Corient Acquires Rootstock, an Ultra-High-Net-Worth Pittsburgh-Based RIA with Approximately $600 Million in Assets Under Management

February 06 2025 - 6:15AM

Business Wire

Corient, one of the nation’s largest and fastest-growing

national wealth advisors, today announced it has acquired Rootstock

Advisors (“Rootstock”), a Pennsylvania-based registered investment

advisory firm with approximately $600 million in assets under

management (as of January 31, 2025). This acquisition strengthens

Corient’s ability to serve ultra-high-net-worth (UHNW) clients and

expands its presence in the Pittsburgh region.

Since its inception, Rootstock has built a client-centric

culture, serving a select group of UHNW and high-net-worth families

and households. The firm provides comprehensive family office

services, including investment management, estate planning

coordination, philanthropic strategy, family governance, education

planning, wealth planning and income tax oversight. With its

dedication to delivering tailored solutions, Rootstock has

cultivated lasting client relationships and become a trusted

partner in preserving and growing generational wealth.

“By joining Corient, we gain access to the expertise, resources

and support of a leading national wealth firm, which enables us to

do more for clients,” said Greg Simpson, Rootstock President.

“Corient’s unique Private Partnership was a critical factor in our

decision to join, as it promotes an alignment of values across the

firm and allows us to collaborate with a large and growing team of

colleagues with significant experience and expertise.”

“Rootstock’s expertise in serving ultra-high-net-worth families

and deep commitment to providing bespoke family office-style

solutions make them an exceptional addition to Corient,” added Kurt

MacAlpine, Partner and Chief Executive Officer of Corient. “We

share a commitment to acting as trusted fiduciaries, providing

solutions that prioritize clients’ interests and simplify the

challenges of managing significant wealth. Together, we’re focused

on exceeding client expectations, helping families navigate

financial complexities and building enduring legacies for the

future.”

The acquisition of Rootstock is Corient’s third transaction in

the past three months. In January, CI acquired the multi-family

office business of Geller and Company of New York, and in December,

CI announced an agreement to acquire H.M. Payson & Co. of

Portland, Maine. The transactions follow CI’s announcement on

November 25, 2024 that it has entered into a definitive agreement

with an affiliate of Mubadala Capital, the alternative asset

management arm of Mubadala Investment Company, to take the firm

private.

About Corient

Corient Private Wealth is a fiduciary, fee-only national wealth

management firm providing comprehensive solutions to

ultra-high-net-worth and high-net-worth clients. We combine the

personal service, creativity and objective advice of a boutique

with the power of experienced advisors, extensive capabilities and

custom-built strategies to create a differentiated wealth

experience. We focus on exceeding expectations, simplifying lives

and establishing lasting legacies. Corient is distinguished by its

private partnership model, which fosters collaboration and the

shared vision of delivering unrivaled client excellence. We have

more than 240 partners and over 1,200 employees managing

approximately $177.3 billion in client assets (as of December 31,

2024)*. Headquartered in Miami, Corient is a subsidiary of

Toronto-based CI Financial Corp. (TSX: CIX), a global asset and

wealth management company. For more information, visit us at

corient.com or LinkedIn.

* Client assets reflect the aggregate assets of Corient Holdings

Inc. (“Holdings”), Corient Private Wealth LLC’s upstream U.S.

holding company. Client assets include all of the assets in which

Holdings has a majority or minority investment. Certain assets are

not considered Regulatory Assets Under Management as defined by the

SEC and reported in Corient Private Wealth LLC’s Form ADV.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206226542/en/

Media Relations

United States Jimmy Moock Managing Partner, StreetCred PR

610-304-4570 jimmy@streetcredpr.com corient@streetcredpr.com

Canada Murray Oxby Vice-President, Corporate Communications CI

Financial 416-681-3254 moxby@ci.com

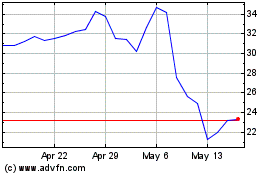

CompX (AMEX:CIX)

Historical Stock Chart

From Mar 2025 to Apr 2025

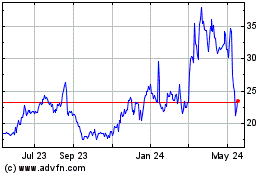

CompX (AMEX:CIX)

Historical Stock Chart

From Apr 2024 to Apr 2025