As

filed with the Securities and Exchange Commission on December 18, 2024.

Registration

No. 333-_______

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

THE

MARYGOLD COMPANIES, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

90-1133909 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

Number) |

120

Calle Iglesia

Unit

B

San

Clemente, CA 92672

Telephone:

949.429.5370

(Address,

including zip code, and telephone number, including area code,

of

registrant’s principal executive offices)

Carolyn

M. Yu, Esq.

Chief

Legal Officer and Chief Continuity Officer

The

Marygold Companies, Inc.

120

Calle Iglesia

Unit

B

San

Clemente, CA 92672

Telephone:

949.429.5370

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of communications to:

Neil

R.E. Carr

Somertons,

PLLC

1025

Connecticut Avenue, N.W., Suite 1000

Washington,

D.C. 20036

Telephone:

202.459.4651

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☐

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

|

Non-accelerated

filer ☒ |

| |

|

|

|

|

| Smaller

reporting company ☒ |

|

Emerging

growth company ☐ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

Currently,

the registrant has a Registration Statement on Form S-3 (File No. 333-264586), initially filed with the Securities and Exchange Commission

(“SEC”) on April 29, 2022, and declared effective by the SEC on May 12, 2022 (“Prior Registration Statement”).

Pursuant to the Prior Registration Statement, $100,000,000 of securities were registered, none of which have been sold as of the date

hereof, and all of which are being carried forward in this registration statement (“unsold securities”). The aggregate

filing fee paid in connection with such unsold securities was $9,270. In accordance with Rule 415(a)(6) under the Securities Act

of 1933, as amended (“Securities Act”), (a) the registration fee applicable to such unsold securities is being carried forward to this registration statement

and will continue to be applied to such unsold securities, and (b) the offering of the securities pursuant to the Prior Registration

Statement will be deemed terminated as of the effective date of this registration statement. This registration statement contains a base

prospectus covering the offer, issuance and sale of up to a maximum aggregate offering price of $100,000,00 of the registrant’s

common stock, preferred stock, warrants to purchase preferred stock or common stock, and units of securities that may include these securities.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not

soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to completion, dated December 18, 2024

PRELIMINARY

PROSPECTUS

THE

MARYGOLD COMPANIES, INC.

$100,000,000

Common

Stock

Preferred

Stock

Warrants

Units

We

may offer and sell from time to time in one or more offerings under this prospectus shares of common stock (“common stock”),

preferred stock (“preferred stock”), and warrants to purchase shares of preferred stock or common stock (“warrants”)

of The Marygold Companies, Inc., a Nevada corporation (“Marygold,” “Company,” “we,” “our,”

or “us”), or any combination of the foregoing, either individually or as units of any one or more of such securities

(“units”). We refer to the common stock, preferred stock, warrants and units collectively as “securities.”

The aggregate initial offering price of all securities that may be offered and sold under this prospectus will not exceed $100,000,000.

This prospectus provides a general description of the securities we may offer and certain other information about us. We may offer the

securities in amounts, at prices, and on terms determined at the time of the offering.

We

will provide the specific terms of the securities to be offered and the specific manner in which they may be offered in one or more supplements

to this prospectus, which may also supplement, update or amend information contained in this prospectus. We may also authorize one or

more free writing prospectuses to be provided to you in connection with these offerings. You should read this prospectus, any accompanying

prospectus supplement, and any related free writing prospectus, together with the documents we incorporate herein by reference, carefully

before you invest in any of these securities.

We

may sell these securities on a continuous or delayed basis directly, through agents, dealers or underwriters as designated from time

to time, or through a combination of these methods. See “Plan of Distribution.” We may also describe the plan of distribution

for any particular offering of our securities in a prospectus supplement. We reserve the sole right to accept and, together with any

agents, dealers and underwriters, the right to reject, in whole or in part, any proposed purchase of the securities. If any agent, dealer

or underwriter is involved in the sale of any securities offered by this prospectus, the applicable prospectus supplement will set forth

any applicable commissions or discounts. Our net proceeds from the sale of the securities also will be set forth in the applicable prospectus

supplement, as well as the specific terms of the plan of distribution.

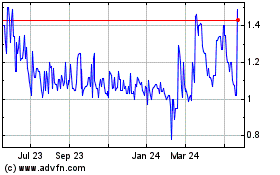

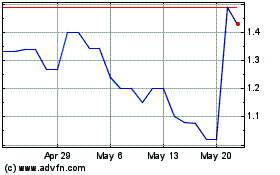

Our

common stock is listed on the NYSE American under the symbol “MGLD.” The last reported sale price of the common stock on

the NYSE American on December 16, 2024, was $1.50 per share.

As

of December 16, 2024, the aggregate market value of our common stock held by non-affiliates, or our “public float,”

pursuant to General Instruction I.B.6 of the Form S-3 is approximately $13.3 million, which is calculated based on 8,840,779

shares of our common stock outstanding held by non-affiliates and a price of $1.50 per share, the closing price of our common

stock on December 16, 2024, as reported on the NYSE American. During the prior 12 calendar month period that ends on and includes

the date of this prospectus, we have not offered or sold any of our common stock or other securities pursuant to General Instruction

I.B.6 to the Form S-3. Pursuant to General Instruction I.B.6 to the Form S-3, in no event will we sell securities registered on this

registration statement in a public primary offering with an aggregate market value exceeding more than one-third of our public float

in any 12-month period so long as our public float remains below $75.0 million.

Investing

in our securities involves a high degree of risk. See “Risk Factors” contained herein for more information on these

risks. Additional risks will be described in the related prospectus supplements under the heading “Risk Factors.”

You should review that section of the related prospectus supplements for a discussion of matters that investors in our securities should

consider.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is December __, 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus, any prospectus supplement or amendment hereto or any free writing prospectus

we furnish to you. We have not authorized anyone to provide you with different information. We may offer to sell, and seek offers to

buy, shares of our securities only in jurisdictions where offers and sales are permitted.

ABOUT

THIS PROSPECTUS

We

have filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-3 under the Securities

Act of 1933, as amended (“Securities Act”), with respect to the securities registered hereby using a “shelf”

registration process. Under this shelf registration process, we may offer to sell any combination of the securities described in this

prospectus in one or more offerings for an aggregate offering price of up to $100,000,000. This prospectus does not contain all of the

information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer

to the registration statement, including its exhibits. This prospectus provides you with a general description of the securities which

may be offered. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information

relating to these offerings. Each time we offer securities for sale, we will provide a prospectus supplement that contains specific information

about the terms of that offering. Any prospectus supplement may also add, or update, information contained in this prospectus. You should

read both this prospectus, any prospectus supplement, and any free writing prospectus, including all documents incorporated herein or

therein by reference, together with additional information described below under “Where You Can Find Additional Information”

and “Incorporation of Documents by Reference.”

We

have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained

or incorporated by reference in this prospectus, any accompanying prospectus supplement, or any related free writing prospectus that

we may authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference

in this prospectus or any accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided

to you. This prospectus, the accompanying prospectus supplement and any related free writing prospectus, if any, do not constitute an

offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do

this prospectus, the accompanying prospectus supplement, or any related free writing prospectus, if any, constitute an offer to sell

or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction.

You

should not assume that the information contained in this prospectus, any applicable prospectus supplement, or any related free writing

prospectus is accurate on any date subsequent to the date of this prospectus or that any information we have incorporated herein by reference

is correct on any date subsequent to the date of the document incorporated by reference (as our business, financial condition, results

of operations and prospects may have changed since that date), even though this prospectus, any applicable prospectus supplement, or

any related free writing prospectus is delivered or securities are sold on a later date.

You

should note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus may not be used to consummate sales of our securities, unless it is accompanied by a prospectus supplement. To the extent

there are inconsistencies between any prospectus supplement, this prospectus and any documents incorporated by reference, the document

with the most recent date will control.

As

permitted by the rules and regulations of the SEC, the registration statement, of which this prospectus forms a part, includes additional

information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the

SEC’s web site or at the SEC’s offices described below under the heading “Where You Can Find Additional Information.”

In

this prospectus, unless the context otherwise requires, references to “Marygold,” “Company,” “we,”

“our,” or “us,” refer to The Marygold Companies, Inc., a Nevada corporation, and its subsidiaries.

Our logo, trademarks and service marks are the property of Marygold. Other trademarks or service marks appearing in this prospectus are

the property of their respective holders.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any accompanying prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein

or therein contain, in addition to historical information, certain forward-looking statements within the meaning of Section 27A of the

Securities Act or 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended (“Securities Exchange Act”), that include information relating to future events, future financial performance,

strategies, expectations, competitive environment, regulatory environment and availability of resources. Such forward-looking statements

include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements

of historical fact. These forward-looking statements are based on our current expectations and projections about future events, and they

are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those

expressed or implied in such statements.

In

some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,”

“estimates,” “plans,” “believes,” “seeks,” “may,” “should”, “could”

or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties

that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their

entirety by reference to the factors discussed throughout this prospectus or any accompanying prospectus supplement or incorporated herein

by reference.

Risks,

uncertainties and other factors that may cause our actual results, performance or achievements to be different from those expressed or

implied in our written or oral forward-looking statements may be found in this prospectus and any accompanying prospectus supplement

under the heading “Risk Factors” and in our Annual Report on Form 10-K for the year ended June 30, 2024, under the

headings “Risk Factors” and “Business,” and in our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024, under the heading “Risk Factors,” as the same may be amended, supplemented or superseded

from time to time by other reports we file with the SEC in the future and any prospectus supplement related to a particular offering.

Forward-looking

statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no

obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting

forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking

statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

New

factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the

impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus, any

accompanying prospectus supplement and incorporated herein by reference, and particularly our forward-looking statements, by these cautionary

statements.

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere or incorporated by reference into this prospectus. It may not contain all

the information that may be important to you. You should read this entire prospectus, the accompanying prospectus supplement, including

all documents incorporated herein by reference, carefully, especially the “Risk Factors” contained in or incorporated by

reference into this prospectus and any accompanying prospectus and under similar headings in the other documents that are incorporated

by reference into this prospectus and accompanying prospectus supplement, including our Annual Report on Form 10-K for the year ended

June 30, 2024, our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and our other SEC filings, as well as our

consolidated financial statements and related notes and other information incorporated by reference into this prospectus and accompanying

prospectus supplement before making an investment decision with respect to our securities. Please see the sections titled “Where

You Can Find Additional Information” and “Incorporation of Documents by Reference” in this prospectus.

Overview

of Our Business

The

Marygold Companies, Inc., a Nevada corporation (together with its subsidiaries, “Marygold,” “Company,” “we,”

“our” or “us”), is a holding company which operates through its wholly owned subsidiaries engaged in certain

diverse business activities listed below:

| |

● |

Fund

Management - USCF Investments, Inc., a Delaware corporation (“USCF Investments”), with corporate headquarters in Walnut

Creek, California and its wholly-owned subsidiaries: |

| |

○ |

United

States Commodity Funds, LLC, a Delaware limited liability company (“USCF LLC”), and |

| |

○ |

USCF

Advisers, LLC, a Delaware limited liability company (“USCF Advisers”). The principal place of business for each of USCF

LLC and USCF Advisers is in Walnut Creek, California. |

| |

● |

Food

Products – Gourmet Foods, Ltd., a registered New Zealand company located in Tauranga, New Zealand and its wholly-owned subsidiary,

Printstock Products Limited, a registered New Zealand company, with its principal manufacturing facility in Napier, New Zealand. |

| |

● |

Security

Systems – Brigadier Security Systems (2000) Ltd., a Canadian registered corporation, with locations in Regina and Saskatoon,

Saskatchewan, Canada. |

| |

● |

Beauty

Products - Kahnalytics, Inc., a California corporation, doing business as “Original Sprout,” located in San Clemente,

California. |

| |

● |

Financial

Services – United States and Great Britain: |

| |

○ |

Marygold

& Co., a Delaware corporation, based in Denver, Colorado, and its wholly-owned subsidiary, Marygold & Co. Advisory Services,

LLC, a Delaware limited liability company, whose principal business office is in New Albany, Ohio; |

| |

○ |

Marygold

& Co., (UK) Limited, a private limited company incorporated and registered in England and Wales, whose registered office is in

London, England, and its wholly-owned subsidiaries: |

| |

■ |

Marygold

& Co. Limited f/k/a Tiger Financial & Asset Management Limited, a company incorporated and registered in England and Wales,

whose registered office is in Northampton, England; and |

| |

■ |

Step-By-Step

Financial Planners Limited, a company incorporated and registered in England and Wales, whose registered office is in Staffordshire,

England. |

Human

capital and resources are an integral part of our businesses. Our business units employed 116 people located in various parts of the

world such as, New Zealand, Canada, Great Britain and the United States as of the fiscal year ended June 30, 2024. This includes all

full and part-time employees as well as executives at our corporate headquarters in San Clemente, California. Consistent with our decentralized

management philosophy, our operating business units individually establish competitive compensation packages to attract, retain and reward

people within their organizations. Given the varied business activities, our business units have policies and practices to address, among

other things, maintaining a safe working environment, eliminating workplace harm, both mental and physical, providing various health

and retirement benefits, as well as incentives to recognize and reward performance on an individual and company goal performance basis.

Certain

Recent Developments

Recent

Note Financing

On

September 19, 2024, we entered into a note purchase agreement (“Purchase Agreement”) with Streeterville Capital, LLC,

a Utah limited liability company (“Holder”), pursuant to which we agreed to issue and sell to Holder a secured promissory

note in an initial principal amount of $4,380,000 (“Initial Note”) payable on or before 24 months from the issuance

date (“Maturity Date”) and, upon the satisfaction of certain conditions in the Purchase Agreement, up to one additional

secured promissory note (“Subsequent Note”) (Initial Note and Subsequent Note, “Notes”). The initial

principal amount of the Notes includes an original issue discount of 9% and expenses the Company agreed to pay to the Holder to cover

the Holder’s transaction costs. The original issue discount of the Initial Note was $360,000. Interest on the principal amount

of the Notes accrues at a rate of 9% per annum. We may pay all or any portion of the amount owed under the Notes earlier than it is due.

All payments made under the Notes, including any repayments, are subject to an additional amount payable equal to 6% of the portion of

the outstanding balance (including accrued interest) being repaid. The Subsequent Note would have a principal amount of $2,180,000, which

will have terms substantially similar to the terms of the Initial Note. The original issue discount on the Subsequent Note, if issued,

will be $180,000.

The

Purchase Agreement contains certain covenants and agreements, including that we will not pledge or grant any lien or security interest

in our or our subsidiaries’ assets without the Holder’s prior written consent and that we will file reports under the Securities

Exchange Act timely, and that our shares will continue to be listed or quoted on the NYSE American or Nasdaq. Also, without the Holder’s

prior written consent, we may not: issue, incur or guarantee any debt obligations other than trade payables in the ordinary course; issue

any security that has conversion rights in which the number of shares varies with the market price of our shares; issue any securities

convertible into our shares with a conversion price that varies with the market price of our shares; issue any securities that have a

conversion or exercise price subject to a reset due to a change in the market price of our shares or upon the occurrence of certain events

related to our business (but excluding certain standard antidilution protection for any reorganization, recapitalization, noncash dividend,

stock split or similar transaction); issue any securities pursuant to an equity line of credit, standby equity purchase agreement or

similar arrangement. The Purchase Agreement also contains a most favored nations provision that provides we will grant to the Holder

the same terms as we offer any subsequent investor in our debt securities and certain arbitration provisions in the event of a claim

arising under the Purchase Agreement or other transaction documents.

The

Notes contain certain trigger events, including in the event that: (a) we fail to pay any amount when due; (b) a receiver or trustee

is appointed with respect to our assets; (c) we become insolvent; (d) we make an assignment for the benefit of creditors; (e) we file

a petition under bankruptcy, insolvency or similar laws; (f) an involuntary bankruptcy proceeding is filed against us; (g) a “fundamental

transaction” occurs without Holder’s prior written consent: (h) we, USCF or any of the USCF subsidiaries, fail to observe

covenants in our agreements with the Holder; (i) we default in observing or performing any covenant in the transaction documents; (j)

any representation in the transaction documents is or becomes false or incorrect; (i) we effect a reverse stock split without 20 trading

days’ prior written notice to the Holder; (k) any judgment is entered against us for more than $500,000 which remains unstayed

for more than 20 days unless consented to by the Holder; (m) our shares cease to be DTC (Depositary Trust Company) eligible; or (n) we

breach any covenant or agreement in any other agreement with Holder or in any financing or other agreement that affects our ongoing business

operations. A “fundamental transaction” occurs if: we merge with another entity; we dispose of all or substantially

all of our assets, we allow more than 50% of our voting shares to be acquired by another person; we enter into a share purchase agreement

with a third party that acquires more than 50% of our shares; we recapitalize or reclassify our shares; we transfer a material asset

to a subsidiary; we pay a dividend to our stockholders; or any person or group becomes the beneficial owner of 50% of the ordinary voting

power of our shares. Upon the occurrence of a trigger event, the Holder may increase the amount outstanding under a Note by 10% for an

event described in (a) through (h) above or 5% for an event described in (i) through (n) above (a “default amount”).

Alternatively, the Holder may treat the trigger event as an event of default and demand repayment of the Note, subject to a five-day

cure period, together with any applicable default amount.

Our obligations under the Note are secured by:

(i) a pledge of all the common stock the Company owns in USCF Investments, Inc. and (ii) a security interest in all of the assets of

the Company. Further, the Company’s Chief Executive Officer’s trust, Nicholas and Melinda Gerber Living Trust (“Gerber

Trust”), provided: (i) a guaranty of the Company’s obligations to the Holder under the Note and (ii) a pledge of all of the

common stock of the Company owned by the Gerber Trust.

Beginning on the date that is six months from

the issuance date until the applicable Note is paid in full, each month the Holder has the right to require the Company to redeem up

to an aggregate of $400,000 with respect to the Initial Note and $200,000 with respect to the Subsequent Note plus any interest accrued

thereunder and an exit fee of 6% of the principal amount and accrued interest redeemed. The Company has the right to defer such redemption

payments that Holder could otherwise elect to make three times by providing advance written notice to Holder. If Company exercises its

deferral right, the outstanding balance automatically increased by 0.85% for each instance that the deferral right is exercised by Company,

which cannot be exercised more than once every ninety calendar days.

Pursuant to the terms of the Purchase Agreement,

beginning on the date of the issuance and sale of the Note and ending 24 months later, Holder will have the right, but not the obligation,

with Company’s prior written consent, to reinvest up to an additional $10,000,000 in the Company on the same terms and conditions

as the Notes (structured as two tranches of $5,000,000 each).

The Company engaged Maxim Group LLC to serve as

placement agent for the transaction between the Company and Holder in exchange for an aggregate commission equal to 7% of the gross cash

proceeds received from the sale of the Notes.

As of September 30, 2024, the note payable balance outstanding, net of the original issue discount and fees paid,

was $3.7 million, of which $2.8 million is due within 12 months from September 30, 2024 and the remaining balance of $0.9 million is

due prior to September 30, 2026.

Securities

We May Offer

We

may offer shares of our common stock, shares of preferred stock, warrants to purchase our preferred stock or common stock, or a combination

of the foregoing securities, either individually or in units, from time to time under this prospectus, together with any applicable prospectus

supplement and related free writing prospectus, at prices and on terms determined by market conditions at the time of an offering. Each

time we offer securities under this prospectus, we will provide offerees with a prospectus supplement that will describe the specific

amounts, prices and other important terms of the securities being offered.

A

prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update, or change

information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free

writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of

the registration statement of which this prospectus is a part.

We

may sell the securities to or through underwriters, dealers or agents or directly to purchasers. We, as well as any agents acting on

our behalf, reserve the sole right to accept and to reject in whole or in part any proposed purchase of securities. Each prospectus supplement

will set forth the names of any underwriters, dealers or agents involved in the sale of securities described in that prospectus supplement

and any applicable fee, commission or discount arrangements with them, details regarding any over-allotment option granted to them, and

net proceeds to us. The following is a summary of the securities we may offer with this prospectus.

Common

Stock

Currently,

we have authorized 900,000,000 shares of common stock, $.001 par value per share (“common stock”). As of December

12, 2024, 40,187,820 shares of our common stock were issued and outstanding. We may offer shares of our common stock either alone or

underlying registered shares of preferred stock or warrants to purchase our common stock or as part of a unit. Holders of our common

stock are entitled to such dividends as our board of directors may declare from time to time out of legally available funds, subject

to the preferential rights of the holders of any shares of our preferred stock that we may issue in the future. Currently, we do not

pay any dividends on our common stock. Each holder of our common stock is entitled to one vote per share. In this prospectus, we provide a general

description of, among other things, the rights and restrictions that apply to holders of our common stock.

Preferred

Stock

Currently,

we have authorized 50,000,000 shares of preferred stock, $.001 par value per share (“preferred stock”), of which 45,000,000

have been designated as Series B Convertible, Voting, Preferred Stock (“Series B Preferred Stock”). As of December

12, 2024, 49,360 shares of Series B Preferred Stock were issued and outstanding. Each outstanding share of Series B Preferred Stock is

convertible into 20 shares of our common stock and votes pari passu with holders of our common stock on an “as if converted”

basis on all matters presented to our stockholders for a vote and, currently, we do not pay any dividends on our Series B Preferred

Stock.

We

may offer shares of our preferred stock either alone, underlying warrants, or as part of a unit. Our board of directors has the authority

to issue from time to time up to 44,950,640 additional shares of Series B Preferred Stock. Also, our board of directors, within the limitations

and restrictions of our articles of incorporation, has the authority to issue from time-to-time up to 5,000,000 shares of preferred stock

in one or more series and to fix the terms, limitations, relative rights and preferences and variations of each series.

Subject

to limitations prescribed by law, our board of directors is authorized at any time to: issue one or more additional series of preferred

stock; determine the designations for any such series of preferred stock; and determine the number of shares in any series. Our board

of directors is also authorized to determine, for each such additional series of preferred stock: whether dividends on that series of

preferred stock will be cumulative and, if so, from which date; the dividend rate; the dividend payment date or dates; any conversion

provisions applicable to that series of preferred stock; the liquidation preference per share of that series of preferred stock, if any;

any redemption or sinking fund provisions applicable to that series of preferred stock; the voting rights of that series of preferred

stock, if any; and the terms of any other preferences or special rights applicable to that series of preferred stock. This prospectus

contains only general terms and provisions of the preferred stock. The applicable prospectus supplement will describe the terms of the

preferred stock being offered thereby. We will incorporate by reference into the registration statement of which this prospectus is a

part the form of any certificate of designations that describes the terms of the series of preferred stock we are offering before the

issuance of shares of that series of preferred stock. You should read any prospectus supplement and any free writing prospectus that

we may authorize to be provided to you related to the series of preferred stock being offered, as well as the complete certificate of

designations that contains the terms of the preferred stock.

Warrants

We

may offer warrants for the purchase of shares of our preferred stock or common stock. We may issue the warrants by themselves or together

with common stock and/or preferred stock. The warrants may be attached to or separate from our common stock or preferred stock. Any warrants

issued under this prospectus may be evidenced by warrant certificates. Warrants may be issued under a separate warrant agreement to be

entered into between us and the investors or a warrant agent. Our board of directors or a committee of the board of directors will determine

the terms of the warrants. This prospectus contains only general terms and provisions of the warrants. The applicable prospectus supplement

will describe the specific terms of the warrants being offered thereby. You should read any prospectus supplement and any free writing

prospectus that we may authorize to be provided to you related to the series of warrants being offered, as well as the complete warrant

agreements that contain the terms of the warrants. Specific warrant agreements will contain additional important terms and provisions

and will be incorporated by reference into the registration statement, of which this prospectus is a part, from reports we file with

the SEC.

Units

We

may offer units consisting of our common stock, preferred stock, and/or warrants to purchase our preferred stock or common stock in one

or more series. We may evidence each series of units by unit certificates that we will issue under a separate agreement. We may enter

into unit agreements with a unit agent. Each unit agent will be a bank, trust company or other agent that we select. We will indicate

the name and address of the unit agent in the applicable prospectus supplement relating to a particular series of units. This prospectus

contains only a summary of certain general features of the units. The applicable prospectus supplement will describe the particular features

of the units being offered thereby. You should read any prospectus supplement and any free writing prospectus that we may authorize to

be provided to you related to the series of units being offered, as well as the complete unit agreements that contain the terms of the

units. Specific unit agreements will contain additional important terms and provisions and will be incorporated by reference into the

registration statement, of which this prospectus is a part, from reports we file with the SEC.

Risks

Factors

Investing

in our securities involves a high degree of risk. Prior to deciding to invest in our securities, you should carefully consider the specific

factors discussed under the heading “Risk Factors” in this prospectus and the applicable prospectus supplement, together

with all the other information contained in or incorporated by reference in this prospectus or the applicable prospectus supplement.

You should also see the risk factors discussed under the heading “Risk Factors” under Item 1A of our Annual Report

on Form 10-K for the year ended June 30, 2024, and Part II of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024,

each as amended or supplemented or superseded from time to time by other reports we file with the SEC in the future, which are incorporated

by reference in this prospectus and any prospectus supplement related to a specific offering. The risks and uncertainties we have described

are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may

also affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment

in the securities offered.

Corporate

Information

We

were incorporated in the State of Nevada on April 20, 2005, under the name Concierge Technologies, Inc., and, on March 10, 2022, we changed

our name to The Marygold Companies, Inc. Our principal executive offices are located at, and our mailing address is: 120 Calle Iglesia,

Unit B. San Clemente, California 92672. Our main telephone number is: 949-429-5370. Our corporate website address is: www.themarygoldcompanies.com.

The information contained on, or that can be accessed through, our website is not a part of this prospectus and should not be relied

upon with respect to any offering.

USE

OF PROCEEDS

Currently,

except as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we intend to

use the net proceeds from the sale of the securities offered under this prospectus for working capital and general corporate purposes.

We may also use the net proceeds to invest in or acquire other businesses, products, or technologies, although we have no current commitments

or agreements with respect to any such investments or acquisitions as of the date of this prospectus. We have not determined the amount

of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation

of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds of any

sale of the securities. Pending use of the net proceeds, we intend to invest the proceeds in short-term, investment-grade, interest-bearing

instruments.

Each

time we offer securities under this prospectus, we will describe the intended use of the net proceeds from that offering in the applicable

prospectus supplement. The actual amount of net proceeds we spend on a particular use will depend on many factors, including our future

capital expenditures, the amount of cash required by our operations, and our expected future revenue growth, if any.

DESCRIPTION

OF OUR CAPITAL STOCK

The

following description of our capital stock, together with any additional information we include in any applicable prospectus supplement

or any related free writing prospectus, summarizes the material terms and provisions of our common stock and the preferred stock that

we may offer under this prospectus. While the terms we have summarized below will apply generally to any future common stock or preferred

stock that we may offer, we will describe the particular terms of any class or series of these securities in more detail in the applicable

prospectus supplement. This description of our capital stock is based upon, and qualified in its entirety by reference to, our Amended

and Restated Articles of Incorporation (our “articles of incorporation”), our Amended and Restated By-laws (our “bylaws”),

certifications of designations related to our preferred stock, amendments thereto, and applicable provisions of Nevada corporations’

law. You should read our articles of incorporation, certifications of designations related to our preferred stock, amendments to the

foregoing, and our bylaws for a more detailed description of our securities.

Authorized

Capital Stock

Our

authorized capital stock consists of 900,000,000 shares of common stock, $0.001 par value per share, and 50,000,000 shares of preferred

stock, $0.001 par value per share.

Common

Stock

General.

We are authorized to issue up to 900,000,000 shares of common stock. As of December 12, 2024, 40,187,820 shares of our common stock

were issued and outstanding. All the issued and outstanding shares of common stock were fully paid and non-assessable.

Voting

Rights. Each holder of common stock is entitled to one non-cumulative vote for each share held on all matters to be voted upon by

stockholders.

Dividends.

The holders of common stock, after any preferences of holders of any preferred stock, are entitled to receive dividends when and if declared

by the board of directors out of legally available funds.

Liquidation

and Dissolution. If we are liquidated or dissolved, the holders of the common stock will be entitled to share in our assets available

for distribution to stockholders in proportion to the amount of common stock they own. The amount available for common stockholders is

calculated after payment of liabilities. Holders of any preferred stock may receive a preferential share of our assets before the holders

of the common stock receive any assets.

Other

Rights. Holders of the common stock have no right to:

| |

●

|

convert

the stock into any other security |

| |

●

|

have

the stock redeemed, or |

| |

●

|

purchase

additional stock to maintain their proportionate ownership interest. |

Holders

of shares of the common stock are not required to make additional capital contributions.

Preferred

Stock

We

are authorized to issue up to 50,000,000 shares of preferred stock and have designated 45,000,000 shares as Series B Preferred Stock.

As of December 12, 2024, 49,360 shares of Series B Preferred Stock were issued and outstanding. See “Description of our Capital

Stock - Series B Preferred Stock,” below. We may offer shares of our preferred stock either alone or as part of a unit. Our

board of directors has the authority to issue from time to time up to 44,950,640 additional shares of Series B Preferred Stock. Also,

our board of directors, within the limitations and restrictions of our articles of incorporation, has the authority to issue from time-to-time

up to 5,000,000 shares of preferred stock in one or more series and to fix the terms, limitations, relative rights and preferences and

variations of each series.

Our

board of directors, within the limitations and restrictions of our articles of incorporation and Nevada law, has the authority to issue

from time-to-time shares of preferred stock in one or more series and to fix the terms, limitations, relative rights and preferences

and variations of each series.

Subject

to limitations prescribed by law, our board of directors is authorized at any time to:

| |

● |

issue

one or more series of preferred stock |

| |

|

|

| |

● |

determine

the designations for any series of preferred stock, and |

| |

|

|

| |

● |

determine

the number of shares in any series |

Our

board of directors is also authorized to determine for each series of preferred stock:

| |

● |

whether

dividends on that series of preferred stock will be cumulative and, if so, from which date |

| |

|

|

| |

● |

the

dividend rate |

| |

|

|

| |

● |

the

dividend payment date or dates |

| |

|

|

| |

● |

any

conversion provisions applicable to that series of preferred stock |

| |

|

|

| |

● |

any

antidilution provisions for that series of preferred stock |

| |

|

|

| |

● |

the

liquidation preference per share of that series of preferred stock, if any |

| |

|

|

| |

● |

any

redemption or sinking fund provisions applicable to that series of preferred stock |

| |

|

|

| |

● |

the

voting rights of that series of preferred stock, if any, and |

| |

|

|

| |

● |

the

terms of any other preferences or special rights applicable to that series of preferred stock |

New

issuances of shares of preferred stock with voting rights can affect the voting rights of the holders of outstanding shares of preferred

stock and common stock by increasing the number of outstanding shares having voting rights and by the creation of class or series voting

rights. Furthermore, additional issuances of shares of preferred stock with conversion rights can have the effect of increasing the number

of shares of common stock outstanding up to the amount of common stock authorized by the articles of incorporation and can also, in some

circumstances, have the effect of delaying or preventing a change in control of Marygold or otherwise adversely affect the rights of

holders of outstanding shares of preferred stock and common stock. To the extent permitted by our articles of incorporation, a series

of preferred stock may have preferences over the common stock (and other series of preferred stock) with respect to dividends and liquidation

rights.

Series

B Preferred Stock

We

have designated a series of our Preferred Stock named Series B Convertible, Voting, Preferred Stock consisting of 45,000,000 shares

(“Series B Preferred”). Each share of Series B Preferred Stock is convertible into 20 shares of our common stock and,

until converted, has 20 votes on all matters brought before the stockholders for a vote. As of the date of this prospectus, there were

49,360 shares of Series B Preferred Stock outstanding that are convertible into 987,200 shares of our common stock.

Options

and Restricted Stock Rights

As

of December 12, 2024, the following stock options and shares of our common stock issued pursuant to restricted stock grants are issued

and outstanding pursuant to our 2021 Omnibus Equity Incentive Plan:

| |

● |

640,881

options to purchase our common stock at a weighted average exercise price of $1.35 per share of which 204,760 are fully vested and

exercisable, and |

| |

|

|

| |

● |

370,584

shares of restricted stock pursuant to restricted stock grants |

Future

Issuances of Preferred Stock

New

issuances of shares of preferred stock with voting rights can affect the voting rights of the holders of outstanding shares of preferred

stock and common stock by increasing the number of outstanding shares having voting rights and by the creation of class or series voting

rights. Furthermore, additional issuances of shares of preferred stock with conversion rights can have the effect of increasing the number

of shares of common stock outstanding up to the amount of common stock authorized by the articles of incorporation and while providing

flexibility in connection with possible acquisitions and other corporate purposes, could in some circumstances have the effect of delaying

or preventing a change in control of Marygold or otherwise adversely affecting the rights of holders of outstanding shares of preferred

stock and common stock. To the extent permitted by our articles of incorporation, a series of preferred stock may have preferences over

the common stock (and other series of preferred stock) with respect to dividends and liquidation rights.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Issuer Direct Corporation, 500 Perimeter Park Drive, Morrisville, North Carolina

27560; telephone number: 877.481.4014.

Stock

Exchange Listing

Our

common stock is listed on the NYSE American under the symbol “MGLD”.

This

foregoing description of our capital stock is based upon, and qualified in its entirety by reference to, our amended and restated articles

of incorporation, certificates of designations for our preferred stock, amendments to the foregoing, and our amended and restated bylaws

and applicable provisions of Nevada law. You should read our articles of incorporation, certificates of designations for our preferred

stock, amendments to the foregoing, and our bylaws for a more detailed description of our securities.

Applicable

Anti-Takeover Law

The

following is a summary of the provisions of our articles of incorporation, certificates of designations for our preferred stock, amendments

to the foregoing, and our bylaws that could have the effect of delaying or preventing a change in control of our company. The following

description is only a summary, and it is qualified by reference to our articles of incorporation, certificates of designations for our

preferred stock, amendments to the foregoing, and our bylaws and relevant provisions of the Nevada Revised Statutes.

Board

of Directors Vacancies

Our

bylaws provide that only our board of directors may fill a vacancy arising from the death, resignation, disqualification or removal from

office of any director, or otherwise, or if a new vacancy is created by an increase in the number of directors and such a director shall

hold office until the expiration of the term of office of the director whom he or she has replaced or until his or her successor is duly

elected and qualified. However, the board of directors may only fill a vacancy on the board of directors resulting from removal by the

stockholders of a director if the stockholders fail to fill such vacancy at the meeting of the stockholders at which (or by the same

written consent of the stockholders by which) stockholders voted to remove the director, such vacancy to be filled by the same vote of

the stockholders as required to elect a director at an annual meeting of the stockholders.

The

number of directors constituting our board of directors may be set only by the resolution of the majority of the incumbent directors

to consist of not less than one (1) director and no more than 12.

Director

Removal by Stockholders

A

director may be removed from office, without assignment of any reason, by a vote of not less than two-thirds (2/3) of the voting power

of the issued and outstanding stock entitled to vote, or by not less than two-thirds of the class or series of stock that elected the

director or director to be removed.

Enhanced

Director Vote

At

meetings of our board of directors, any director who does not own our shares of common stock or preferred stock is entitled to one (1)

vote on matters presented to our board of directors. A director who owns our shares of common stock and/or preferred stock is entitled

to cast a number of votes on matters presented to our board of directors equal to the product of (x) multiplied by (y), where: (x) is

the percentage determined by dividing (A) the number of shares of common stock and preferred stock beneficially owned by such director

(or any “group” of which such director is a member, as defined by Section 13(d) of the Securities Exchange Act, and the rules

thereunder), on an as-converted, fully diluted basis, by (B) the number of issued and outstanding shares of our common stock and preferred

stock, on an as-converted, fully diluted basis; and (y) is the total number of votes a director may cast at a board meeting. Such enhanced

director voting right is suspended during any period in which (i) we are required to have a board comprised of a majority of directors

that are “independent” as defined under the rules of a national securities exchange on which our shares are traded

or (ii) such voting rights are prohibited under any law or regulation applicable to us, including the listing standards of any national

securities exchange applicable to us in which event a director shall have one vote on matters brought before the board of directors.

Pursuant to a voting agreement, dated January 27, 2015, between the Nicholas and Melinda Gerber Living Trust (“Gerber Trust”),

of which Nicholas D. Gerber is a trustee, and the Schoenberger Family Trust (Schoenberger Trust”), of which Mr. Schoenberger

is a trustee, the Gerber Trust and Schoenberger Trust have agreed to vote all shares of voting securities owned by them or subsequently

acquired to elect Mr. Gerber and Mr. Schoenberger or their respective designees to the board of directors, to elect five other board

designees mutually agreed upon by them, and to elect additional directors nominated pursuant to our bylaws and articles of incorporation.

As of the date of this prospectus, the Gerber Trust and Schoenberger Trust own approximately 56% of our voting stock. Accordingly, through

their respective trusts, Mr. Gerber and Mr. Schoenberger represent over 50% of the voting stock with respect to matters that may

have a material impact on our strategy and shareholder rights. Because more than 50% of the combined voting power of all our outstanding

voting stock is beneficially owned by Mr. Gerber, our CEO and a director, and Mr. Schoenberger, a director,

we are deemed a “controlled company” as defined in Section 801(a) of the NYSE American Company Guide. As such, we

are excepted from certain NYSE American rules requiring our board of directors to have a majority of independent directors, a compensation

committee composed entirely of independent directors, and a nominating and governance committee composed entirely of independent directors.

Special

Meeting of Stockholders

Our

bylaws provide that special meetings of our stockholders may be called by our board of directors, the chairman of our board of directors,

or by our president, and shall be called by the president or secretary at the written request of the holders of fifteen percent (15%)

or more of the shares then outstanding and entitled to vote, or as otherwise required by law.

Advance

Notice Requirements for Stockholder Proposals and Director Nominations

Our

bylaws provide that stockholders who wish to present a business proposal at a meeting of stockholders called by a stockholder are required

to give timely notice thereof in writing to the Secretary of the Company. Such notice must be received at our principal executive offices

not less than 120 days before the date our proxy statement is released to stockholders in connection with the previous year’s annual

meeting or as otherwise provided in our proxy materials for the most recent meeting of stockholders. However, if we did not hold an annual

meeting in the previous year, or if the date of the current annual meeting has been changed by more than 30 days from the date of the

previous year’s meeting, then the deadline is a reasonable time before we begin to print and send our proxy materials. A stockholder’s

notice shall set forth as to each matter the stockholder proposes to bring before the meeting: a brief description of the business desired

to be brought before the meeting and the reasons for conducting such business at the meeting, the name and address, as they appear on

our books, of the stockholder proposing such business, the class and number of our shares which are beneficially owned by the stockholder,

and any material interest of the stockholder in such business.

Stockholders

who wish to nominate a person for election as a director at a meeting of stockholders are required to give timely notice in writing to

the Secretary of the Company. To be timely, such notice must be delivered to or mailed and received at our principal executive offices

not less than 45 days or more than 75 days prior to the date on which we first mailed our proxy materials in connection with our previous

year’s annual meeting (or the date on which we mail our proxy materials for the current year if during the prior year we did not

hold an annual meeting or if the date of the annual meeting was changed by more than 30 days from the prior year) or as otherwise provided

in the proxy statement for the prior year’s meeting at which directors were elected. Such stockholder’s notice shall set

forth: as to each person whom the stockholder proposes to nominate for election or re-election as a director, the name, age, business

address and residence address of the person, the principal occupation or employment of the person, the class and number of our shares

which are beneficially owned by the person, the reasons why such person is qualified to serve as a director, and any other information

relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation

14A under the Securities Exchange Act; and as to the stockholder giving the notice: the name and record address of the stockholder, and

the class and number of our shares beneficially owned by the stockholder. We may require any proposed nominee to furnish such other information

as may reasonably be required by us to determine the eligibility of such proposed nominee to serve as a director

Authorized

but Unissued Shares

Our

authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval and

may be utilized for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions

and employee benefit plans, subject to any requirement or limitation under the rules of any stock exchange or over the counter market

on which our shares are then listed or quoted. The existence of authorized but unissued and unreserved common stock and preferred stock

could render more difficult or discourage an attempt to obtain control of our Company by means of a proxy contest, tender offer, merger

or otherwise.

DESCRIPTION

OF WARRANTS

The

following description, together with the additional information we may include in any applicable prospectus supplements and free writing

prospectuses, summarizes the material terms and provisions of the warrants that we may offer from time to time under this prospectus,

which may consist of warrants to purchase preferred stock or common stock and may be issued in one or more series. Warrants may be offered

independently or together with common stock and preferred stock offered by any prospectus supplement and may be attached to or separate

from those securities and may be offered as part of units of securities. While the terms we have summarized below will apply generally

to any warrants that we may offer under this prospectus, we will describe the specific terms of any series of warrants that we may offer

in more detail in the applicable prospectus supplement and any applicable free writing prospectus. The terms of any warrants offered

under a prospectus supplement may differ from the terms described below. However, no prospectus supplement will fundamentally change

the terms that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at the time

of its effectiveness.

We

may issue the warrants under a warrant agreement that we will enter into with a warrant agent to be selected by us. If selected, the

warrant agent will act solely as an agent of ours in connection with the warrants and will not act as an agent for the holders or beneficial

owners of the warrants. If applicable, we will file as exhibits to the registration statement of which this prospectus is a part, or

will incorporate by reference from a Current Report on Form 8-K that we file with the SEC or as otherwise permitted under SEC rules,

the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular series of warrants

we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrants.

The warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and

warrant certificate applicable to a particular series of warrants. We urge you to read the applicable prospectus supplement and any applicable

free writing prospectus related to the particular series of warrants that we sell under this prospectus, as well as the complete warrant

agreements and warrant certificates that contain the terms of the warrants.

General

The

terms of each issue of warrants and the warrant agreement relating to the warrants will be described in the applicable prospectus supplement,

including, as applicable:

| |

● |

the

title of the warrants |

| |

|

|

| |

● |

the

initial offering price |

| |

|

|

| |

● |

the

exercise price |

| |

|

|

| |

● |

the

currency in which the warrants may be purchased |

| |

|

|

| |

● |

the

aggregate number of warrants and the aggregate number of shares of preferred stock or common stock purchasable upon exercise of the

warrants |

| |

|

|

| |

● |

if

applicable, the terms of the equity securities with which the warrants are issued, and the number of warrants issued with each equity

security |

| |

|

|

| |

● |

if

applicable, the date on and after which the warrants and the related securities will be separately transferable |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants will commence and the date on which the right will expire |

| |

|

|

| |

● |

if

applicable, the minimum or maximum number of the warrants that may be exercised at any one time |

| |

|

|

| |

● |

anti-dilution

provisions of the warrants, if any |

| |

|

|

| |

● |

redemption

or call provisions, if any, applicable to the warrants |

| |

● |

any

additional terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants |

| |

|

|

| |

● |

the

effect of any merger, consolidation, sale or other disposition of our business on the warrant agreements and the warrants |

| |

|

|

| |

● |

any

provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants |

| |

|

|

| |

● |

the

manner in which the warrant agreements and warrants may be modified |

| |

|

|

| |

● |

United

States federal income tax consequences of holding or exercising the warrants, and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights or limitations of or restrictions on the warrants |

Holders

of warrants will not be entitled, solely by virtue of being holders, to vote, receive dividends, or receive notice as stockholders with

respect to any meeting or written consent of stockholders for the election of directors or any other matter, or to exercise any rights

whatsoever as a holder of the equity securities purchasable upon exercise of the warrants. Until any warrants to purchase common stock

are exercised, the holder of the warrants will not have any rights of holders of preferred stock or common stock that can be purchased

upon exercise.

Exercise

of Warrants

Each

warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price

that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders

of the warrants may exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable

prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with

specified information and paying the required amount to the warrant agent in immediately available funds, as provided in the applicable

prospectus supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the

information that the holder of the warrant will be required to deliver to us or the warrant agent as applicable.

Upon

receipt of the required payment and the warrant certificate properly completed and duly executed at the corporate trust office of the

warrant agent or any other office indicated in the applicable prospectus supplement, we will issue and deliver the securities purchasable

upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new

warrant certificate for the remaining amount of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants

may surrender securities as all or part of the exercise price for warrants.

Enforceability

of Rights by Holders of Warrants

If

selected, each warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or

relationship of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than

one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant

agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon

us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate

legal action its right to exercise, and receive the securities purchasable upon exercise of, its warrants.

DESCRIPTION

OF UNITS

The

following description, together with the additional information we may include in any applicable prospectus supplements and free writing

prospectuses, summarizes the material terms and provisions of the units that we may offer under this prospectus.

While

the terms we have summarized below will apply generally to any units that we may offer under this prospectus, we will describe the terms

of any series of units in more detail in the applicable prospectus supplement. The terms of any units offered under a prospectus supplement

may differ from the terms described below. However, no prospectus supplement will fundamentally change the terms that are set forth in

this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness.

We

will file as exhibits to the registration statement of which this prospectus is a part or will incorporate by reference from a Current

Report on Form 8-K that we file with the SEC or as otherwise permitted under SEC rules, the form of unit agreement that describes the

terms of the series of units we are offering, and any supplemental agreements, before the issuance of the related series of units. The

following summaries of material terms and provisions of the units are subject to, and qualified in their entirety by reference to, all

the provisions of the unit agreement and any supplemental agreements applicable to a particular series of units. We urge you to read

the applicable prospectus supplements related to the series of units that we sell under this prospectus, as well as the complete unit

agreement and any supplemental agreements that contain the terms of the units.

General

We

may issue units comprised of one or more shares of common stock, shares of preferred stock and warrants in any combination. Each unit

will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will

have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that

the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date.

We

will describe in the applicable prospectus supplement the terms of the series of units, including:

| |

● |

the

designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those

securities may be held or transferred separately |

| |

|

|

| |

● |

any

provisions of the governing unit agreement that differ from those described below, and |

| |

|

|

| |

● |

any

provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units. |

The

provisions described in this section, as well as those described under “Description of Capital Stock” and “Description

of Warrants” will apply to each unit and to any common stock, preferred stock, or warrant included in each unit, respectively.

Unit

Agent

The

name and address of the unit agent, if any, for any units we offer will be set forth in the applicable prospectus supplement.

Issuance

in Series

We

may issue units in such amounts and in numerous distinct series as we determine.

Enforceability

of Rights by Holders of Units

Each

unit agent will act solely as our agent under the applicable unit agreement and will not assume any obligation or relationship of agency

or trust with any holder of any unit. A single bank or trust company may act as unit agent for more than one series of units. A unit

agent will have no duty or responsibility in case of any default by us under the applicable unit agreement or unit, including any duty

or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a unit may, without the

consent of the related unit agent or the holder of any other unit, enforce by appropriate legal action its rights as holder under any

security included in the unit.

We,

the unit agents and any of their agents, may treat the registered holder of any unit certificate as an absolute owner of the units evidenced

by that certificate for any purpose and as the person entitled to exercise the rights attaching to the units so requested, despite any

notice to the contrary.

PLAN

OF DISTRIBUTION

We

may offer and sell the securities being offered hereby in one or more of the following ways from time to time:

| |

● |

through

agents to the public or to investors |

| |

|

|

| |

● |

to

or through underwriters, brokers or dealers |

| |

|

|

| |

● |

negotiated

transactions |

| |

|

|

| |

● |

block

trades |

| |

|

|

| |

● |

directly

to investors |

| |

|

|

| |

● |

in