Rising Rates and Soaring Stocks: Time for Convertible Bond ETFs - ETF News And Commentary

December 18 2013 - 7:04AM

Zacks

The market has seen a sudden surge in convertible bond investing

owing to the growing concerns of rising rates that hit the

conventional debt markets. Meanwhile, stock markets set new highs

last month and with decent economic fundamentals, this type of bond

is back in the limelight.

This is especially true thanks to solid economic data such as a

revised U.S. GDP figure of 3.6% for Q3 against 2.8% predicted

earlier, a reduction in jobless claims and a continued surge in

manufacturing numbers renewed the taper concern. This has pushed up

interest rates leading to the widest spread between the 2-year and

10-year bond yield since July 2011 (read: 3 Sector ETFs to Profit

from Rising Rates).

What Should the Bet Be Now?

Amid such a backdrop, it is necessary to look for some ETFs which

are less-vulnerable to rate rises but offer decent level yields. At

the same time, investors can take advantage of soaring equity

markets. But finding a better option other than convertible bond

ETFs that can serve all these factors in one product is a tall

order.

The convertible bond is a ‘hybrid ‘product of both debt and equity.

These are those products that can be exchanged if the holder

chooses to, for a specific number of preferred or common

shares if the company’s share price climbs past a said conversion

price during the bond’s tenure. If it falls, some yield will still

pass on to the investors’ though probably not as much as with a

traditional bond.

As such, these are attractive for investors seeking to tap the

potential upside in equities while enjoying a steady flow of income

and reduced downside risk (read: Convertible Bond ETFs for Income

With Growth Potential).

The price of these bonds generally moves in-line with the

underlying shares. However, unlike shares, the convertible bonds

have some coverage against downside risks as investors can redeem

these at par on maturity if the issuer is in business. And in case

of bankruptcy, convertible bond holders get paid out ahead of

equity holders.

Flurry of Convertibles in 2013

To make the most of the situation, a deluge of issues from the

likes of

Yahoo (YHOO), Tesla Motors (TSLA),

NetSuite (N) and

Salesforce.com (CRM) has hit the

market in 2013. The sales of converts more than doubled to $38.3

billion this year from $18.7 billion last year.

The largest was Yahoo’s issuance of $1.25 billion of convertible

senior notes due 2018 in November. The deal had a conversion

premium of about 45–50%. Low-yielding products are especially in

demand due to rising rate concerns amid a prospective taper (read:

Time for the Convertible Bond ETF?).

ETF Impact

Choices are very few in this corner of the ETF world. There is only

one pure-play in the convertible bonds section –

SPDR Barclays Capital Convertible

Securities ETF (CWB). Quite expectedly, the current macro

backdrop has led to some great trading in CWB in the recent

past.

Over the last six-month period, CWB has outpaced one of its big

traditional bond counterparts

PIMCO Total Return

ETF (BOND) by a wide margin and though it did not

exactly catch up, was close to the return offered by the broad

equity ETF

SPDR S&P 500 (SPY). This suggests

that the ETF could be an interesting pick for investors seeking

exposure to the fixed income market, while still experiencing a bit

of the equity rally.

This Barclays fund has so far generated $1.9 billion in assets and

is exposed to 97 securities with average maturity of 12.88 years.

The fund charges 40 basis points in expense per year and has a

dividend yield of 3.47% currently. Around 35% of the holdings are

rated Baa or higher thus implying lower default risks.

However, the fund hasn’t exactly done great in this QE Taper

environment. It is flat over the past six months, which compares

very unfavorably to its convertible bond counterpart, and the broad

stock market as a whole as well.

Conclusion

‘QE Taper’ and ‘rising interest rates’ have become synonymous in

the market. We would like to notify investors that even if the Fed

starts tapering, income seeking investors may weather the fall in

bond prices with rising stock prices through this instrument.

And with the broader economy finally finding its footing, stock

markets are expected to hold steady next year, potentially making

CWB a solid pick for investors seeking a good combo of fixed income

and equity in their portfolios.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

PIMCO-TOT RETRN (BOND): ETF Research Reports

SPDR-BC CONV SC (CWB): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

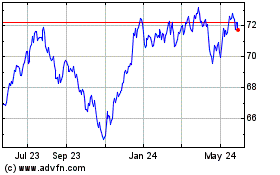

SPDR Bloomberg Convertib... (AMEX:CWB)

Historical Stock Chart

From Feb 2025 to Mar 2025

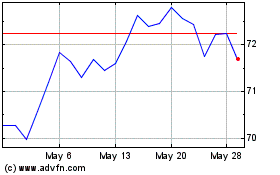

SPDR Bloomberg Convertib... (AMEX:CWB)

Historical Stock Chart

From Mar 2024 to Mar 2025