UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ______)

| Filed by the Registrant |

☒ |

|

| |

|

|

| Filed by a party other than the Registrant |

☐ |

|

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☒ |

Soliciting Material Under

Section 240.14a-12 |

BM

Technologies, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with

preliminary materials. |

| |

|

| ☐ |

Fee computed on table exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(I) and 0-11. |

This

Schedule 14A relates to the proposed acquisition of BM Technologies, Inc., a Delaware corporation (the “Company”), by First

Carolina Bank, a North Carolina state-chartered bank (“Parent”) pursuant to the Agreement and Plan of Merger by and among

the Company, Parent, and Double Eagle Acquisition Corp, Inc., a Delaware corporation and a wholly owned subsidiary of Parent, dated October

24, 2024 (the “Merger”).

The

following is the FAQ shared with employees of the Company and the Parent on October 30, 2024 relating to the Merger.

Frequently

Asked Questions

Introduction:

While there is excitement about the new partnership between BMTX and First Carolina Bank, we understand there are also questions

and concerns regarding potential changes to your employment, role and responsibilities, and perks and benefits. We want to assure you

that we’re committed to maintaining open communication and transparency throughout this process.

Here is

how we plan to support you during this time of transition:

| ● | You

can utilize this survey link to submit anonymous questions. |

| ● | Regular

correspondence will be provided with key milestones, updates and answers to your frequently

asked questions. |

| ● | A

joint SharePoint site, accessible to both First Carolina Bank and BMTX employees, was created

to provide you with valuable reference materials. A link to the SharePoint site will be shared

with you via email. |

Below

is a list of FAQs we hope will help guide you during this transition.

Overall

Organization

| 1. | What

is the goal of the merger?

This merger aims to bring together two strong organizations, allowing us to leverage each

other’s strengths and create a more comprehensive offering. While there may be some

changes, we are committed to maintaining the core values and culture of both companies that

we have worked hard to cultivate. |

| 2. | When

will the merger between BMTX and First Carolina Bank be official?

We expect that the merger will be completed by the end of January 2025, subject to receipt

of required regulatory approvals (if any) and other closing conditions, which may impact

the closing timeline. We will provide details as they become available. |

| 3. | Will

there be changes to BMTX and First Carolina Bank’s leadership structure after the merger?

As part of the integration process, there may be some adjustments to the leadership structure. |

| 4. | Will

there be changes to BMTX policies and procedures after the merger?

Yes, you will follow the policies and procedures set forth by First Carolina Bank after the

merger is complete. You will receive additional information, including a new hire orientation

session. |

| 5. | If

I am contacted by the media, what should I do?

Employees should direct all media questions to Kristen Brabble, Chief Operating Officer of

First Carolina Bank, at kristenbrabble@firstcarolinabank.com. |

| 6. | What

does this mean for our customers?

There will be no change for the First Carolina Bank and BMTX customers. They will continue

to have access to funds and call centers outlined in their agreements. Over time, First Carolina

Bank and BMTX will work to enhance and build additional product offerings. |

Potential

Organizational Changes

| 7. | Are

there any planned terminations as part of the merger?

As we plan to integrate our organizations, we are carefully reviewing all staffing needs

and positions. We expect most BMTX positions to remain in place following the closing of

the merger. |

| 8. | How

will the merger impact my department, position, or job responsibilities?

The leadership team is finalizing the new organizational structure. Some departments may

experience more change than others. We will work to ensure a smooth transition. You will

receive additional information about any changes that affect your position or department. |

| 9. | Will

I still report to my current manager after the merger?

As part of the integration process, there may be changes to reporting structures. If your

manager does change, we will ensure you have a clear understanding of the new reporting structure

and expectations. |

Employment

& Benefits

| 10. | How

will BMTX and First Carolina Bank employees be affected by the merger?

As we begin integrating companies, some BMTX and First Carolina Bank departments and

positions may be impacted differently than others. The leadership team of both companies

are working closely together to ensure a smooth transition. |

| 11. | Is

my employer going to be BMTX or First Carolina Bank?

BMTX will be a wholly owned subsidiary of First Carolina Bank. Some departments will

fold into First Carolina Bank while others will stay under BMTX. For the purposes of tenure,

you will keep your BMTX hire date. |

| 12. | Will

there be changes to my compensation?

There will be no changes in compensation for First Carolina Bank employees. First Carolina

Bank employees will go through the normal year-end performance review process. |

First

Carolina Bank will honor current BMTX base compensation for the first year following the merger. A mid-year compensation analysis may

result in positive adjustments as needed.

| 13. | What

will the pay schedule be?

Currently, First Carolina Bank pays base compensation bi-weekly 26 times per year in

one-week arrears. For example: the pay period of 08/25/2024 – 09/07/2024 will be paid

to the employee on a check date of 09/13/2024. |

During

this time of transition, we will maintain both the BMTX and First Carolina Bank pay schedule until both pay schedules are aligned. You

will receive information about your payroll schedule closer to the date of the merger.

| 14. | Will

BMTX employees still be able to work remotely after the merger?

BMTX employees will continue to work remotely. BMTX employees located near one of First

Carolina Bank’s offices – North Carolina, South Carolina, Georgia, and Virginia

– will have the opportunity to work onsite after the transition as space allows. |

| 15. | Can

I still use my Paid Time Off (PTO) during the integration process?

Yes. You are entitled to use your accrued and unused PTO, just as you normally would. |

Some

First Carolina Bank departments may opt to have a semi-blackout period at year-end to ensure all business needs are met. You will receive

additional information if your department elects to have a semi-blackout period.

| 16. | Will

I be able to roll over any unused PTO at the end of the year?

First Carolina Bank employees are not eligible for PTO rollover unless they were hired after

July 2024. If an exception to the Policy is granted by executive leadership, the exception

will be communicated to you. |

BMTX

employees can roll over a maximum of 40 hours into 2025 per their Policy. All rollover hours must be used by 12/31/2025.

The

PTO Policy will be reviewed and updated accordingly to meet our merged goals and benefits package. Any changes will be communicated to

you in advance.

| 17. | How

will the merger impact employee benefits (e.g., health insurance, 401K plan)?

BMTX employees will retain benefits through BMTX until the merger is complete. |

Effective

when the merger is complete, BMTX employees will start benefits through First Carolina Bank. First Carolina Bank has competitive benefits

and great perks for employees to take advantage of.

The

2025 First Carolina Bank Benefits Guidebook is on the joint SharePoint site. If BMTX employees elect to enroll in 2025 benefits they

will participate in an open enrollment, hosted by First Carolina Bank, in December.

First

Carolina Bank employees will participate in an open enrollment in November.

| 18. | What

happens to BMTX’s current 401(k) plan? Will my years of service with BMTX carry over

after the merger for vesting purposes?

The BM Technologies, Inc. 401(k) Plan will be terminated the day the merger is complete.

Following the merger, you will be eligible to enroll in First Carolina Bank’s 401(k)

Plan. You will receive more information about the First Carolina Bank plan and how to enroll.

You will have the option to roll over your current BMTX plan funds into the First Carolina

Bank plan or transfer the funds elsewhere. |

| 19. | What

happens to my loan under the BMTX 401(k) plan?

Existing BMTX 401(k) Plan loans will be handled pursuant to the document and loan policy.

The First Carolina Bank 401(k) Plan also offers loans. |

| 20. | Will

there be opportunities for professional development and training after the merger?

Yes, the First Carolina Bank Learning and Development team will conduct a new hire orientation.

On-the-job training will happen in coordination with your manager. |

If

you have additional questions, please feel free to contact your manager or the Human Resources Team.

BMTX: peopleteam@bmtx.com

First Carolina

Bank: humanresources@firstcarolinabank.com

Forward

Looking Statements

Certain

statements in this communication are “forward-looking statements” within the meaning of federal securities laws and are made

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect,

among other things, the Company’s current expectations, assumptions, plans, strategies and anticipated results. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that may differ materially

from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances

of future performance.

There

are a number of risks, uncertainties and conditions that may cause the Company’s actual results to differ materially from those

expressed or implied by these forward-looking statements, including but not limited to: (i) uncertainties as to the timing of the Merger;

(ii) the risk that the Merger may not be completed on the anticipated terms in a timely manner or at all; (iii) the failure to satisfy

any of the conditions to the consummation of the Merger, including receiving, on a timely basis or otherwise, the required approvals

of the Merger by the Company’s stockholders; (iv) the possibility that competing offers or acquisition proposals for the Company

will be made; (v) the possibility that any or all of the various conditions to the consummation of the Merger may not be satisfied or

waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions,

limitations or restrictions placed on such approvals); (vi) the occurrence of any event, change or other circumstance that could give

rise to the termination of the Merger Agreement, including in circumstances which would require the Company to pay a termination fee;

(vii) the effect of the announcement or pendency of the transactions contemplated by the Merger Agreement on the Company’s ability

to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business,

or its operating results and business generally; (viii) risks related to diverting management’s attention from the Company’s

ongoing business operations; (ix) the risk that stockholder litigation in connection with the transactions contemplated by the Merger

Agreement may result in significant costs of defense, indemnification and liability; (x) certain restrictions during the pendency of

the Merger that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; (xi) uncertainty

as to the timing of completion of the Merger; (xii) risks that the benefits of the Merger are not realized when and as expected; (xiii)

legislative, regulatory and economic developments; and (xiv) (A) the risk factors described in Part I, Item 1A of Risk Factors in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and (B) the other risk factors identified from time to

time in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). Filings with the SEC are

available on the SEC’s website at http://www.sec.gov.

Many

of these circumstances are beyond the Company’s ability to control or predict. These forward-looking statements necessarily involve

assumptions on the Company’s part. These forward-looking statements may include words such as “believe,” “expect,”

“anticipate,” “estimate,” “intend,” “plan,” “project,” “should,”

“may,” “will,” “might,” “could,” “would,” or similar expressions. All forward-looking

statements attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the

cautionary statements that appear throughout this communication. Furthermore, undue reliance should not be placed on forward-looking

statements, which are based on the information currently available to the Company and speak only as of the date they are made. The Company

disclaims any intention or obligation to update or revise publicly any forward-looking statements.

Participants in the

Solicitation

The

Company and its directors, executive officers and other members of management and employees, under SEC rules, may be deemed to be “participants”

in the solicitation of proxies from stockholders of the Company in favor of the proposed transaction. Information about the Company’s

directors and executive officers is set forth in the Company’s Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Shareholders,

which was filed with the SEC on April 29, 2024. To the extent holdings of the Company’s securities by its directors or executive

officers have changed since the amounts set forth in such 2024 proxy statement, such changes have been or will be reflected on Initial

Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information

concerning the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of

the Company’s stockholders generally, will be set forth in the Company’s proxy statement relating to the proposed transaction

when it becomes available.

Additional

Information and Where to Find It

This

communication may be deemed to be solicitation material in respect of the proposed acquisition of the Company by Parent. In connection

with the proposed transaction, the Company intends to file relevant materials with the SEC, including the Company’s proxy statement

in preliminary and definitive form. INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE

SEC, INCLUDING THE COMPANY’S PROXY STATEMENT (WHEN THEY ARE AVAILABLE), BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE COMPANY, PARENT AND THE PROPOSED TRANSACTION. Investors and stockholders of the Company are or will be able to obtain these

documents (when they are available) free of charge from the SEC’s website at www.sec.gov, or free of charge from the Company by

directing a request to the Company at 201 King of Prussia Road, Suite 650, Wayne, PA 19087, Attention: Investor Relations or at tel:

(877) 327-9515.

No

Offer or Solicitation

This

communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any

securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction.

Page 6

of 6

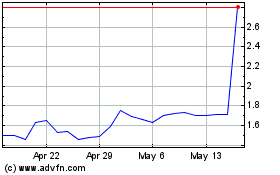

BM Technologies (AMEX:BMTX)

Historical Stock Chart

From Feb 2025 to Mar 2025

BM Technologies (AMEX:BMTX)

Historical Stock Chart

From Mar 2024 to Mar 2025