UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the Month of October 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒

Form

40-F ☐

Resignation

and Appointment of Chief Financial Officer

On

October 9, 2024, Adrian Reese (“Mr. Reese”) resigned as Chief Financial Officer (“CFO”) of Genius

Group Limited (the “Company”). Mr. Reese’s decision to resign did not arise or result from any disagreement

with the Company.

To

fill in the vacancy created by the resignation of Mr. Reese as the CFO of the Company, on October 9, 2024, the Board appointed Gaurav

Dama (“Mr. Dama”) to serve as the Interim Chief Financial Officer of the Company, effective on October 9, 2024.

Since

September 2017, Mr. Dama has been the Senior Finance Manager of the Company and has been responsible for managing the Company’s

global finance team. From October 2013 to June 2017, Mr. Dama was an Exempt Non-Officer with Credit Suisse. From January 2012 to October

2013, Mr. Dama was a Senior Officer of Finance and Accounts for APM Terminals.

In

2012, Mr. Dama earned a Master of Management Studies in Finance from the University of Mumbai.

There

is no family relationship between Mr. Dama and any director or executive officer of the Company. To the best knowledge of the Company,

there is no understanding or arrangement between Mr. Dama and any other person pursuant to which he was appointed as the Company’s

CFO. Additionally, there has been no transaction in the past two years to which the Company or any of its subsidiaries or affiliates

was or is to be a party in which Mr. Dama had, has or will have a direct or indirect material interest.

Mr.

Dama entered into an Addendum to Employment Contract with the Company, which establishes certain terms and conditions governing his service

to the Company. The agreement is filed hereto as Exhibit 99.2. The agreement sets forth the following material terms:

| ● | In

addition to Mr. Dama’s current remuneration in his role as Senior Finance Manager of

the Company, Mr. Dama shall receive an additional monthly payment of $8,000 for his role

as Interim Chief Financial Officer of the Company. |

| ● | Mr.

Dama’s services as Chief Financial Officer shall be on a probationary basis for three

months. |

| ● | The

HR department will confirm his appointment upon successful completion of the probation period,

subject to meeting pre-agreed performance expectations. |

| ● | The

probation period may be extended, if necessary, based on Mr. Dama’s performance during

this time. |

Resignation

of Directors

On

October 9, 2024, four members (the “Resigning Directors”) of the Company’s Board of Directors (the “Board”)

tendered their resignations effective at such time.

| ● | Michael

Moe resigned as a director and a member of the Audit Committee, the Compensation Committee

and the Nominating and Corporate Governance Committee of the Company; |

| ● | Richard

Berman resigned as a director and a member of the Audit Committee, the Compensation Committee

and the Nominating and Corporate Governance Committee of the Company; |

| ● | Salim

Ismail resigned as a director, chairman of the board, and a member of the Audit Committee,

the Compensation Committee and the Nominating and Corporate Governance Committee of the Company;

and |

| ● | Riaz

Shah resigned as a director of the Company. |

The

resignations resulted from a request from the Company’s senior management and certain of the Company’s shareholders. The

resignations were requested based upon the Resigning Directors breach of fiduciary and other duties at common law and under the Companies

Act (Cap. 50) owed to the Company as follows:

| ● | On

September 22, 2024, the Resigning Directors held an invalid board meeting and executed an

unauthorized document entitled “Written consent of the Board of Directors and Compensation

Committee” in violation of the Company’s constitution which purported to

appoint Michael Moe as the Company’s Chief Executive Officer (“CEO”)

while at the same time terminating and removing the existing CEO, Mr Roger Hamilton from

being the Company’s CEO; |

| ● | The

Resigning Directors interfered with Mr. Hamilton’s ability to perform his duties as

CEO of the Company; |

| ● | Resigning

Director Mr. Michael Moe failed to declare his conflict of interest arising from the proposed

acquisition agreement between LZG International, Inc. (“LZGI”) and the

Company and failed to recuse himself from numerous board meetings where the strategy of the

Company against LZGI was discussed; and |

| ● | Additionally,

Resigning Directors Mr. Richard Berman and Mr. Michael Moe failed to declare their conflicts

of interest arising from being the subject of the Whistleblower Report against them and each

failed to recuse himself from numerous board meetings where the contents of the whistleblower

report and other matters including the LZGI acquisition were discussed. |

Appointment

of Board Members

Pursuant

to Regulation 73 and Regulation 100 of the Company’s Constitution, the Company appointed the four directors described below to

fill the vacancies created by the resignation of the above four directors.

Eduardo

Huerta-Mercado Herrera, age 59, Independent Director, Member of the Audit Committee, Member of Compensation Committee and Member of the

Nominating and Corporate Governance Committee

Effective

October 12, 2024, Eduardo Huerta-Mercado Herrera (“Mr. Huerta-Mercado”) was appointed to serve as a director, a member

of the Audit Committee, a member of the Compensation Committee and a member of the Nominating and Corporate Governance Committee of the

Company until the earlier of (i) the Company’s next annual meeting of shareholders called for the election of directors, (ii) until

his successor is duly elected and qualified, or (iii) until his earlier death, resignation or removal.

Mr.

Huerta-Mercado is a seasoned education professional. Since February 2020, Mr. Huerta-Mercado has served as the Director of the Innovation

and Technology Center and Global MBA program at GERENS Escuela de Postgrado in Peru. Since April 2019, Mr. Huerta-Mercado has been a

Senior Advisor and Research Scholar at Purdue University Daniels School of Business. Since January 2018, Mr. Huerta-Mercado has been

the Director at Invent College. Since January 2018, Mr. Herera has been the Director at Girls Who Venture. Since January 2017, Mr. Huerta-Mercado

has been the Director at United Technologies for Kids. In addition to his entrepreneurial education experience, he consults on public

investment and governance to the World Bank and The Inter-American Development Bank Latin America, Europe and Asia.

In

2018 Mr. Huerta-Mercado earned a Diploma in the Executive Program in General Management from the Massachusetts Institute of Technology.

In 2000, Mr. Huerta-Mercado earned a Master of Business Administration from Purdue University Daniels School of Business. In 1997, Mr.

Huerta-Mercado earned a Diploma, Integrated Manufacturing Systems from Instituto Tecnologico de Monterrey. In 1992, Mr. Huerta-Mercado

earned a Master of Science, Management of Technology from the University of California, Berkeley. In 1992, Mr. Huerta-Mercado earned

a Master of Science, Industrial Engineering & Operations Research from the University of California, Berkeley. In 1987, Mr. Huerta-Mercado

earned an Ingeniero, Ingeniero Mecanico from Pontificia Universidad Catolica del Peru.

Mr.

Huerta-Mercado is an independent director under the applicable rules and regulations of the SEC and rules of the NYSE: New York Stock

Exchange. He does not have a family relationship with any director or executive officer of the Company and has not been involved in any

transaction with the Company during the past three years that would require disclosure under Item 404(a) of Regulation S-K. There are

no arrangements or understandings with major shareholders, customers, suppliers or others, pursuant to which Mr. Huerta-Mercado was selected

as a director.

A

copy of the Director Officer Letter by and between the Company and Mr.Huerta-Mercado is attached as Exhibit 99.3 hereto. The Director

Offer Letter sets forth the following material terms:

| ● | Mr.

Huerta-Mercado’s compensation shall consist of (i) $5,000 in cash per month to be paid

quarterly in arrears by the Company and (ii) 50,000 shares of the Company’s ordinary

shares annually with the 1st grant on October 12, 2024 (the “Grant Shares”); |

| ● | The

Grant Shares are valued at the closing price on the last trading date prior to the grant; |

| ● | The

Grant Shares shall vest quarterly over 2 years following each grant date conditioned upon

the continued service of Mr. Huerta-Mercado as a director of the Company; |

| ● | Should

Mr. Huerta-Mercado cease to serve as a director on the Board, his right to any unvested options

shall terminate immediately; |

| ● | Mr.

Huerta-Mercado’s compensation will be reviewed and may be amended as determined in

accordance with the constitutional documents of the Company from time to time; |

| ● | The

Company shall reimburse Mr. Huerta-Mercado for all reasonable travel and other out-of-pocket

expenses incurred in connection with Mr. Huerta-Mercado’s services rendered; |

| ● | Mr.

Huerta-Mercado’s services can be terminated at any time upon thirty (30) days prior

written notice to the other party or such shorter period as the parties may agree upon; and |

| ● | The

Company retains the right to terminate Mr. Huerta-Mercado’s services without any prior

notice or payment in lieu of notice, in the event of any misrepresentation, misconduct, violation

of discipline, criminal offence, illegal action, breach of Company policy or any activities

amounting to moral turpitude or jeopardizing the interests of the Company, in each case to

be judged on the merits in good faith by the Company. |

Ian

Putter, age 54, Independent Director, Member and Chairman of the Audit Committee and Member of the Nominating and Corporate Governance

Committee

Effective

on October 12, 2024, the Board appointed Ian Putter (“Mr. Putter”) to serve as a director, a member and chairman of

the Audit Committee and a member of the Nominating and Corporate Governance Committee of the Company until the earlier of (i) the Company’s

next annual meeting of shareholders called for the election of directors, (ii) until his successor is duly elected and qualified, or

(iii) until his earlier death, resignation or removal.

Mr.

Putter has over 20 years of experience within international banking and fintech, as CFO, board member and other technical finance re-engineering

and integration roles. From June 2019 to April 2024, Mr. Putter was the Head of the Blockchain Domain at Standard Bank and established

the Blockchain Research Institute Africa, a think tank that collaborated with research institutes across the globe to identify blockchain

use cases relevant to Africa. Since July 2024, Mr. Putter has served as the Chief Compliance Officer and Chief Financial Officer of Tokinvest

in Dubai. Since June 2022, Mr. Putter has served as a board member of Hedera LLC.

In

2000, Mr. Putter earned a Bachelor of Commerce Honours, Accounting and Finance from the University of Johannesburg.

Mr.

Putter is an independent director under the applicable rules and regulations of the SEC and rules of the NYSE: New York Stock Exchange.

He does not have a family relationship with any director or executive officer of the Company and has not been involved in any transaction

with the Company during the past three years that would require disclosure under Item 404(a) of Regulation S-K. There are no arrangements

or understandings with major shareholders, customers, suppliers or others, pursuant to which Mr. Putter was selected as a director.

A

copy of the Director Officer Letter by and between the Company and Mr. Putter is attached as Exhibit 99.4 hereto. The Director Offer

Letter sets forth the following material terms:

| ● | Mr.

Putter’s compensation shall consist of (i) $5,000 in cash per month to be paid quarterly

in arrears by the Company and (ii) 50,000 shares granted annually with the 1st grant on October

12, 2024 (the “Grant Shares”); |

| ● | The

Grant Shares are valued at the closing price on the last trading date prior to the grant

and shall vest |

| ● | The

Grant Shares vest quarterly over 2 years following each grant date on the continued service

as a director of the Company; |

| ● | If

Mr. Putter ceases to serve as a director on the Board, his right to any unvested options

will terminate immediately; |

| ● | Mr.

Putter’s compensation will be reviewed and may be amended as determined in accordance

with the constitutional documents of the Company from time to time; |

| ● | The

Company shall reimburse Mr. Putter for all reasonable travel and other out-of-pocket expenses

incurred in connection with Mr. Putter’s services rendered; |

| ● | Mr.

Putter’s services can be terminated at any time upon thirty (30) days prior written

notice to the other party or such shorter period as the parties may agree upon; and |

| ● | The

Company retains the right to terminate Mr. Putter’s services without any prior notice

or payment in lieu of notice, in the event of any misrepresentation, misconduct, violation

of discipline, criminal offence, illegal action, breach of Company policy or any activities

amounting to moral turpitude or jeopardizing the interests of the Company, in each case to

be judged on the merits in good faith by the Company. |

Thomas

Power, age 60, Independent Director, Member of the Compensation Committee and Member and Chairman of the Nominating and Corporate Governance

Committee

Effective

on October 12, 2024, the Board appointed Thomas Power (“Mr. Power”) to serve as a director, a member of the Compensation

Committee and a member and chairman of the Nominating and Corporate Governance Committee of the Company until the earlier of (i) the

Company’s next annual meeting of shareholders called for the election of directors, (ii) until his successor is duly elected and

qualified, or (iii) until his earlier death, resignation or removal.

Mr.

Power has over thirty years of leadership experience in fast-growth technology companies. In September 2014, Mr. Power founded the BIP100

Club in the UK, an exclusive community platform for business owners focused on innovation, training, and mutual support. Since February

2008, Mr. Power has been a member of the Board of Directors at Savortex. From March 2011 to June 2014, Mr. Power was a member of the

Board of Directors at Digital Youth Academy. From June 2009 to November 2014, Mr. Power was a member of the Board of Directors at LeadORS.

From December 2014 to September 2019, Mr. Power was a member of the Board of Directors at Electric Dog. From October 2014 to July 2022,

Mr. Power was a member of the Board of Directors at 9 Spokes. From December 2010 to January 2021, Mr. Power was a member of the Board

of Directors at Digital Entrepreneur. From November 2013 to December 2022, Mr. Power was a member of the Board of Directors at The Business

Café. From January 2016 to December 2020, Mr. Power was a member of the Board of Directors at Team Blockchain. From September

2018 to December 2010, Mr. Power was a member of the Board of Directors at the Blockchain Industry Compliance and Regulation Association

(BICRA).

In

1982, Mr. Power earned a Higher National Diploma, Business, Finance & Marketing from Croydon College.

Mr.

Power is an independent director under the applicable rules and regulations of the SEC and rules of the NYSE: New York Stock Exchange.

He does not have a family relationship with any director or executive officer of the Company and has not been involved in any transaction

with the Company during the past three years that would require disclosure under Item 404(a) of Regulation S-K. There are no arrangements

or understandings with major shareholders, customers, suppliers or others, pursuant to which Mr. Power was selected as a director.

A

copy of the Director Officer Letter by and between the Company and Mr. Power is attached as Exhibit 99.5 hereto. The Director Offer Letter

sets forth the following material terms:

| ● | Mr.

Power’s compensation shall consist of (i) $5,000 in cash per month to be paid quarterly

in arrears by the Company and (ii) 50,000 shares granted annually with the 1st grant on October

12, 2024 (the “Grant Shares”); |

| ● | The

Grant Shares shall be valued at the closing price on the last trading date prior to the grant; |

| ● | The

Grant Shares vest quarterly over 2 years following each grant date conditioned on the continued

service as a director; |

| ● | Should

Mr. Power cease to serve as a director, his right to any unvested options will terminate

immediately; |

| ● | Mr.

Power’s compensation will be reviewed and may be amended as determined in accordance

with the constitutional documents of the Company from time to time; |

| ● | The

Company shall reimburse Mr. Power for all reasonable travel and other out-of-pocket expenses

incurred in connection with Mr. Power’s services rendered; |

| ● | Mr.

Power’s services can be terminated at any time upon thirty (30) days prior written

notice to the other party or such shorter period as the parties may agree upon; and |

| ● | The

Company retains the right to terminate Mr. Power’s services without any prior notice

or payment in lieu of notice, in the event of any misrepresentation, misconduct, violation

of discipline, criminal offence, illegal action, breach of Company policy or any activities

amounting to moral turpitude or jeopardizing the interests of the Company, in each case to

be judged on the merits in good faith by the Company. |

Gary

Pattison, age 54, Lead Independent Director, Member of the Audit Committee and Member and Chairman of the Compensation Committee

Effective

on October 12, 2024, the Board appointed Gary Pattison, aka Gary Wilde (“Mr. Pattison”), to serve as a director, a

member of the Audit Committee and a member and chairman of the Compensation Committee of the Company until the earlier of (i) the Company’s

next annual meeting of shareholders called for the election of directors, (ii) until his successor is duly elected and qualified, or

(iii) until his earlier death, resignation or removal.

Mr.

Pattison is an education entrepreneur, CEO mentor and rapid growth specialist with international experience working with CEOs and senior

management on rapid transformation and turnaround strategies. Since January 2022, Mr. Pattison has been the co-founder and MD of Legend

X Limited, a company specialising in professional coaching and mentoring of founder CEOs and entrepreneurs. Since November 2016, Mr.

Pattison has been the co-founder and Chief Executive Officer of Wilde Success Limited & Wilde Sucess UK Limited [now Legend X UK

Limited], a professional training and coaching company. From August 2007 to January 2022, Mr. Pattison was the co-founder and Chief Executive

Officer of Wild Creations CC, where he drove strategy formulation and the development and delivery of leadership programs, strategic

interventions, and company turnarounds.

Mr.

Pattison’s certifications include IBG Certified Executive Coach, IBG Certified Sales Coach, IBG Certified Business Coach, IBG Certified

Guerrilla Marketing Business Advisor Practitioner, Demartini Method Facilitator, Certified Eriksonian Psychotherapist, Certified NLP

Practitioner, Certified EFT Practitioner, Certified Hypnotherapist, and Certified Timeline Paradigm Techniques Practitioner.

Mr.

Pattison is an independent director under the applicable rules and regulations of the SEC and rules of the NYSE: New York Stock Exchange.

He does not have a family relationship with any director or executive officer of the Company and has not been involved in any transaction

with the Company during the past three years that would require disclosure under Item 404(a) of Regulation S-K. There are no arrangements

or understandings with major shareholders, customers, suppliers or others, pursuant to which Mr. Pattison was selected as a director.

A

copy of the Director Officer Letter by and between the Company and Mr. Pattison is attached as Exhibit 99.6 hereto. The Director Offer

Letter sets forth the following material terms:

| ● | Mr.

Pattison’s compensation shall consist of (i) $5,000 in cash per month to be paid quarterly

in arrears by the Company and (ii) 50,000 shares granted annually with the 1st grant on October

12, 2024 (the “Grant Shares”); |

| ● | The

Grant Shares shall be valued at the closing price on the last trading date prior to the grant.

The Grant Shares are vested quarterly over 2 years following each grant date conditioned

on the continued service as a director on the Board of the Company; |

| ● | If

Mr. Pattison ceases to serve as a director, his right to any unvested options will terminate

immediately; |

| ● | Mr.

Pattison’s compensation will be reviewed and may be amended as determined in accordance

with the constitutional documents of the Company from time to time; |

| ● | The

Company shall reimburse Mr. Pattison for all reasonable travel and other out-of-pocket expenses

incurred in connection with Mr. Pattison’s services rendered; |

| ● | Mr.

Pattison’s services can be terminated at any time upon thirty (30) days prior written

notice to the other party or such shorter period as the parties may agree upon; and |

| ● | The

Company retains the right to terminate Mr. Pattison’s services without any prior notice

or payment in lieu of notice, in the event of any misrepresentation, misconduct, violation

of discipline, criminal offence, illegal action, breach of Company policy or any activities

amounting to moral turpitude or jeopardizing the interests of the Company, in each case to

be judged on the merits in good faith by the Company. |

After

the resignations and appointments mentioned above, the Board of Directors of the Company and their service on the Company’s Committees

are as follows:

| Name |

|

Age |

|

Position |

| Roger

James Hamilton |

|

55 |

|

Chairman

of the Board of Directors |

| Suraj

Naik |

|

39 |

|

Director |

| Eduardo

Huerta-Mercado Herrera |

|

59 |

|

Independent

Director (Member of Audit Committee, Member Compensation Committee and Member of Nominating and Corporate Governance Committee) |

| Ian

Putter |

|

54 |

|

Independent

Director (Member and Chairman of Audit Committee and Member of Nominating and Corporate Governance Committee) |

| Thomas

Power |

|

60 |

|

Independent

Director (Member of Compensation Committee and Member and Chairman of Nominating and Corporate Governance Committee) |

| Gary

Pattison |

|

54 |

|

Lead

Independent Director (Member of Audit Committee and Member and Chairman of Compensation Committee) |

None

of the newly appointed directors named above have been the subject of any of the following during the past ten years:

| ● | a

petition under the Federal bankruptcy laws or any state insolvency law was filed by or against,

or a receiver, fiscal agent or similar officer was appointed by a court for the business

or property of such person, or any partnership in which he was a general partner at or within

two years before the time of such filing, or any corporation or business association of which

he was an executive officer at or within two years before the time of such filing; |

| ● | a

conviction in a criminal proceeding or named subject of a pending criminal proceeding (excluding

traffic violations and other minor offenses); |

| ● | the

subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated,

of any court of competent jurisdiction, permanently or temporarily enjoining him from, or

otherwise limiting, the following activities: (i) Acting as a futures commission merchant,

introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage

transaction merchant, any other person regulated by the Commodity Futures Trading Commission,

or an associated person of any of the foregoing, or as an investment adviser, underwriter

broker or dealer in securities, or as an affiliated person, director or employee of any investment

company, bank, savings and loan association or insurance company, or engaging in or continuing

any conduct or practice in connection with such activity; (ii) Engaging in any type of business

practice; or (iii) Engaging in any activity in connection with the purchase or sale of any

security or commodity or in connection with any violation of Federal or State securities

laws or Federal commodities laws; |

| ● | any

order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal

or State authority barring, suspending or otherwise limiting for more than 60 days the right

of such person to engage in any activity described in paragraph (f)(3)(i) of this section,

or to be associated with persons engaged in any such activity; |

| ● | being

found by a court of competent jurisdiction in a civil action or by the Commission to have

violated any Federal or State securities law, and the judgment in such civil action or finding

by the Commission has not been subsequently reversed, suspended, or vacated; |

| ● | being

found by a court of competent jurisdiction in a civil action or by the Commodity Futures

Trading Commission to have violated any Federal commodities law, and the judgment in such

civil action or finding by the Commodity Futures Trading Commission has not been subsequently

reversed, suspended or vacated; |

| ● | any

Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently

reversed, suspended or vacated, relating to an alleged violation of (i) Any Federal or State

securities or commodities law or regulation; or (ii) Any law or regulation respecting financial

institutions or insurance companies including, but not limited to, a temporary or permanent

injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent

cease-and-desist order, or removal or prohibition order; or (iii) Any law or regulation prohibiting

mail or wire fraud or fraud in connection with any business entity; or |

| ● | a

party to, any sanction or order, not subsequently reversed, suspended or vacated, of any

self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C.

78c(a)(26)), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange

Act (7 U.S.C. 1(a)(29)), or any equivalent exchange, association, entity or organization

that has disciplinary authority over its members or persons associated with a member. |

Class

Action Litigation

On

October 4, 2024, a class action litigation was filed against Michael Moe, Peter Ritz, LZGI International, Inc. (“LZGI”),

Roger Hamilton and the Company in the United States District Court for the Southern District of New York, Case No. 1:24-cv-07551. The

litigation contains allegations emanating from the LZGI/Company business combination. Plaintiffs in the action are seeking to recover

compensable damages caused by alleged violations of the federal securities laws and to pursue remedies under Sections 10(b) and 20(a)

of the Securities Exchange Act of 1934, and Rule 10b-5 promulgated thereunder. The Company believes that the claims in this complaint

against it are unfounded and intends to vigorously defend itself against such allegations.

Defaults

in Financing with its Institutional Investor

The

Company is currently in default with its financing arrangements with Ayrton Capital including, inter alia, its inability to obtain

shareholder approval of a proposed reverse stock split of the Company’s current shares and its inability to make the periodic payment

due on October 1, 2024 due to the investor. The Company is currently working with the investors to cure these defaults and enter into

a forbearance regarding these defaults while cures are effected.

Other

Events

On

October 15, 2024, the Company issued the press release titled “Genius Group Restructures Board with Four New Appointees”,

which press release is attached hereto as Exhibit 99.1.

The

information in this Current Report on Form 6-K (including the press release attached hereto as Exhibit 99.1) shall not be deemed to be

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act. This current report on Form 6-K (including the press release attached hereto

as Exhibit 99.1) will not be deemed an admission as to the materiality of any information contained herein.

Financial

Statements and Exhibits

| Exhibit

No. |

|

Description |

| 99.1 |

|

October 15, 2024, Press Release |

| 99.2 |

|

Addendum to Employment Contract by and between the Company and Gaurav Dama, dated October 11, 2024 |

| 99.3 |

|

Director Offer Letter by and between the Company and Eduardo Huerta-Mercado Herrera, dated October 12, 2024 |

| 99.4 |

|

Director Offer Letter by and between the Company and Ian Putter, dated October 12, 2024 |

| 99.5 |

|

Director Offer Letter by and between the Company and Thomas Power, dated October 12, 2024 |

| 99.6 |

|

Director Offer Letter by and between the Company and Gary Pattison, dated October 12, 2024 |

| 104 |

|

Cover

Page Interactive Data File |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

| Date:

October 15, 2024 |

By: |

/s/

Roger Hamilton |

| |

Name:

|

Roger

Hamilton |

| |

Title:

|

Chief

Executive Officer

(Principal

Executive Officer) |

Exhibit

99.1

Genius

Group Restructures Board with Four New Appointees

SINGAPORE,

October 15, 2024 - Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a

leading AI-powered education and acceleration group, today announced changes to its Board and Management team commensurate with its international

growth plans.

The

Company’s Board of Directors has appointed Eduardo Huerta-Mercado Herrera, Ian Putter, Thomas Power and Gary Pattison to the Board,

bringing with them extensive experience at Board and Senior Management levels in high-growth, international public companies and higher

education institutions.

Eduardo

Huerta-Mercado Herrera is a seasoned education professional and currently the Director of the Innovation and Technology Center and Global

MBA program at GERENS Escuela de Postgrado in Peru. He is also a Senior Advisor and Research Scholar to Purdue University Daniels School

of Business, Director at United Technologies for Kids, Director at Invent College and Director at Girls Who Venture. In addition to his

entrepreneurial education experience, he consults on public investment and governance to The World Bank and The Inter-American Development

Bank in Latin America, Europe and Asia.

Ian

Putter has over 20 years of experience within international banking and fintech, as CFO, board member and other technical finance re-engineering

and integration roles. He was the Head of Blockchain Domain at Standard Bank and established the Blockchain Research Institute Africa,

a think tank that collaborated with research institutes across the globe to identify blockchain use cases relevant to Africa. He is currently

the Chief Compliance Officer and Chief Financial Officer of Tokinvest in Dubai and a board member of Hedera LLC.

Thomas

Power has over thirty years of leadership experience in fast-growth technology companies. He co-founded the UK-based Ecademy, which grew

into one of the first social networks for entrepreneurs with 650,000 members. He has been Board Director at Digital Youth Academy, LeadORS,

Electric Dog, 9 Spokes, Digital Entrepreneur, The Business Café, Savortex, Team Blockchain and the Blockchain Industry Compliance

and Regulation Association (BICRA).

Gary

Pattison is an education entrepreneur with over 25 years of experience as a turnaround specialist, CEO wingman, and behavioural adaptation

strategist. He has successfully led numerous projects over the decades, including notable turnarounds of a SABMiller operation in South

Africa and a foundry for Finnish company Metso, as well as many rapid transformation initiatives, including his work with the London-listed

Grit Real Estate Income Group.

The

four new appointees to the Board are based in Peru, Dubai, England and Mauritius, respectively, aligning with the Company’s international

growth plans in South America, Europe and Asia. They will join Roger James Hamilton and Suraj Naik on the Board, and the Company will

be presenting the new appointees at the Company’s next Annual General Meeting for confirmation by shareholder approval.

The

new appointments replace four directors who are exiting the Board. Following a written request from the Company’s Senior Management

and certain shareholders for their resignations, on October 10, 2024, Michael Moe, Richard Berman, Salim Ismail and Riaz Shah submitted

their resignations to the Company, which were accepted by the Board of Directors. The resignation of the four directors was requested

due to conflicts of interest and breaches of fiduciary and statutory duties to the Company as set forth in the Form 6-K filed with the

Securities and Exchange Commission on October 15, 2024.

As

part of the Board and management restructuring, Adrian Reese has resigned as CFO and Gaurav Dama has been appointed as Interim CFO. Gaurav

Dama has been Senior Finance Manager for the Company for seven years, managing the Company’s global finance team.

On

the current restructuring, the CEO of Genius Group, Roger Hamilton, said, “Genius Group is building an increasingly international

footprint with the growth of our AI-powered education platform and Genius Cities model. This restructure aligns with our growth in Asia,

Europe and South America, and I look forward to working with our new Board and management to achieve our mission.”

Please

see the Company’s Report on Form 6-K filed with the SEC on October 15, 2024 for additional information regarding the resignations

of four directors and appointment of new directors.

About

Genius Group

Genius

Group (NYSE: GNS) is a leading provider of AI-powered, digital-first education and acceleration solutions for the future of work. Genius

Group serves 5.4 million users in over 100 countries through its Genius City model and online digital marketplace of AI training, AI

tools and AI talent. It provides personalized, entrepreneurial AI pathways combining human talent with AI skills and AI solutions at

the individual, enterprise and government levels. To learn more, please visit www.geniusgroup.net.

For

more information, please visit https://www.geniusgroup.net/

Forward-Looking

Statements

Statements

made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,”

“will”, “plan,” “should,” “expect,” “anticipate,” “estimate,”

“continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and

uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve

factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue

reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors

under the heading “Risk Factors” in the Company’s Annual Reports on Form 20-F, as may be supplemented or amended by

the Company’s Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking

statements that become untrue because of subsequent events, new information or otherwise. No information in this press release should

be construed as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

Contacts

MZ

Group - MZ North America

(949) 259-4987

GNS@mzgroup.us

www.mzgroup.us

Exhibit 99.2

Exhibit 99.3

Exhibit 99.4

Exhibit 99.5

Exhibit 99.6

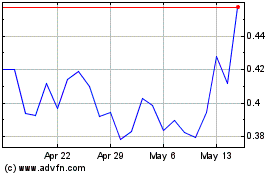

Genius (AMEX:GNS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Genius (AMEX:GNS)

Historical Stock Chart

From Dec 2023 to Dec 2024