ETF Trading Report: Dollar, Europe ETFs in Focus - ETF News And Commentary

March 18 2013 - 12:21PM

Zacks

Investors finally saw a decisive down day in the markets, ending

the relatively bullish trend that many had been seeing for the past

few weeks. This abrupt shift wasn’t the result of any changes in

the U.S. market though, as all eyes centered on the tiny nation of

Cyprus and their bank bailout.

The country appears likely to vote on a very controversial plan

that could tax all deposits in the small nation at a rate of nearly

10% for those with more than 100,000 euros deposited. This is

pretty surprising as it comes just days after Cyprus leaders

assured depositors that a tax was not in the works, and that all

their capital was safe.

This no longer appears to be the case and it has called into

question future bailouts of other weak countries in the region.

After all, if this can happen in Cyprus, many are wondering, what

is to stop it from happening in other fiscally weak nations in the

region?

This speculation reignited worries over key markets and sent

stocks tumbling across the globe. Asian benchmarks finished the day

down about 2% on average, while European and American indexes did

slightly better, but were still down on the day (read 2 Sector ETFs

Posting Incredible Gains).

Commodities and bonds were also volatile, as investors embraced

safe havens and hard assets alike. Gold and crude were both up on

the session, while American benchmark debt saw yields slump thanks

to higher demand for low risk assets.

Meanwhile in the ETF world, there was a great deal of

interesting trading activity thanks to this market shift. Many key

products saw trading volumes that were in-line with averages, but a

number of leveraged and currency funds saw heavier volume days.

In particular, ETF investors saw a big volume day out of the

PowerShares US Dollar Bullish Fund (UUP). This ETF

saw volume levels that were roughly 1.5 times higher than normal,

largely thanks to the demand for dollars and the exodus away from

euros (see What’s next for Currency ETFs?).

This is especially important in this ETF, as the majority of its

exposure is in euros anyway. Thus, when investors are having an

opinion on this currency—as well as the rest of the global currency

market—this fund is a popular choice. During today’s trading, the

ETF added about 0.7%, continuing the bullish trend for this product

in the short term.

Another in focus product was the ProShares Short MSCI

EAFE ETF (EFZ). This inverse fund usually does about

75,000 shares in volume, but today saw a spike to a roughly quarter

million shares a day, largely thanks to the renewed fears of a

European problem (read the Guide to the Most Popular ETFs).

The ETF also moved higher in the session, gaining about 1.2%,

thanks to its heavy European exposure. In fact, Europe accounts for

roughly two-thirds of EFZ’s exposure profile, so any more negative

news out of the continent is very likely to have a positive impact

on this inverse ETF going forward.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EAFE (EFA): ETF Research Reports

PRO-SH MSCI EAF (EFZ): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

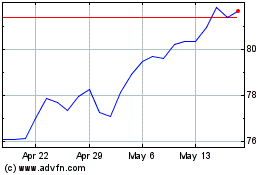

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Oct 2024 to Nov 2024

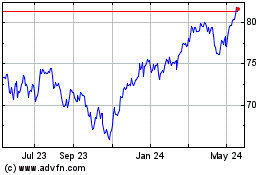

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Nov 2023 to Nov 2024