false

0001009891

0001009891

2024-12-20

2024-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

December 20, 2024

AIR INDUSTRIES GROUP

(Exact Name of Registrant as Specified in its Charter)

| Nevada |

|

001-35927 |

|

80-0948413 |

| State of Incorporation |

|

Commission File Number |

|

IRS Employer I.D. Number |

1460 Fifth Avenue, Bay Shore, New York 11706

(Address of Principal Executive Offices)

Registrant’s telephone number: (631) 968-5000

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

ARI |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On December 20, 2024, Air Industries Group (the

“Company”) issued a press release announcing that it had secured a long term contract valued at $33.0 million to manufacture

and supply complex components for the CH-53K King Stallion Heavy-Lift helicopter The seven year agreement strengthens Air’s pivotal

role in supporting one of the U. S. Department of Defense’s most important procurement programs..

The information in this Form 8-K, including Exhibit

99.1 attached hereto, shall not be deemed as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

(the “Exchange Act”), or otherwise subject to the liability of such Section, nor shall it be deemed incorporated by reference

in any filing by Air Industries under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: December 20, 2024

| |

AIR INDUSTRIES GROUP |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

|

Scott Glassman

Chief Financial Officer |

2

Exhibit 99.1

December 20, 2024 07:00 AM Eastern Standard Time

Air Industries Group Secures $33

Million Contract for the CH-53K King Stallion Heavy-Lift Helicopter Components

BAY SHORE, N.Y.--(BUSINESS WIRE)-- Air Industries Group

(“Air Industries”) (NYSE American: AIRI), a leading manufacturer of precision components and assemblies for large aerospace

and defense prime contractors, today announced that it has secured a long-term contract valued at more than $33.0 million to manufacture

and supply complex components for the CH-53K King Stallion helicopter program. The seven-year agreement strengthens Air Industries’

pivotal role in supporting one of the U.S. Department of Defense’s most important procurement programs.

The CH-53K helicopter is the latest and most advanced iteration

of the CH-53 series of helicopters. The aircraft plays a critical role in deploying and supporting troops in island and coastal environments.

As the US Military – particularly the Marine Corps – focuses on enhancing readiness for potential conflicts, the CH-53K program

stands as one of the Department of Defense’s highest-priority initiatives.

Lou Melluzzo, Chief Executive Officer of Air Industries

Group commented: “This contract marks a significant milestone for our company. We have an impeccable record of proudly producing

military aircraft parts for over 80 years, and this contract is a testament to our legacy of excellence, and our unwavering commitment

to quality. We are honored to be a trusted partner increasing production to meet the Department of Defense’s build-rate for CH-53K

helicopters.”

Mr. Melluzzo added: “Over the past two years, we have

been developing and refining the manufacturing plans for these components. This contract will enable us to quickly and significantly ramp

up production. The anticipated increase in production and deliveries is expected to increase revenue and enhance profitability by increasing

manufacturing hours and absorbing overhead costs.

“We will be investing in several pieces of new equipment

necessary to manufacture the projected volume of product. These investments will create additional capacity and increase efficiency and

preserve the capacity to accommodate additional organic growth. As part of our forward-looking business strategy, we remain committed

to competing for and securing contracts that support profitable growth.

“All components under this agreement will be manufactured

at our Sterling Engineering Division in Connecticut. The continued investment in Connecticut will ensure that we keep ahead of customer

demands and create a state-of-the-art facility.”

ABOUT AIR INDUSTRIES GROUP

Air Industries Group is a leading manufacturer of precision

components and assemblies for large aerospace and defense prime contractors. Its products include landing gears, flight controls, engine

mounts and components for aircraft jet engines, ground turbines and other complex machines. Whether it is a small individual component

or complete assembly, its high quality and extremely reliable products are used in mission critical operations that are essential for

the safety of military personnel and civilians.

FORWARD LOOKING STATEMENTS

Certain matters discussed in this press release are ‘forward-looking

statements’ intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995.

In particular, the Company’s statements regarding trends in the marketplace, future revenues, earnings and Adjusted EBITDA, the ability

to realize firm backlog and projected backlog, cost cutting measures, potential future results and acquisitions, are examples of such

forward-looking statements. The forward-looking statements are subject to numerous risks and uncertainties, including, but not limited

to, the timing of projects due to variability in size, scope and duration, the inherent discrepancy in actual results from estimates,

projections and forecasts made by management, regulatory delays, changes in government funding and budgets, and other factors, including

general economic conditions, not within the Company’s control. The factors discussed herein and expressed from time to time in the Company’s

filings with the Securities and Exchange Commission could cause actual results and developments to be materially different from those

expressed in or implied by such statements. The forward-looking statements are made only as of the date of this press release and the

Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

NON-GAAP FINANCIAL MEASURES

The Company uses Adjusted EBITDA, a Non-GAAP financial measure

as defined by the SEC, as a supplemental profitability measure because management finds it useful to understand and evaluate results,

excluding the impact of non-cash depreciation and amortization charges, stock based compensation expenses, and nonrecurring expenses and

outlays, prior to consideration of the impact of other potential sources and uses of cash, such as working capital items. This calculation

may differ in method of calculation from similarly titled measures used by other companies and may be different than the EBITDA calculation

used by our lenders for purposes of determining compliance with our financial covenants. This Non-GAAP measure may have limitations when

understanding performance as it excludes the financial impact of transactions such as interest expense necessary to conduct the Company’s

business and therefore are not intended to be an alternative to financial measure prepared in accordance with GAAP. The Company has not

quantitatively reconciled its forward looking Adjusted EBITDA target to the most directly comparable GAAP measure because items such as

amortization of stock-based compensation and interest expense, which are specific items that impact these measures, have not yet occurred,

are out of the Company’s control, or cannot be predicted. For example, quantification of stock-based compensation is not possible

as it requires inputs such as future grants and stock prices which are not currently ascertainable.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240401999918/en/

Contacts

Air Industries Group

Chief Financial Officer

631-328-7039

Anyone wishing to contact us or send a message can also do

so by visiting: www.airindustriesgroup.com/contact-us/

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

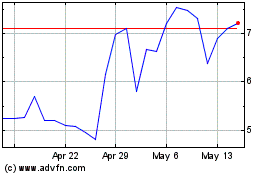

Air Industries (AMEX:AIRI)

Historical Stock Chart

From Nov 2024 to Dec 2024

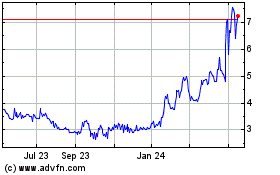

Air Industries (AMEX:AIRI)

Historical Stock Chart

From Dec 2023 to Dec 2024