TIDMZEN

RNS Number : 7267C

Zenith Energy Ltd

24 January 2018

January 24, 2018

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this announcement via a regulatory information

service ("RIS"), the inside information contained in this document

is now considered to be in the public domain.

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Issue of equity to fund field development programme, settlement

of debt for shares and appointment of new joint broker

Zenith Energy Ltd., ("Zenith" or the "Company"), (LSE: ZEN;

TSX.V: ZEE), the dual listed international oil & gas production

company operating the largest onshore oilfield in Azerbaijan, is

pleased to announce that following the successful private placing

in Canada, as announced on January 10, 2018, (the "Canadian

Placing"), the Company has completed a placing in the UK (the

"Placing") to raise gross proceeds of GBP677,800 (approximately

CAD$1,158,000) by issuing 9,000,000 common shares of no par value

in the capital of the Company (the "New Common Shares") at a price

of GBP0.0742 (approximately CAD$0.1287) per New Common Share.

The New Common Shares were offered by the Company's brokers to

certain investors, principally UK institutions, at the same

sterling equivalent price as the Canadian Placing. The Placing

garnered considerable interest, with the Company receiving offers

for subscription significantly in excess of the maximum 9,000,000

New Common Shares that the Company was able to offer to UK

investors.

The Company intends to use the proceeds of the Placing to

finance its continued investment in its Azerbaijan field operations

and for general working capital.

The New Common Shares will comprise approximately 8.088% of the

Company's enlarged issued share capital at the date of the

admission to trading on London Stock Exchange and are anticipated

to be issued as depository interests in CREST in the United

Kingdom. An application will be made for the New Common Shares to

be admitted to the standard segment of the Financial Conduct

Authority Official List and to trading on the Main Market for

listed securities of the London Stock Exchange ("Admission") as

well as to be listed on the TSX Venture Exchange ("TSXV") in

Canada. It is expected that Admission will become effective on

February 2, 2018.

Under the terms of the Placing, Daniel Stewart & Company Plc

were issued 180,000 warrants in the Company, priced at GBP0.0925,

with an expiry date of two years from Admission.

The Placing is subject to the approval of the TSXV in Canada and

Admission.

Appointment of Joint Broker

The Company is pleased to announce the appointment of Daniel

Stewart & Company Plc as joint corporate broker to the Company

on the London Stock Exchange with immediate effect.

Debt Settlement

The Company announces that it has agreed to issue 1,598,579

common shares (the "Settlement Shares") at a deemed price of

CAD$0.14 to settle a debt of US$180,000 owed by the Company (the

"Share Settlement").

The Settlement Shares, issued pursuant to the Share Settlement,

will be subject to a contractual hold period of one year, inclusive

of a four-month hold period under the rules and regulations of the

TSX Venture Exchange and applicable Canadian securities laws.

The Share Settlement is subject to the final approval of the

TSXV.

An application will be made for the Settlement Shares to be

admitted to the standard segment of the Financial Conduct Authority

Official List and to trading on the Main Market for listed

securities of the London Stock Exchange prior to the expiry of the

hold period, as well as to be listed on the TSXV in Canada.

Total Voting Rights

Following the aforementioned transactions, the Company wishes to

announce, in accordance with the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules, the following

information following Admission:

Class of share Total number Number of Total number

of shares voting rights of voting

per share rights per

class of

share

------------------------ --------------- ---------------- ---------------

Common Shares

in issue and admitted

to trading on

the Main Market

of the London

Stock Exchange 153,200,119 1 153,200,119

------------------------ --------------- ---------------- ---------------

Common shares

in issue and admitted

to trading on

the TSXV 158,798,698 1 158,798,698

------------------------ --------------- ---------------- ---------------

No shares are held in treasury. The above figure for total

number of common shares may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Andrea Cattaneo, Chief Executive Officer of Zenith,

commented:

"The Board of Directors has long stated its desire to attract

institutional investment in the Company to support our long-term

development. This placing is important as it marks the first

significant investment by a number of institutional investors in

Zenith. The level of interest we have received is clear evidence of

the great value of the Zenith story and the exciting journey

ahead."

For further information please contact:

Zenith Energy Ltd.

Andrea Cattaneo

Chief Executive Officer

Email: info@zenithenergy.ca

Telephone: +1 (587) 315 9031

Beaufort Securities Limited - (Joint Broker)

Jon Belliss

Telephone: +44 (0) 207 382 8300

Daniel Stewart & Company Plc - (Joint Broker)

Robert Emmet- Corporate Broking

Nikhil Varghese- Corporate Finance

Telephone: + 44 (0) 207 776 6550

Optiva Securities - (Joint Broker)

Christian Dennis

Telephone: + 44 (0) 203 137 1903

Allenby Capital Limited - (Financial Adviser)

Nick Harriss

Nick Athanas

Telephone: + 44 (0) 203 328 5656

Yellow Jersey (Financial PR/IR)

Tim Thompson

Telephone: +44 (0) 203 735 8825

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOELFFSFLVIVFIT

(END) Dow Jones Newswires

January 24, 2018 02:00 ET (07:00 GMT)

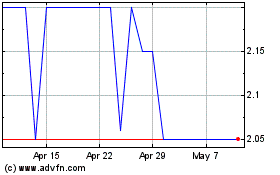

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

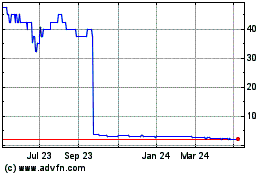

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jul 2023 to Jul 2024