Fisker (NYSE:FSR) – Shares of the electric

vehicle startup fell 39.71% in pre-market trading, following a Wall

Street Journal report that Fisker hired

restructuring consultants as part of preparations for a possible

bankruptcy filing. At the end of February, Fisker

admitted to having doubts about its ability to continue operating,

as it faced difficulties in securing additional financing. The

company reported a larger-than-expected loss in 2023 and failed to

meet its production targets by a wide margin.

Anheuser-Busch InBev (NYSE:BUD), Altria

Group (NYSE:MO) – Altria Group plans to

sell part of its stake in Anheuser-Busch InBev for

up to $2.2 billion to fund share buybacks. The sale will occur

through a global secondary offering. The decision reflects the

search for a substantial return on investment.

Nio (NYSE:NIO) – Nio, the

Chinese electric vehicle manufacturer, partnered with

CATL to develop longer-lasting batteries, aiming

to reduce operational costs. Efforts include cutting battery rental

fees, contributing to lowering the total cost of electric

vehicles.

Albemarle (NYSE:ALB) –

Albemarle announced auctions to sell the metal,

aiming to increase market transparency. Lithium prices fell due to

overproduction in China and slow global demand. The first auction

is scheduled for March 26.

Boeing (NYSE:BA) – The investigation into why

LATAM’s 787 from Sydney to Auckland suddenly plunged, injuring more

than 50 passengers, focuses on the movement of a cockpit seat.

Involuntary pilot action and a possible short circuit are

suspected. Airlines, constrained by a market dominated by

Boeing and Airbus, express

frustrations with Boeing due to safety crises

impacting their plans. Yet, airlines negotiate new orders, using

delays to obtain better terms, despite challenges in switching to

Airbus (USOTC:EADSY) due to its already full order

book. The interim head of Europe’s aviation regulator indicated the

agency might suspend its approval of Boeing jet

production if necessary due to safety concerns but expressed

confidence in the company’s approach to the crisis.

Delta Air Lines (NYSE:DAL) – Delta Air

Lines announced on Wednesday that it would resume flights

to Israel starting June 7, becoming the second major U.S. airline

to do so after the Hamas attack. United Airlines

(NASDAQ:UAL) had already resumed flights.

McDonald’s (NYSE:MCD) –

McDonald’s international sales are expected to

fall next quarter due to the conflict in the Middle East and weak

demand in China, CFO Ian Borden said on Wednesday.

McCormick (NYSE:MKC) – Investors await

McCormick‘s earnings report, scheduled for March

26, hoping to boost the stock. The company has faced challenges,

but there is potential for recovery with a focus on innovation and

improvements in volume trends.

Dollar Tree (NASDAQ:DLTR) – Dollar

Tree missed market expectations, planning to close 970

Family Dollar stores. Shares fell on Wednesday after the company

forecasted sales and profits for 2024 below expectations.

Dollar Tree reported a net loss of $1.71 billion,

or $7.85 per share, for the quarter ended February 3, compared to a

profit from the previous year of $452.2 million, or $2.04 per

share.

Under Armour (NYSE:UAA) – The sportswear

company announced that CEO Stephanie Linnartz would be leaving the

position just over a year after her appointment. Former CEO Kevin

Plank will reassume the role, while renowned economist and

businessman Mohamed El-Erian is set to become the next board

chairman.

Fossil Group (NASDAQ:FOSL) –

Fossil shares rose 6.2% in pre-market following

CEO Kosta Kartsotis’s departure and the announcement of a strategic

review, in response to pressure from an activist investor. The

company appointed Jeffrey Boyer as interim CEO.

Microsoft (NASDAQ:MSFT) –

Microsoft will expand access to its AI-powered

cybersecurity tool starting April 1st, adopting a “pay-as-you-go”

model. The ‘Security Copilot’ simplifies analysis tasks and will be

charged based on usage. Furthermore, US Senator Mark Warner

criticized Microsoft for complying with internet censorship in

China, urging them to consider withdrawing Bing from the country.

Microsoft defended its presence, stating it complies with local

law.

Oracle (NYSE:ORCL) – Oracle

announced on Thursday the incorporation of generative AI features

into its enterprise software, directly competing with

Microsoft (NASDAQ:MSFT) and other companies. These

features aim to optimize tasks like generating reports and

summarizing complex data.

Apple (NASDAQ:AAPL) – Epic

Games asked a federal judge to assess

Apple for contempt of court, claiming the company

did not fully comply with an order to allow external payment

options on its App Store. Epic argues that Apple

made the external links “commercially unusable” by imposing various

fees and rules.

Alphabet (NASDAQ:GOOGL) –

Waymo, a subsidiary of Alphabet,

announced on Wednesday the launch of free driverless robotaxi

services for select members in Los Angeles starting Thursday,

following CPUC approval. The expansion includes 63 square miles and

will transition to paid services soon.

Spotify (NYSE:SPOT) – Spotify

is launching full music videos in beta for premium subscribers,

competing with YouTube‘s two-decade dominance.

Available in some countries, the initiative aims to increase its

user base while facing competition from Apple

Music and YouTube.

Amazon (NASDAQ:AMZN) – Amazon

committed to fixing flaws in its advertising operation after

incorrectly charging online merchants to promote unavailable

products. The issue arose when a seller discovered they were being

charged for ads that did not generate sales.

Nvidia (NASDAQ:NVDA) – Nvidia

shares fell 0.4% in pre-market trading on Thursday, ahead of the

GTC developers’ event. While Wall Street supports the stock, it

appears to be in a volatile pattern. Analysts expect market

expansion and product updates.

UiPath (NYSE:PATH) – Shares of the software

company rose by 4.95% in pre-market after reporting fourth-quarter

results, which exceeded analysts’ predictions.

UiPath achieved an adjusted profit of 22 cents per

share, with revenue of $405 million, surpassing analysts’

expectations of a 16-cent profit per share and $384 million in

revenue, as reported by LSEG.

SentinelOne (NYSE:S) –

SentinelOne reported an adjusted loss of 2 cents

per share with revenue of $174 million in the fourth quarter,

compared to analysts’ forecasts of a 4-cent loss per share and $170

million in revenue. The cybersecurity company’s stock value

decreased by 8.9% in pre-market after releasing first-quarter and

full-year guidelines that were in line with analysts’ estimates, as

reported by LSEG.

Adobe (NASDAQ:ADBE) – Analysts project

Adobe to report quarterly earnings of $4.38 per

share and revenue of $5.14 billion for the first quarter. Ahead of

the report scheduled for after Thursday’s market close,

Adobe, known for its creative software tools like

Photoshop, Illustrator, and InDesign, saw a 1.01% increase in

pre-market trading on Thursday.

Lennar (NYSE:LEN) – Shares of the homebuilder

Lennar are down by -0.9% in pre-market after

reporting mixed fiscal first-quarter results, with profits up but

revenue below expectations due to high mortgage rates, limiting

demand for new homes. Lennar reported a profit of

$2.57 per share on revenue of $7.31 billion, while analysts

expected a profit per share of $2.21 on revenues of $7.38

billion.

Robinhood (NASDAQ:HOOD) – The trading

platform’s stock values increased approximately 12.5% in Thursday’s

pre-market after releasing selected monthly operational data for

February 2024. Robinhood reported that trading

volumes during February rose to $80.9 billion, representing a 36%

increase from January and 41% from February 2023. Cryptocurrency

trading volumes in February also increased to $6.5 billion, marking

a 10% increase from January and 86% from the previous year.

Additionally, analysts at Bernstein began coverage of the stock

with an Outperform rating and a $30 price target.

KKR (NYSE:KKR) – KKR offered

$3.06 billion for Encavis (USOTC:ENCVF).

Viessmann will invest as a shareholder.

KKR plans to rapidly de-list

Encavis‘s capital after closing. The offer is 30%

above Encavis‘s closing share price listed on the

MDAX. Additionally, KKR plans to maintain real

estate investments in Japan, even with the possibility of rising

interest rates. The Japanese market is attractive, offering returns

of 4-5% on assets like apartments, logistics, and hotels.

Controlled inflation and sustained economic growth contribute to

its attractiveness.

Deutsche Bank (NYSE:DB) – Deutsche

Bank CEO Christian Sewing received $9.52 million (8.7

million euros) in 2023, slightly less than in 2022, due to

declining profits. Issues in the Postbank unit resulted in bonus

reductions for other employees.

Barclays (NYSE:BCS) – Three black bankers who

sued Barclays in London, alleging racial

discrimination and other grievances, largely lost the case. The

East London Employment Tribunal dismissed almost all the claims

except for inadequate health adjustments in a 2019 performance

assessment.

Goldman Sachs (NYSE:GS) – Goldman

Sachs Asset Management plans to resume “active investment”

in U.S. commercial properties this year, with falling prices and a

potential recovery. Schroders (LSE:SDR) is also

preparing to buy billions in U.S. commercial properties.

US Steel (NYSE:X) – U.S. President Joe Biden

plans to express concerns about Nippon Steel‘s

$14.9 billion purchase of US Steel. The issue may

affect a U.S.-Japan summit on security in the face of growing

Chinese strength.

UnitedHealth Group (NYSE:UNH) – The U.S.

government is investigating the cyberattack on UnitedHealth

Group and Change Healthcare for possible

health privacy law violations. It’s the first Department of Health

and Human Services investigation into the February 21st

incident.

AstraZeneca (NASDAQ:AZN) –

AstraZeneca announced on Thursday the acquisition

of Amolyt Pharma for $1.05 billion in cash, aiming

to expand its rare diseases portfolio. The deal, with an upfront

payment of $800 million and an additional $250 million upon

regulatory milestones, is expected to close in the third quarter of

2024.

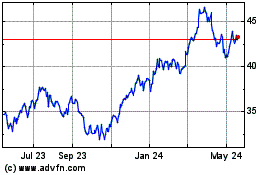

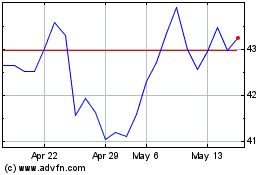

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Feb 2024 to Feb 2025