false

0001460602

0001460602

2024-07-03

2024-07-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 3, 2024

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

001-38416 |

|

98-0583166

|

| (State

or Other Jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

Incorporation) |

|

Number) |

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 3, 2024, Koligo Therapeutics Inc. (“Borrower”), a subsidiary of Orgenesis Inc. (the “Company”), entered

into a loan agreement (the “Loan Agreement”) with Yehuda Nir (the “Lender”), pursuant to which the Lender

agreed to loan the Borrower $2,000,000 (the “Loan”). The Loan shall consist of an initial installment of $1,000,000 on

or about July 3, 2024 and a second installment of $1,000,000 on or about July 8, 2024 in accordance with the terms of the Loan

Agreement. The Loan shall bear annual 10% simple interest and each installment shall become due and payable no later than 90 days

after the receipt of such installment by the Borrower, subject to extension at the discretion of the Lender. The Loan Amount may be

prepaid by the Borrower in whole or in part at any time without the prior written approval of the Lender.

The

Loan Agreement contains certain specified events of default, the occurrence of which would entitle the Lender to immediately demand repayment

of all Loan obligations. Such events of default include, among others, the commencement of bankruptcy or insolvency proceedings against

the Borrower, breaches of any covenants or representations and warranties by the Borrower in any material respect, failure to make payments

under the Loan Agreement when due, and if the Company replaces its current Chief Executive Officer with another appointee without the

express written confirmation of the Lender.

The

foregoing summary of the Loan Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full

text of such document attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information required by this Item 2.03 is included under Item 1.01 of this Current Report on Form 8-K.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

| Date:

July 8, 2024 |

By: |

/s/

Victor Miller |

| |

|

Victor

Miller |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary |

Exhibit

10.1

LOAN

AGREEMENT

THIS

LOAN AGREEMENT (this “Agreement”) is made as of the 3rd day of July, 2024 (“Effective Date”), by

and between Yehuda Nir, having an address at ________________ (“Lender”), and Koligo Therapeutics INC.,

a Kentucky, USA company (“Borrower”) a wholly owned subsidiary of Orgenesis Inc. a Nevada, USA company (“ORGS”),

(Lender together with Borrower, each a “Party” and together, the “Parties”).

WHEREAS,

Lender desires to provide financing by way of a loan to the Borrower to be used by the Borrower for working capital and ongoing operations,

and the Borrower desires to receive such financing to be used by the Borrower for working capital and ongoing operations;

NOW,

THEREFORE, in consideration of the premises and the mutual covenants herein contained, and other good and valuable consideration

the receipt and sufficiency of which is hereby acknowledged, the Parties hereby agree as follows:

1.

Funding. Lender has committed to provide financing in form of a loan in the amount of US$2 million dollars, under the terms of

this Agreement, in two installments of $1 million each, the first instalment to be lent on or about July 3, 2024, and the second on or

about July 8, 2024 (the “Loan Amount”) in accordance with the terms hereof.

2.

Loan; Closing.

(a)

Terms of Loan. The Lender shall lend the Loan Amount to the Borrower, and the Borrower shall borrow the Loan Amount from the Lender.

The Loan Amount shall bear annual 10% simple interest and each installment shall become due and payable no later 90 days after the receipt

of such installment, subject to extension in the discretion of the Lender. The Loan Amount may be prepaid by the Borrower in whole or

in part at any time without the prior written approval of the Lender.

(b)

The Closing. The closing of the loans shall take place on or after the Effective Date, or such other date, time and place as the

Lender and the Borrower shall agree upon in writing (the “Closing”). At the Closing, the Lender and the Borrower shall each

deliver a fully executed version of this Agreement to the other Party. Following the Closing, the Lender shall transfer to the Borrower

the Loan Amount by wire transfer, to the bank account of the Borrower in accordance with wiring instructions provided by the Borrower

to the Lender.

3.

Use of Proceeds. The Borrower shall use the Loan Amount to fund its working capital and financing needs (the “Purpose”).

4.

Events of Default.

(a)

The following shall constitute events of default (each an “Event of Default”):

i.

filing of a petition in bankruptcy or the commencement of any proceedings under any bankruptcy laws by or against the Borrower, which

filing or proceeding, is not dismissed within sixty (60) days after the filing or commencement thereof, or if the Borrower shall completely

cease or suspend the conduct of its usual business or if the Borrower shall become, insolvent and admits in writing that it is unable

to pay its debts or liabilities as they fall due;

ii.

breaches any material covenant by the Borrower (other than a payment covenant) which is not cured within 30 days of receipt of written

notice of such breach;

iii.

an order, judgment or decree shall be entered, without the application, approval or consent of the Borrower by any court of competent

jurisdiction, approving a petition seeking reorganization of the Borrower or appointing a receiver, trustee or liquidator of the Borrower

or of all or a substantial part of its assets, and such order, judgment or decree shall continue unstayed and in effect for any period

of ninety (90) consecutive days;

iv.

Borrower fails to repay principal when due and such failure continues for ten business days of the Borrower’s receipt of written

notice from the Lender; or

v.

ORGS replaces its current Chief Executive Officer with another appointee without the express written confirmation of the Lender.

(b)

If, at any time, an Event of Default shall occur, all obligations under this Agreement shall become immediately due and payable without

presentment, demand or protest, all of which are hereby waived by the Borrower.

5.

Representations and Warranties. The Borrower represents and warrants to the Lender (and to the extent identified below, the Lender

represents and warrants to the Borrower) as follows:

(a)

The Borrower is duly formed, validly existing and in good standing under the laws of the State of Israel. The Borrower has full power

and authority to consummate the transactions contemplated hereunder, and the consummation of such transactions and the performance of

this Agreement by the Borrower does not violate the provisions of any applicable law, and will not result in any material breach of,

or constitute a material default under any agreement or instrument to which the Borrower is a party or under which the Borrower is bound.

(b)

The execution and performance of this Loan Agreement by the Borrower has been duly authorized by all necessary actions. This Loan Agreement

has been duly executed and delivered by the Borrower and the Lender and this Loan Agreement is the legal, valid, and binding obligation

of the Borrower and the Lender, and is fully enforceable against the Borrower and the Lender according to its terms.

(c)

There is no existing lien, encumbrance, security interest, indebtedness, mortgage or third party rights of any kind that are, or could

be, ranked senior in nature to the outstanding loan amount other than any lien arising by operation of law.

6.

Waiver; Non-Negotiable. The Borrower, for itself and each of its legal representatives, hereby waives presentment for payment,

demand, right of setoff, notice of nonpayment, notice of dishonor, protest of any dishonor, notice of protest and protest of this Agreement,

and all other notices in connection with the delivery, acceptance, performance, default or enforcement of the obligations under this

Agreement. This Agreement is non-negotiable.

7.

No Security Interest. At all times, the outstanding loan amount shall rank, and shall be deemed, pari passu or senior to any and

all indebtedness of the Borrower unless otherwise subordinated by the Lender in writing in the Lender’s sole and absolute discretion.

The Borrower hereby agrees, covenants and undertakes not to permit any indebtedness, lien, encumbrance, mortgage or third party right

of any kind to become senior to the outstanding loan amount other than any lien arising by operation of law and the ordinary course of

business.

8.

Further Assurances. The Parties shall perform such further acts and execute such further documents as may reasonably be necessary

to carry out and give full effect to the provisions of this Agreement.

9.

Miscellaneous.

(a)

Entire Agreement; Amendments. This Agreement constitutes the entire understanding of the Parties hereto with respect to the subject

matter hereof and supersedes all prior written and oral understandings of such Parties with regard thereto. This Agreement may be modified,

amended, or any term hereof waived with the written consent of the Borrower and the Lender. Any amendment effected in accordance with

this Section 9(a) shall be binding upon all Parties and their respective successors and assignees.

(b)

Governing Law; Jurisdiction. This Loan Agreement shall be governed by and construed according to the laws of the State of Israel

without regard to the conflict of laws provisions thereof. In the event of any dispute and/or claim arising out of and/or in relation

to this Agreement (“Dispute”), the Parties agree to make a good faith attempt to negotiate an amicable resolution

of such Dispute. If any such Disputes cannot be resolved by the Parties within a period of forty-five (45) days following the first receipt

by a Party of written notice of such Dispute form the other Party, such Dispute shall be brought exclusively to the competent court in

Tel-Aviv-Jaffa, and the parties irrevocably consent to the personal jurisdiction and venue therein.

(c)

Notices. All notices and other communications required or permitted hereunder to be given to a Party to this Loan Agreement shall

be in writing and shall be telecopied or mailed by registered or certified mail, postage prepaid, or otherwise delivered by hand or by

messenger. Any notice sent in accordance with this Loan Agreement shall be effective (i) if mailed, seven (7) business days after mailing

to the address set forth each Party’s signature below, (ii) if sent by messenger, upon delivery, and (iii) if sent via email, upon

transmission and electronic confirmation of receipt or (if transmitted and received on a non-business day) on the first business day

following transmission and electronic confirmation of receipt.

(d)

Assignment; Waiver. This Loan Agreement may not be assigned by the Borrower without the prior written consent of the Lender. The

Lender may assign this Loan Agreement without the prior written consent of the Borrower. This Loan Agreement shall be binding upon the

successors, assigns and representatives of each Party. No delay or omission to exercise any right, power, or remedy accruing to any Party

upon any breach or default under this Loan Agreement, shall be deemed a waiver of any other breach or default theretofore or thereafter

occurring. All remedies, either under this Loan Agreement or by law or otherwise afforded to any of the Parties, shall be cumulative

and not alternative.

(e)

Severability. If any provision of this Loan Agreement is held by a court of competent jurisdiction to be unenforceable under applicable

law, then such provision shall be excluded from this Loan Agreement and the remainder of this Loan Agreement shall be interpreted as

if such provision were so excluded and shall be enforceable in accordance with its terms; provided, however, that in such event this

Loan Agreement shall be interpreted so as to give effect, to the greatest extent consistent with and permitted by applicable law, to

the meaning and intention of the excluded provision as determined by such court of competent jurisdiction.

(f)

Counterparts. This Loan Agreement may be executed in any number of counterparts, each of which shall be deemed an original but

all of which together shall constitute one and the same instrument.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, the Parties have executed this Loan Agreement as of the date first above written.

| LENDER |

|

| |

|

|

| Yehuda

Nir |

|

| |

|

|

| By:

|

|

|

| |

|

|

| THE

BORROWER |

|

| |

|

|

| Koligo

Therapeutics Inc. |

|

| |

|

|

| By:

|

|

|

| Name: |

Vered

Caplan |

|

| Title:

|

|

|

| Address: |

|

| |

|

|

| Address: 20271 Goldenrod Lane, Germantown ,MD 20876, USA |

|

[Signature

page to the Loan Agreement between Yehuda Nir. and Koligo Therapeutics INC.]

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

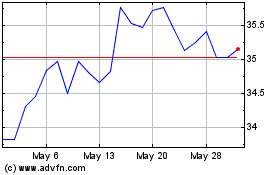

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Dec 2023 to Dec 2024