UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of May, 2022

Commission File Number: 001-35936

B2Gold

Corp.

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 3400, Park Place

666 Burrard Street

Vancouver, British Columbia

V6C 2X8

Canada

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| [ ] Form 20-F |

[X] Form 40-F |

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): [ ]

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): [ ]

DOCUMENTS INCLUDED AS PART

OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B2Gold Corp. |

|

| |

|

|

|

| |

|

|

|

| Date: May 26,

2022 |

By: |

/s/ Roger Richer |

|

| |

Name: |

Roger Richer |

|

| |

Title: |

Executive Vice President, General Counsel & Secretary |

|

EXHIBIT INDEX

Exhibit 99.1

News Release

B2Gold Corp. to Acquire Oklo Resources Limited and

its

Extensive Land Package near the Fekola Mine

Vancouver, May 26, 2022 - B2Gold Corp. (TSX:

BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold”) is pleased to announce that it has entered into a definitive Scheme Implementation

Agreement (“Agreement”) with Oklo Resources Limited (ASX: OKU) (“Oklo”) pursuant to which B2Gold

has agreed to acquire 100% of the fully paid ordinary shares of Oklo (the “Oklo Shares”) in consideration for 0.0206

of a common share of B2Gold (each whole share, a “B2Gold Share”) and A$0.0525 in cash for each Oklo Share held (“Scheme

Consideration”). The Scheme Consideration represents a purchase price of approximately A$0.1725 for each Oklo Share and values

the transaction at approximately A$91.3 million (including up to approximately A$27.4 million cash consideration). The transaction as

contemplated by the Agreement (the “Transaction”) will be implemented by way of a scheme of arrangement pursuant to

Part 5.1 of the Australian Corporations Act 2001 (Cth) (“Scheme”). Upon implementation of the Scheme, in addition

to the cash consideration, B2Gold expects to issue up to 10,754,284 B2Gold Shares to Oklo shareholders, representing approximately 1%

of the B2Gold Shares on an undiluted basis.

The acquisition of Oklo is expected to provide B2Gold

with an additional landholding of 1,405 km2 covering highly prospective greenstone belts in Mali, West Africa, including Oklo’s

flagship Dandoko Project (550 km2). The Oklo properties are located on a subparallel, north-trending structure east of the

prolific Senegal-Mali Shear Zone, approximately 25 kilometres from the Fekola Mine and approximately 25 kilometres from the Anaconda area,

where B2Gold is currently conducting a 2022 Mali drill program of approximately 225,000 metres of drilling with a budget of US$35.5 million.

In March 2021, Oklo delivered an initial JORC 2012

compliant Measured and Indicated mineral resource estimate of 8.70 million tonnes at 1.88 grams per tonne (“g/t”) for

528,000 ounces of gold and an Inferred mineral resource estimate of 2.63 million tonnes at 1.67 g/t for 141,000 ounces of gold. The mineral

resources are distributed across the Seko, Koko, Disse and Diabarou deposits, which all remain open and are expected to grow with ongoing

exploration drilling both along strike and at depth. Significantly, B2Gold believes that approximately 65% of the resource

is contained in soft oxidized material, which would be amenable to processing at B2Gold’s Fekola mill.

Board of Directors’ Approval and Recommendations

The Board of Directors of B2Gold has unanimously approved

the Transaction, including, without limitation, the Scheme Consideration.

The Board of Directors of Oklo considers the Scheme

to be in the best interests of Oklo shareholders and has unanimously recommended the Scheme to Oklo Shareholder and recommends that all

Oklo shareholders vote in favour of the proposed Scheme at the Scheme Meeting (as defined below), in both cases in the absence of a superior

proposal or the independent expert appointed by Oklo (the “Independent Expert”) concluding that the Scheme is not in

the best interests of Oklo shareholders. Subject to those same qualifications, each director of Oklo intends to vote (or cause to be voted)

all Oklo Shares in which he or she has a Relevant Interest (as defined in the Agreement) in favour of the Scheme, representing approximately

3% of the issued and outstanding Oklo Shares, and any other scheme related matters at the meeting of the shareholders of Oklo (the “Scheme

Meeting”).

Transaction Structure and Certain Terms of the

Agreement

Pursuant to the Agreement, B2Gold

has agreed to acquire all the fully paid Oklo Shares by way of the Scheme pursuant to which Oklo shareholders will receive 0.0206 B2Gold

Shares and A$0.0525 in cash for each Oklo Share held. In addition, under the terms of the Agreement, Oklo is required to procure that

all unvested Oklo options automatically vest, in accordance with their terms upon the Supreme Court of Western Australia (the “Court”)

approving the Scheme. Oklo optionholders who exercise their Oklo options prior to the Scheme record date will be entitled to participate

in the Scheme. Additionally, Oklo has entered into option cancellation deeds with certain Oklo optionholders pursuant to which their unexercised

options will be cancelled with effect on implementation of the Scheme.

The Transaction, including without limitation, the

Scheme, is subject to approval by the Court, the Oklo shareholders at the Scheme Meeting, together with other customary closing conditions.

The Scheme is also conditional on, among other things, approval from the Malian Minister of Mines of the indirect transfer of ownership

of certain mineral rights, and approval from the TSX and NYSE American, including in respect of the issuance and listing of new B2Gold

Shares issuable pursuant to the Scheme.

A Scheme Booklet setting out the key terms of the

Transaction, including the Scheme, the Independent Expert’s report and the reasons for the Oklo directors’ recommendation

will be sent to all Oklo shareholders in due course. The Scheme Meeting to consider the Scheme is expected to be held in August 2022 and

the Scheme is expected to be implemented in September 2022, subject to satisfaction of all conditions and receipt of all necessary approvals.

The Scheme is conditional, among other things, upon approval by at least 75% of the number of votes cast, and more than 50% of the number

of Oklo shareholders present and voting, at the Scheme Meeting.

The Agreement also contains customary deal protection

mechanisms, including no shop and no talk provisions, matching and notification rights for B2Gold in the event of a competing proposal

and a reimbursement fee payable by Oklo in specified circumstances.

Qualified Person

Tom Garagan, Senior

Vice President of Exploration at B2Gold, a qualified person under National Instrument 43-101, has reviewed and approved the information

contained in this news release.

About B2Gold Corp.

B2Gold is a low-cost international senior gold producer

headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines and numerous

exploration and development projects in various countries including Mali, Colombia, Finland and Uzbekistan. B2Gold forecasts total consolidated

gold production of between 990,000 and 1,050,000 ounces in 2022.

On

Behalf of B2GOLD CORP.

“Clive T. Johnson”

President & Chief

Executive Officer

For more information on B2Gold please visit the

Company website at www.b2gold.com or contact:

Randall Chatwin

SVP,

Legal and Corporate Communications

604-681-8371

rchatwin@b2gold.com

The Toronto Stock Exchange and NYSE American LLC neither

approve nor disapprove the information contained in this news release.

Production guidance presented in this news

release reflect total production at the mines B2Gold operates on a 100% project basis. Please see our Annual Information Form dated March

30, 2022 for a discussion of our ownership interest in the mines B2Gold operates.

This news release includes certain "forward-looking

information" and "forward-looking statements" (collectively forward-looking statements") within the meaning of applicable

Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; statements regarding

the Transaction, including, without limitation, the expected shareholding in B2Gold by B2Gold shareholders and former Oklo shareholders

upon completion of the Scheme, the timing of the Oklo Shareholders’ Meeting, the completion of the Scheme, including receipt of

all necessary regulatory approvals, including from the TSX and NYSE MKT, and the satisfaction of conditions; statements relating to the

expected landholding in Mali following acquisition of Oklo and certain mineral resources being amenable to processing at B2Gold’s

Fekola mill, and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues

and cash flows, and capital costs (sustaining and non-sustaining) and operating costs, and including, without limitation: total consolidated

gold production of between 990,000 and 1,050,000 ounces in 2022. All statements in this news release that address events or developments

that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical

facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate",

"project", "target", "potential", "schedule", "forecast", "budget", "estimate",

"intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will",

"would", "may", "could", "should" or "might" occur. All such forward-looking statements

are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond B2Gold's control, including risks associated with or related to: the

duration and extent of the COVID-19 pandemic, the effectiveness of preventative measures and contingency plans put in place by the Company

to respond to the COVID-19 pandemic, including, but not limited to, social distancing, a non-essential travel ban, business continuity

plans, and efforts to mitigate supply chain disruptions; escalation of travel restrictions on people or products and reductions in the

ability of the Company to transport and refine doré; the volatility of metal prices and B2Gold's common shares; changes in tax

laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving

production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in B2Gold's

feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining

activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change

and climate change regulations; the ability to replace mineral reserves and identify acquisition opportunities; the unknown liabilities

of companies acquired by B2Gold; the ability to successfully integrate new acquisitions; fluctuations in exchange rates; the availability

of financing; financing and debt activities, including potential restrictions imposed on B2Gold's operations as a result thereof and the

ability to generate sufficient cash flows; operations in foreign and developing countries and the compliance with foreign laws, including

those associated with operations in Mali, Namibia, the Philippine and Colombia and including risks related to changes in foreign laws

and changing policies related to mining and local ownership requirements or resource nationalization generally, including in response

to the COVID-19 outbreak; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of

energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory,

political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors,

third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which

owns the Masbate Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain

skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition

with other mining companies; community support for B2Gold's operations, including risks related to strikes and the halting of such operations

from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to

maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance

with anti-corruption laws, and sanctions or other similar measures; social media and B2Gold's reputation; risks affecting Calibre having

an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other

factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information

Form, B2Gold's current Form 40-F Annual Report and B2Gold's other filings with Canadian securities regulators and the U.S. Securities

and Exchange Commission (the "SEC"), which may be viewed at www.sedar.com and www.sec.gov, respectively (the "Websites").

The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements

B2Gold's forward-looking statements are based

on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to

management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to B2Gold's ability

to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development

and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or

reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; B2Gold's ability

to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including

gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political

conditions; and other assumptions and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based

on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's

beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking

statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in,

or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. For the reasons set

forth above, undue reliance should not be placed on forward-looking statements.

This regulatory filing also includes additional resources:

ex991.pdf

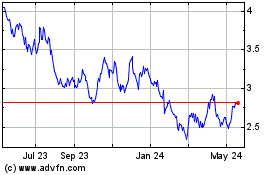

B2Gold (AMEX:BTG)

Historical Stock Chart

From Jan 2025 to Feb 2025

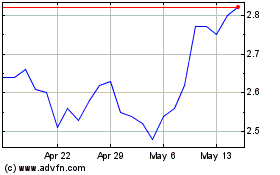

B2Gold (AMEX:BTG)

Historical Stock Chart

From Feb 2024 to Feb 2025