BiomX Inc. (NYSE American: PHGE) (“BiomX” or the “Company”), a

clinical-stage company advancing novel natural and engineered phage

therapies that target specific pathogenic bacteria, today reported

financial results and provided business and program updates for the

first quarter ended March 31, 2024. BiomX is announcing merged

financial reporting for the first time following the closing of its

merger with Adaptive Phage Therapeutics, Inc. (“APT”) in March 2024

and a concurrent $50 million private placement.

Based on a cash balance, short term deposits and restricted cash

of $44.1 million as of March 31, 2024, BiomX estimates it currently

has a cash runway through the fourth quarter of 2025. The Company

anticipates data readouts for both of its lead programs in 2025:

Topline results (through Week 13) for the Phase 2 study of BX211, a

personalized phage treatment for the treatment of diabetic foot

osteomyelitis (“DFO”) associated with Staphylococcus aureus (S.

aureus), are expected in the first quarter of 2025, and Phase 2b

trial results for BX004, a fixed multi-phage cocktail for the

treatment of cystic fibrosis (“CF”) patients with chronic pulmonary

infections caused by Pseudomonas aeruginosa (P. aeruginosa), are

expected in the third quarter 2025.

“With the recent merger with APT and our private placement, we

believe we have entered into a new era for BiomX as a leading phage

company focused on treating harmful bacteria underlying serious

chronic infections,” said Jonathan Solomon, Chief Executive Officer

of BiomX. “BiomX is rapidly advancing a pipeline with two lead

candidates, both expecting Phase 2 readouts next year. For BX004,

we have demonstrated for the first time in a randomized controlled

study that a subset of CF patients converted to sputum culture

negative for P. aeruginosa after only 10 days of treatment with

BX0041. These findings were showcased in a presentation that was

selected as a ‘Top Poster’ at last month’s ESCMID Global Congress.

With the APT merger, we now have added BX211, a promising treatment

for DFO, advancing in a Phase 2 study with more than 70% of

patients enrolled. On the business side, we have gained important

and accredited life sciences investors, another important

validation for the potential of phage therapy as a new therapeutic

modality and the strength of our lead candidates. We believe these

and other recent achievements are bringing us closer to our goal of

meeting unmet patient needs through advancement of our phage-based

therapies.”

Business Update

- In March 2024, the Company announced the closing of its merger

with APT and concurrent closing of a private placement financing

with $50 million of gross proceeds led by top institutional

healthcare investors, including affiliates of Deerfield Management

and the AMR Action Fund, and additional investors including the

Cystic Fibrosis Foundation, OrbiMed, and Nantahala Capital

Management. The net proceeds from the private placement are

primarily being used to further advance BiomX’s lead product

candidates, BX004 and BX211.

Clinical Program Updates

Cystic Fibrosis (BX004)

- In January 2024, the Company announced that BX004 was granted

Orphan Drug Designation by the United States Food and Drug

Administration (“FDA”), for the treatment of chronic pulmonary

infection caused by P. aeruginosa in patients with CF.

- In April 2024, the Company presented at this year’s European

Society of Clinical Microbiology and Infectious Diseases (ESCMID)

Global Congress positive safety and efficacy results from Part 2 of

the Phase 1b/2a trial evaluating the Company’s novel phage

cocktail, BX004, for the treatment of chronic pulmonary infections

caused by P. aeruginosa in CF patients. BiomX’s poster was selected

as a “Top Poster”, ranking it among the 1-2% of top-rated abstracts

in the category submitted and accepted at the ESCMID Global

Congress.

- Highlights from the Part 2 data of the Phase 1b/2a study

included:

- Study drug was safe and well-tolerated, with no related SAEs

(serious adverse events) or related APEs (acute pulmonary

exacerbations) to study drug.

- In the BX004 arm, 3 out of 21 (14.3%) patients converted to

sputum culture negative for P. aeruginosa after 10 days of

treatment (including 2 patients after 4 days) compared to 0 out of

10 (0%) in the placebo arm1. BX004 vs. placebo showed a clinical

effect in a predefined subgroup of patients with reduced baseline

lung function (FEV1<70%). Difference between groups at Day 17:

relative FEV1 improvement of 5.67% (change from baseline +1.46 vs.

-4.21) and +8.87 points in CFQR respiratory symptom scale (change

from baseline +2.52 vs. -6.35).

Diabetic Foot Osteomyelitis (BX211)

- BX211 is a personalized phage treatment that BiomX is now

developing following the merger with APT. BX211 is being developed

for the treatment of DFO associated with S. aureus. The safety,

tolerability, and efficacy of BX211 is currently being evaluated in

a randomized, double-blind, placebo-controlled, multi-center Phase

2 trial for subjects with DFO. Target enrollment for the study is

45 patients, and to date, more than 70% of the patients have been

enrolled. Initial topline results of the Phase 2 trial are expected

in the first quarter of 2025. Study design was guided in part by

experience with numerous compassionate cases using phage therapy

for the treatment of DFO and Osteomyelitis.

First Quarter 2024 Financial Results

The financial results of the first quarter of 2024 include the

consolidation of the financial results of APT from the closing date

of the merger and the accounting implications derived from the

merger and the concurrent private placement.

- Cash balance, short-term deposits and restricted

cash as of March 31, 2024, were $44.1 million, compared to

$30.3 million as of March 31, 2023. The increase was primarily due

to the private placement, which was partially offset by net cash

used in operating activities and the repayment of a debt facility

in March 2024. The Company estimates its cash, cash equivalents and

short-term deposits are sufficient to fund its operations through

the fourth quarter of 2025.

- Research and development expenses, net were

$4.1 million for the first quarter of 2024, compared to $4.6

million for the first quarter of 2023. The decrease is primarily

due to the completion of the CF clinical trial, and was partially

offset by lower grants payments from the Israeli Innovation

Authority and R&D expenses related to APT that were incurred

after the merger.

- General and administrative expenses were $2.7

million for the first quarter of 2024, compared to $1.6 million for

the first quarter of 2023. The increase primarily resulted from

expenses related to the merger with APT and the concurrent private

placement.

- Net loss was $17.3 million for the first

quarter of 2024, compared to $6.4 million for the first quarter of

2023. The increase is mainly due to changes in fair value of

private placement warrants that were issued in this quarter.

- Net cash used in operating activities for the

three months ended March 31, 2024, was $11.4 million, compared to

$5.0 million for the same period in 2023.

Conference Call and Webcast Details BiomX will

host a conference call and webcast on May 21, 2024, at 8:00 a.m. ET

to discuss its first quarter 2024 financial results and to provide

a corporate update.

Conference Call Dial-In Information:

| Participant Dial-In Number: |

+1 877-407-0724 |

| Participant International

Dial-In |

+1 201-389-0898 |

| Webcast: |

Link |

About BX004 BiomX is developing BX004, a fixed

multi-phage cocktail, for the treatment of CF patients with chronic

pulmonary infections caused by P. aeruginosa, a main contributor to

morbidity and mortality in patients with CF. In November 2023,

BiomX announced positive topline results from Part 2 of the Phase

1b/2a trial where BX004 demonstrated improvement in pulmonary

function associated with a reduction in P. aeruginosa burden

compared to placebo in a predefined subgroup of patients with

reduced lung function (baseline FEV1<70%).

BiomX expects to initiate a randomized, double blind,

placebo-controlled, multi-center Phase 2b trial in CF patients with

chronic P. aeruginosa pulmonary infections in the fourth quarter of

2024. The trial is designed to enroll approximately 60 patients

randomized at a 2:1 ratio to BX004 or placebo. Treatment is

expected to be administered via inhalation twice daily for a

duration of 8 weeks. The trial is designed to monitor the safety

and tolerability of BX004 and is designed to demonstrate

improvement in microbiological reduction of P. aeruginosa burden

and evaluation of effects on clinical parameters such as lung

function measured by FEV1 and patient reported outcomes. Trial

results are expected in the third quarter 2025. The FDA has granted

BX004 Fast Track designation and Orphan Drug Designation.

About BX211 BX211 is a personalized phage

treatment for the treatment of DFO associated with S. aureus. The

personalized phage treatment tailors a specific phage selected from

a proprietary phage-bank according to the specific strain of S.

aureus biopsied and isolated from each patient. DFO is a bacterial

infection of the bone that usually develops from an infected foot

ulcer and is a leading cause of amputation in patients with

diabetes.

The ongoing randomized, double-blind, placebo-controlled,

multi-center Phase 2 trial investigating the safety, tolerability,

and efficacy of BX211 for subjects with DFO associated with S.

aureus is expected to enroll approximately 45 subjects randomized

at a 2:1 ratio to BX211 or placebo. BX211 or placebo is designed to

be administered weekly, by topical and IV route at Week 1 and by

the topical route only at each of Weeks 2-12. Over the 12-week

treatment period, all subjects are expected to continue to be

treated in accordance with standard of care which will include

antibiotic treatment as appropriate. A first readout of study

topline results is expected at Week 13 evaluating healing of the

wound associated with osteomyelitis, followed by a second readout

at Week 52 evaluating amputation rates and resolution of

osteomyelitis based on X-ray, clinical assessments, and established

biomarkers (ESR and CRP). These readouts are expected in the first

quarter of 2025 and the first quarter of 2026, respectively.

About BiomX BiomX is a clinical-stage company

leading the development of natural and engineered phage cocktails

and personalized phage treatments designed to target and destroy

harmful bacteria for the treatment of chronic diseases with

substantial unmet needs. BiomX discovers and validates proprietary

bacterial targets and applies its BOLT (“BacteriOphage Lead to

Treatment”) platform to customize phage compositions against these

targets. For more information, please visit www.biomx.com, the

content of which does not form a part of this press release.

Safe Harbor This press release contains express

or implied “forward-looking statements” within the meaning of the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

words such as: “target,” “believe,” “expect,” “will,” “may,”

“anticipate,” “estimate,” “would,” “positioned,” “future,” and

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. For

example, when BiomX discusses the expected timing of clinical

trials, key data readouts and topline results, its cash runway and

sufficiency of capital to meet milestones and the potential

benefits of BX004 and BX211, BiomX is making forward-looking

statements. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based only

on BiomX management’s current beliefs, expectations and

assumptions. In addition, past and current pre-clinical and

clinical results, as well as compassionate use, are not indicative

and do not guarantee future success of BiomX clinical trials.

Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are

outside of BiomX’s control. Actual results and outcomes may differ

materially from those indicated in the forward-looking statements,

as a result of various important factors, including risks and

uncertainties related to the ability to recognize the anticipated

benefits of the merger with APT; the outcome of any legal

proceedings that may be instituted against BiomX following the

merger and related transactions; the ability to obtain or maintain

the listing of the common stock of BiomX on the NYSE American

following the merger; costs related to the merger; changes in

applicable laws or regulations; the possibility that BiomX may be

adversely affected by other economic, business, and/or competitive

factors, including risks inherent in pharmaceutical research and

development, such as: adverse results in BiomX’s drug discovery,

preclinical and clinical development activities, the risk that the

results of preclinical studies and early clinical trials may not be

replicated in later clinical trials, BiomX’s ability to enroll

patients in its clinical trials, and the risk that any of its

clinical trials may not commence, continue or be completed on time,

or at all; decisions made by the FDA and other regulatory

authorities; investigational review boards at clinical trial sites

and publication review bodies with respect to our development

candidates; BiomX’s ability to obtain, maintain and enforce

intellectual property rights for its platform and development

candidates; its potential dependence on collaboration partners;

competition; uncertainties as to the sufficiency of BiomX’s cash

resources to fund its planned activities for the periods

anticipated and BiomX’s ability to manage unplanned cash

requirements; and general economic and market conditions.

Therefore, investors should not rely on any of these

forward-looking statements and should review the risks and

uncertainties described under the caption “Risk Factors” in BiomX’s

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on April 4, 2024, and additional disclosures

BiomX makes in its other filings with the SEC, which are available

on the SEC’s website at www.sec.gov. Forward-looking

statements are made as of the date of this press release, and

except as provided by law BiomX expressly disclaims any obligation

or undertaking to update forward-looking statements.

BiomX, Inc. Assaf Oron +97254-2228901assafo@biomx.com

1 In patients that had quantitative CFU levels at study

baseline

|

BIOMX INC. CONDENSED CONSOLIDATED BALANCE

SHEETS(USD in thousands, except share and per share

data)(unaudited) |

|

|

|

As of |

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

43,007 |

|

|

|

14,907 |

|

| Restricted cash |

|

|

1,108 |

|

|

|

957 |

|

| Other current assets |

|

|

2,986 |

|

|

|

1,768 |

|

| Total current assets |

|

|

47,101 |

|

|

|

17,632 |

|

| |

|

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

|

| Operating lease right-of-use

assets |

|

|

11,279 |

|

|

|

3,495 |

|

| Property and equipment,

net |

|

|

7,438 |

|

|

|

3,902 |

|

| In-process Research and

development (“IPR&D”) assets and Goodwill |

|

|

15,788 |

|

|

|

- |

|

| Total non-current assets |

|

|

34,505 |

|

|

|

7,397 |

|

| |

|

|

81,606 |

|

|

|

25,029 |

|

|

|

|

As of |

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Trade accounts payable |

|

|

3,686 |

|

|

|

1,381 |

|

| Current portion of lease

liabilities |

|

|

985 |

|

|

|

666 |

|

| Other accounts payable |

|

|

6,036 |

|

|

|

3,344 |

|

| Current portion of long-term

debt |

|

|

- |

|

|

|

5,785 |

|

| Total current liabilities |

|

|

10,707 |

|

|

|

11,176 |

|

| |

|

|

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

|

|

| Contract liability |

|

|

1,976 |

|

|

|

1,976 |

|

| Long-term debt, net of current

portion |

|

|

- |

|

|

|

5,402 |

|

| Operating lease liabilities,

net of current portion |

|

|

9,139 |

|

|

|

3,239 |

|

| Other liabilities |

|

|

153 |

|

|

|

155 |

|

| Private Placement

Warrants |

|

|

36,755 |

|

|

|

- |

|

| Total non-current

liabilities |

|

|

48,023 |

|

|

|

10,772 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies (Note 7) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Redeemable Convertible

Preferred Shares |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Preferred Stock, $0.0001 par

value; Authorized - 1,000,000 shares as of March 31, 2024 and

December 31, 2023. Issued and outstanding- 256,887 as of March 31,

2024. No shares issued and outstanding as of December 31,

2023. |

|

|

32,420 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity

(Capital Deficiency) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Common Stock, $0.0001 par

value; Authorized - 120,000,000 shares as of March 31, 2024 and

December 31, 2023. Issued and outstanding-59,998,342 shares as of

March 31, 2024 and 45,979,930 shares as of December 31, 2023. |

|

|

4 |

|

|

|

3 |

|

| |

|

|

|

|

|

|

|

|

| Additional paid in

capital |

|

|

170,749 |

|

|

|

166,048 |

|

| Accumulated deficit |

|

|

(180,297 |

) |

|

|

(162,970 |

) |

| Total stockholders’ equity

(Capital Deficiency) |

|

|

(9,544 |

) |

|

|

3,081 |

|

| |

|

|

81,606 |

|

|

|

25,029 |

|

|

BIOMX INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(USD in thousands, except share and per share

data)(unaudited) |

| |

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

Research and development (“R&D”) expenses, net |

|

|

4,105 |

|

|

|

4,564 |

|

| General and administrative

expenses |

|

|

2,680 |

|

|

|

1,644 |

|

| |

|

|

|

|

|

|

|

|

| Operating

loss |

|

|

6,785 |

|

|

|

6,208 |

|

| |

|

|

|

|

|

|

|

|

| Other income |

|

|

(88 |

) |

|

|

(91 |

) |

| Interest expenses |

|

|

850 |

|

|

|

565 |

|

| Loss from change in fair value

of Private Placement Warrants |

|

|

8,010 |

|

|

|

- |

|

| Finance expense (income),

net |

|

|

1,765 |

|

|

|

(327 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before

tax |

|

|

17,322 |

|

|

|

6,355 |

|

| |

|

|

|

|

|

|

|

|

| Tax expenses |

|

|

5 |

|

|

|

6 |

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

|

17,327 |

|

|

|

6,361 |

|

| |

|

|

|

|

|

|

|

|

| Basic and diluted loss per

share of Common Stock |

|

|

0.28 |

|

|

|

0.20 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average number of

shares of Common Stock outstanding, basic and diluted |

|

|

62,292,277 |

|

|

|

32,125,227 |

|

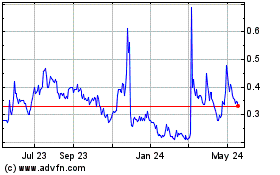

BiomX (AMEX:PHGE)

Historical Stock Chart

From Oct 2024 to Nov 2024

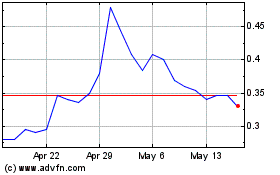

BiomX (AMEX:PHGE)

Historical Stock Chart

From Nov 2023 to Nov 2024