Bekaert - Update on the Share Buyback Program and the Liquidity Agreement

January 10 2025 - 1:15AM

UK Regulatory

Bekaert - Update on the Share Buyback Program and the Liquidity

Agreement

Update on the Share Buyback Program and

the Liquidity Agreement

Period from 2 January 2025 to 8 January 2025

Share Buyback Program

On 22 November 2024, Bekaert announced the start of the first

tranche of its share buyback program, for a total maximum

consideration of up to € 25 million (the First Tranche). As

announced previously, the purpose of the Program is to cancel all

shares repurchased.

Bekaert announces today that during the period from

2 January 2025 to 8 January 2025, Kepler Cheuvreux SA on

behalf of Bekaert has bought 59 869 shares.

The table below provides an overview of the transactions under

the First Tranche of the Program during the period

from 2 January 2025 to 8 January 2025:

|

|

Repurchase of shares |

|

Date |

Market |

Number of Shares |

Average Price paid (€) |

Highest Price

paid (€) |

Lowest Price

paid (€) |

Total

Amount (€) |

|

2 January 2025 |

Euronext Brussels |

8 000 |

33.66 |

33.96 |

33.48 |

269 280 |

|

|

MTF CBOE |

4 000 |

33.65 |

33.86 |

33.50 |

134 600 |

|

|

MTF Turquoise |

|

|

|

|

|

|

|

MTF Aquis |

|

|

|

|

|

|

3 January 2025 |

Euronext Brussels |

8 000 |

33.29 |

33.68 |

33.02 |

266 329 |

|

|

MTF CBOE |

4 000 |

33.28 |

33.52 |

33.02 |

133 101 |

|

|

MTF Turquoise |

|

|

|

|

|

|

|

MTF Aquis |

|

|

|

|

|

|

6 January 2025 |

Euronext Brussels |

7 899 |

33.83 |

34.36 |

33.08 |

267 223 |

|

|

MTF CBOE |

3 970 |

33.84 |

34.32 |

33.40 |

134 345 |

|

|

MTF Turquoise |

|

|

|

|

|

|

|

MTF Aquis |

|

|

|

|

|

|

7 January 2025 |

Euronext Brussels |

7 800 |

33.79 |

34.50 |

33.54 |

263 562 |

|

|

MTF CBOE |

4 200 |

33.78 |

34.44 |

33.58 |

141 876 |

|

|

MTF Turquoise |

|

|

|

|

|

|

|

MTF Aquis |

|

|

|

|

|

|

8 January 2025 |

Euronext Brussels |

7 800 |

32.93 |

33.40 |

32.64 |

256 854 |

|

|

MTF CBOE |

4 200 |

32.92 |

33.32 |

32.64 |

138 264 |

|

|

MTF Turquoise |

|

|

|

|

|

|

|

MTF Aquis |

|

|

|

|

|

|

Total |

|

59 869 |

33.50 |

34.50 |

32.64 |

2 005 434 |

Liquidity agreement

In relation to the renewed liquidity agreement with Kepler

Cheuvreux announced on 25 June 2024, Bekaert announces today that

Kepler Cheuvreux on behalf of Bekaert has bought 6 000 shares

during the period from 2 January 2025 to 8 January 2025

on Euronext Brussels. During the same period, Kepler Cheuvreux on

behalf of Bekaert has sold 4 100 shares on Euronext

Brussels.

The tables below provide an overview of the transactions under

the liquidity agreement during the period from 2 January 2025

to 8 January 2025:

|

|

Purchase of shares |

|

Date |

Number of Shares |

Average Price (€) |

Highest Price (€) |

Lowest Price (€) |

Total Amount (€) |

|

2 January 2025 |

400 |

33.53 |

33.56 |

33.50 |

13 412 |

|

3 January 2025 |

2 000 |

33.26 |

33.60 |

33.00 |

66 520 |

|

6 January 2025 |

0 |

0.00 |

0.00 |

0.00 |

0 |

|

7 January 2025 |

1 600 |

33.80 |

33.90 |

33.60 |

54 080 |

|

8 January 2025 |

2 000 |

33.01 |

33.40 |

32.70 |

66 020 |

|

Total |

6 000 |

|

|

|

200 032 |

|

|

Sale of shares |

|

Date |

Number of Shares |

Average Price (€) |

Highest Price (€) |

Lowest Price (€) |

Total Amount (€) |

|

2 January 2025 |

1 400 |

33.91 |

34.00 |

33.88 |

47 474 |

|

3 January 2025 |

0 |

0.00 |

0.00 |

0.00 |

0 |

|

6 January 2025 |

2 400 |

33.75 |

34.42 |

33.28 |

81 000 |

|

7 January 2025 |

300 |

34.50 |

34.50 |

34.50 |

10 350 |

|

8 January 2025 |

0 |

0.00 |

0.00 |

0.00 |

0 |

|

Total |

4 100 |

|

|

|

138 824 |

The balance held by Bekaert under the liquidity agreement at the

end of the period is 42 305 shares.

On 8 January 2025 after closing of the market, Bekaert

holds 2 296 856 own shares, or 4.23% of the total number

of the outstanding shares.

This information is also made available on the investor

relations pages of our website.

- p250110E - Bekaert - Update on the Share Buyback Program and

the Liquidity Agreement

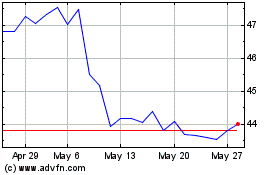

NV Bekaert (EU:BEKB)

Historical Stock Chart

From Dec 2024 to Jan 2025

NV Bekaert (EU:BEKB)

Historical Stock Chart

From Jan 2024 to Jan 2025