0.01

Issued and fully paid:

Ordinary shares

Number GBP '000 USD '000

---------------------------------- ------------------ --------- ---------

Share capital as at 31 March

2022 (audited) 187,740,730 1,877 2,544

---------------------------------- ------------------ --------- ---------

Share capital as at 30 September

2022 (unaudited) 187,740,730 1,877 2,544

Issued 7 February 2023 15,000,000 150 180

Share capital as at 31 March

2023 (audited) 202,740,730 2,027 2,724

---------------------------------- ------------------ --------- ---------

Share capital as at 30 September

2023 (unaudited) 202,740,730 2,027 2,724

---------------------------------- ------------------ --------- ---------

The number of shares in issue above includes 4,584,283 treasury

shares - refer to note 7.

S hare premium

GBP '000 USD '000

---------------------------------- --------- ---------

Share premium as at 31 March

2022 (audited) 432,756 588,181

----------------------------------- --------- ---------

Share premium as at 30 September

2022 (unaudited) 432,756 588,181

----------------------------------- --------- ---------

Proceeds of issue of shares 61,650 74,072

Share issue costs (1,706) (2,050)

Share premium as at 31 March

2023 (audited) 492,700 660,203

----------------------------------- --------- ---------

Share premium as at 30 September

2023 (unaudited) 492,700 660,203

----------------------------------- --------- ---------

The Company has one class of shares which carry no right to

fixed income.

6. Share-based payments

The Company implemented an equity-settled share-based

compensation plan in 2019 which provides for the award of long-term

incentives and an annual bonus to management personnel.

During the period, USD14,109 was recognised in the statement of

comprehensive income, in relation to share-based payments (30

September 2022: USD18,000).

7. Treasury shares

Number GBP '000 USD '000

---------------------------------------------------------------------------------------- ------------------ --------------------- ---------------------

Treasury shares as at 31 March

2022 (audited) 4,069,498 8,681 11,219

---------------------------------------------------------------------------------------- ------------------ --------------------- ---------------------

Share buyback programme 566,833 2,352 2,997

Treasury shares as 30 September

2022 (unaudited) 4,636,331 11,033 14,216

---------------------------------------------------------------------------------------- ------------------ --------------------- ---------------------

Treasury shares as 31 March 2023

(audited) 4,636,331 11,033 14,216

---------------------------------------------------------------------------------------- ------------------ --------------------- ---------------------

Exercise

of

long-term

incentive

options (52,048) (123) (155)

Treasury shares as at 30 September

2023 (unaudited) 4,584,283 10,910 14,061

---------------------------------------------------------------------------------------- ------------------ --------------------- ---------------------

On 2 June 2023, following an exercise of share options on 24 May

2023 under the Yellow Cake plc Share Option Plan 2019, 31,686

ordinary shares held as treasury shares were transferred at 213p

per share to satisfy the exercise.

On 25 July 2023, following an exercise of share options on 19

July 2023 under the Yellow Cake plc Share Option Plan 2019, 20,362

ordinary shares held as treasury shares were transferred at 288p

per share to satisfy the exercise.

Following these transfers, the total number of treasury shares

held by the Company reduced from 4,636,331 to 4,584,283 . The

reduction in the value of treasury shares resulting from the

exercise of share options has been calculated based on the weighted

average acquisition cost of the treasury shares.

8. Commission, procurement and consultancy fees

308 Services Limited ("308 Services") provides procurement

services to the Company relating to the sourcing of U(3) O(8) and

other uranium transactions and in securing competitively priced

converter storage services.

Under the terms of the agreement entered into between the

Company and 308 Services on 30 May 2018, 308 Services is entitled

to receive:

1) Holding Fee comprised of a Fixed Fee of USD275,000 per

calendar year plus a Variable Fee equal to 0.275% per annum of the

amount by which the value of the Company's holdings of U(3) O(8)

exceeds USD100 million; and

2) Storage Incentive Fee equal to 33% of the difference between

the amount obtained by multiplying the Target Storage Cost

(initially set at USD0.12/lb per year) by the volume of U(3) O(8)

(in pounds) owned by the Company on 31 December of each respective

year and the total converter storage fees paid by the Company in

the preceding calendar year.

The Company considers Holding Fees and Storage Incentive Fees to

be costs of an ongoing nature. Holding and Storage Incentive Fees

payable by the Company to 308 Services in respect of the period

were USD1,469,168 (30 September 2022: USD1,618,711).

308 Services is also entitled to receive commissions equivalent

to 0.5% of the transaction value in respect of certain uranium sale

and purchase transactions completed at the request of the Yellow

Cake Board. Commissions in respect of the period payable by the

Company to 308 Services were USD330,075 (30 September 2022:

USD226,000).

In addition, if the purchase price paid by the Company in

respect of such a purchase transaction is in the lowest quartile of

the range of reported uranium spot prices in the calendar year in

which the transaction completed, 308 Services is entitled to

receive, at the beginning of the following calendar year, an

additional commission of 0.5% of the value of the uranium

transacted. If the purchase price paid by the Company in respect of

such a purchase transaction is in the second lowest quartile of the

range of reported uranium spot prices in the calendar year in which

the transaction completed, 308 Services is entitled to receive, at

the beginning of the following calendar year, an additional

commission of 0.25% of the value of the uranium transacted. If the

purchase price is in the top half of the range for the calendar

year in which the transaction completed, no additional commission

will be payable to 308 Services.

Based on broker and industry expert uranium price forecasts and

the Company's own views, the Company considers it reasonably likely

that the purchase prices paid by the Company during the period will

be in the lowest quartile of the range of reported uranium spot

prices in the 2023 calendar year. The Company has therefore elected

to include a provisional commission of USD330,075 within these

interim financial statements in respect of the uranium purchase

transactions completed by the Company during the period to which a

commission applies, equal to 0.5% of the value transacted.

During the period, commissions and provisional commissions

payable to 308 Services totalled USD660,150 (30 September 2022:

USD452,010).

9. Related party transactions

During the period, the Company incurred USD86,033 (30 September

2022: USD82,594) of administration fees payable to Langham Hall

Fund Management (Jersey) Limited ("Langham Hall"). Claire Brazenall

is an employee of Langham Hall and has served as a Non-Execute

Director of the Company since 9 November 2022, for which she has

received no Directors' fees. As at 30 September 2023, there were no

amounts due to Langham Hall (31 March 2023: USD nil).

The following Directors own ordinary shares in the Company as at

30 September 2023:

Name Number of ordinary % of share

shares capital

----------------------------- ------------------- -----------

The Lord St John of Bletso* 26,302 0.01%

Sofia Bianchi 13,186 0.01%

The Hon Alexander Downer 29,925 0.02%

Claire Brazenall - -

Alan Rule 18,837 0.01%

Andre Liebenberg 121,478 0.06%

Carole Whittall 101,966 0.05%

Total 311,694 0.16%

----------------------------- ------------------- -----------

* The Lord St John of Bletso's shares are held through African

Business Solutions Limited, in which he holds 100% of the Ordinary

Shares.

While the Non--Executive Directors hold shares in the Company,

the holdings are considered sufficiently small so as not to impinge

on their independence.

10. Earnings per share

1 April 2023 1 April 2022

To to

30 September 30 September

2023 2022

(unaudited) (unaudited)

Profit/(loss) for the period (USD '000) 458,824 (145,476)

Weighted average number of shares during

the period - Basic* 198,135,025 183,186,301

Weighted average number of shares during

the period - Diluted* 198,390,197 183,422,810

Earnings/(loss) per share attributable to the equity owners

of the Company (USD):

Basic 2.32 (0.79)

Diluted 2.31 (0.79)

------------------------------------------ ------------- -------------

*The weighted average number of shares excludes treasury

shares.

11. Events after the period end

On 2 October 2023, the Company completed a share placing which

raised gross proceeds of approximately GBP102.9 million (USD124.7

million). Following completion of the placing, Yellow Cake informed

Kazatomprom that it had elected to purchase 1,526,717 lb of U(3)

O(8) at a price of USD65.50/lb, or USD100.0 million in aggregate,

exercising the entirety of the Company's 2023 uranium purchase

option under its Framework Agreement with Kazatomprom. The Company

expects delivery to take place in H1 2024. On completion of this

purchase, Yellow Cake will hold 21.68 million lb of U(3) O(8) .

In the opinion of the Directors, there are no other significant

events subsequent to the period end that are deemed necessary to be

disclosed in the interim financial statements.

1 Based on the daily spot price of USD50.65/lb published by UxC,

LLC on 31 March 2023 and 18,805,601 lb U O held by the Company on

that date.

2 Based on the daily spot price of USD73.50/lb published by UxC,

LLC on 30 September 2023 and 20,155 , 601 lb U O held by the

Company on that date.

3 Daily spot price published by UxC, LLC on 31 March 2023.

4 Daily spot price published by UxC, LLC on 30 September 2023.

5 Net asset value as at 31 March 2023 of USD1,035.3 million

comprises 18.81 million lb of U(3) O(8) valued at the daily spot

price of USD50.35/lb published by UxC, LLC on 31 March 2023 and

cash and other current assets and liabilities of USD82.8

million.

6 Estimated net asset value as at 30 September 2023 of

USD1,494.2 million comprises 20.16 million lb of U(3) O(8) valued

at the daily spot price of USD73.50/lb published by UxC, LLC on 30

September 2023 and cash and other current assets and liabilities of

USD12.7 million.

7 Net asset value per share as at 31 March 2023 is calculated

assuming 202,740,730 ordinary shares in issue less 4,636,331 shares

held in treasury on that date and the Bank of England's daily USD/

GBP exchange rate of 1.2364.

8 Estimated net asset value per share as at 30 September 2023 is

calculated assuming 202,740,730 ordinary shares in issue, less

4,584,283 shares held in treasury on that date and the Bank of

England's daily USD/ GBP exchange rate of 1.2207.