000136686812/31FALSE00013668682025-02-072025-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2025

GLOBALSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-33117 | 41-2116508 |

| (State or Other Jurisdiction of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 1351 Holiday Square Blvd. | |

| Covington, | LA | 70433 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (985) 335-1500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock, par value $0.0001 per share | GSAT | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

As previously disclosed, on December 17, 2024, by written consent, following the approval and recommendation of the Strategic Review Committee of the Board of Directors (the “Board”) of Globalstar, Inc. (the “Company”) and the Board, James Monroe III, a director and Executive Chairman of the Board, and certain of Mr. Monroe’s affiliates, including FL Investment Holdings LLC, Thermo Funding Company, LLC, Thermo Funding II LLC, Globalstar Satellite, L.P., Monroe Irrevocable Educational Trust, Thermo Properties II LLC, James Monroe III Grantor Trust, Thermo Investments LP, and Thermo XCOM LLC, as the majority stockholders of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), approved amendments to the Company’s certificate of incorporation to (i) effect a reverse stock split (the “Reverse Stock Split”) of the Common Stock, at a ratio of between 1 for 10 to 1 for 25, such ratio to be determined by the Chief Executive Officer or the Chief Financial Officer of the Company (the “Authorized Officers”), in conjunction with the Board; and (ii) to reduce the 2,150,000,000 shares of Common Stock currently authorized under the Company’s certificate of incorporation to a lower amount in proportion to the Reverse Stock Split (the “Authorized Share Reduction Charter Amendment”).

Additionally, as previously disclosed, on January 21, 2025, the Company announced that it intended to voluntarily delist the shares of its Common Stock from the NYSE American LLC (“NYSE American”) and transfer its listing to the Nasdaq Global Select Market (“Nasdaq”), subject to the completion of the Reverse Stock Split.

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in each of Items 5.03 and 8.01 of this Current Report on Form 8-K is incorporated by reference herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 7, 2025, the Company filed with the Delaware Secretary of State a Certificate of Amendment to the Company’s certificate of incorporation to (i) effect the Reverse Stock Split at a ratio of 1 for 15 for each share of Common Stock effective as of February 10, 2025 at 5:30 PM ET (the “Effective Time”), (ii) effect the Authorized Share Reduction Charter Amendment to reduce the number of shares of Common Stock authorized under the certificate of incorporation in proportion to the Reverse Stock Split ratio, and (iii) change all references to the “New York Stock Exchange” in the certificate of incorporation to “Nasdaq Stock Market LLC” (the “Charter Amendments”). Other than the Charter Amendments, no additional changes have been made to the Company’s certificate of incorporation.

As a result of the Reverse Stock Split, every 15 shares of issued and outstanding Common Stock will be automatically combined at the Effective Time into one issued and outstanding share of Common Stock, without any change in the par value per share. No fractional shares will be issued as a result of the Reverse Stock Split. Any fractional shares that would otherwise have resulted from the Reverse Stock Split will be rounded up to the next whole number. The number of authorized shares of Common Stock under the Company’s certificate of incorporation as amended by the Certificate of Amendment will be reduced to 143,333,334 shares of Common Stock. Neither the Reverse Stock Split nor the Charter Amendments will have any impact on the number of shares of preferred stock that the Company is authorized to issue under its certificate of incorporation or the number of issued and outstanding shares of its Series A Preferred Stock.

Furthermore, as a result of the Reverse Stock Split, the Company expects the last day of trading of its Common Stock on the NYSE American to be February 10, 2025. The Company expects its Common Stock will begin trading on the Nasdaq on a split-adjusted basis under new CUSIP number 378973507 on February 11, 2025, the first trading day after the Effective Time, and will continue to trade under the symbol “GSAT.”

Following the Reverse Stock Split, the Company will make proportionate adjustments, as necessary, to (i) its outstanding equity awards, (ii) the number of shares authorized to be issued under the Company’s 2006 Equity Incentive Plan, and (iii) the number of shares of its Common Stock issuable pursuant to outstanding warrants in proportion to the Reverse Stock Split pursuant to the terms and conditions of the definitive agreements governing such warrants, as applicable.

Additional information about the Reverse Stock Split and Charter Amendments can be found in the Company’s definitive information statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on December 27, 2024. The foregoing description of the Certificate of Amendment is not complete and is subject to, and qualified in its entirety by reference to, the full text of the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8‑K and is incorporated herein by reference.

Item 8.01 Other Events.

The information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

The Company issued a press release on February 7, 2025 announcing its planned timing to implement the Reverse Stock Split and Charter Amendments, the transfer of the listing of its Common Stock from the NYSE American to Nasdaq and the corresponding change of the CUSIP number for its Common Stock, each as described above. Additional information about the anticipated implementation of the Reverse Stock Split and Charter Amendments and the transfer of the listing of the Common Stock from the NYSE American to Nasdaq are contained in the Company’s press release, a copy of which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Forward-Looking Statements

Certain statements contained in this Current Report on Form 8-K other than purely historical information, including, but not limited to, expectations regarding the timing of completion of the Reverse Stock Split, and delisting from NYSE American and listing on Nasdaq are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Risks and uncertainties that could cause or contribute to such differences include, without limitation, those described under Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in the Company’s other filings with the SEC. The Company undertakes no obligation to update any of the forward-looking statements after the date of this report to reflect actual results, future events or circumstances or changes in our assumptions, business plans or other changes.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 3.1 | | |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| GLOBALSTAR, INC. |

|

|

| /s/ Rebecca S. Clary |

| Rebecca S. Clary |

| Chief Financial Officer |

Date: February 7, 2025

GLOBALSTAR, INC.

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF INCORPORATION

Globalstar, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware as set forth in Title 8 of the Delaware Code (the “DGCL”), hereby certifies as follows:

1.This Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s Third Amended and Restated Certificate of Incorporation filed with the Secretary of State on May 27, 2021 (the “Certificate of Incorporation”).

2.That the Board of Directors of the Corporation duly adopted resolutions setting forth the approval of the following Certificate of Amendment of the Certificate of Incorporation of the Corporation, declaring said Certificate of Amendment to be advisable and recommending that the majority stockholders of the Corporation approve the same.

3.That thereafter, pursuant to a written consent, the necessary number of shares as required by statute voted to approve this Certificate of Amendment.

4.That the Certificate of Incorporation of this Corporation be amended by changing the Article thereof numbered “FOURTH” by:

A.Amending and restating the first sentence of the Article thereof numbered “FOURTH” in its entirety, as follows:

“The Corporation shall have the authority to issue Two Hundred Forty-Three Million Three Hundred Thirty-Three Thousand Three Hundred Thirty-Four (243,333,334) total shares of capital stock, consisting of One Hundred Million (100,000,000) shares of Preferred Stock, $0.0001 par value per share (the “Preferred Stock”), and One Hundred Forty-Three Million Three Hundred Thirty-Three Thousand Three Hundred Thirty-Four (143,333,334) shares of voting common stock, $0.0001 par value per share (the “common stock” or “Common Stock”).”

B.Inserting the following in the Article thereof numbered “FOURTH” immediately after the amended and restated first sentence thereof as amended by this Certificate of Amendment, as follows:

“Upon the filing and effectiveness (the “Effective Time”), pursuant to the General Corporation Law of the State of Delaware, of this Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation of the Corporation, each 15 shares of Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one validly issued, fully-paid and non-assessable share of Common Stock without any further action by the Corporation or the holder thereof (the “Reverse

Stock Split”). No fractional shares shall be issued in connection with the Reverse Stock Split. Holders of Common Stock who otherwise would be entitled to receive fractional shares of Common Stock because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an additional fraction of a share of Common Stock to round up to the next whole share of Common Stock in lieu of any fractional share created as a result of such Reverse Stock Split. For avoidance of doubt, the Reverse Stock Split shall also apply to the amount of shares of the Company’s Common Stock issuable upon conversion or exercise of any derivative securities, including options, restricted stock units, warrants, and convertible debt or equity, subject to the terms and conditions of any plans or agreements governing such securities.”

C. Replacing the reference to “the New York Stock Exchange” with “The Nasdaq Stock Market LLC” in the Article numbered “TWELFTH” in the Certificate of Incorporation.

5. This Certificate of Amendment has been approved and duly adopted in accordance with the provisions of Section 242 of the DGCL.

6. The effective date and time of this Certificate of Amendment shall be February 10, 2025 at 5:30 PM Eastern Time.

7. All other provisions of the Certificate of Incorporation shall remain in full force and effect.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation as of this 7th day of February, 2025.

GLOBALSTAR, INC.

By: /s/ Rebecca S. Clary

Name: Rebecca S. Clary

Title: Chief Financial Officer

Globalstar Transfers to Nasdaq Global Select Market

Globalstar to implement a 1-for-15 Reverse Stock Split effective February 11, 2025

Covington, LA, Feb. 7, 2025 -- Globalstar, Inc. (NYSE American: GSAT) (“Globalstar” or the “Company”), a next-generation telecommunications infrastructure and technology provider, today announced that it intends to (i) implement the previously-disclosed reverse stock split and related charter amendments and to voluntarily transfer the listing of its common stock, par value $0.0001 per share (the “Common Stock”) from the NYSE American LLC (“NYSE American”) effective following the close of trading on February 10, 2025, and (ii) transfer the listing of its Common Stock to the Nasdaq Global Select Market (“Nasdaq”) effective February 11, 2025. Upon transferring, Globalstar expects to meet the eligibility requirements for inclusion in the Nasdaq Composite Index.

“This strategic decision to complete a reverse stock split and uplist to the Nasdaq Global Select Market reflects the strong growth trajectory in our business. With these changes, we expect to enhance our visibility, attract a more diverse and institutional shareholder base, and improve overall liquidity,” said Dr. Paul E. Jacobs, Chief Executive Officer of Globalstar.

The Company plans to file today with the Delaware Secretary of State a Certificate of Amendment to the Company’s certificate of incorporation to (i) effect the reverse stock split at a ratio of 1 for 15 for each share of Common Stock effective as of February 10, 2025 at 5:30 PM ET (the “Effective Time”) and (ii) reduce the number of shares of Common Stock authorized under the certificate of incorporation in proportion to the reverse stock split ratio.

As a result of the implementation of the reverse stock split, every 15 shares of issued and outstanding Common Stock will be automatically combined at the Effective Time into one issued and outstanding share of Common Stock, without any change in the par value per share. No fractional shares will be issued as a result of the reverse stock split. Any fractional shares that would otherwise have resulted from the reverse stock split will be rounded up the next whole number. The number of authorized shares of Common Stock under the Company’s certificate of incorporation as amended by the Certificate of Amendment will be reduced to 143,333,334 shares of Common Stock.

Furthermore, as a result of the reverse stock split, the Company expects the last day of trading of its Common Stock on the NYSE American to be February 10, 2025. The Company expects its Common Stock will begin trading on the Nasdaq on a split-adjusted basis under new CUSIP number 378973507 on February 11, 2025, the first trading day after the Effective Time, and will continue to trade under the symbol “GSAT.”

Computershare Trust Company, N.A. (“Computershare”), the Company’s transfer agent, will act as the exchange agent for the reverse stock split. Stockholders with certificated shares will receive a letter of transmittal from Computershare with instructions on how to surrender certificates representing pre-split shares. Stockholders with book-entry shares or who hold their shares through a bank, broker or other nominee will not need to take any action.

Additional information about the reverse stock split and charter amendments can be found in the Company’s definitive information statement filed with the U.S. Securities and Exchange Commission on December 27, 2024.

About Globalstar, Inc.

Globalstar empowers its customers to connect, transmit, and communicate in smarter ways – easily, quickly, securely, and affordably – offering reliable satellite and terrestrial connectivity services as an international telecom infrastructure provider. The Company’s low Earth orbit (“LEO”) satellite constellation ensures secure data transmission for connecting and protecting assets, transmitting critical operational data, and saving lives for consumers, businesses, and government agencies across the globe. Globalstar’s terrestrial spectrum, Band 53, and its

5G variant, n53, offer carriers, cable companies, and system integrators a versatile, fully licensed channel for private networks with a growing ecosystem to improve customer wireless connectivity, while Globalstar’s XCOM RAN product offers significant capacity gains in dense wireless deployments. In addition to SPOT GPS messengers, Globalstar offers next-generation internet of things (“IoT”) hardware and software products for efficiently tracking and monitoring assets, processing smart data at the edge, and managing analytics with cloud-based telematics solutions to drive safety, productivity, and profitability. For more information, visit www.globalstar.com.

Forward-Looking Statements

Certain statements contained in this press release other than purely historical information, including, but not limited to, expectations regarding the timing of completion of the reverse stock split, and delisting from NYSE American and listing on Nasdaq are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Risks and uncertainties that could cause or contribute to such differences include, without limitation, those described under Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in the Company’s other filings with the SEC. The Company undertakes no obligation to update any of the forward-looking statements after the date of this press release to reflect actual results, future events or circumstances or changes in our assumptions, business plans or other changes.

Investor Contact Information:

investorrelations@globalstar.com

v3.25.0.1

Cover

|

Feb. 07, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 07, 2025

|

| Entity Registrant Name |

GLOBALSTAR, INC.

|

| Entity Address, City or Town |

Covington,

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33117

|

| Entity Tax Identification Number |

41-2116508

|

| Entity Address, Address Line One |

1351 Holiday Square Blvd.

|

| Entity Address, State or Province |

LA

|

| Entity Address, Postal Zip Code |

70433

|

| City Area Code |

985

|

| Local Phone Number |

335-1500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

GSAT

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001366868

|

| Current Fiscal Year End Date |

--12-31

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

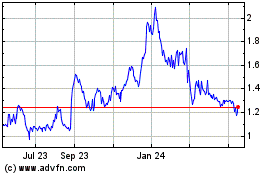

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

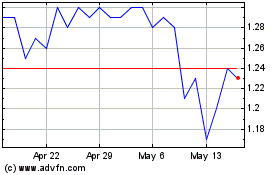

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Feb 2024 to Feb 2025