Is The Bitcoin Bull Cycle Really Over? This Indicator Suggests Price Could Rebound To $130,000

March 01 2025 - 11:00AM

NEWSBTC

The past week has been a rollercoaster ride for the cryptocurrency

market, as the value of most large-cap assets took a significant

hit over the last seven-day period. Specifically, the Bitcoin price

fell beneath $80,000 for the first time since that almost vertical

surge in November 2024. As expected, the market downturn has led to

discussions and commentary about the price of Bitcoin already

reaching its top in this cycle. Nevertheless, the latest on-chain

data suggests that the premier cryptocurrency might still have room

for a final upward rally. How BTC Price Could Go For A Final Peak

In This Cycle In a Quicktake post on the CryptoQuant platform, an

analyst with the pseudonym Tarekonchain revealed the “truth” behind

the current cycle, saying the latest market crash might be an

opportunity for investors to buy the dip. This prediction is based

on a key on-chain indicator, the MVRV Ratio. Related Reading:

Dogecoin Open Interest Declines 67% In Three Months – Can Meme

Coins Recover? The MVRV (Market Value to Realized Value) ratio is

an indicator that tracks the ratio between a coin’s market cap and

its realized cap. When the value of this ratio is greater than 1,

it implies that more investors are considered to be in profit at

the moment. High MVRV ratios are considered price top signals, as

traders typically show a propensity to sell off their assets when

they are in the green. According to Tarekonchain, the price of

Bitcoin peaked in every previous cycle when the MVRV ratio crossed

3.5. However, on-chain data shows that this indicator only reached

2.7 as the price of Bitcoin notched a new all-time high around the

$110,000 region. Tarekonchain noted that the Bitcoin price might

not have topped out in the current cycle as its MVRV ratio is yet

to reach 3.5 as it did in previous cycles. The Quicktake analyst

also noted that while BTC’s slump beneath the 365-day moving

average is undeniably a bearish signal, the premier cryptocurrency

still has an opportunity to rebound from the critical $65,000

support level. “This does not mean the price must reach $65K, but

rather that it’s a strong support level,” Tarekonchain added.

According to the analyst, the MVRV ratio needs to at least cross

3.0 to be able to confirm the Bitcoin price reaching the cycle top.

If the premier cryptocurrency finds support and successfully

rebounds, investors could see BTC target new all-time highs — the

final peak of this cycle — around $120K–$130K. Bitcoin Price At A

Glance As of this writing, the price of BTC stands at around

$85,000, reflecting no significant movement in the past 24 hours.

Related Reading: Is Solana In A Macro Trend Move? Charts Show

Potential Shift Featured image from iStock, chart from TradingView

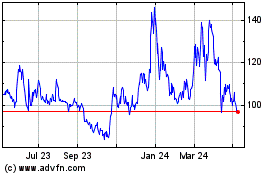

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

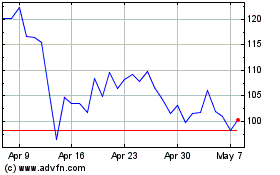

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025