Bitcoin STH Average Cost Basis At $90,950 — Why Is It Relevant?

March 02 2025 - 3:30AM

NEWSBTC

The Bitcoin price continues to dance within the newly formed

$80,000 – $85,000 range, showing some level of indecisiveness in

its movement. Since the premier cryptocurrency lost its hold above

$90,000, investors have wondered whether the ongoing correction is

a “buy the dip” opportunity or the market top is in. While there is

no surefire way to put these doubts away, on-chain data can provide

relevant insights into what is to come. The latest on-chain data

suggests the highlighted level below is the one to watch before

investors return to the market. Level To Watch Before ‘Buying The

Dip’ In a recent post on the X platform, crypto analyst Maartunn

shared that it might not be technically secure to reenter the

Bitcoin market at the current price. This analysis is based on the

movement of the Bitcoin price relative to the current value of the

short-term holders’ (STH) average cost basis. Related Reading:

Litecoin Price Shows Resilience In Uncertain Market Conditions —

What’s Next For LTC? The STH average cost basis metric estimates

the average price at which short-term holders (investors who have

owned Bitcoin for less than 155 days) acquired their coins. It

represents a psychological level for BTC investors and could act as

a reference point for price analysis, especially during bull

cycles. Bitcoin usually trades above the short-term holders’

average cost basis during bull markets, signaling substantial

buying pressure and optimistic sentiment from short-term investors.

On the flip side, when the price of BTC falls beneath this cost

basis — as seen in the ongoing correction, it implies that

short-term investors are at a loss, which could lead to a sell-off

and precipitate significant bearish pressure. According to data

from CryptoQuant, the Bitcoin price is currently 6% below the

short-term holders’ average cost basis at $90,950. With the

flagship cryptocurrency beneath the realized price of short-term

holders, the odds are that BTC price could face further selling

pressure as the investor cohort looks to minimize their loss. Using

this logic, Maartunn noted that investors might want to wait till

the price of Bitcoin climbs above the STH average cost price before

reentering the market. Interestingly, the short-term investors

appear to still be loading their bags. Crypto analyst Ali Martinez

revealed in a post on X that short-term holders have purchased more

than 35,000 BTC in the past 4 days. Bitcoin Price At A Glance

As of this writing, the price of BTC sits just below the $86,000

mark, reflecting an over 2% jump in the past 24 hours. Related

Reading: Whales Add 190,000 Ethereum In The Last 24 Hours – The

Accumulation Continues Featured image from iStock, chart from

TradingView

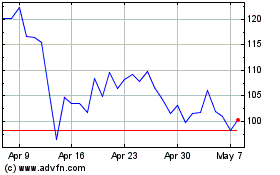

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

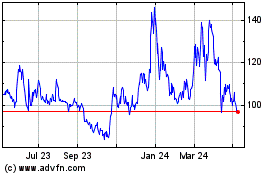

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025