TD Bank Targets Billion in Lending to Diverse, Underserved U.S. Communities

January 24 2024 - 9:24AM

Dow Jones News

By Robb M. Stewart

Toronto-Dominion Bank set a target of $20 billion to boost

lending, banking access, philanthropy and other activities aimed at

underserved and diverse communities in the U.S.

The big Canadian lender's three-year community impact plan will

focus on communities across its footprint in 15 states and

Washington, D.C.

The effort seeks to provide $10 billion in residential loans and

liquidity to the residential lending market, including first-time

homebuyer and home-equity loans for low- and moderate-income and

minority borrowers and in lower-income and minority census tracts,

particularly in Boston, Baltimore, D.C., New York, Miami and

Philadelphia.

The plan also includes about $7.5 billion in community lending

and investment, $2.8 billion lending to smaller businesses with

less than $1 million in annual revenue and $70 million in Community

Reinvestment Act-related philanthropy over the next three years,

the bank said.

TD Bank said that in an effort to make banking accessible it

will seek to open about 15 million locations in low- to

moderate-income or majority-minority markets, subject to regulatory

approvals, which will include additional community-centered

stores.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

January 24, 2024 10:09 ET (15:09 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

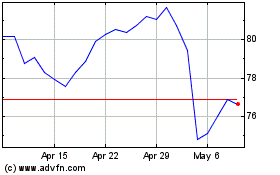

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Apr 2023 to Apr 2024