false

0001069394

A0

0001069394

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): August 14, 2024

FLEXIBLE

SOLUTIONS INTERNATIONAL INC.

(Exact

name of Registrant as specified in its charter)

| Alberta |

|

001-31540 |

|

71-1630889 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(Employer

Identification No.) |

6001

54 Ave.

Taber,

Alberta, Canada T1G 1X4

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (250) 477-9969

N/A

(Former

name or former address if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-14(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

Stock |

|

FSI |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§203.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§204.12b-2 of this chapter.

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

On

August 14, 2024, the Company issued a press release announcing its financial results for the second quarter ended June 30, 2024.

On

August 15, 2024 the Company held a conference call to discuss its financial results for the second quarter ended June 30, 2024, as well

as other information regarding the Company.

Item

9.01 Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

August 15, 2024 |

FLEXIBLE

SOLUTIONS INTERNATIONAL INC. |

| |

|

| |

By: |

/s/

Daniel B. O’Brien |

| |

|

Daniel

B. O’Brien, President and Chief Executive Officer |

EXHIBIT

99.1

NEWS

RELEASE

August

14, 2024

FSI

ANNOUNCES SECOND QUARTER, 2024 FINANCIAL RESULTS

A

Conference call is scheduled for Thursday, August 15, 2024, 11:00am Eastern Time

See

dial in number below

VICTORIA,

BRITISH COLUMBIA, August 14, 2024 – FLEXIBLE SOLUTIONS INTERNATIONAL, INC. (NYSE Amex: FSI), is the developer and manufacturer

of biodegradable polymers for oil extraction, detergent ingredients and water treatment as well as crop nutrient availability chemistry.

Flexible Solutions also manufactures biodegradable and environmentally safe water and energy conservation technologies. Today the Company

announces financial results for second quarter ended June 30, 2024.

Mr.

Daniel B. O’Brien, CEO, states, “The second quarter results are a solid improvement over the year earlier period. We will

try to build on these results over the remainder of the year.” Mr. O’Brien continues, “We also hope that the hard work

the entire team has put into the Food/Nutrition division will start to pay off with new revenue as early as the current quarter.”

| |

● |

Sales

for the second quarter(Q2) were $10,528,739 up approximately 2% when compared to sales of $10,331,291 in the corresponding period

a year ago. |

| |

|

|

| |

● |

Q2,

2024 net income was $1,289,796 or $0.10 per share, compared to a net income of $809,865, or $0.07 per share, in Q2, 2023. |

| |

|

|

| |

● |

Basic

weighted average shares used in computing earnings per share amounts were 12,450,532 and 12,435,532 for Q2, 2024 and Q2, 2023 respectively. |

| |

|

|

| |

● |

Q2,

2024 - Non-GAAP operating cash flow: The Company shows 6 months operating cash flow of $3,853,907, or $0.31 per share. This

compares with operating cash flow of $3,220,674, or $0.26 per share, in the corresponding 6 months of 2023 (see the table and notes

that follow for details of these calculations). |

The

NanoChem division and ENP subsidiary continue to be the dominant sources of revenue and cash flow for the Company. New opportunities

continue to unfold in detergent, food, nutraceuticals, oil field extraction, turf, ornamental and agricultural use to further increase

sales in these divisions.

Conference

call

A

conference call has been scheduled for 11:00 am Eastern Time, 8:00 am Pacific Time, on Thursday August 15th, 2024. CEO,

Dan O’Brien will be presenting and answering questions on the conference call. To participate in this call please dial 1-800-245-3047

(or 1-203-518-9765) just prior to the scheduled call time. To join the call participants will be requested to give their name

and company affiliation. The conference ID: SOLUTIONS and/or call title Flexible Solutions International –

Second Quarter, 2024 Financials may be requested

The

above information and following table contain supplemental information regarding income and cash flow from operations for the period

ended June 30, 2024. Adjustments to exclude depreciation, stock option expenses and one time charges are given. This financial information

is a Non-GAAP financial measure as defined by SEC regulation G. The GAAP financial measure most directly comparable is net income.

The

reconciliation of each Non-GAAP financial measure is as follows:

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

consolidated

Statement of Operations

For

Three Months Ended June 30, 2024 and 2023

(SIX

Months Operating Cash Flow - Unaudited)

| | |

3 months Net Income Ended June 30 | |

| | |

2024 | | |

2023 | |

| Revenue | |

$ | 10,528,739 | | |

$ | 10,331,291 | |

| Income (loss) before income tax – GAAP | |

$ | 1,990,684 | | |

$ | 1,349,099 | |

| Provision for Income tax – net - GAAP | |

$ | (558,251 | ) | |

$ | (354,372 | ) |

| Net income (loss) Controlling interest - GAAP | |

$ | 1,289,796 | | |

$ | 809,865 | |

| Net income (loss) per common share – basic. – GAAP | |

$ | 0.10 | | |

$ | 0.07 | |

| 3 month weighted average shares used in computing per share amounts – basic.- GAAP | |

| 12,450,532 | | |

| 12,435,532 | |

| | |

6

month Operating Cash Flow Ended June 30 | |

| Operating Cash Flow (6 months). NON-GAAP | |

$ | 3,853,907 | a,b,c | |

$ | 3,220,674 | a,b,c |

| Operating Cash Flow per share excluding non-operating items and items not related to current operations (6 months) – basic. -NON-GAAP | |

$ | 0.31 | a,b,c | |

$ | 0.26 | a,b,c |

| Non-cash Adjustments (6 month) -GAAP | |

$ | 1,318,784 | d | |

$ | 1,118,100 | d |

| Shares (6 month basic weighted average) used in computing per share amounts – basic -GAAP | |

| 12,450,118 | | |

| 12,434,230 | |

Notes:

certain items not related to “operations” of the Company’s net income are listed below.

a)

Non-GAAP – Flexible Solutions International purchased 65% of ENP in 4th quarter, 2018 (October 2018). Therefore

Operating Cash Flow is adjusted by the pre tax Net income or loss of the non-controlling interest in ENP for 2023 only. The 2024

entry in the “Statement of operations and comprehensive income” is a pretax number therefore no adjustment is required.

b)

Non-GAAP – amounts exclude certain cash and non-cash items: Depreciation and Stock compensation expense (2024 = $1,318,784,

2023 = $1,118,100), Interest expense (2024 = $332,397, 2023 = $250,368), Interest income (2024 = $109,637, 2023 = $53,185), Gain on investment

(2024 = $298,438, 2023 = $326,703), Loss on lease termination (2024 = $41,350, 2023 = N/A), Income tax (2024 = ($822,429), 2023 = ($654,149)),

and pretax Net income attributable to non-controlling interests (2024 = $201,620, 2023 = $381,276). Although included in operating expenses

these onetime expenditures were not related to operations of FSI. *See the financial statements for all adjustments.

c)

The revenue and gain from the 50% investment in the private Florida LLC announced in January 2019 are not treated as revenue or profit

from operations by Flexible Solutions given the Company only purchased 50% of the LLC. The profit is treated as investment income and

therefore occurs below Operating income in the Statement of Operations. As a result, the Gains on all investments, including those

from the Florida LLC, are removed from the calculation to arrive at Operating Cash Flow. Again, see the financials.

d)

Non-GAAP – amounts represent depreciation and stock compensation expense.

Safe

Harbor Provision

The

Private Securities Litigation Reform Act of 1995 provides a “Safe Harbor” for forward-looking statements. Certain of the

statements contained herein, which are not historical facts, are forward looking statement with respect to events, the occurrence of

which involve risks and uncertainties. These forward-looking statements may be impacted, either positively or negatively, by various

factors. Information concerning potential factors that could affect the company is detailed from time to time in the company’s

reports filed with the Securities and Exchange Commission.

Flexible

Solutions International

6001

54th Ave, Taber, Alberta, CANADA T1G 1X4

Company

Contacts

Jason

Bloom

Toll

Free: 800 661 3560

Fax:

403 223 2905

E-mail:

info@flexiblesolutions.com

If

you have received this news release by mistake or if you would like to be removed from our update list please reply to: info@flexiblesolutions.com

To

find out more information about Flexible Solutions and our products, please visit www.flexiblesolutions.com.

EXHIBIT

99.2

Q2

2024 Speech

Good

morning. I’m Dan O’Brien, CEO of Flexible Solutions.

Safe

Harbor provision:

The

Private Securities Litigation Reform Act of 1995 provides a “Safe Harbor” for forward-looking statements. Certain of the

statements contained herein, which are not historical facts, are forward looking statements with respect to events, the occurrence of

which involve risks and uncertainties. These forward-looking statements may be impacted, either positively or negatively, by various

factors. Information concerning potential factors that could affect the company is detailed from time to time in the company’s

reports filed with the Securities and Exchange Commission.

Welcome

to the FSI conference call for Q2 2024.

To

start, I would like to discuss our Company condition and our product lines along with what we think might occur in the remainder of 2024.

I will comment on our financials in the second part of the speech.

NanoChem

division: NCS represents approximately 70% of FSI’s revenue. This division makes thermal poly-aspartic acid, called TPA for

short, a biodegradable polymer with many valuable uses. NCS also manufactures SUN 27™ and N Savr 30™ which are used to reduce

nitrogen fertilizer loss from soil. In 2022, NCS started food grade toll operations using the spray dryer we installed over the last

several years.

TPA

is used in agriculture to significantly increase crop yield. It acts by slowing crystal growth between fertilizer ions and other

ions in the soil resulting in the fertilizer remaining available longer for the plants to use.

TPA

is a biodegradable way of treating oilfield water to prevent pipes from plugging with mineral scale. Preventing scale keeps the oil recovery

pipes from clogging.

TPA

is also sold as a biodegradable ingredient in cleaning products, and as a water treatment chemical.

In

our food division, a special version of TPA is sold as a liquid stability aid.

SUN

27™ and N Savr 30™ are nitrogen conservation products. Nitrogen is a critical fertilizer that can be lost through bacterial

breakdown, evaporation and soil runoff.

SUN

27™ is used to conserve nitrogen from attack by soil bacterial enzymes that cause evaporation while N Savr 30™ is effective

at reducing nitrogen loss from leaching.

Food

products: Our IL plant is food grade qualified and we have received our FDA certification. We have commercialized one food product

based on polyaspartates that was developed fully in house. This product had normal sales in Q2 which contributed to the good results

for the quarter. And, the customer has indicated that orders for the full year will substantially exceed FY 2023 so we expect solid performance

in Q3 and Q4. NCS now has a pipeline of five products, each with seven figure revenue potential, at the final stages prior to purchase

orders. We believe that purchase orders will be received for at least two of these products in 2024.

ENP

Division: ENP represents most of our other revenue. ENP is focused on sales into the greenhouse, turf and golf markets, while, NCS

sells into row crop agriculture. We expect some ENP revenue growth in 2024 with the growth concentrated in Q3 and Q4.

The

Florida LLC investment: The LLC was profitable in second quarter. The better margins for this investment in Q1 carried through into

Q2. The Company is focused on international agriculture sales into multiple countries.

Subsequent

to the end of the quarter, we sold this asset for $2 million in cash and $800,000 per year for 5 years. Our total purchase price was

$3.5 million. The LLC has retained us as an exclusive supplier for 5 years and we hope to extend the contract even longer by being better

than any competitors. We expect sales to the LLC to grow in 2024.

Agricultural

products in the US are selling reasonably well but crop prices are still not increasing at the rate of inflation. The recent reduction

in inflation rates may have a positive impact on 2025 early buy decisions in Q4. We think that growth in 2024 remains probable but, most

of it will be international, and recognized through sales to the Florida LLC.

Oil,

gas and industrial sales of TPA were stable in Q2 and this is likely to continue throughout 2024.

Food

division sales are sure to grow based on our customer’s order schedule. They may grow even further if POs are received for

any of the products in development.

Tariffs:

Since 2019, several of our raw materials imported from China have included a 25% tariff. International customers are not charged

the tariffs because we have applied for the export rebates available to recover the tariffs. The tariffs are affecting our cost of goods,

our cash flow and our profits negatively. Rebates are extremely difficult to obtain even though we are entitled to them. We submitted

our initial applications more than 5 years ago. The total dollar amount due back to us is well in excess of $1 MM and grows each quarter.

We will persevere until we succeed in recovering our funds.

Shipping

and Inventory: Shipping prices are stable but higher than prior to covid. Shipping times are reasonable on the routes we use. None

of our products or raw materials ship through the Red Sea area.

Raw

material prices do not appear to be reverting to historic levels. Instead, they are stable but increasing with inflation. Passing price

increases, even small inflation related ones, along to customers always takes several months and is not always possible.

We

believe that the sum of the issues we faced last year which resulted in lower revenue, lower cash flow and lower profits for the full

year have partly resolved. Progress is being made. We have streamlined operations by closing our Naperville R&D facility and moving

all the work to our Peru, IL building. The exit costs from this action were completed in Q2 so, the benefits will become fully evident

in Q3. Some price increases have been possible. Several large new opportunities have been found in the food/nutraceutical market and

are proceeding toward revenue in the 2024 year. Therefore, we expect that growth will continue in sales, cash flow and profit for the

rest of 2024.

Option

grants: In the first half of 2024, the Company granted many more options than are usual. 850,000 were granted to employees and consultants

for prospective activity in the medical drug compounding field. The Board set harsh vesting terms for these option grants – in

general, none will vest unless the Company successfully begins operating as a drug compounder and drug revenue reaches $100 million per

year. The Company believes that if vesting is attained, the shareholders will be well compensated for the dilution. It should also be

said that the Board does not expect further grants other than our small annual employee/consultant grant.

GLP-1

drug production line: The drug compounding industry is a logical progression for FSI so, when a production line for injectable drugs

became available at an extremely low price, we bought it. We intend to de-risk our possible entry by securing sales prior to further

expenditure and by looking for partners. Only if we can de-risk sufficiently, will we proceed.

FSI

has progressed from good manufacturing practice to food grade certification and production over the last 3 years. We have developed the

skills to operate in clean room environments as part of our food/nutrition division and are comfortable that our skills are transferable

to drug operations.

Senior

executives are spending portions of their time searching for customers and for potential partners. There is no guarantee that we will

succeed in either but, if we do, there is a very large revenue and profit opportunity in injectable diabetes/weight loss drugs. Other,

highly profitable drug categories can also be serviced by the production line we own.

Highlights

of the financial results:

FSI

and its subsidiaries will continue to examine all our costs and economize where possible. Even more critical is obtaining new sales in

the food industry to ensure that our wage and other base costs are spread over more revenue dollars. We resumed growth in Q2, at a low

rate, but with better profits and expect to show incremental success in these areas during the course of the 2024 year.

Sales

for the quarter increased 2% to 10.53 million, compared with 10.33 million in Q2 2023.

Profits:

Q2 2024 shows a profit of $1.29 million or 10 cents per share, compared to a profit of $810 thousand, or $0.07 per share, in Q2 2023.

Operating

Cash Flow: This non-GAAP number is useful to show our progress with non-cash items removed for clarity. For the first half of 2024,

it was $3.85 million or 31 cents per share up from $3.22 million or 26 cents per share in first half 2023.

Long

term debt: We continue to pay down our long-term debt according to the terms of the loans.

Additional

factory space in Illinois: In the second quarter 2023 we invested to acquire 80% of an LLC called 317 Mendota that in turn purchased

a large building on 37 acres of land in Mendota IL. We have determined that 240,000 square feet is available for our use or for rental.

The ENP division has moved all operations to 60,000 square feet of this building. The remaining 180,000 square feet will be rented when

suitable tenants are found.

Working

capital is adequate for all our purposes. We have lines of credit with Stock Yards Bank for the ENP and NCS subsidiaries. We are

confident that we can execute our plans with our existing capital.

The

text of this speech will be available as an 8K filing on www.sec.gov by Friday Aug 16th. Email or fax copies can be requested

from Jason Bloom at Jason@flexiblesolutions.com. Thank you, the floor is open for questions.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

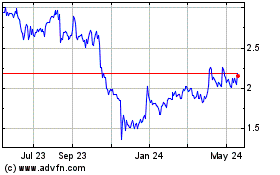

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Feb 2025 to Mar 2025

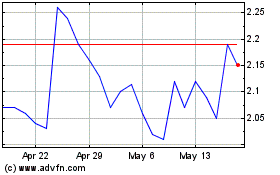

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Mar 2024 to Mar 2025