Eagle Capital Growth Fund Declares Year-End Cash Dividend of $1.05 Per Share; Receives 5-Star Rating from Morningstar

December 05 2011 - 3:00PM

Business Wire

The Eagle Capital Growth Fund, Inc. (“Fund”) (NYSE Amex: GRF)

today declared a year-end cash dividend of $1.05 per share. The

record date for this dividend is December 16, 2011, and the payment

date is December 27, 2011.

On a preliminary basis, this dividend represents a combination

of net investment income of $0.1012 per share, and long-term

capital gains of $0.9488 per share. The net investment income is

derived solely from “qualified” dividends for U.S. Federal income

tax purposes. This preliminary tax information is subject to

change. Shareholders will receive definitive information with

respect to U.S. Federal income tax treatment in the ordinary

course. In addition, shareholders can access definitive tax

information by going to the Fund’s website after year-end.

The Fund recently received a 5-star Morningstar rating*, the

highest possible designation. With its 5-star rating, the Fund’s

investment performance places it within the top 10% of managers

pursuing similar investment strategies. “We are obviously thrilled

to receive Morningstar’s highest rating,” said Luke E. Sims, the

Fund’s President, CEO and portfolio co-manager, “since Morningstar

is the recognized authority in the field. Since we took over

investment responsibility for the Fund in mid-2007, we’ve put our

disciplined investment strategy to work. It’s heartening to see our

efforts pay off.”

Fund portfolio co-manager David C. Sims also welcomed the

Morningstar news: “When we assumed responsibility for the Fund it

held a 2-star rating. We’ve pursued our patient, conservative

investment philosophy for the past four years, and our new 5-star

rating from Morningstar reflects our success to date. Going

forward, we remain committed to research, and to continue the

disciplined execution of the investment principles enunciated by

Benjamin Graham and refined by Warren Buffett.”

The Fund is a closed-end investment company that invests

primarily in high quality growth companies. The Fund currently

holds a 5-star rating from Morningstar, Inc.* To learn more about

the Fund, please go to the Fund’s website:

www.eaglecapitalgrowthfund.com

If you have a question about the year-end dividend or other Fund

matter, please contact David C. Sims, the Fund’s Chief Financial

Officer and Chief Compliance Officer, at (414) 765-1107, or by

e-mail to: dave@simscapital.com

*Past performance does not guarantee future results.

Performance represents past performance; future performance may

be lower or higher. The investment return and principal

value will fluctuate so that an investment, in the future, may be

worth more or less than the original cost.

Morningstar, Inc. rates mutual funds from one to five stars

based on how well they’ve performed (after adjusting for risk and

accounting for all sales charges) in comparison to similar

funds. Within each Morningstar category, the top 10% of

funds receive five stars, the next 22.5% four stars, the middle 35%

three stars, the next 22.5% two stars, and the bottom 10% receive

one star. Funds are rated for up to three time periods --

three-, five- and 10 years -- and these ratings are combined to

produce an overall rating. Ratings are objective, based

entirely on a mathematical evaluation of past performance.

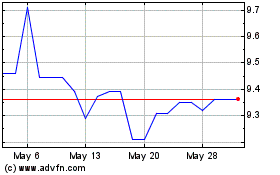

Eagle Capital Growth (AMEX:GRF)

Historical Stock Chart

From Jun 2024 to Jul 2024

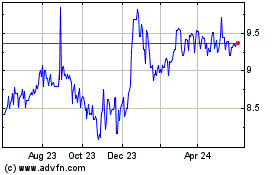

Eagle Capital Growth (AMEX:GRF)

Historical Stock Chart

From Jul 2023 to Jul 2024