FSI ANNOUNCES SECOND QUARTER, 2024 FINANCIAL RESULTS

August 14 2024 - 3:30PM

FLEXIBLE SOLUTIONS INTERNATIONAL, INC. (NYSE Amex: FSI), is the

developer and manufacturer of biodegradable polymers for oil

extraction, detergent ingredients and water treatment as well as

crop nutrient availability chemistry. Flexible Solutions also

manufactures biodegradable and environmentally safe water and

energy conservation technologies. Today the Company announces

financial results for second quarter ended June 30, 2024.

Mr. Daniel B. O’Brien, CEO, states, “The second

quarter results are a solid improvement over the year earlier

period. We will try to build on these results over the remainder of

the year.” Mr. O’Brien continues, “We also hope that the hard work

the entire team has put into the Food/Nutrition division will start

to pay off with new revenue as early as the current quarter.”

- Sales for the

second quarter(Q2) were $10,528,739 up approximately 2% when

compared to sales of $10,331,291 in the corresponding period a year

ago.

- Q2, 2024 net

income was $1,289,796 or $0.10 per share, compared to a net income

of $809,865, or $0.07 per share, in Q2, 2023.

- Basic weighted

average shares used in computing earnings per share amounts were

12,450,532 and 12,435,532 for Q2, 2024 and Q2, 2023

respectively.

- Q2, 2024 -

Non-GAAP operating cash flow: The Company shows 6 months operating

cash flow of $3,853,907, or $0.31 per share. This compares with

operating cash flow of $3,220,674, or $0.26 per share, in the

corresponding 6 months of 2023 (see the table and notes that follow

for details of these calculations).

The NanoChem division and ENP subsidiary

continue to be the dominant sources of revenue and cash flow for

the Company. New opportunities continue to unfold in detergent,

food, nutraceuticals, oil field extraction, turf, ornamental and

agricultural use to further increase sales in these divisions.

CONFERENCE CALL

A conference call has been

scheduled for 11:00 am Eastern Time, 8:00 am Pacific Time, on

Thursday August 15th, 2024. CEO, Dan O’Brien will

be presenting and answering questions on the conference call. To

participate in this call please dial

1-800-245-3047 (or

1-203-518-9765) just prior to the

scheduled call time. To join the call participants will be

requested to give their name and company

affiliation. The conference ID:

SOLUTIONS and/or call title Flexible

Solutions International – Second Quarter, 2024 Financials

may be requested

The above information and following table

contain supplemental information regarding income and cash flow

from operations for the period ended June 30, 2024. Adjustments to

exclude depreciation, stock option expenses and one time charges

are given. This financial information is a Non-GAAP financial

measure as defined by SEC regulation G. The GAAP financial measure

most directly comparable is net income.

The reconciliation of each Non-GAAP financial

measure is as follows:

FLEXIBLE SOLUTIONS INTERNATIONAL,

INC.CONSOLIDATED STATEMENT OF

OPERATIONSFOR THREE MONTHS ENDED JUNE 30, 2024 AND

2023(SIX MONTHS OPERATING CASH FLOW -

UNAUDITED)

| |

|

3 months Net Income Ended June 30 |

|

| |

|

2024 |

|

|

2023 |

|

|

| Revenue |

|

$ |

10,528,739 |

|

|

$ |

10,331,291 |

|

|

| Income (loss) before income tax – GAAP |

|

$ |

1,990,684 |

|

|

$ |

1,349,099 |

|

|

| Provision for Income tax – net - GAAP |

|

$ |

(558,251 |

) |

|

$ |

(354,372 |

) |

|

| Net income (loss) Controlling interest - GAAP |

|

$ |

1,289,796 |

|

|

$ |

809,865 |

|

|

| Net income (loss) per common share – basic. – GAAP |

|

$ |

0.10 |

|

|

$ |

0.07 |

|

|

| 3 month weighted average shares used in computing per share

amounts – basic.- GAAP |

|

|

12,450,532 |

|

|

|

12,435,532 |

|

|

| |

|

|

6 month Operating Cash FlowEnded June 30 |

|

| Operating Cash Flow (6 months).

NON-GAAP |

|

$ |

3,853,907 |

a,b,c |

|

$ |

3,220,674 |

a,b,c |

|

| Operating Cash Flow per share excluding non-operating items and

items not related to current operations (6 months) – basic.

-NON-GAAP |

|

$ |

0.31 |

a,b,c |

|

$ |

0.26 |

a,b,c |

|

| Non-cash Adjustments (6 month) -GAAP |

|

$ |

1,318,784 |

d |

|

$ |

1,118,100 |

d |

|

| Shares (6 month basic weighted average) used in computing per

share amounts – basic -GAAP |

|

|

12,450,118 |

|

|

|

12,434,230 |

|

|

Notes: certain

items not related to “operations” of the Company’s net income are

listed below.

a) Non-GAAP – Flexible

Solutions International purchased 65% of ENP in 4th quarter, 2018

(October 2018). Therefore Operating Cash Flow is adjusted by the

pre tax Net income or loss of the non-controlling interest in ENP

for 2023 only. The 2024 entry in the “Statement of operations and

comprehensive income” is a pretax number therefore no adjustment is

required.b) Non-GAAP – amounts exclude certain

cash and non-cash items: Depreciation and Stock compensation

expense (2024 = $1,318,784, 2023 = $1,118,100), Interest expense

(2024 = $332,397, 2023 = $250,368), Interest income (2024 =

$109,637, 2023 = $53,185), Gain on investment (2024 = $298,438,

2023 = $326,703), Loss on lease termination (2024 = $41,350, 2023 =

N/A), Income tax (2024 = ($822,429), 2023 = ($654,149)), and pretax

Net income attributable to non-controlling interests (2024 =

$201,620, 2023 = $381,276). Although included in operating expenses

these onetime expenditures were not related to operations of FSI.

*See the financial statements for all

adjustments.c) The revenue and gain from the 50%

investment in the private Florida LLC announced in January 2019 are

not treated as revenue or profit from operations by Flexible

Solutions given the Company only purchased 50% of the LLC. The

profit is treated as investment income and therefore occurs below

Operating income in the Statement of Operations. As a result, the

Gains on all investments, including those from the Florida LLC, are

removed from the calculation to arrive at Operating Cash Flow.

Again, see the financials.d) Non-GAAP – amounts

represent depreciation and stock compensation expense.

SAFE HARBOR PROVISION

The Private Securities Litigation Reform Act of

1995 provides a "Safe Harbor" for forward-looking statements.

Certain of the statements contained herein, which are not

historical facts, are forward looking statement with respect to

events, the occurrence of which involve risks and uncertainties.

These forward-looking statements may be impacted, either positively

or negatively, by various factors. Information concerning potential

factors that could affect the company is detailed from time to time

in the company's reports filed with the Securities and Exchange

Commission.

Flexible Solutions

International6001 54th

Ave, Taber, Alberta, CANADA T1G 1X4

Company ContactsJason BloomToll Free: 800 661

3560Fax: 403 223 2905E-mail: info@flexiblesolutions.com

If you have received this news release by

mistake or if you would like to be removed from our update list

please reply to: info@flexiblesolutions.com

To find out more information about Flexible

Solutions and our products, please visit

www.flexiblesolutions.com.

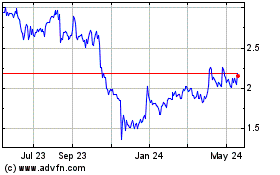

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

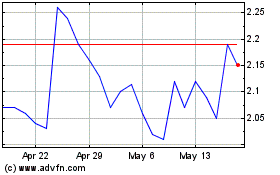

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Jan 2024 to Jan 2025