Today's Top Supply Chain and Logistics News From WSJ

May 24 2017 - 6:22AM

Dow Jones News

By Brian Baskin

Sign up:With one click, get this newsletter delivered to your

inbox.

It's China and Russia vs. Airbus SE and Boeing Co. in a fight to

control the passenger jet market. The two countries are teaming up

to take on the duopoly that dominates passenger aircraft

production, the WSJ's Trefor Moss reports. The partnership is a

sign of how jet production remains one of the most difficult

sectors to break into, where Airbus and Boeing use enormous

technical advantages in areas such as fuel efficiency to hold onto

customers. China and Russia can marshal massive state resources to

muscle their way in, with plans to build a 280-seat long-haul plane

that would start flying toward the end of the next decade. The two

countries have long been geopolitical rivals, but increasingly team

up in the business arena, particularly in areas where they both lag

European and American rivals. Widebody jets would be a particularly

big prize, with Airbus estimating the market to be worth over $2

trillion over the next two decades.

Western companies operating in China will need to get used to

having the government looking over their shoulder. Foreign firms

will be a part of the Social Credit System, a state initiative that

will use data collection and analysis to enforce norms in

everything from factory emissions to worker safety, the WSJ's

Andrew Browne writes in his "China's World" column. The program,

which is expected to ramp up by 2020, is one of many ways China is

attempting to exert greater control over how foreign manufacturers

operate within its borders. It's a trend that rarely works out to

the benefit of Western firms. Technology suppliers are being shut

out of infrastructure projects in the name national security, and a

"Made in China 2025" campaign would have Chinese technologies play

a growing role in robotics and semiconductors. With the Social

Credit System, companies would need to maintain ratings akin to

credit scores, and would face taxes and other penalties for running

afoul of a formula that is far from transparent, raising fears of

antiforeign bias.

A proposed merger of two trading houses could place an enormous

amount of the world's commodities under one roof. Glencore PLC has

approached grain trader Bunge Ltd. about a takeover, in deal that

would easily clear $10 billion and give the Swiss mining giant the

major U.S. presence it has long sought. A tie-up would also help

unlock the "frozen" grain market, where a glut of staple crops has

farmers unwilling to sell at rock-bottom prices, and food

processors won't buy in advance because they expect prices to stay

low, the WSJ's Dana Mattioli, Jacob Bunge and Scott Patterson

write. Consolidation would give the remaining players in the grain

market more control over supply, potentially resulting in fewer and

shorter gluts, and comes as other blockbuster mergers are being

pursued in other corners of the agriculture sector, including

pesticides and genetically engineered seeds. The status of talks is

unknown, and a deal is far from certain. But the fact that

Glencore, once thought by many analysts and investors to be close

to insolvency, is in a position to make such an offer is a sign

that the company has weathered the commodities rout.

POLITICS

The border tax is stuck in customs. Political prospects for

border adjustment, where imports would be taxed and exports

exempted, are fading amid opposition from corporations, antitax

conservatives and Senate Republicans, the WSJ's Richard Rubin

reports. Proponents say the tax will encourage more companies to

make more goods in the U.S., but the proposal could harshly

penalize companies like Target Corp. that rely on cheap imports

from Asia and Latin America to keep prices low. Retailers appear to

be winning the political fight, with border adjustment potentially

failing even to make it out of the Ways and Means Committee. The

provision's fate has implications beyond the border, as revenue

generated by the tax is needed to pay for proposed cuts to the

corporate tax rate.

QUOTABLE

IN OTHER NEWS

Brazilian meatpacker JBS's shares fell and the company could

sell some assets amid insider-trading accusations. (WSJ)

The U.S. is preparing to sue Fiat Chrysler Automobiles NV for

allegedly cheating on government emissions tests. (WSJ)

Uber Technologies Inc. said it underpaid New York City drivers

for more than two years. (WSJ)

The U.S. labor market still has room for improvement despite low

unemployment, the Federal Reserve's Lael Brainard said. (WSJ)

Eurozone manufacturing added jobs at the fastest pace in 20

years. (WSJ)

Sears Holdings Corp. reached an agreement to extend the

maturities for some of its debt. (WSJ)

Bond ratings companies are downgrading mall-backed debt as

stores close. (WSJ)

Shipping lines and large shippers will need to join forces to

optimize increasingly complex supply chains, a professor writes.

(Splash 24/7)

Unionized pilots plan to picket Amazon.com Inc.'s annual

meeting, protesting the wages paid by the retailer's cargo air

service. (Quartz)

A union leader raised concerns about the cost of renting chassis

at the Port of New York and New Jersey. (American Shipper)

Leased demand for industrial property lagged construction for

the first time since 2010, CBRE said. (DC Velocity)

U.S. truck tonnage fell 1.8% in April compared with a year

earlier. (Transport Topics)

Shares of Cosco Shipping Holdings remain halted amid rumors the

company is planning a takeover bid for a rival. (Lloyd's List)

CMA CGM will introduce a $150 cancellation fee for shippers that

fail to show up at certain ports in the Middle East and India.

(Seatrade-Maritime)

Six state attorneys general are asking federal regulators to

strengthen rules on trains transporting crude oil. (The Hill)

Fast-fashion leaders Inditex SA's Zara and Hennes & Mauritz

are being challenged by even speedier online-only rivals.

(RetailDIVE)

ABOUT US

Brian Baskin is editor of WSJ Logistics Report. Follow him at

@brianjbaskin, and follow the entire WSJ Logistics Report team:

@PaulPage, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Brian Baskin at brian.baskin@wsj.com

(END) Dow Jones Newswires

May 24, 2017 07:07 ET (11:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

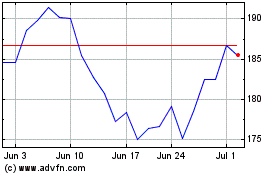

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024