Tesla (NASDAQ:TSLA) – Tesla settled a lawsuit

regarding a fatal Autopilot accident before the high-profile trial.

The company faces legal and reputational challenges amidst

promoting autonomous driving technology. Despite Elon Musk’s

optimism, critics question the feasibility of self-driving cars. In

other news, Tesla founder Martin Eberhard expressed regret over the

cancellation of plans for a low-cost car, citing intense

competition in China. Initially committed to affordable electric

vehicles, Tesla now focuses on luxury models.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase’s

board has identified potential successors for CEO Jamie Dimon,

paving the way for a leadership transition at America’s largest

bank. At 68, Dimon has led the bank for over 18 years, becoming a

prominent figure in American business. Potential candidates include

Jennifer Piepszak and Marianne Lake. The succession is gaining

attention on Wall Street, as other banks also undergo leadership

changes. Meanwhile, in his annual letter to shareholders, Dimon

praised the economic power and leadership of the US, invoking

“freedom and justice for all.” He highlighted American

exceptionalism and addressed issues such as succession, foreign

policy, and banking regulation. He also criticized the political

delays in US natural gas projects and those advocating for halting

oil and gas projects as “wrong” and “extremely naive.” He supported

LNG exports as an economic benefit and realpolitik goal.

General Motors (NYSE:GM) – Cruise, General

Motors’ autonomous vehicle unit, plans to resume testing its

robotaxis with safety drivers in Phoenix, Arizona. The company aims

to rebuild trust and plans a gradual return to the streets this

year.

HSBC (NYSE:HSBC) – HSBC is selling its business

in Argentina, taking a $1 billion loss, to Grupo Financiero

Galicia. This move is part of the bank’s strategy to simplify and

focus on Asia, reallocating capital to markets like India and

China.

Morgan Stanley (NYSE:MS) – The recent behavior

of the US stock market suggests that investors are starting to

envision a scenario of sustained economic growth rather than a

gradual slowdown. Morgan Stanley strategists highlighted that

robust economic data and strengthened inflation reports are

influencing this change in perspective.

Bank of America (NYSE:BAC) – Since its launch

in 2018, over 42 million Bank of America customers have used the

virtual financial assistant Erica more than 2 billion times. Erica

facilitates transfers, bill payments, and mobile banking

operations, and also assists Merrill Lynch clients in trading and

monitoring investments. In July last year, 37 million customers had

already used the assistant, emphasizing the importance of mobile

banking services to customer preferences.

Goldman Sachs (NYSE:GS) – EG Morse, co-head of

Goldman Sachs’ China business, will retire after 16 years with the

company. His departure follows others from global investment banks

in China, who are recalibrating their approaches amid geopolitical

tensions and a decline in transactions. Morse led the bank’s

expansion into Chinese business since 2022.

UBS Group AG (NYSE:UBS) – UBS is seeking to

fully acquire its platform in China, offering its stake in the

Credit Suisse venture in exchange for shares from the Beijing

government. The proposal comes amid global banks’ exits from the

country and regulatory uncertainties, with Citadel Securities also

vying for the acquisition.

Tradeweb Markets (NASDAQ:TW) –

Tradeweb plans to acquire Institutional Cash Distributors (ICD) for

$785 million, aiming to expand its offering to corporate treasury

professionals. Established in 2003, ICD facilitates short-term

investments for large corporations, covering almost 17% of the

S&P 100 index. The transaction, expected in the second half of

2024, will be internally funded. Tradeweb remains one of the few

electronic trading platforms in the bond market, serving a range of

clients from asset managers to financial institutions.

Bain Capital (NYSE:BCSF) – Bain Capital sold

its stake in Axis Bank at 1,071 rupees per share, totaling $429

million. The final price, near the lower end of the initial range,

represents a 0.5% discount to the stock’s closing.

Blackstone (NYSE:BX) – Blackstone is finalizing

a deal to acquire skincare company L’Occitane International SA in a

private transaction valued at $5.55 billion, according to Bloomberg

News. The deal’s structure has not been disclosed. Billionaire

Reinold Geiger, owner of L’Occitane, may join Blackstone.

Target (NYSE:TGT) – Target is implementing

TruScan technology at its self-checkout registers to combat theft.

Sensors and cameras alert shoppers about unscanned items, helping

to reduce theft and product shortages. Other retailers are also

adopting similar measures to address security issues.

Apple (NASDAQ:AAPL) – Apple pleasantly

surprised investors on Monday by recording its highest growth in

Mac unit shipments in at least two years, with a 14.8% increase in

the first quarter, according to IDC. The company also gained market

share, reaching 8.1%. Financial results will be announced on May

2nd.

Amazon (NASDAQ:AMZN) – Amazon and Temu see

potential in Central and Eastern Europe, where growth is expected,

but Allegro maintains leadership with a broad range of services.

Both are challenging Polish e-commerce leader Allegro, with Amazon

focusing on local video content and Temu betting on affordable

fashion.

Meta Platforms (NASDAQ:META) – Malaysia has

urged Meta’s Facebook and TikTok to increase surveillance on their

platforms due to a rise in harmful content. There was a significant

increase in cases referred in the first three months of 2024

compared to the entire previous year. The move aims to restrict

sensitive content, including ethnic and religious issues.

Alphabet (NASDAQ:GOOGL) – Alphabet, the parent

company of Google, is considering acquiring marketing software

company HubSpot, despite potential regulatory objections. Experts

suggest this would not restrict competition but would face

antitrust scrutiny.

Boeing (NYSE:BA) – Relatives of victims from

fatal accidents involving the Boeing 737 MAX are pressuring US

authorities for criminal actions against the company. The January

5th air explosion of a Boeing 737 MAX 9 operated by Alaska Airlines

(NYSE:ALK) raised concerns about Boeing’s compliance with a

previous agreement. Meetings with the Department of Justice are

scheduled to address the matter.

United Airlines (NASDAQ:UAL) – United Airlines

announced on Monday the postponement of two new international

routes due to FAA certification pauses following safety incidents.

The routes between Tokyo and Cebu, and Newark and Faro were

affected. The FAA has increased its oversight of United following a

series of incidents.

Spirit Airlines (NYSE:SAVE) – Spirit Airlines

reached an agreement with Airbus (USOTC:EADSY) to

delay all aircraft deliveries planned from the second quarter of

2025 until 2026 and plans to lay off about 260 pilots to save

money. The carrier faces financial challenges and aims to reduce

its capacity to increase profitability.

Bloom Energy (NYSE:BE) – Bloom Energy, a fuel

cell manufacturer, will receive up to $75 million in federal tax

credits for its Fremont, California plant as part of the Biden

administration’s $4 billion tax credits to promote clean energy and

reduce industrial greenhouse gas emissions.

Shell (NYSE:SHEL) – A Bloomberg Opinion article

revealed that Shell is considering “all options,” including moving

its listing from London to New York, according to CEO Wael Sawan.

Sawan announced that if the valuation gap persists until mid-2025,

the move is not ruled out.

BP plc (NYSE:BP) – BP anticipates robust

upstream production and trading performance to offset negative

impacts from lower oil and gas prices and the devaluation of the

Egyptian currency, which could reduce profits by $1.2 billion in

the first quarter of 2024. BP shares rose up to 2% in pre-market

trading on Tuesday, boosted by this update. The company expects

higher upstream oil and gas production and strong refining margins,

predicting positive results. The upcoming first-quarter results

will be the first under new CEO Murray Auchinloss, following

Bernard Looney’s departure in September 2023.

Maxeon Solar Technologies (NASDAQ:MAXN) –

Maxeon Solar Technologies released its preliminary fiscal

fourth-quarter results, forecasting a $32 million loss compared to

a $20 million profit in the previous year. The company expects

revenue of $229 million, down from $324 million the previous year.

For the first quarter, Maxeon’s revenue forecast is $186 million,

lower than analysts’ estimates of $242.5 million, resulting in an

8.1% drop in shares during pre-market trading.

Applied Materials (NASDAQ:AMAT) – Applied

Materials, a leading US semiconductor equipment manufacturer, is

considering delaying or abandoning a $4 billion research facility

in Silicon Valley due to lack of government funding. The Biden

administration withdrew financial support due to high demand for

funds from the Chips and Science Act.

SoFi Technologies (NASDAQ:SOFI) – The total

compensation for Anthony Noto, CEO of SoFi Technologies, increased

by more than 40% in 2023, mainly driven by the rise in the value of

his stock awards, totaling $18.3 million compared to $12.9 million

in 2022. SoFi shares rose 116% in 2023, after a 71% decline in

2022, but fell 22% in 2024 following an announced capital

increase.

Broadcom (NASDAQ:AVGO) – Broadcom shares

doubled over the last year, driven by investments in artificial

intelligence (AI). Deutsche Bank analyst Ross Seymore predicts

further growth, highlighting the recent acquisition of VMware and

the expansion of the AI customer base. He reinstated a buy

recommendation with a target price of $1,500.

Harmonic (NASDAQ:HLIT) – Harmonic shares fell

more than 6% in pre-market trading on Tuesday after announcing it

completed its review of the video business without proceeding with

a transaction, citing market conditions unfavorable for its value

creation goals. CEO Patrick Harshman will retire in June, to be

succeeded by Nimrod Ben-Natan. The company will now focus on cost

reduction and profitable growth.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group’s share value decreased by

-1.45% in Tuesday’s pre-market. The shares of the parent company of

the social media site Truth Social fell 8.4% on Monday and have

seen a 28% decline over the last five days.

Novo Nordisk (NYSE:NVO),

Catalent (NYSE:CTLT) – Novo Nordisk re-submitted a

request to the FTC for approval to acquire Catalent for $16.5

billion. The deal aims to boost production of the weight loss drug

Wegovy. After discussions with the FTC, the company refiled the

request to provide more time for the authorities.

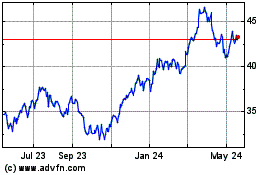

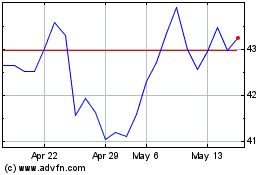

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Feb 2024 to Feb 2025