false

0001389545

0001389545

2024-05-28

2024-05-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: May 28, 2024

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33678

|

68-0454536

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

(510) 899-8800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange On Which

Registered

|

|

Common Stock, par value $0.01 per share

|

|

NBY

|

|

NYSE American

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On May 28, 2024, NovaBay Pharmaceuticals, Inc. (the “Company”) received a letter (“Additional Deficiency Letter”) from the NYSE American LLC (the “NYSE American”) stating that the Company is not in compliance with the minimum stockholders’ equity requirements of Section 1003(a)(i) of the NYSE American Company Guide. Section 1003(a)(i) of the NYSE American Company Guide requires a listed company to maintain stockholders’ equity of $2.0 million or more if the listed company has reported losses from continuing operations and/or net losses in two of its three most recent fiscal years. The Company reported stockholders’ equity of $160 thousand as of March 31, 2024 and has had losses from continuing operations and net losses in each of the last three fiscal years.

As previously reported in Item 3.01 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on April 19, 2024, the Company was previously notified by the NYSE American on April 18, 2024 (“Initial Deficiency Letter”) that it was not in compliance with the minimum stockholders’ equity requirement of Sections 1003(a)(ii) and 1003(a)(iii) of the NYSE American Company Guide requiring a listed company to have stockholders’ equity of (1) $4.0 million or more if the listed company has reported losses from continuing operations and/or net losses in three of its four most recent fiscal years and (2) $6.0 million or more if the listed company has reported losses from continuing operations and/or net losses in its five most recent fiscal years, respectively. In accordance with the Initial Deficiency Letter, the Company submitted a plan to the NYSE American to regain compliance with the stockholders’ equity continued listing standards on May 8, 2024 (the “Compliance Plan”).

Pursuant to the Additional Deficiency Letter, the Company is subject to the requirements in the Initial Deficiency Letter, and if the Company is not in compliance with all of the stockholders’ equity standards by October 18, 2025 or does not make substantial progress consistent with the Compliance Plan, then the NYSE American will initiate delisting proceedings as appropriate.

The Additional Deficiency Letter has no immediate effect on the listing or trading of the Company’s common stock, par value $0.01 (“Common Stock”), and the Company’s common stock will continue to trade on the NYSE American under the symbol “NBY” with a “below compliance” indicator appended to the Company’s ticker symbol (with the added designation of “.BC”) during the period the Company is not in compliance with the NYSE American’s continued listing standards. The Company’s receipt of the Additional Deficiency Letter does not affect the Company’s business operations or its reporting requirements with the SEC.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 28, 2024, the Company held its 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”), at which the Company’s stockholders voted on five (5) proposals, each of which is described in more detail in the Company’s proxy statement filed with the SEC on April 18, 2024 (the “Proxy Statement”). There were 36,060,825 outstanding shares entitled to vote and there were 18,317,862 shares present in person or by proxy at the 2024 Annual Meeting, representing approximately fifty-one percent (51%) of the shares outstanding and entitled to vote and constituting a quorum. The voting results are presented below.

1. To elect three (3) Class II directors nominated by the Company’s Board of Directors to hold office for a term of three (3) years or until their respective successors are elected and qualified.

|

Nominee

|

For

|

Withhold

|

Broker Non-Vote1

|

|

Julie Garlikov

|

8,426,320

|

1,401,370

|

8,490,172

|

|

Justin M. Hall, Esq.

|

8,301,613

|

1,526,077

|

8,490,172

|

|

Yongxiang (Sean) Zheng

|

7,836,350

|

1,991,340

|

8,490,172

|

2. To ratify the appointment by the Company’s Audit Committee of WithumSmith+Brown, PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

|

For

|

Against

|

Abstain

|

|

15,348,923

|

2,880,950

|

87,989

|

1A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to the item and has not received voting instructions from the beneficial owner of the shares it holds. Broker non-votes are counted when determining whether the necessary quorum of stockholders is present or represented at each annual meeting.

3. To approve, as required by, and in accordance with, Sections 713(a) and 713(b) of the NYSE American Company Guide, the issuance of an aggregate of 2,528,848 shares of Common Stock upon the exercise and in accordance with the terms of the Company’s Series C Warrants that were issued in the Company’s 2023 Warrant Reprice Transaction (both as defined in the Proxy Statement).

|

For

|

Against

|

Abstain

|

Broker Non-Vote1

|

|

7,161,691

|

2,621,492

|

44,507

|

8,490,172

|

4. To approve the issuance of an aggregate of 4,750,000 shares of Common Stock upon (i) the conversion of the $525 thousand aggregate principal amount of Unsecured Convertible Notes due March 25, 2026 (as defined in the Proxy Statement) and (ii) the exercise of the Series D Warrant, that were all issued in the Company’s Secured Parties Consent Transaction (both as defined in the Proxy Statement).

|

For

|

Against

|

Abstain

|

Broker Non-Vote1

|

|

7,189,067

|

2,607,787

|

30,836

|

8,490,172

|

5. To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended, to effect a reverse stock split of all of the Common Stock issued and outstanding, or held in treasury, at a ratio of not less than 1-for-10 and not more than 1-for-35 (the “Proposed Reverse Stock Split”), and to grant authorization to the Company’s Board of Directors to determine, in its sole discretion, the specific ratio at any whole number within such share range and the timing of the Proposed Reverse Stock Split becoming effective or to abandon the Proposed Reverse Stock Split.

|

For

|

Against

|

Abstain

|

|

12,159,305

|

6,091,423

|

67,134

|

Item 8.01 Other Events

On May 28, 2024, following stockholder approval, the Board approved a Reverse Stock Split ratio of 1-for-35, and the Company issued a press release announcing the same as well as disclosing the Additional Deficiency Letter. A copy of this press release is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Language Concerning Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs. The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words or expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the impact of the Proposed Reverse Stock Split and the Company’s ability to comply with the continued listing requirements of the NYSE American. These statements involve risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by the forward-looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Other risks relating to the Company’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this report, are detailed in the Company’s latest Form 10-Q/K filings with the SEC, especially under the heading “Risk Factors,” and in the Proxy Statement, especially under the heading “Proposal Five: The Reverse Stock Split Proposal — Risks Relating to the Reverse Stock Split.” The forward-looking statements in this report speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NovaBay Pharmaceuticals, Inc.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Justin M. Hall

|

|

| |

|

Justin M. Hall

|

|

| |

|

Chief Executive Officer and General Counsel

|

|

Dated: May 29, 2024

Exhibit 99.1

NovaBay Pharmaceuticals Announces Approval of All Proposals at its 2024 Annual Meeting of Stockholders and Provides Other Corporate Updates

Announces a 1-for-35 Reverse Stock Split and Receipt of NYSE American Notice Regarding Stockholders’ Equity

EMERYVILLE, Calif. (May 29, 2024) – NovaBay® Pharmaceuticals, Inc. the “Company”) (NYSE American: NBY) announces that a quorum was reached and that all proposals in the Company’s Definitive Proxy Statement filed on April 18, 2024 with the Securities and Exchange Commission (the “SEC”) were approved by stockholders at its 2024 Annual Meeting of Stockholders held on May 28, 2024. Among the proposals, stockholders approved a reverse stock split and authorized the Company’s Board of Directors to determine the specific split ratio and effective date.

“We thank stockholders for their support in approving all proposals during our annual meeting,” said Justin Hall, NovaBay’s CEO. “The approval of these proposals allows us to move forward with several strategic initiatives meant to help us regain compliance with NYSE American’s continued listing standards and grow our business. We believe the anticipated increased market price resulting from the reverse split will improve the marketability and liquidity of our stock and could encourage additional interest and trading.”

Reverse Stock Split

The Company’s Board of Directors has authorized a 1-for-35 reverse stock split of all outstanding shares of common stock of the Company. The Company anticipates that the 1-for-35 reverse stock split will be effective as of 4:15 p.m. New York City time on Thursday, May 30, 2024, and that the Company's common stock will begin trading on a split-adjusted basis on Friday, May 31, 2024.

The effect of the reverse stock split will be to combine every 35 shares of outstanding Company common stock into 1 share of common stock. The reverse stock split will not reduce the number of authorized shares of common stock or authorized shares of preferred stock or change the par values of the Company’s common stock or preferred stock.

The Company will issue an additional whole share to all holders who would otherwise receive a fractional share of common stock. Except for adjustments resulting from the treatment of fractional shares, each stockholder will hold the same percentage of our outstanding common stock immediately following the reverse stock split as such stockholder held immediately prior to the reverse stock split.

All outstanding options, restricted stock awards, warrants, preferred stock, convertible debentures and other Company securities entitling their holders to purchase, exercise, convert or otherwise receive shares of common stock will be adjusted as a result of the reverse stock split, as required by the terms of each security.

The Company expects that the reverse stock split will increase the per-share price of its common stock, which the Company believes will enable it to comply with the NYSE American's continued-listing requirement relating to the price of its common stock. The Company's trading symbol of “NBY” will not change as a result of the reverse stock split; however, a new CUSIP number has been assigned: 66987P 409.

The reverse stock split will reduce the number of shares of common stock issued and outstanding from approximately 40,309,991 shares to approximately 1,151,715 shares (prior to rounding). Because the reverse stock split will not reduce the number of authorized shares of common stock, the effect of the reverse stock split will be to increase the number of common shares available for issuance relative to the number of common shares issued and outstanding. The reverse stock split will not modify any voting rights or other terms of the common stock.

Computershare Inc. is acting as the exchange agent and transfer agent for the reverse stock split. Computershare will provide instructions to stockholders with physical certificates regarding the process for exchanging their pre-split stock certificates for post-split shares. Computershare can be reached at (800) 962-4284. For additional information regarding the reverse stock split, please refer to NovaBay’s Current Report on Form 8-K filed with the SEC today, May 29, 2024.

NYSE American Notice Regarding Stockholders’ Equity

The Company also announces that on May 28, 2024 it received notice from the NYSE American that it is not in compliance with Section 1003(a)(i) of the NYSE American Company Guide requiring stockholders’ equity of $2.0 million or more if the Company has reported losses from continuing operations and/or net losses in two of the three most recent fiscal years.

In a press release dated April 19, 2024, the Company announced notification by the NYSE American on April 18, 2024 that it was not in compliance with the minimum stockholders’ equity requirement of Sections 1003(a)(ii) and 1003(a)(iii) of the NYSE American Company Guide requiring stockholders’ equity of $4.0 million or more if the Company has reported losses from continuing operations and/or net losses in three of its four most recent fiscal years, and $6.0 million or more if the Company has reported losses from continuing operations and/or net losses in its five most recent fiscal years, respectively.

On May 8, 2024, the Company submitted its plan to regain compliance to NYSE American. The Company is subject to the requirements in the April and May notice and if the Company is not in compliance with all of the stockholders’ equity standards by October 18, 2025 or does not make substantial progress consistent with its compliance plan, then the NYSE American staff will initiate delisting proceedings, as appropriate.

Form 10-K - Going Concern

The Company also announces that, as previously disclosed in its Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on March 26, 2024 and amended on March 29, 2024, the audited financial statements contained an unqualified audit opinion from its independent registered public accounting firm that included an explanatory paragraph related to the Company’s ability to continue as a going concern. This announcement is made pursuant to NYSE American Company Guide Section 610(b), which requires public announcement of the receipt of an audit opinion containing a going concern paragraph. This announcement does not represent any change or amendment to the Company’s financial statements or to its Annual Report on Form 10-K for the year ended December 31, 2023.

About NovaBay Pharmaceuticals, Inc.:

NovaBay’s leading product Avenova® Antimicrobial Lid & Lash Solution is often prescribed by eyecare professionals for blepharitis and dry-eye disease and is available directly to consumers through online distribution channels such as Amazon.com. It is clinically proven to kill a broad spectrum of bacteria to help relieve the symptoms of bacterial dry eye, yet is non-irritating and completely safe for regular use. NovaBay offers a full portfolio of scientifically developed products for each step of the standard dry eye treatment regimen, including the Avenova Eye Health Support antioxidant-rich oral supplement, Avenova Lubricating Eye Drops for instant relief, Avenova Warm Eye Compress to soothe the eyes and the i-Chek by Avenova to monitor physical eyelid health. The Avenova Allograft, an amniotic tissue prescription-only product, is available through eyecare professionals in the United States.

NovaBay Pharmaceuticals Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, statements that are based upon management's current expectations, assumptions, estimates, projections and beliefs. The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words or expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding our business strategies and prospects, expected future financial results (including our ability to continue as a going concern), the impact of the reverse stock split, and the Company's ability to regain compliance with the continued listing requirements of the NYSE American. These statements involve risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by the forward-looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in NovaBay’s latest Form 10-Q/K filings with the SEC, especially under the heading “Risk Factors,” and in the definitive proxy statement filed by NovaBay with the SEC, especially under the heading “Proposal Five: The Reverse Stock Split Proposal - Risks Relating to the Reverse Stock Split.” The forward-looking statements in this press release speak only as of this date, and NovaBay disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Socialize and Stay Informed on NovaBay’s Progress

Like us on Facebook

Follow us on X

Connect with NovaBay on LinkedIn

Visit NovaBay’s Website

Avenova Purchasing Information

For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com

Avenova.com

NovaBay Contact

Justin Hall

Chief Executive Officer and General Counsel

510-899-8800

jhall@novabay.com

Investor Contact

LHA Investor Relations

Jody Cain

310-691-7100

jcain@lhai.com

# # #

v3.24.1.1.u2

Document And Entity Information

|

May 28, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 28, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street

|

| Entity, Address, Address Line Two |

Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

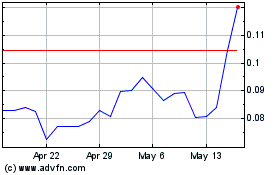

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From May 2024 to Jun 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Jun 2023 to Jun 2024