0001643988

false

0001643988

2023-09-12

2023-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 12, 2023

Loop Media, Inc.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-41508 |

|

47-3975872 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

2600 West Olive Avenue, Suite 54470

Burbank, CA |

|

91505 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(213) 436-2100

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common stock, $0.0001 par value per share |

|

LPTV |

|

The NYSE American, LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry into a Material Definitive Agreement. |

Note Conversion Agreement

As

previously disclosed, on April 25, 2022, Loop Media, Inc. (the “Company”) entered into a Non-Revolving

Line of Credit Loan Agreement (the “2022 Loan Agreement”) with Excel Family Partners, LLLP (the “Holder”

or “Excel”), an entity managed by Bruce Cassidy, chairman of the Company’s board of directors (the “Board”),

for principal amount of up to $4,022,986. As of September 12, 2023, $4,444,060 of principal and interest were outstanding (the “2022

Loan Amount”). On September 12, 2023, the Company and the Holder entered into a Note Conversion Agreement (the “Note

Conversion Agreement”), pursuant to which the Holder agreed to convert the 2022 Loan Amount owed under the 2022 Loan Agreement

into 6,005,487 shares (the “Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common

Stock”), at a conversion price per share of $0.74. The closing price of the Common Stock on the NYSE American on September 11,

2023 was $0.535 per share. After the conversion of the 2022 Loan Amount and the issuance of the Shares, there was no principal or interest

remaining under the 2022 Loan Agreement. The Note Conversion Agreement contains customary representations, warranties, agreements and

obligations of the parties.

Pay Off Agreement

As previously disclosed, effective as of May 10, 2023, the Company

entered into a Secured Non-Revolving Line of Credit Loan Agreement (the “2023 Secured Loan Agreement”) with several

individuals and institutional lenders (each individually a “Lender” and collectively, the “Lenders”)

for aggregate loans of up to $4.0 million (the “2023 Secured Loan”). The 2023 Secured Loan matures twenty-four (24)

months from the date of the 2023 Secured Loan Agreement, or May 10, 2025, and accrues interest, payable semi-annually in arrears,

at a fixed rate of interest equal to twelve (12) percent per year. Excel committed to be a Lender under the 2023 Secured Loan Agreement

for an aggregate loan of $2.65 million. As of September 11, 2023, Excel had not

loaned any funds to the Company under the 2023 Secured Loan.

In connection with the 2023 Secured Loan, we agreed

to issue a warrant to each Lender, upon drawdown, under the 2023 Secured Loan Agreement to purchase up to an aggregate of 369,517 shares

of our Common Stock. The warrants have an exercise price of $4.33 per share, expire on May 10, 2026, and shall be exercisable

at any time prior to such date (each, a “Warrant”).

As previously disclosed, effective May 31, 2023, the Company

entered into a Secured Non-Revolving Line of Credit Loan Agreement with Excel (the “$2.2M 2023 Loan Agreement”), for

principal amount of up to $2,200,000 (the “$2.2M 2023 Loan”). The $2.2M 2023 Loan matured ninety (90) days from the

date of the $2.2M 2023 Loan Agreement, or August 29, 2023. As previously disclosed, effective August 29, 2023, the Company

entered into a letter agreement with Excel to amend the $2.2M 2023 Loan Agreement to extend the maturity date of the $2.2M 2023 Loan

from ninety (90) days to one hundred twenty (120) days from the date of the $2.2M 2023 Loan Agreement, or September 28, 2023. As

of September 12, 2023, $2,266,733 of principal and interest were outstanding (the “$2.2M 2023 Loan Amount”).

On September 12, 2023, the Company and Excel entered into a Pay

Off Leter Agreement (the “Pay Off Agreement”), pursuant to which the Company agreed to pay off the $2.2M 2023 Loan

Amount by refinancing the $2.2M 2023 Loan Amount to be included as part of the obligations under the 2023 Secured Loan Agreement. Under

the terms of the 2023 Secured Loan Agreement, Excel will be issued a Warrant to purchase 209,398 shares of Common Stock.

The Audit Committee of the Board and the Board approved the Note Conversion

Agreement and the Pay Off Agreement pursuant to the Company’s Policy and Procedures for Related Person Transactions.

The foregoing descriptions of the Note Conversion Agreement and the

Pay Off Agreement are not complete and are qualified in their entirety by reference to the full text of the Note Conversion Agreement

and the Pay Off Agreement, copies of which are filed herewith as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current

Report on Form 8-K and are incorporated by reference herein.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information contained above in Item 1.01 related to the 2022 Loan

Agreement, the Note Conversion Agreement, the 2023 Secured Loan Agreement, the $2.2M 2023 Loan Agreement and the Pay Off Agreement is

hereby incorporated by reference into this Item 2.03.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The information contained above in Item 1.01 related to the Note Conversion

Agreement and the Warrant issued to Excel is hereby incorporated by reference into this Item 3.02. The Shares and Warrant have not been

registered under the Securities Act of 1933, as amended (the “Securities Act”), and are being offered pursuant to the

exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

| Item 7.01. | Regulation FD Disclosure. |

On September 13, 2023, the Company issued a press release announcing

the Note Conversion Agreement and the Pay Off Agreement. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K under Item

7.01, including the information contained in Exhibit 99.1 is being furnished to the Securities and Exchange Commission, and shall

not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities

of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act,

except as shall be expressly set forth by a specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

Number |

|

Description |

| |

|

|

| 10.1 |

|

Note Conversion Agreement, dated September 12, 2023, by and between the Company and Excel Family Partners, LLLP |

| |

|

|

| 10.2 |

|

Pay Off Agreement, dated September 12, 2023, by and between the Company and Excel Family Partners, LLLP |

| |

|

|

| 99.1 |

|

Press Release, dated September 13, 2023 |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LOOP MEDIA, INC. |

| |

|

|

| Dated: September 13, 2023 |

By: |

/s/ Jon Niermann |

| |

Name: |

Jon Niermann |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

NOTE CONVERSION AGREEMENT

This Note

Conversion Agreement (this “Agreement”) is made and entered into as of September 12, 2023 (the “Effective

Date”), by and among Loop Media, Inc., a Nevada corporation (the “Company”), and Excel Family Partners,

LLLP, a Florida limited liability limited partnership (the “Holder”).

Recitals

Whereas,

on April 25, 2022, the Company and the Holder entered into a Non-Revolving Line of Credit Loan Agreement (the “2022 Loan

Agreement”) under which $4,444,060.11 of principal and interest are outstanding as of the date of this Agreement (the “Loan

Amount”); and

Whereas,

the Company and the Holder desire to convert the Loan Amount, including outstanding interest thereon, into shares of the Company’s

common stock (the “Common Stock”), par value $0.0001 per share, at a conversion price per Share of $0.74 (the “Conversion

Price”).

Agreement

Now,

Therefore, in consideration of the premises and the covenants and agreements set forth herein, and other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Conversion.

On the Effective Date, the Loan Amount shall be converted at the Conversion Price, resulting in the issuance by the Company to the

Holder of 6,005,487 shares of Common Stock (the “Shares”). The Company and the Holder agree that after the conversion

of the Loan Amount and the issuance of the Shares, there will be no principal or interest outstanding or due under the 2022 Loan Agreement.

2. Holder’s

Representations and Warranties. The Holder represents and warrants to the Company that:

(a) Understandings

or Arrangements. The Holder is acquiring the Shares as principal for its own account and has no direct or indirect arrangement

or understandings with any other persons to distribute or regarding the distribution of such Shares (this representation and

warranty not limiting the Holder’s right to sell the Shares in compliance with applicable federal and state securities laws).

The Holder understands that the Shares are “restricted securities” and have not been registered under the Securities Act

of 1933, as amended (the “Securities Act”) or any applicable state securities law and is acquiring such Shares as

principal for his, her or its own account and not with a view to or for distributing or reselling such Shares or any part thereof in

violation of the Securities Act or any applicable state securities law, has no present intention of distributing any of such Shares

in violation of the Securities Act or any applicable state securities law and has no direct or indirect arrangement or

understandings with any other persons to distribute or regarding the distribution of such Shares in violation of the Securities Act

or any applicable state securities law (this representation and warranty not limiting the Holder’s right to sell such Shares

pursuant in compliance with applicable federal and state securities laws). The Holder is acquiring the Shares in the ordinary course

of its business.

(b) Holder

Status. At the time the Holder was offered the Shares, it was, and as of the date hereof it is an “accredited

investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9), (a)(12), or (a)(13) under the Securities

Act.

3. Miscellaneous.

(a) Successors

and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and permitted assigns.

(b) Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of the Agreement shall be governed by and

construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of

law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions

contemplated by this Agreement (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders,

partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York.

Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of New York, Borough

of Manhattan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed

herein (including with respect to the enforcement of this Agreement), and hereby irrevocably waives, and agrees not to assert in any Proceeding,

any claim that it is not personally subject to the jurisdiction of any such court, that such Proceeding is improper or is an inconvenient

venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any

such proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party

at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service

of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner

permitted by law.

(c) Execution.

This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to each other party, it being understood that

the parties need not sign the same counterpart. In the event that any signature is delivered by electronic mail, or otherwise by electronic

transmission (including any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g.,www.docusign.com) evidencing

an intent to sign this Agreement, such electronic mail or other electronic transmission shall create a valid and binding obligation of

the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were

an original. Execution and delivery of this Agreement by electronic mail or other electronic transmission is legal, valid and binding

for all purposes.

(d) Severability.

In the event that any provision of this Agreement, or the application thereof, becomes or is declared by a court of competent jurisdiction

to be illegal, void or unenforceable, the remainder of this Agreement shall continue in full force and effect and shall be interpreted

so as reasonably to effect the intent of the parties hereto. The parties hereto further agree to use their commercially reasonable efforts

to replace such void or unenforceable provision of this Agreement with a valid and enforceable provision that shall achieve, to the extent

possible, the economic, business and other purposes of such void or unenforceable provision.

(e) Entire

Agreement. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid,

illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full

force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable

efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term,

provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed

the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal,

void or unenforceable.

(f) Amendment;

Waiver. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument signed, in

the case of an amendment, by the Company and the Holder. No waiver of any default with respect to any provision, condition or requirement

of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other

provision, condition or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner

impair the exercise of any such right.

(g) Rules of

Construction. The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise this

Agreement and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting

party shall not be employed in the interpretation of this Agreement or any amendments thereto.

[Remainder

of page intentionally left blank]

In

Witness Whereof, the Company and the Holder have executed this Note Conversion Agreement

as of the date first set forth above.

| |

COMPANY: |

| |

|

| |

LOOP MEDIA, INC. |

| |

|

| |

By: |

/s/ Jon Niermann |

| |

Name: |

Jon Niermann |

| |

Title: |

Chief Financial Officer |

| |

|

| |

|

| |

HOLDER: |

| |

|

| |

EXCEL FAMILY PARTNERS, LLLP |

| |

By: Fortress Holdings, LLC, its General

Partner |

| |

|

| |

By: |

/s/ Bruce A. Cassidy, Sr. |

| |

Name: |

Bruce A. Cassidy, Sr. |

| |

Title: |

Manager |

Exhibit 10.2

As of September 12, 2023

Loop Media, Inc.

2600 West Olive Avenue, Suite 5470

Burbank, CA 91505

Attn: Jon Niermann

Re: Pay-Off Letter

Dear Jon:

Reference is made to the following:

Secured Non-Revolving Line of Credit Loan Agreement for principal

amount of up to $2,200,000, dated as of May 31, 2023 (as may be amended, restated, amended and restated, supplemented or modified

from time to time, the “Loan Agreement”), between Loop Media, Inc., a Nevada corporation (“Borrower”)

and Excel Family Partners, LLLP, a Florida limited liability limited partnership (“Lender”), and that certain $2,200,000

Secured Non-Revolving Line of Credit Promissory Note dated as of May 31, 2023 (the “Note”), issued by the Borrower to

the Lender.

Capitalized terms used herein but not otherwise defined herein shall

have the meanings ascribed to such terms in the Loan Agreement.

Borrower has advised Lender that it intends to repay all amounts due

and owing under the Loan Agreement as of September 12, 2023 (the “Computation Date”) and has requested that Lender

confirm pay-off amounts for the amounts due and owing by Borrower to Lender under the Loan Agreement and other Loan Documents (such amounts,

collectively, the “Obligations”).

The pay-off amounts for Borrower for all outstanding Obligations under

the Loan Agreement and other Loan Documents as of the Computation Date is $2,266,733.34 (collectively, the “Pay-Off Amount”).

The Pay-Off Amount shall be repaid by refinancing the Pay-Off Amount to be included as part of the obligations under that certain Secured

Non-Revolving Line of Credit Loan Agreement, dated as of May 10, 2023 (the “Existing Loan Agreement”).

Subject to, and effective immediately upon receipt of the Line of Credit

Advance Request, without further action on the part of the parties hereto, (i) the Loan Agreement, the Note and all Obligations thereunder

shall be deemed terminated all without any further action being required to effectuate the foregoing, (ii) all security interests

and other liens granted to or held for the benefit of the Lender as security for the Obligations shall be automatically satisfied in full,

released and discharged and (iii) such Pay-Off Amount shall be deemed an outstanding obligation under the Existing Loan Agreement

and shall be governed by the terms thereof.

This letter may be executed by any of the parties hereto on separate

counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed

signature page of this letter by facsimile or other electronic transmission shall be effective as delivery of a manually executed

counterpart hereof.

This letter shall be governed by the laws of the State of Florida and

shall become effective only when signed by Lender and accepted by Borrower by its due execution in the space provided below.

[SIGNATURE PAGE FOLLOWS]

| |

Very truly yours, |

| |

|

| |

EXCEL FAMILY PARTNERS, LLLP |

| |

By: Fortress Holdings, LLC, its General

Partner |

| |

|

| |

|

| |

By: |

/s/ Bruce A. Cassidy, Sr. |

| |

|

Name: Bruce A. Cassidy, Sr. |

| |

|

Title: Manager |

| Acknowledged and Accepted: |

|

| |

|

| LOOP MEDIA, INC. |

|

| |

|

| |

|

| By: |

/s/ Jon Niermann |

|

| Name: Jon Niermann |

|

| Title: Chief Executive Officer |

|

Exhibit 99.1

Loop Media Strengthens Balance Sheet

Conversion of significant debt to equity and

extension of short-term note delivers significantly

improved debt position for the company as it looks forward to the year ahead

Glendale, CA

– September 13, 2023 — Loop Media, Inc.(NYSE American: LPTV) (“Loop Media”), the free streaming

television media company for businesses which provides over 2 billion video views every month via restaurants, retail businesses, office

buildings, doctors’ offices, airports, bars and college campuses, has converted approximately $4.4 million of short-term debt and

accrued interest into 6,005,487 shares of Loop Media common stock, at a conversion price of $0.74 per share – a premium to the closing

price of Loop Media’s common stock on NYSE American on September 11, 2023 of $0.535 per share. In addition, Loop Media has

also rolled over approximately $2.3 million of short-term indebtedness due in September 2023 into Loop Media’s $4.0 million

line of credit due in May 2025. These steps are intended to help shore up Loop Media’s balance sheet as it moves forward into

its new fiscal year starting October 1, 2023, by eliminating $4.4 million of indebtedness on the balance sheet and moving $2.3 million

of short-term debt into long-term debt. These transactions eliminate 6.7 million of short-term debt from Loop Media’s balance sheet,

which constitutes a majority of Loop’s short-term debt.

“Last week, we held an extensive board session,

annual budget meeting and business review for the challenges experienced over the last few quarters, as well as the business plan and

expectations for fiscal 2024, and despite a challenging 2023, I am confident in Loop Media’s business model and management

team. To evidence that confidence and to further support our business and all shareholders and other stakeholders, I have gladly

agreed to support Loop and improve its debt position by converting a significant amount of debt due to myself and affiliated parties into

equity as well as extending other short-term debt into longer term debt.” said Bruce Cassidy, Chairman of Loop Media, Inc.

“While the recent declines in our share price is not a welcomed development, I am confident in the fundamentals of the business,

the overall opportunity and the steps being taken by management to reduce costs and strengthen the business, as we seek to maintain and

improve growth,” Mr. Cassidy continued.

“We appreciate the support of our Chairman

and the rest of our board after their review of our growth plans for the coming year. Our team intends to focus on implementing our business

plan and continue to seek opportunities to grow our business while focusing on strengthening the bottom line,” said Jon Niermann,

CEO and Co-founder. “We believe that fiscal year 2024 will provide some unique opportunities for us, and that through the implementation

of our business plan, we can achieve both top and bottom line growth.”

In addition to the conversion of debt into equity

and extending the due date of certain of our short-term debt, Loop Media has further tightened cost control and has identified certain

areas for further reductions in our SG&A for fiscal 2024, all while maintaining our commitment to the growth of its revenue and platform

distribution. Senior Management of Loop Media is dedicated to the business and its stakeholders and has agreed to significantly reduce

their salaries for the time being. In addition, no management bonuses will be paid for fiscal 2023 and several cost centers will be reduced

in size while sales, revenue and marketing will continue to aggressively expand and push forward with the strategic plans where it makes

sense to do so.

On September 12, 2023, Loop Media and Excel

Family Partners, LLLP (“Excel”) entered into a Note Conversion Agreement, pursuant to which Excel agreed to convert $4.4 million

of short-term debt, including interest, under the Loop Media non-revolving line of credit agreement entered into on April 25, 2022

(the “Excel 2022 Debt"), into 6,005,487 shares of Loop Media common stock at a per share price of $0.74. Loop Media and Excel

also entered into a Pay Off Letter Agreement on September 12, 2023, pursuant to which Loop Media paid off $2.27 million of short-term

debt plus accrued interest due September 28, 2023, under Loop Media’s secured non-revolving line of credit loan agreement,

entered into on May 31, 2023 (the “Excel 2023 Debt”). Excel agreed to convert this amount into longer term debt due May 10,

2025, under the secured non-revolving line of credit loan agreement entered into on May 10, 2023, between Loop Media and various

lenders, including Excel (the “2025 LOC”). As a result of these transactions, the $6.7 million in principal and interest aggregate

indebtedness under the Excel 2022 Debt and the Excel 2023 Debt will be extinguished and indebtedness under the 2025 LOC will be increased

by $2.27 million. Under the terms of the 2025 LOC, Excel will also be issued a warrant to purchase 209,398 shares of Loop Media common

stock. The warrant has an expiration date of May 10, 2026, and is exercisable immediately at an exercise price of $4.33 per share.

After these transactions, outstanding principal amount of indebtedness under the 2025 LOC will be $3.17 million.

The offer and sale of the securities described

above are being offered in a private placement under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”), and Regulation D promulgated thereunder and, along with the shares of common stock underlying the warrants, have not been

registered under the Securities Act, or applicable state securities laws. Accordingly, the securities issued in the private placement

and the shares of common stock underlying the warrants may not be offered or sold in the United States except pursuant to an effective

registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities

laws.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or other jurisdiction.

About Loop Media, Inc.

Loop Media, Inc. (“Loop

Media”) (NYSE American: LPTV) is a leading digital out of home (“DOOH”) TV and digital signage platform optimized for

businesses, providing free music video, news, sports, and entertainment channels through its Loop TV service. Loop Media is the leading

company in the U.S. licensed to stream music videos to businesses through its proprietary Loop Player.

Loop Media’s digital video content reaches millions of viewers

in DOOH locations including bars/restaurants, office buildings, retail businesses, college campuses, airports and on free ad-supported

TV platforms and at local gas stations on GSTV terminals in the United States.

Loop is fueled by one of the largest and most important short form

entertainment libraries that includes music videos, movie trailers and live performances. Loop Media’s non-music channels cover

a multitude of genres and moods and include movie trailers, sports highlights, lifestyle and travel videos, viral videos and more. Loop

Media’s streaming services generate revenue from advertising, sponsorships, and from subscriptions.

To learn more about Loop Media products

and applications, please visit us online at Loop.tv

Follow us on social:

Instagram: @loopforbusiness

X (Twitter): @loopforbusiness

LinkedIn: https://www.linkedin.com/company/loopforbusiness/

Safe Harbor Statement and Disclaimer

This

news release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, Loop Media’s expected

2023 results, ability to compete in the highly competitive markets in which it operates, statements regarding Loop Media’s ability

to develop talent and attract future talent, the success of strategic actions Loop Media is taking, and the impact of strategic transactions.

Forward-looking statements give our current expectations, opinion, belief or forecasts of future events and performance. A statement

identified by the use of forward-looking words including "will," "may," "expects," "projects,"

"anticipates," "plans," "believes," "estimate," "should," and certain of the other

foregoing statements may be deemed forward-looking statements. Although Loop Media believes that the expectations reflected in such forward-looking

statements are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be

materially different from those suggested or described in this news release. Investors are cautioned that any forward-looking statements

are not guarantees of future performance and actual results or developments may differ materially from those projected. The forward-looking

statements in this press release are made as of the date hereof. Loop Media takes no obligation to update or correct its own forward-looking

statements, except as required by law, or those prepared by third parties that are not paid for by Loop Media. Loop Media’s SEC

filings are available at www.sec.gov.

Loop Media Press Contact – PhillComm

Global PR Agency

Jon

Lindsay Phillips

jon@phillcomm.global

Investor Relations – Loop Media

ir@loop.tv

v3.23.2

Cover

|

Sep. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 12, 2023

|

| Entity File Number |

001-41508

|

| Entity Registrant Name |

Loop Media, Inc.

|

| Entity Central Index Key |

0001643988

|

| Entity Tax Identification Number |

47-3975872

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2600 West Olive Avenue

|

| Entity Address, Address Line Two |

Suite 54470

|

| Entity Address, City or Town |

Burbank

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91505

|

| City Area Code |

213

|

| Local Phone Number |

436-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

LPTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

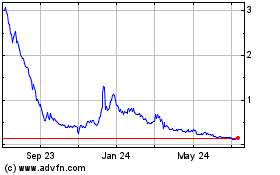

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Apr 2024 to May 2024

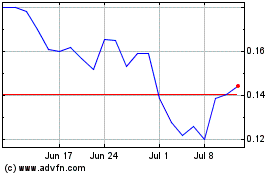

Loop Media (AMEX:LPTV)

Historical Stock Chart

From May 2023 to May 2024