Franklin Limited Duration Income Trust (“FTF” or the “Fund”) Announces Notification of Sources of Distributions

September 27 2024 - 11:22AM

Business Wire

.

Franklin Limited Duration Income Trust [NYSE American: FTF]:

Notification of Sources of

Distributions

Pursuant to Section 19(a) of the

Investment Company Act of 1940

The Fund’s estimated sources of the distribution to be paid on

September 30, 2024 and for the fiscal year 2024 year-to-date are as

follows:

Estimated Allocations for September Monthly Distribution as of

August 31, 2024:

Distribution

Per Share

Net Investment

Income

Net Realized

Short-Term Capital

Gains

Net Realized

Long-Term Capital Gains

Return of Capital

$0.0615

$0.0437 (71%)

$0.0025 (4%)

$0.00 (0%)

$0.0153 (25%)

Cumulative Estimated Allocations fiscal year-to-date as of

August 31, 2024, for the fiscal year ending December 31, 2024:

Distribution

Per Share

Net Investment

Income

Net Realized

Short-Term Capital

Gains

Net Realized

Long-Term Capital

Gains

Return of Capital

$0.4920

$0.3155 (64%)

$0.0170 (4%)

$0.00 (0%)

$0.1595 (32%)

The Fund has experienced a cumulative loss in undistributed net

realized and unrealized capital gains and losses totaling $1.6354

per share. Of that amount, $0.4783 per share represents unrealized

depreciation of portfolio securities.

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of the current distribution

or from the terms of the Fund’s Plan. FTF estimates that it has

distributed more than its income and net realized capital gains;

therefore, a portion of the FTF distribution to shareholders may be

a return of capital. A return of capital may occur, for example,

when some or all of the money that a shareholder invested in a Fund

is paid back to them. A return of capital distribution does not

necessarily reflect FTF’s investment performance and should not be

confused with ‘yield’ or ‘income’. The amounts and sources of

distributions reported herein are only estimates and are not being

provided for tax reporting purposes. The actual amounts and sources

of the amounts for tax reporting purposes will depend upon the

Fund’s investment experience during the remainder of its fiscal

year and may be subject to changes based on tax regulations. The

Fund will send a Form 1099-DIV to shareholders for the calendar

year that will describe how to report the Fund’s distributions for

federal income tax purposes.

Average Annual Total Return (in relation

to the change in net asset value (NAV) for the 5-year period ended

on 8/31/2024)1

Annualized Distribution Rate (as a

percentage of NAV for the current fiscal period through

8/31/2024)2

Cumulative Total Return (in relation to

the change in NAV for the fiscal period through 8/31/2024)3

Cumulative Fiscal Year-To-Date

Distribution Rate (as a percentage of NAV as of 8/31/2024)4

2.97%

10.39%

5.95%

6.93%

Fund Performance and Distribution Rate Information:

- Average Annual Total Return in relation to NAV represents

the compound average of the Annual NAV Total Returns of the Fund

for the five-year period ended through August 31, 2024. Annual NAV

Total Return is the percentage change in the Fund’s NAV over a

year, assuming reinvestment of distributions paid.

- The Annualized Distribution Rate is the current fiscal

period’s distribution rate annualized as a percentage of the Fund’s

NAV through August 31, 2024.

- Cumulative Total Return is the percentage change in the

Fund’s NAV from December 31, 2023 through August 31, 2024, assuming

reinvestment of distributions paid.

- The Cumulative Fiscal Year-To-Date Distribution Rate is the

dollar value of distributions for the fiscal period (December 31,

2023 through August 31, 2024), as a percentage of the Fund’s NAV as

of August 31, 2024.

The Fund’s Board of Trustees (the “Board”) has authorized a

managed distribution plan (the “Plan”) pursuant to which the Fund

makes monthly distributions to shareholders at the fixed rate of

$0.0615 per share. The Plan is intended to provide shareholders

with consistent distributions each month and is intended to narrow

the discount between the market price and the net asset value

(“NAV”) of the Fund’s common shares, but there can be no assurance

that the Plan will be successful in doing so. The Fund is managed

with a goal of generating as much of the distribution as possible

from net ordinary income and short-term capital gains, that is

consistent with the Fund’s investment strategy and risk profile. To

the extent that sufficient distributable income is not available on

a monthly basis, the Fund will distribute long-term capital gains

and/or return of capital in order to maintain its managed

distribution rate. A return of capital may occur, for example, when

some or all of the money that was invested in the Fund is paid back

to shareholders. A return of capital distribution does not

necessarily reflect the Fund’s investment performance and should

not be confused with “yield” or “income”. Even though the Fund may

realize current year capital gains, such gains may be offset, in

whole or in part, by the Fund’s capital loss carryovers from prior

years.

The Board may amend the terms of the Plan or terminate the Plan

at any time without prior notice to the Fund’s shareholders. The

amendment or termination of the Plan could have an adverse effect

on the market price of the Fund’s common shares. The Plan will be

subject to the periodic review by the Board, including a yearly

review of the fixed rate to determine if an adjustment should be

made.

For further information on Franklin Limited

Duration Income Trust, please visit our web site at:

www.franklintempleton.com

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 150 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With more than 1,500 investment professionals, and offices in major

financial markets around the world, the California-based company

has over 75 years of investment experience and over $1.6 trillion

in assets under management as of August 31, 2024. For more

information, please visit franklintempleton.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240927472134/en/

For more information, please contact Franklin Templeton at

1-800-342-5236

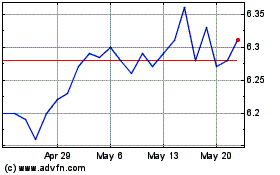

Franklin Limited Duratio... (AMEX:FTF)

Historical Stock Chart

From Dec 2024 to Jan 2025

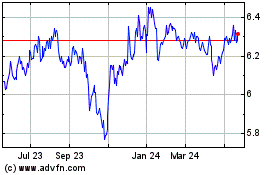

Franklin Limited Duratio... (AMEX:FTF)

Historical Stock Chart

From Jan 2024 to Jan 2025