false000150237700015023772024-05-012024-05-010001502377dei:FormerAddressMember2024-05-012024-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 01, 2024 |

Contango Ore, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35770 |

27-3431051 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

516 2nd Avenue Suite 401 |

|

Fairbanks, Alaska |

|

99701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (907) 888-4273 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

CTGO |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 1, 2024, Contango ORE, Inc. (“Contango” or the “Company”) entered into a definitive arrangement agreement (the “Arrangement Agreement”), by and among the Company, Contango Mining Canada Inc., a corporation organized under the laws of British Columbia and a wholly owned subsidiary of the Company, and HighGold Mining Inc., a corporation existing under the laws of the Province of British Columbia (“HighGold”), pursuant to which the Company intends to acquire 100% of the outstanding equity interests of HighGold (the “HighGold Acquisition”).

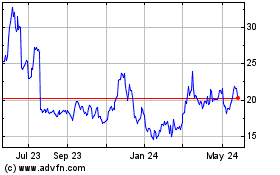

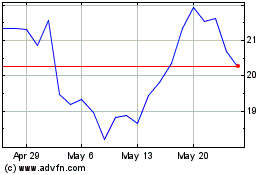

Under the terms of the Arrangement Agreement, each HighGold share of common stock will be exchanged for 0.019 shares of Contango common stock (the “Exchange Ratio”) based on the volume weighted average price (“VWAP”) of Contango shares on the NYSE American for the five-day period ending on May 1, 2024. The Exchange Ratio implies total consideration of approximately $0.40 per HighGold share and total HighGold equity value of approximately $37 million. Upon completion of the HighGold Acquisition, existing Contango shareholders will own approximately 85% and HighGold shareholders will own approximately 15% of the combined company. In connection with the HighGold Acquisition, Contango will grant to HighGold the right to appoint one director to Contango’s board of directors.

Closing of the HighGold Acquisition is subject to customary closing conditions and is expected to occur in July 2024. The Arrangement Agreement contains customary representations, warranties and covenants and also includes indemnification provisions under which the parties have agreed to indemnify each other against certain liabilities. A copy of the Arrangement Agreement is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Arrangement Agreement is qualified in its entirety by reference to such exhibit.

On May 2, 2024, the Company issued a press release announcing the HighGold Acquisition. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On May 2, 2024, the Company made available a new corporate presentation. A copy of this presentation titled “Building Alaska’s Next Gold Mines – Corporate Presentation – HighGold Transaction” is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is available on the Company’s website at www.contangoore.com.

The Company’s presentation furnished as Exhibit 99.2 to this Current Report contains non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Reconciliations of these non-GAAP financial measures are not included in the furnished presentation due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate the most directly comparable GAAP financial measures. In addition, certain of the non-GAAP financial measures have been prepared by Kinross Gold Corporation, the Company’s partner in, and the manager of, Peak Gold, LLC, a joint venture company in which the Company currently holds a 30% interest, and are based on International Financial Reporting Standards (IFRS) accounting standards and detailed information to which the Company has not had access to at this time. As a result, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measure without unreasonable efforts.

The information included herein and in Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 8.01 Other Events.

On May 1, 2024, the Company entered into a stock purchase agreement (the “SP Agreement”) with Avidian Gold Corp. (“Avidian”) pursuant to which the Company has agreed to purchase Avidian’s 100% owned Alaskan subsidiary, Avidian Gold Alaska Inc. (“Avidian Alaska”) for initial consideration of $2,400,000, with a contingent payment for up to $1,000,000 (the "Avidian Transaction").

The Company will pay Avidian an initial purchase price of $2,400,000 consisting of (i) $400,000 in cash (the “Cash Consideration”) and (ii) $2,000,000 in shares of Contango common stock (the “Equity Consideration”). The Cash Consideration shall be paid in the following tranches: (i) a deposit $50,000 (paid) (ii) $150,000 due on the closing date, and (iii) $200,000 due on or before the 6-month anniversary of the closing date. The number of shares of common stock constituting the Equity Consideration will be determined based on Contango’s 10-day VWAP on the NYSE American immediately prior to the closing date.

If the Company makes a positive production decision on either of the Amanita or Golden Zone properties within 120 months of the closing date, the Company will pay Avidian an additional $1,000,000 within thirty (30) days of such decision (the “Deferred Purchase Price”). The Deferred Purchase Price can be paid in either cash or Contango shares at the Company’s sole discretion. If at any time prior

to this production decision, within the 120-month period, Contango enters into a third-party transaction on any of the properties, Avidian will receive 20% of the consideration received by Contango (capped at $500,000 per property) credited against the total Deferred Purchase Price.

The Avidian Transaction is subject to Avidian shareholder approval, as well as the receipt of all required governmental and/or regulatory approvals, including that of the Toronto Venture Exchange and NYSE American. Should Avidian shareholders not approve this transaction the SP Agreement will terminate and a termination fee of $175,000 will be paid to the Company, representing liquidated damages for the time, resources and opportunities lost in facilitating this transaction. The Avidian Transaction is expected to close in July 2024.

Cautionary Note Regarding Forward-Looking Statements

Many of the statements included or incorporated in this Current Report on Form 8-K and the furnished exhibit constitutes “forward-looking statements.” In particular, they include statements relating to future actions, strategies, future operating and financial performance, ability to realize the anticipated benefits of the transactions with an affiliate of Kinross Gold Corporation and the Company’s future financial results. These forward-looking statements are based on current expectations and projections about future events. Readers are cautioned that forward-looking statements are not guarantees of future operating and financial performance or results and involve substantial risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual performance of the Company may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, factors described from time to time in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein).Cautionary Note

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CONTANGO ORE, INC. |

|

|

|

|

Date: |

May 6, 2024 |

By: |

/s/ Mike Clark |

|

|

|

Mike Clark, CFO |

CONTANGO ORE, INC.

AND

CONTANGO MINING CANADA INC.

AND

HIGHGOLD MINING INC.

Dated May 1, 2024

TABLE OF CONTENTS

Page

|

|

|

1.1 |

Definitions |

1 |

1.2 |

Interpretation Not Affected by Headings |

15 |

1.3 |

Number and Gender |

16 |

1.4 |

Date for Any Action |

16 |

1.5 |

Statutory References |

16 |

1.6 |

Currency |

16 |

1.7 |

Accounting Matters |

16 |

1.8 |

Knowledge |

16 |

1.9 |

Disclosure Letter |

16 |

1.10 |

Schedules |

17 |

2.1 |

Arrangement |

17 |

2.2 |

Interim Order |

17 |

2.3 |

U.S. Securities Law Matters |

19 |

2.4 |

HighGold Meeting |

20 |

2.5 |

HighGold Circular |

21 |

2.6 |

Final Order |

23 |

2.7 |

Court Proceedings |

23 |

2.8 |

Arrangement and Effective Date |

24 |

2.9 |

HighGold Options |

24 |

2.10 |

HighGold Warrants |

25 |

2.11 |

Payment of Consideration |

25 |

2.12 |

Announcement and Shareholder Communications |

26 |

2.13 |

Withholding Taxes |

26 |

2.14 |

Onyx Lock-Up Agreement |

27 |

3.1 |

Representations and Warranties |

27 |

3.2 |

Survival of Representations and Warranties |

50 |

4.1 |

Representations and Warranties |

50 |

4.2 |

Survival of Representations and Warranties |

59 |

5.1 |

Representations and Warranties |

60 |

5.2 |

Survival of Representations and Warranties |

61 |

6.1 |

Covenants of HighGold Regarding the Conduct of Business |

61 |

6.2 |

Additional Covenants of HighGold |

67 |

6.3 |

Covenants of Contango Regarding the Conduct of Business |

68 |

|

|

|

6.4 |

Mutual Covenants of the Parties Relating to the Arrangement |

69 |

6.5 |

Regulatory Approvals |

71 |

7.1 |

Mutual Conditions Precedent |

72 |

7.2 |

Additional Conditions Precedent to the Obligations of Contango and the Purchaser |

73 |

7.3 |

Additional Conditions Precedent to the Obligations of HighGold |

74 |

7.4 |

Satisfaction of Conditions |

75 |

8.1 |

Notice of Breach |

75 |

8.2 |

HighGold Non-Solicitation |

75 |

8.3 |

Expenses and Termination Fees |

81 |

8.4 |

Access to Information; Confidentiality |

83 |

8.5 |

Insurance and Indemnification |

84 |

9.1 |

Term |

85 |

9.2 |

Termination |

85 |

9.3 |

Amendment |

87 |

9.4 |

Waiver |

88 |

10.1 |

Notices |

88 |

10.2 |

Governing Law |

90 |

10.3 |

Injunctive Relief |

90 |

10.4 |

Time of Essence |

90 |

10.5 |

Entire Agreement, Binding Effect and Assignment |

90 |

10.6 |

Severability |

91 |

10.7 |

Further Assurances |

91 |

10.8 |

No Third Party Beneficiaries |

91 |

10.9 |

Mutual Interest |

91 |

10.10 |

Counterparts, Execution |

91 |

SCHEDULE A PLAN OF ARRANGEMENT |

A-1 |

SCHEDULE B highgold RESOLUTION |

B-1 |

SCHEDULE C Key regulatory approvals |

C-1 |

SCHEDULE d Key third party consents |

D-1 |

SCHEDULE E ONYX LOCK-UP AGREEMENt consents |

e-1 |

ARRANGEMENT AGREEMENT

THIS ARRANGEMENT AGREEMENT dated May 1, 2024,

BETWEEN:

CONTANGO ORE, INC., a corporation existing under the laws of the State of Delaware (“Contango”)

- and -

CONTANGO MINING CANADA INC., a corporation existing under the laws of the Province of British Columbia (the “Purchaser”).

- and -

HIGHGOLD MINING INC., a corporation existing under the laws of the Province of British Columbia (“HighGold”).

RECITALS:

A. Contango and HighGold wish to enter into a transaction providing for the acquisition by Contango, through the Purchaser, of all of the HighGold Shares.

B. Contango, the Purchaser and HighGold intend to carry out the transactions contemplated by this Agreement by way of a plan of arrangement under the provisions of the BCBCA.

C. The HighGold Board, after receiving financial and legal advice, has unanimously determined that the Arrangement is in the best interests of HighGold and that the Consideration to be received by the Affected Securityholders pursuant to the Arrangement is fair, from a financial point of view, to Affected Securityholders. The HighGold Board has approved the transactions contemplated by this Agreement and unanimously determined to recommend approval of the Plan of Arrangement to Affected Securityholders.

NOW THEREFORE, in consideration of the covenants and agreements herein contained and other good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged), the Parties agree as follows:

Article 1

INTERPRETATION

1.1 Definitions

In this Agreement, unless the context otherwise requires:

“Acquisition Proposal” means, other than the transactions contemplated by this Agreement, any offer, proposal, expression of interest or inquiry, or public announcement of an intention (orally or in writing) from any person (other than Contango or any of its affiliates) made after the date of

this Agreement (including, for greater certainty, amendments or variations after the date of this Agreement to any offer, proposal, expression of interest or inquiry that was made before the date of this Agreement), relating to:

(a) any joint venture, earn-in right, royalty grant, lease, license, acquisition, sale or transfer, direct or indirect, in a single transaction or a series of related transactions, of:

(i) the assets of HighGold and/or any of its subsidiaries that, individually or in the aggregate, constitute 20% or more of the fair market value of the consolidated assets of HighGold and its subsidiaries, taken as a whole, or contribute 20% or more of the consolidated revenue, net income or earnings before interest, Taxes, depreciation and amortization of HighGold and its subsidiaries, taken as a whole; or

(ii) 20% or more of the issued and outstanding voting or equity securities (and/or securities convertible into, or exchangeable or exercisable for voting or equity securities) of HighGold or any of its subsidiaries whose assets, individually or in the aggregate, constitute 20% or more of the fair market value of the consolidated assets of HighGold and its subsidiaries, take as a whole;

(b) any take-over bid, tender offer, exchange offer, sale or treasury issuance of securities or other transaction that, if consummated, would result in such person beneficially owning, directly or indirectly, 20% or more of any class of the issued and outstanding voting or equity securities (and/or securities convertible into, or exchangeable or exercisable for voting or equity securities) of HighGold or any of its subsidiaries, whose assets, individually or in the aggregate, constitute 20% or more of the fair market value of the consolidated assets of HighGold and its subsidiaries, take as a whole;

(c) a plan of arrangement, merger, amalgamation, consolidation, share exchange, share issuance, business combination, reorganization, recapitalization, liquidation, dissolution, share reclassification, winding-up or other similar transaction or series of transactions involving HighGold or any of its subsidiaries whose assets, individually or in the aggregate, constitute 20% or more of the fair market value of the consolidated assets of HighGold and its subsidiaries, take as a whole;

(d) any other transaction, the consummation of which could reasonably be expected to impede, interfere with, prevent or delay the transactions contemplated by this Agreement or the Arrangement.

“Affected Securities” means the HighGold Shares and the HighGold Options.

“Affected Securityholder Approval” means the approval of the HighGold Resolution by the Affected Securityholders at the HighGold Meeting in accordance with Section 2.2(c).

“Affected Securityholders” means the HighGold Shareholders and the HighGold Optionholders.

“affiliate” means an “affiliated entity” within the meaning of MI 61-101.

“Agreement” means this arrangement agreement, including the Schedules hereto, together with the HighGold Disclosure Letter, as the same may be amended, supplemented or otherwise modified from time to time in accordance with the terms hereof.

“Arrangement” means the arrangement pursuant to Section 288 of the BCBCA with respect to HighGold, the Affected Securityholders, Contango and the Purchaser on the terms and subject to the conditions set out in the Plan of Arrangement, subject to any amendments or variations thereto made in accordance with Section 9.3 of this Agreement, the Plan of Arrangement or at the direction of the Court in the Interim Order or Final Order with the consent of Contango, the Purchaser and HighGold, each acting reasonably.

“BCBCA” means the Business Corporations Act (British Columbia).

“BCSC” means the British Columbia Securities Commission.

“Business Day” means any day, other than a Saturday, a Sunday or any other day on which the banks located in Vancouver, British Columbia are closed or authorized to be closed.

“CIRI ” means Cook Inlet Region, Inc.

“CIRI Exploration Agreement” means the exploration agreement dated July 1, 2023 between CIRI and J T Mining, Inc.

“CIRI Lease Agreement” means the lease agreement dated May 17, 2019 made among CIRI, HighGold and J T Mining, Inc.

“Confidentiality Agreement” means the non-disclosure agreement dated as of January 8, 2024, by and between HighGold and Contango, as supplemented, amended, restated or otherwise modified from time to time.

“Consideration” means the consideration payable pursuant to the Plan of Arrangement to a person who is an Affected Securityholder.

“Contango Annual Report” means Contango’s Annual Report on Form 10-K for the year ended June 30, 2023 and Contango’s Transition Report on Form 10-KT/A, including Amendment No.1, for the transition period from July 1, 2023 to December 31, 2023 filed on EDGAR.

“Contango Board” means the board of directors of Contango as the same is constituted from time to time.

“Contango Concessions” means those mining, mineral or exploration concession, claim, lease, license, Permit or other right to explore for, exploit, develop, mine or produce Minerals from the Contango Material Property or any interest therein which Contango, any of its subsidiaries, owns or has a right or option to acquire or use.

“Contango Financial Statements” has the meaning ascribed thereto in Section 4.1(j).

“Contango Lands” means any interests and rights in real and immoveable property interests, including property rights, fee lands, possession rights, licenses, leases, rights of way, rights to use, surface rights or easements with respect to the Contango Material Property, which Contango or any of its subsidiaries has a right in or interest in or has an option or other right to acquire or use.

“Contango Material Adverse Effect” means any change, effect, event, occurrence, circumstance or state of facts that, individually or in the aggregate with other such changes, effects, events, occurrences, circumstances or states of fact, is or would reasonably be expected to be, material and adverse to the business, properties, assets, Permits, capital, liabilities (contingent or otherwise), operations, results of operations or condition (financial or otherwise) of Contango and its subsidiaries, taken as a whole, other than any change, effect, event, occurrence or state of facts resulting from:

(a) the public announcement of the execution of this Agreement or the transactions contemplated hereby or the performance of any obligation hereunder;

(b) any changes in general political, economic or financial conditions in the United States or Canada;

(c) any change or proposed change in any applicable Laws or the interpretation, application or non-application of any applicable Laws by any Governmental Entity;

(d) any generally applicable changes in U.S. GAAP;

(e) any natural disaster, war, armed hostilities or act of terrorism;

(f) any epidemic, pandemic or outbreak of illness or health crisis or public health event, or any worsening of any of the foregoing;

(g) conditions generally affecting the mining industry;

(h) any change in currency exchange, interest or inflation rates;

(i) any change in the market price of gold; or

(j) any decrease in the market price or any decline in the trading volume of Contango Shares on the NYSE American (it being understood that any cause underlying such change in market price or trading volume may be taken into account in determining whether a Contango Material Adverse Effect has occurred),

provided that, notwithstanding the foregoing, any change, effect, event, occurrence, circumstance or state of facts described in clauses (b), (c), (d), (e), (f), (g) and (h) of this definition shall constitute a Contango Material Adverse Effect to the extent that any such change, effect, event, occurrence, circumstance or state of facts has or would reasonably be expected to have, individually or in the aggregate, a disproportionate material adverse impact on the business, properties, assets, Permits, capital, liabilities, operations, results of operations or condition (financial or otherwise) of Contango and its subsidiaries, taken as a whole, relative to other industry participants of similar size and references in this Agreement to dollar amounts are not intended to be and shall not be

deemed to be illustrative or interpretive for purposes of determining whether a “Contango Material Adverse Effect” has occurred.

“Contango Material Contracts” means the Contracts of Contango or any of its subsidiaries set out in Item 15. (b). Exhibits of the Contango Annual Report that comprises part of the Contango Public Disclosure Record.

“Contango Material Property” means the Manh Choh project in Alaska.

“Contango Public Disclosure Record” means all documents and information filed by Contango under U.S. Securities Laws since January 1, 2021 and publicly available on EDGAR.

“Contango’s Representatives” means officers, directors, financial advisors, lawyers, accountants and advisors to Contango.

“Contango Response Period” has the meaning ascribed thereto in Section 8.2(g)(v).

“Contango Share” means a share of common stock in the authorized share structure of Contango.

“Contango Technical Reports” has the meaning ascribed thereto in Section 4.1(o).

“Contract” means any written or oral contract, agreement, license, franchise, lease, arrangement, commitment, understanding, joint venture, partnership or other right or obligation to which HighGold or Contango, respectively, or any of their respective subsidiaries is a party or by which HighGold or Contango, respectively, or any of their respective subsidiaries is bound or affected or to which any of their respective properties or assets is subject.

“Corruption Acts” has the meaning ascribed thereto in Section 3.1(ss)(ii).

“Court” means the Supreme Court of British Columbia.

“Credit and Guarantee Agreement” means the credit and guarantee agreement dated as of May 17, 2023 by and among CORE Alaska, LLC, Contango, Contango Lucky Shot Alaska, LLC (formerly Alaska Gold Torrent, LLC), Contango Minerals Alaska, LLC, ING Capital LLC and Macquarie Bank Limited.

“CSA” means the Canadian Securities Administrators.

“Data Related Vendors” has the meaning ascribed there to in Section 3.1(ff)(v).

“Depositary” means Computershare Investor Services Inc., in its capacity as depositary for the Arrangement.

“Dissent Rights” means the rights of dissent exercisable by registered HighGold Shareholders as of the record date of the HighGold Meeting, described in Section 5.1 of the Plan of Arrangement.

“Dissenting Shareholder” means a registered HighGold Shareholder as of the record date of the HighGold Meeting that validly exercises the Dissent Rights in strict compliance with Sections 237 to 247 of the BCBCA, as modified by the Interim Order or the Final Order and Section 5.1 of the

Plan of Arrangement and has not withdrawn or been deemed to have withdrawn such exercise of Dissent Rights.

“EDGAR” means the SEC’s Electronic Data Gathering, Analysis and Retrieval website.

“Effective Date” means the date upon which the Arrangement becomes effective, as set out in Section 2.8(a).

“Effective Time” means the time on the Effective Date that the Arrangement becomes effective, as set out in the Plan of Arrangement.

“Environmental Laws” means all applicable federal, provincial, regional, municipal, local or other Laws, imposing liability or standards of conduct for or relating to the regulation of activities, materials, substances or wastes in connection with or for or to the protection of human health, safety, the environment or natural resources (including ambient air, surface water, groundwater, wetlands, land surface or subsurface strata, wildlife, aquatic species and vegetation).

“Environmental Liabilities” means, with respect to any person, all liabilities, obligations, responsibilities, response, remedial and removal costs, investigation costs, capital costs, operation and maintenance costs, losses, damages, punitive damages, property damages, consequential damages, treble damages, costs and expenses, fines, penalties and sanctions incurred as a result of or related to any Hazardous Substance or any claim, suit, action, administrative order, investigation, proceeding or demand by any person, whether based in contract, tort, implied or express warranty, strict liability, criminal or civil statute or common law, relating to any environmental matter arising under or related to any Environmental Laws, Environmental Permits, or in connection with any Release or threatened Release or presence of a Hazardous Substance whether on, at, in, under, from or about or in the vicinity of any real or personal property.

“Environmental Permits” means all Permits under any Environmental Laws.

“Final Order” means the final order of the Court pursuant to Section 291 of the BCBCA, in a form acceptable to Contango, the Purchaser and HighGold, each acting reasonably, after a hearing upon the procedural and substantive fairness of the terms and conditions of the Arrangement, approving the Arrangement, as such order may be amended, modified, supplemented or varied by the Court (with the consent of Contango, the Purchaser and HighGold, each acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended on appeal (provided that any such amendment is acceptable to Contango, the Purchaser and HighGold, each acting reasonably).

“Financial Advisory Agreement” means the engagement letter dated April 8, 2024 between HighGold and the HighGold Financial Advisor.

“First Nations” means any first nations, indigenous or aboriginal persons, tribe or Indian band of the United States of America, including Métis communities.

“Form 51-102F5” means Form 51-102F5 as prescribed in National Instrument 51-102 – Continuous Disclosure Obligations.

“Governmental Entity” means (a) any multinational, federal, national, provincial, state, regional, municipal, local or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, commissioner, board, minister, ministry, bureau, agency or instrumentality, domestic or foreign, (b) any subdivision, agent, commission, board or authority of any of the foregoing, (c) any quasi-governmental or private body, including any tribunal, commission, regulatory agency or self-regulatory organization, exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing, or (d) any stock exchange, including the NYSE American and TSXV.

“Hazardous Substance” means any pollutant, contaminant, waste or chemical or any toxic, radioactive, ignitable, corrosive, reactive or otherwise hazardous or deleterious substance, waste or material, including metals, petroleum, polychlorinated biphenyls, asbestos and urea- formaldehyde insulation, and any other material or contaminant regulated or defined pursuant to any Environmental Law.

“HighGold” means HighGold Mining Inc.

“HighGold Benefit Plans” has the meaning ascribed thereto in Section 3.1(dd)(i).

“HighGold Board” means the board of directors of HighGold as the same is constituted from time to time.

“HighGold Board Recommendation” has the meaning ascribed thereto in Section 3.1(a).

“HighGold Change in Recommendation” has the meaning ascribed thereto in Section 9.2(a)(iii)(A).

“HighGold Circular” means the notice of the HighGold Meeting and accompanying management information circular, including all schedules, appendices and exhibits thereto, to be sent to Affected Securityholders in connection with the HighGold Meeting, as amended, supplemented or otherwise modified from time to time.

“HighGold Concessions” means any mining, mineral or exploration concession, claim, lease, license, Permit or other right to explore for, exploit, develop, mine or produce Minerals or any interest therein which HighGold or any of its subsidiaries owns or has a right or option to acquire or use.

“HighGold Disclosure Letter” means the disclosure letter executed by HighGold and delivered to Contango and the Purchaser concurrently with the execution of this Agreement.

“HighGold Equity Incentive Plan” means the HighGold 2022 Omnibus Share Incentive Plan approved by the HighGold shareholders on August 25, 2022.

“HighGold Fairness Opinions” has the meaning ascribed thereto in Section 3.1(b).

“HighGold Financial Advisor” means Agentis Capital Mining Partners.

“HighGold Financial Statements” has the meaning ascribed thereto in Section 3.1(m).

“HighGold In-The-Money Option” means a HighGold Option in respect of which the HighGold Option In-The-Money Amount, determined on the last Business Day immediately preceding the Effective Date, is a positive amount.

“HighGold Information Security” has the meaning ascribed thereto in Section 3.1(ff)(i).

“HighGold Lands” means any interests and rights in real and immoveable property interests, including property rights, fee lands, possession rights, licenses, leases, rights of way, rights to use, surface rights or easements which HighGold or any of its subsidiaries have a right in or interest in or have an option or other right to acquire or use.

“HighGold Locked-Up Shareholders” means all directors and officers of HighGold, all of whom have entered into the HighGold Voting Agreements.

“HighGold Material Adverse Effect” means any change, effect, event, occurrence, circumstance or state of facts that, individually or in the aggregate with other such changes, effects, events, occurrences, circumstances or states of fact, is or would reasonably be expected to be material and adverse to the business, properties, assets, Permits, capital, liabilities (contingent or otherwise), operations, results of operations or condition (financial or otherwise) of HighGold and its subsidiaries, taken as a whole, other than any change, effect, event, occurrence or state of facts resulting from:

(a) the public announcement of the execution of this Agreement or the transactions contemplated hereby or the performance of any obligation hereunder;

(b) any changes in general political, economic or financial conditions in the United States of American or Canada;

(c) any change or proposed change in any applicable Laws or the interpretation, application or non-application of any applicable Laws by any Governmental Entity;

(d) any generally applicable changes in IFRS;

(e) any natural disaster, armed hostilities, war or act of terrorism;

(f) any epidemic, pandemic or outbreak of illness health crisis or public health event, or any worsening of any of the foregoing;

(g) conditions generally affecting the mining industry;

(h) any change in currency exchange, interest or inflation rates;

(i) any change in the market price of gold; or

(j) any decrease in the market price or any decline in the trading volume of HighGold Shares on the TSXV (it being understood that any cause underlying such change in market price or trading volume may be taken into account in determining whether a HighGold Material Adverse Effect has occurred),

provided that, notwithstanding the foregoing, any change, effect, event, occurrence or state of facts described in clauses (b), (c), (d), (e), (f), (g) and (h) of this definition shall constitute a HighGold Material Adverse Effect to the extent that any such change, effect, event, occurrence, circumstance or state of facts has or would reasonably be expected to have, individually or in the aggregate, a disproportionate material adverse impact on the business, properties, assets, Permits, capital, liabilities (contingent or otherwise), operations, results of operations or condition (financial or otherwise) of HighGold and its subsidiaries, taken as a whole, relative to other industry participants of similar size and references in this Agreement to dollar amounts are not intended to be and shall not be deemed to be illustrative or interpretive for purposes of determining whether a “HighGold Material Adverse Effect” has occurred.

“HighGold Material Contracts” means the CIRI Lease Agreement, the CIRI Exploration Agreement, the Zoic Sublease Agreement and the Financial Advisory Agreement.

“HighGold Meeting” means the special meeting of Affected Securityholders, including any adjournment or postponement thereof, to be called and held in accordance with the Interim Order to consider the HighGold Resolution.

“HighGold Office Leases” means the office leases listed in Schedule 3.1(u) of the HighGold Disclosure Letter.

“HighGold Option” means an option to purchase a HighGold Share granted pursuant to the HighGold Equity Incentive Plan.

“HighGold Option In-The-Money Amount” in respect of a HighGold Option means the amount, if any, by which the total fair market value (determined immediately before the Effective Time) of the HighGold Share that a holder is entitled to acquire on exercise of such HighGold Option immediately before the Effective Time exceeds the aggregate exercise price to acquire such HighGold Share.

“HighGold Optionholder” means a holder of one or more HighGold Options.

“HighGold Out-of-the-Money Option” means a HighGold Option other than a HighGold In-The-Money Option.

“HighGold Public Disclosure Record” means all documents and information filed by HighGold under applicable Securities Laws since January 1, 2021 and publicly available on SEDAR+.

“HighGold Resolution” means the special resolution to be considered by the Affected Securityholders at the HighGold Meeting, substantially on the terms and in the form attached as Schedule B to this Agreement.

“HighGold RSU” means a restricted share unit awarded pursuant to the HighGold Equity Incentive Plan.

“HighGold Security” means a HighGold Share, HighGold Option, HighGold RSU or HighGold Warrant.

“HighGold Securityholder” means a holder of one or more HighGold Securities.

“HighGold Share” means a common share in the authorized share structure of HighGold.

“HighGold Shareholder” means a holder of one or more HighGold Shares.

“HighGold Technical Report” has the meaning ascribed thereto in Section 3.1(x).

“HighGold Voting Agreements” mean the voting support agreements (including all amendments thereto) between Contango and the HighGold Locked-Up Shareholders.

“HighGold Warrants” means the 75,500 common share purchase warrants of HighGold, entitling the holder to purchase one HighGold Share for each HighGold Warrant held at an exercise price of $0.45 until August 19, 2024.

“HSR Act” means the United States Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“IFRS” means generally accepted accounting principles in Canada from time to time including, for the avoidance of doubt, the standards prescribed in Part I of the CPA Canada Handbook - Accounting (International Financial Reporting Standards) as the same may be amended, supplemented or replaced from time to time.

“including”, “includes” or similar expressions are not intended to be limiting and are deemed to be followed by the expression “without limitation”.

“Intellectual Property” means all intellectual property and other similar proprietary rights in any jurisdiction worldwide, whether registered or unregistered, including such rights in and to: (a) patents (including all reissues, divisions, provisionals, continuations and continuations-in-part, re-examinations, renewals and extensions thereof), patent applications, patent disclosures or other patent rights; (b) copyrights, design, design registration, and all registrations, applications for registration, and renewals for any of the foregoing, and any “moral” rights; (c) trademarks, service marks, trade names, business names, logos, trade dress, certification marks and other indicia of commercial source or origin together with all goodwill associated with the foregoing, and all registrations, applications and renewals for any of the foregoing; (d) trade secrets and business, technical and know-how information, databases (including assay), data collections, and drawings; (e) software, including data files, source code, object code, application programming interfaces, architecture, files, records, schematics, computerized databases and other software-related specifications and documentation; and (f) Internet domain name registrations.

“Interim Order” means the interim order of the Court contemplated by Section 2.2 of this Agreement and made pursuant to Section 291 of the BCBCA in a form and substance acceptable to Contango, the Purchaser and HighGold, each acting reasonably, providing for, among other things, the calling and holding of the HighGold Meeting, as the same may be amended, modified, supplemented or varied by the Court (provided that any such amendment, modification, supplement or variation is acceptable to Contango, the Purchaser and HighGold, each acting reasonably).

“Johnson Tract Project” means HighGold’s polymetallic gold, zinc, copper, silver and lead project located in the south-central coastal Alaska, USA.

“Key Regulatory Approvals” means those consents, orders, exemptions, permits and other approvals of Governmental Entities as set out in Schedule C hereto.

“Key Third Party Consents” means those consents, approvals and notices required from any third party to proceed with the transactions contemplated by this Agreement and the Plan of Arrangement, as set out in Schedule D hereto.

“Law” or “Laws” means all laws (including common law), by-laws, statutes, rules, regulations, principles of law and equity, orders, rulings, ordinances, judgements, injunctions, determinations, awards, decrees or other requirements, whether domestic or foreign, and the terms and conditions of any grant of approval, permission, authority or license of any Governmental Entity or self-regulatory authority (including, where applicable, the TSXV and the NYSE American), and the term “applicable” with respect to such Laws and in a context that refers to one or more persons, means such Laws as are applicable to such person or its business, undertaking, assets, property or securities and emanate from a person having jurisdiction over the person or persons or its or their business, undertaking, assets, property or securities.

“Liens” means any hypothec, mortgage, pledge, assignment, lien, charge, security interest, encumbrance, adverse right or claim, other third person interest or encumbrance of any kind, whether contingent or absolute, and any agreement, option, right or privilege (whether by Law, contract or otherwise) capable of becoming any of the foregoing.

“Mailing Deadline” means June 5, 2024, or such other date as may be agreed between the Parties.

“material fact” has the meaning ascribed thereto in the Securities Act.

“MI 61-101” means Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions.

“Minerals” means all ores, and ores and concentrates derived therefrom, of precious, base and industrial minerals, including diamonds, which may be lawfully explored for, mined and sold.

“misrepresentation” has the meaning ascribed thereto in the Securities Act.

“Money Laundering Laws” has the meaning ascribed thereto in Section 3.1(tt).

“NI 43-101” means National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

“NI 54-101” means National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer.

“NYSE American” means the NYSE American Stock Exchange.

“Onyx” means Onyx Gold Corp.

“Onyx Lock-Up Agreement” means the lock-up agreement in substantially the form of Schedule E.

“Order” means all judicial, arbitral, administrative, ministerial, departmental or regulatory judgments, injunctions, orders, decisions, rulings, determinations, awards, or decrees of any Governmental Entity (in each case, whether temporary, preliminary or permanent).

“ordinary course of business” means, with respect to an action taken by a person, that such action is consistent with the past practices of such person and is taken in the ordinary course of the normal day-to-day business and operations of such person.

“Outside Date” means the date that is five months following the date of this Agreement, or such later date as may be agreed to in writing by the Parties.

“Parties” means Contango, the Purchaser and HighGold, and “Party” means any of them.

“Permit” means any license, permit, certificate, consent, Order, grant, approval, classification, waiver, writ, consent, registration or other authorization of or from any Governmental Entity.

“person” includes an individual, sole proprietorship, partnership, association, body corporate, trust, natural person in his or her capacity as trustee, executor, administrator or other legal representative, Governmental Entity or any other entity, whether or not having legal status.

“Personal Information” means information in the possession or under the control of HighGold or any if its subsidiaries about an identifiable individual.

“Plan of Arrangement” means the plan of arrangement of HighGold, substantially in the form of Schedule A hereto, and any amendments or variations thereto made in accordance with this Agreement and the Plan of Arrangement or upon the direction of the Court (with the prior written consent of Contango, the Purchaser and HighGold, each acting reasonably) in the Final Order.

“Privacy Legal Requirements” has the meaning ascribed thereto in Section 3.1(ff)(iii).

“Proceeding” means any suit, claim, action, charge, complaint, litigation, arbitration, proceeding (including any civil, criminal, administrative, investigative or appellate proceeding), hearing, audit, examination or investigation commenced, brought, conducted or heard by or before, any court or other Governmental Entity.

“Purchaser” means Contango Mining Canada Inc.

“Qualified Person” has the meaning ascribed to such term in NI 43-101.

“Regulatory Approvals” means those sanctions, rulings, consents, orders, exemptions, permits and other approvals (including the lapse, without objection, of a prescribed time under a statute or regulation that states that a transaction may be implemented if a prescribed time lapses following the giving of notice without an objection being made) of Governmental Entities required in relation to the transactions contemplated hereby.

“Release” means any release, spill, emission, leaking, pumping, pouring, emitting, emptying, escape, injection, deposit, disposal, discharge, dispersal, dumping, leaching or migration of a Hazardous Substance in the indoor or outdoor environment, including the movement of a Hazardous Substance through or in the air, soil, surface water, ground water or property.

“Representatives” means, with respect to any person, its and its subsidiaries’ officers, directors, employees, representatives (including any financial and other advisors) and agents.

“Returns” means all reports, forms, elections, statements, declarations, designations, notices, filings, returns and other documents (whether in tangible, electronic or other form) and including any amendments, schedules, attachments, supplements, appendices and exhibits thereto made, prepared, filed or required to be made, prepared or filed by a Governmental Entity to be made, prepared or filed by Law in respect of Taxes.

“SEC” means the U.S. Securities and Exchange Commission.

“Section 3(a)(10) Exemption” has the meaning ascribed thereto in Section 2.3.

“Securities Act” means the Securities Act (British Columbia).

“Securities Authorities” means, collectively, the BCSC and the applicable securities commissions and other securities regulatory authorities in each of the other provinces of Canada.

“Securities Laws” means the Securities Act and the securities legislation of each other province of Canada and the rules, regulations, forms, published instruments, policies, bulletins and notices of the Securities Authorities made thereunder, as now in effect and as they may be promulgated or amended from time to time.

“SEDAR+” means CSA’s System for Electronic Document Analysis Retrieval+ website.

“subsidiary” has the meaning ascribed to it in National Instrument 45-106 – Prospectus Exemptions, in force as of the date of this Agreement.

“Superior Proposal” means an unsolicited bona fide written Acquisition Proposal from an arm’s length third party that is made after the date of this Agreement (and is not obtained in violation of this Agreement) to acquire all of the outstanding HighGold Shares (other than HighGold Shares beneficially owned by the person or persons making such Acquisition Proposal) or all or substantially all of the assets of HighGold and its subsidiaries on a consolidated basis, and (a) that did not result from or arise in connection with a breach of this Agreement; (b) that is reasonably capable of being completed without undue delay, taking into account all financial, legal, regulatory and other aspects of such Acquisition Proposal and the person or persons making such Acquisition Proposal; (c) that, if it relates to the acquisition of HighGold Shares, is made to all HighGold Shareholders on the same terms and conditions; (d) that is not subject to any financing condition and in respect of which it has been demonstrated to the satisfaction of the HighGold Board, acting in good faith (and after receiving the advice of its outside legal advisors and financial advisors), that adequate arrangements have been made in respect of any required financing required to complete such Acquisition Proposal; (e) that is not subject to any due diligence or access condition; (f) that complies with Securities Laws; (g) in respect of which the HighGold Board unanimously determines, in its good faith judgment, after receiving the advice of its outside legal advisors and financial advisors, that (A) failure to recommend such Acquisition Proposal to the HighGold Shareholders would be inconsistent with its fiduciary duties under applicable Law; and (B) having regard for all of the terms and conditions of the Acquisition Proposal, including all financial, legal, regulatory and other aspects of such proposal and the person making such proposal, such Acquisition Proposal, will, if consummated in accordance with its terms (but not assuming away

any risk of non-completion), result in a transaction more favourable to the HighGold Shareholders from a financial point of view than the transactions contemplated by this Agreement, after taking into account any amendment to the terms of this Agreement and the Plan of Arrangement proposed by the Purchaser pursuant to Section 9.3.

“Tax Act” means the Income Tax Act (Canada).

“Taxes” means with respect to any Person, all supranational, national, federal, provincial, state, local or other taxes, including income taxes, branch taxes, profits taxes, capital gains taxes, gross receipts taxes, digital services taxes, windfall profits taxes, value added taxes, severance taxes, ad valorem taxes, property taxes, capital taxes, net worth taxes, production taxes, sales taxes, use taxes, licence taxes, excise taxes, franchise taxes, environmental taxes, transfer taxes, withholding or similar taxes, payroll taxes, employment taxes, employer health taxes, government pension plan premiums and contributions, social security premiums, workers’ compensation premiums, employment/unemployment insurance or compensation premiums and contributions, stamp taxes, occupation taxes, premium taxes, alternative or add-on minimum taxes, global minimum or “Pillar 2” taxes, GST/HST, customs duties or other taxes of any kind whatsoever imposed or charged by any Governmental Entity, any requirement to pay or repay any amount to a Governmental Entity in respect of a tax credit, refund, rebate, governmental grant or subsidy, overpayment, or similar adjustment of Taxes, and any instalments in respect thereof, together with any tax indemnity obligation, interest, penalties, or additions with respect thereto and any interest in respect of such additions or penalties, and whether disputed or not.

“Termination Fee” has the meaning ascribed thereto in Section 8.3(c).

“TSXV” means the TSX Venture Exchange.

“U.S. Exchange Act” means the United States Securities Exchange Act of 1934 as the same has been and hereinafter from time to time may be amended and the rules and regulations promulgated thereunder.

“U.S. GAAP” means generally accepted accounting principles in the United States.

“U.S. Securities Act” means the United States Securities Act of 1933 as the same has been and hereinafter from time to time may be amended and the rules and regulations promulgated thereunder.

“U.S. Securities Laws” means the U.S. federal securities laws, including without limitation, the U.S. Securities Act, the U.S. Exchange Act and applicable securities laws of any state of the United States.

“United States” or “U.S.” means the United States of America, its territories and possessions, any state of the United States and the District of Columbia.

“Zoic Sublease Agreement” means the Offer to Sublease dated June 24, 2022 between HighGold and Zoic Studios BC Inc.

1.2 Interpretation Not Affected by Headings

The division of this Agreement into articles, sections, subsections and paragraphs and the insertion of headings are for convenience of reference only and shall not affect in any way the meaning or interpretation of this Agreement. Unless the contrary intention appears, references in this Agreement to an Article, Section, subsection, paragraph or Schedule by number or letter or both refer to the Article, Section, subsection, paragraph or Schedule, respectively, bearing that designation in this Agreement. The terms “this Agreement”, “hereof”, “herein”, “hereto”, “hereunder” and similar expressions refer to this Agreement and not any particular article, section, subsection, paragraph or other portion hereof and include any instrument supplementary or ancillary hereto.

1.3 Number and Gender

In this Agreement, unless the context otherwise requires, words importing the singular include the plural and vice versa, and words importing gender include all genders.

1.4 Date for Any Action

If the date on which any action is required to be taken hereunder by a Party is not a Business Day, such action shall be required to be taken on the next succeeding day which is a Business Day.

1.5 Statutory References

Any reference in this Agreement to a statute includes all rules and regulations made thereunder, all amendments to such statute, rule or regulation in force from time to time and any statute, rule or regulation that supplements or supersedes such statute, rule or regulation.

1.6 Currency

Unless otherwise stated, all references in this Agreement to sums of money are expressed in lawful money of Canada and “$” refers to Canadian dollars.

1.7 Accounting Matters

Unless otherwise stated, all accounting terms used in this Agreement shall have the meanings attributable thereto under IFRS and all determinations of an accounting nature in required to be made shall be made in accordance with IFRS consistently applied.

1.8 Knowledge

In this Agreement, (a) references to “the knowledge of HighGold” means the knowledge of Darwin Green (President and Chief Executive Officer) and Aris Morfopoulos (Chief Financial Officer) after due enquiry, and (b) references to “the knowledge of Contango” means the knowledge of Rick Van Nieuwenhuyse (President, CEO) and Michael Clark (Chief Financial Officer) after due enquiry.

1.9 Disclosure Letter

The HighGold Disclosure Letter and all information contained in the HighGold Disclosure Letter is confidential information and subject to the terms and conditions of the Confidentiality Agreement.

1.10 Schedules

The following Schedules are annexed to this Agreement and are incorporated by reference into this Agreement and form a part hereof:

|

|

Schedule A |

Plan of Arrangement |

Schedule B |

HighGold Resolution |

Schedule C |

Key Regulatory Approvals |

Schedule D Schedule E |

Key Third Party Consents Onyx Lock-Up Agreement |

|

|

|

|

Article 2

THE ARRANGEMENT

2.1 Arrangement

HighGold, Contango and the Purchaser agree that the Arrangement shall be implemented in accordance with the terms and subject to the conditions contained in this Agreement and the Plan of Arrangement.

2.2 Interim Order

HighGold shall, as soon as reasonably practicable following the date of this Agreement, and in any event in sufficient time to file, furnish and mail the HighGold Circular in accordance with Section 2.5, apply to the Court in a manner acceptable to Contango, acting reasonably, pursuant to subsection 291 of the BCBCA and, in cooperation with Contango, prepare, file and diligently pursue an application to the Court for the Interim Order, which shall provide, among other things:

(a) for the class of persons to whom notice is to be provided in respect of the Arrangement and the HighGold Meeting and for the manner in which such notice is to be provided;

(b) for confirmation of the record date for the purposes of determining the Affected Securityholders entitled to vote at the HighGold Meeting (which date shall be fixed and filed by HighGold in consultation with Contango, acting reasonably) and that such record date will not change in respect of any adjournment(s) or postponement(s) of the HighGold Meeting;

(c) that the requisite approval for the HighGold Resolution shall be:

(i) 66⅔% of the votes cast on the HighGold Resolution by the HighGold Shareholders present in person or represented by proxy at the HighGold Meeting, with each HighGold Share entitling a HighGold Shareholder to one vote; and

(ii) 66⅔% of the votes cast on the HighGold Resolution by the Affected Securityholders present in person or represented by proxy at the HighGold Meeting voting together as members of a single class, with each Affected Security entitling an Affected Securityholder to one vote;

(d) that, in all other respects, other than as ordered by the Court, the terms, restrictions and conditions of HighGold’s constating documents, including quorum requirements and all other matters, shall apply in respect of the HighGold Meeting;

(e) for the grant of Dissent Rights to those HighGold Shareholders who are registered holders of HighGold Shares as of the record date of the HighGold Meeting;

(f) for the notice requirements with respect to the presentation of the application to the Court for the Final Order;

(g) that the HighGold Meeting may be adjourned or postponed from time to time by the HighGold Board subject to the terms of this Agreement without the need for additional approval of the Court;

(h) that each Affected Securityholder will have the right to appear before the Court at the hearing of the application for the Final Order so long as they enter an appearance within a reasonable time and are in accordance with the procedures set out in the Interim Order;

(i) that the deadline for the submission of proxies by Affected Securityholders for the HighGold Meeting shall be 48 hours (excluding Saturdays, Sundays and statutory holidays in Vancouver, British Columbia) prior to the HighGold Meeting, subject to waiver by HighGold in accordance with the terms of this Agreement;

(j) that it is the Parties’ intention to rely on the Section 3(a)(10) Exemption and similar exemptions from applicable securities Laws of any state of the United States with respect to the issuance of Contango Shares to Affected Securityholders pursuant to the Arrangement, subject to and conditioned on the Court’s determination that the Arrangement is substantively and procedurally fair to the Affected Securityholders and based on the Court’s approval of the Arrangement following a hearing at which the Affected Securityholders are permitted to appear and be heard;

(k) that each Affected Securityholder will have the right to appear before the Court at the hearing of the Court to give approval of the Arrangement so long as they enter an appearance within a reasonable time in accordance with the procedures set out in the Interim Order; and

(l) for such other matters as Contango and the Purchaser may reasonably require subject to obtaining the prior written consent of HighGold, such consent not to be unreasonably withheld or delayed.

2.3 U.S. Securities Law Matters

The Parties agree that the Arrangement will be carried out with the intention that all Contango Shares to be issued to Affected Securityholders in exchange for their HighGold Shares and HighGold Options to be issued pursuant to the Plan of Arrangement will be issued in reliance on the exemption from the registration requirements of the U.S. Securities Act provided by Section 3(a)(10) of the U.S. Securities Act (the “Section 3(a)(10) Exemption”) and pursuant to exemptions from applicable securities Laws of any state of the United States. In order to ensure the availability of the Section 3(a)(10) Exemption, the Parties agree that the Arrangement will be carried out on the following basis:

(a) the procedural and substantive fairness of the terms and conditions of the Arrangement will be subject to the approval of the Court;

(b) the Court will be advised as to the intention of the Parties to rely on the Section 3(a)(10) Exemption prior to the hearing required to approve the procedural and substantive fairness of the terms and conditions of the Arrangement to the Affected Securityholders;

(c) the Court will be required to satisfy itself as to the procedural and substantive fairness of the terms and conditions of the Arrangement to the Affected Securityholders;

(d) HighGold will ensure that each Affected Securityholder will be given adequate notice advising them of their right to attend the hearing of the Court to approve the procedural and substantive fairness of the terms and conditions of the Arrangement and providing them with sufficient information necessary for them to exercise that right;

(e) Affected Securityholders will be advised that the Contango Shares issued pursuant to the Arrangement have not been registered under the U.S. Securities Act and will be issued by Contango in reliance on the Section 3(a)(10) Exemption;

(f) the Interim Order will specify that each Affected Securityholder will have the right to appear before the Court at the hearing of the Court to give approval of the Arrangement so long as they enter an appearance within a reasonable time in accordance with the procedures set out in the Interim Order and in accordance with the requirements of the Section 3(a)(10) Exemption;

(g) the Court will hold a hearing before approving the procedural and substantive fairness of the terms and conditions of the Arrangement to the Affected Securityholders; and

(h) the Final Order will expressly state that the Arrangement is approved by the Court as being procedurally and substantively fair to the Affected Securityholders, and the Final Order shall include a statement to substantially the following effect:

“This Order shall serve as a basis of a claim to an exemption, pursuant to Section 3(a)(10) of the United States Securities Act of 1933, as amended, from the registration requirements otherwise imposed by such act regarding the distribution of securities pursuant to the Plan of Arrangement.”

2.4 HighGold Meeting

(a) Subject to the terms of this Agreement, HighGold shall convene and conduct the HighGold Meeting in accordance with the Interim Order, HighGold’s notice of articles and articles and applicable Law as soon as reasonably practicable, and in any event on or before July 2, 2024 (and, in that regard, HighGold shall abridge, as necessary, any time periods that may be abridged under NI 54-101). Except as required by applicable Law, or with the prior written consent of Contango and the Purchaser, which shall not be unreasonably withheld or delayed, the HighGold Resolution shall be the only matter of business transacted at the HighGold Meeting.

(b) Subject to the terms of this Agreement, HighGold shall use its commercially reasonable efforts to solicit proxies (i) in favour of the approval of the HighGold Resolution and take all other action necessary or desirable to secure the approval of the HighGold Resolution and all other matters to be brought before the HighGold Meeting intended to facilitate and complete the transactions contemplated by this Agreement, and (ii) against any resolution submitted by any Affected Securityholder that is inconsistent with the HighGold Resolution and the completion of the transactions contemplated by this Agreement, including, if so requested by Contango, using proxy solicitation services, as requested by Contango, acting reasonably.

(c) HighGold shall provide Contango with copies of or access to information regarding the HighGold Meeting generated by any proxy solicitation services firm engaged by HighGold, as requested from time to time by Contango.

(d) HighGold shall give notice to Contango of the HighGold Meeting and allow Contango’s Representatives and legal counsel to attend the HighGold Meeting.

(e) HighGold shall advise Contango as Contango may reasonably request, and at least on a daily basis on each of the last ten Business Days prior to the date of the HighGold Meeting, as to the aggregate tally of the proxies received by HighGold in respect of the HighGold Resolution and any other matters properly brought before the HighGold Meeting.

(f) HighGold will promptly advise Contango and the Purchaser of any communication (orally or in writing) from any Affected Securityholder in opposition to the Arrangement.

(g) HighGold will promptly advise Contango and the Purchaser of any written notice of dissent or purported exercise by any HighGold Shareholder of Dissent Rights received by HighGold in relation to the HighGold Resolution and any withdrawal of Dissent Rights received by HighGold. HighGold shall provide Contango with an opportunity to review and comment on any written communications sent by or on behalf of HighGold to any HighGold Shareholder who is exercising or purporting to exercise Dissent Rights in relation to the HighGold Resolution and shall not make any payment or settlement offer, or agree to any payment or settlement prior to the Effective Time with respect to Dissent Rights without the prior written consent of Contango and the Purchaser.

(h) HighGold shall, upon the request from time to time by Contango, promptly deliver to Contango (i) lists of all registered HighGold Shareholders and other security holders of HighGold, showing the name and address of each holder and the number of HighGold Shares or other securities of HighGold held by each such holder, and securities positions, and (ii) from time to time, at the request of Contango, updated or supplemental lists setting out any changes from the list(s) referred to in clause (i) of this Section 2.4(h).

(i) HighGold shall not, except as required for quorum purposes, as required by Law or as otherwise permitted under this Agreement, adjourn, postpone or cancel (or propose for adjournment, postponement or cancellation), or fail to call, the HighGold Meeting without Contango’s and the Purchaser’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed, other than as expressly required or permitted in accordance with Section 8.2(k).

(j) HighGold shall not change the record date for the Affected Securityholders entitled to vote at the HighGold Meeting in connection with any adjournment or postponement of the HighGold Meeting unless required by Law.

(k) HighGold shall not, without the prior written consent of Purchaser, waive the deadline for the submission of proxies by Affected Securityholders for the HighGold Meeting.

(l) HighGold shall promptly advise Contango of any communication (written or oral) received by HighGold from the TSXV, any of the Securities Authorities or any other Governmental Entity in connection with the HighGold Meeting.

2.5 HighGold Circular

(a) Subject to Contango and the Purchaser complying with Section 2.5(c), HighGold shall (i) as promptly as reasonably practicable following the date of this Agreement, prepare the HighGold Circular (together with any other documents required by applicable Laws in connection with the HighGold Meeting) in compliance in all material respects with all applicable Laws, and (ii) as promptly as reasonably practicable after obtaining the Interim Order file or furnish, as applicable, the HighGold Circular with respect to the HighGold Meeting in all jurisdictions where the same is required to be filed or furnished and mail the same as required by the

Interim Order and in accordance with all applicable Laws in all jurisdictions where the same is required to be mailed (it being understood that HighGold will so file, furnish and mail the HighGold Circular by no later than the close of business on the Mailing Deadline). If necessary, HighGold shall, in consultation with Contango abridge the timing contemplated by NI 54-101, as provided in section 2.20 thereof (provided, however, that for greater certainty, the foregoing obligation shall not extend to the making of an application for a waiver or exemption from the requirements of NI 54-101).

(b) HighGold shall ensure that the HighGold Circular complies in all material respects with all applicable Laws and the Interim Order, and, without limiting the generality of the foregoing, that the HighGold Circular shall not contain any misrepresentation (except that HighGold shall not be responsible for any information included in the HighGold Circular relating to Contango, the Purchaser and its affiliates that was provided by Contango expressly for inclusion in the HighGold Circular pursuant to Section 2.5(c)) and shall provide Affected Securityholders with information in sufficient detail to permit them to form a reasoned judgment concerning the matters to be placed before them at the HighGold Meeting. The HighGold Circular shall include (a) the HighGold Board Recommendation, (b) a statement that each of the HighGold Locked-Up Shareholders has signed a HighGold Voting Agreement, pursuant to which they have agreed to, among other things, vote all of their Affected Securities in favour of the HighGold Resolution and any other resolution presented at the HighGold Meeting required to give effect to the Arrangement, and (c) a summary and copies of the HighGold Fairness Opinions. The content of the HighGold Circular shall comply with the terms of this Agreement.

(c) Contango shall furnish to HighGold on a timely basis such information regarding Contango, its affiliates, and the Purchaser as may be required by Law or reasonably required by HighGold in the preparation of the HighGold Circular (including, as required by section 14.2 of Form 51-102F5), and Contango shall ensure that such information does not contain any misrepresentation concerning Contango or the Purchaser.

(d) Contango shall use commercially reasonable efforts to obtain any necessary consents from its auditor, Qualified Persons and any other advisors to the use of any financial, technical or other expert information required to be included in the HighGold Circular and to the identification in the HighGold Circular of each such advisor.

(e) Contango and its legal counsel shall be given a reasonable opportunity to review and comment on drafts of the HighGold Circular, prior to the HighGold Circular being printed, mailed to Affected Securityholders and filed with any Governmental Entity, and reasonable consideration shall be given to any comments made by Contango and its legal counsel, provided that all information relating solely to Contango, its affiliates, and the Purchaser included in the HighGold Circular, and any information describing the terms and conditions of this Agreement, the HighGold Voting Agreements or the Plan of Arrangement, shall be in form and content approved in writing by Contango, acting reasonably. HighGold shall

provide Contango with final copies of the HighGold Circular prior to its mailing to the Affected Securityholders.

(f) Each of the Parties shall each promptly notify the other if at any time before the Effective Date it becomes aware (in the case of Contango and the Purchaser, only in respect of information relating to Contango, its affiliates or the Purchaser) that the HighGold Circular contains a misrepresentation, or otherwise requires an amendment or supplement to the HighGold Circular, and the Parties shall co-operate in the preparation of any amendment or supplement to the HighGold Circular, as required or appropriate, and HighGold shall promptly mail or otherwise publicly disseminate any amendment or supplement to the HighGold Circular to Affected Securityholders and, if required by the Court or applicable Laws, file the same with any Governmental Entity and as otherwise required.

(g) HighGold shall promptly advise Contango and the Purchaser of any communication (written or oral) received by HighGold from the TSXV, any of the Securities Authorities or any other Governmental Entity in connection with the HighGold Circular.

2.6 Final Order

If (a) the Interim Order is obtained and (b) the HighGold Resolution is passed at the HighGold Meeting by Affected Securityholders, as provided for in the Interim Order and as required by applicable Law, HighGold shall as soon as reasonably practicable thereafter and in any event within three Business Days thereafter take all steps necessary or desirable to submit the Arrangement to the Court and diligently pursue an application for the Final Order pursuant to Section 291 of the BCBCA.

2.7 Court Proceedings

Subject to the terms of this Agreement, Contango and the Purchaser will cooperate with, assist and consent to HighGold seeking the Interim Order and the Final Order, including by providing HighGold on a timely basis any information required to be supplied by Contango and the Purchaser in connection therewith, and HighGold will diligently pursue the Interim Order and the Final Order. HighGold will provide legal counsel to Contango and the Purchaser with a reasonable opportunity to review and comment upon drafts of all material to be filed with, or submitted to, the Court in connection with the Arrangement (including by providing, on a timely basis and prior to the service and filing of such material, a description of any information required to be supplied by Contango or the Purchaser for inclusion in such material), and will give reasonable and due consideration to all such comments, provided that all information relating to Contango and the Purchaser included in such materials shall be in a form and substance satisfactory to Contango and the Purchaser, each acting reasonably. HighGold will also provide legal counsel to Contango on a timely basis with copies of any notice of appearance or notice of intent to oppose and any evidence or other documents delivered to HighGold or its legal counsel in respect of the application for the Interim Order or the Final Order or any appeal therefrom, and any notice, written or oral, indicating the intention of any Person to appeal, or oppose the granting of, the Interim Order or the Final Order. HighGold shall ensure that all materials filed with the Court in connection with the Arrangement are consistent with the terms of this Agreement and the Plan of

Arrangement. Subject to applicable Law, HighGold will not file any material with the Court in connection with the Arrangement or serve any such material, and will not agree to modify or amend materials so filed or served, except with Contango and the Purchaser’s prior written consent, such consent not to be unreasonably withheld, conditioned or delayed; provided that nothing herein shall require Contango and the Purchaser to agree or consent to any increase in or variation in the form of Consideration or other modification or amendment to such filed or served materials that expands or increases Contango or the Purchaser’s obligations, or diminishes or limits Contango or the Purchaser’s rights, set forth in any such filed or served materials or under this Agreement or the Arrangement. In addition, HighGold will not object to legal counsel to Contango or the Purchaser making such submissions on the hearing of the motion for the Interim Order and the application for the Final Order as such counsel considers appropriate; provided that HighGold is advised of the nature of any submissions with reasonably sufficient time prior to such hearing and such submissions are consistent in all material respects with this Agreement and the Plan of Arrangement. HighGold will also oppose any appearance, proposal or motion from any party on the hearing of the motion for the Interim Order and the application for the Final Order which is inconsistent with this Agreement or the Plan of Arrangement. HighGold will also consult with Contango and the Purchaser with respect to the defense or settlement of any Affected Securityholder or derivative Proceeding and shall not settle in respect of any such Proceeding without Contango and the Purchaser’s prior written consent, such consent not to be unreasonably withheld, conditioned or delayed. If at any time after the issuance of the Final Order and prior to the Effective Date, HighGold is required by the terms of the Final Order or by Law to return to the Court with respect to the Final Order, it shall do so after notice to, and in consultation and cooperation with Contango and the Purchaser.

2.8 Arrangement and Effective Date