false

0001739174

0001739174

2024-05-30

2024-05-30

0001739174

PHGE:UnitsEachConsistingOfOneShareOfCommonStock0.0001ParValueAndOneWarrantMember

2024-05-30

2024-05-30

0001739174

PHGE:CommonStock0.0001ParValueMember

2024-05-30

2024-05-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): May

30, 2024

| BiomX Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware |

|

001-38762 |

|

82-3364020 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

22 Einstein St., Floor 4

Ness Ziona, Israel |

|

7414003 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: +972 723942377

| n/a |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Units, each consisting of one share of Common Stock, $0.0001 par value, and one warrant |

|

PHGE.U |

|

NYSE American |

| Common Stock, $0.0001 par value |

|

PHGE |

|

NYSE American |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice Of Delisting

or Failure to Satisfy A Continued Listing Rule or Standard; Transfer of Listing.

On May 23, 2024, BiomX, Inc. (the “Company”

or “BiomX”) received a notification (the “Notice”) from the NYSE American LLC (“NYSE American”) that

the Company is no longer in compliance with NYSE American’s continued listing standards. Specifically, the letter states that the

Company is not in compliance with the continued listing standards set forth in Sections 1003(a)(i), 1003(a)(ii) and 1003(a)(iii) of the

NYSE American Company Guide (the “Company Guide”). Section 1003(a)(i) requires a listed company to have stockholders’

equity of $2 million or more if the listed company has reported losses from continuing operations and/or net losses in three of its four

most recent fiscal years. Section 1003(a)(ii) requires a listed company to have stockholders’ equity of $4 million or more if the

listed company has reported losses from continuing operations and/or net losses in its five most recent fiscal years. Section 1003(a)(iii)

requires a listed company to have stockholders’ equity of $6 million or more if the listed company has reported losses from continuing

operations and/or net losses in its five most recent fiscal years. The Company reported a total stockholders’ capital deficiency

of $9,544,000 as of March 31, 2024, and losses from continuing operations and/or net losses in its five most recent fiscal years ended

December 31, 2023.

The Notice further provides that the Company must

submit a plan of compliance (the “Plan”) by June 22, 2024, addressing how it intends to regain compliance with the continued

listing standards by November 23, 2025. The Plan is required to include specific milestones, quarterly financial projections and details

related to any strategic initiatives the Company plans to complete.

The Company has begun to prepare its Plan for

submission to the NYSE American by the June 22, 2024 deadline. If the NYSE American accepts the Company’s Plan, the Company will

be able to continue its listing during the Plan period and will be subject to continued periodic review by the NYSE American staff. If

the Plan is not submitted, or not accepted, or is accepted but the Company is not in compliance with the continued listing standards by

November 23, 2025, or if the Company does not make progress consistent with the Plan during the Plan period, the Company will be subject

to delisting procedures as set forth in the NYSE American Company Guide.

As previously reported, on March 15, 2024, the

Company consummated an acquisition of Adaptive Phage Therapeutics, Inc. and a private investment in public equity resulting in aggregate

gross proceeds of approximately $50 million. Due to certain accounting standards, these proceeds were not registered as equity of the

Company and therefore were not taken into consideration for the purposes of the Company’s compliance with the listing standards

of the Company Guide. At a stockholders meeting that is expected to take place in July 2024, the Company’s stockholders will be

asked to approve the conversion of the Company’s Series X Non-Voting Convertible Preferred Stock into Common Stock. If approved,

at least $32.4 million will be reclassified to stockholders equity, and the Company expects that would resolve the issue of the stockholders

equity deficiency.

The Company is committed to achieving compliance

with the NYSE American’s requirements. However, there can be no assurance that the Company will be able to achieve compliance with

the NYSE American’s continued listing standards within the required timeframe.

The Notice has no immediate impact on the listing

of the Company’s shares of common stock, par value $0.0001 per share (the “Common Stock”), which will continue to be

listed and traded on the NYSE American during this period, subject to the Company’s compliance with the other listing requirements

of the NYSE American. The Common Stock will continue to trade under the symbol “PHGE”, but will have an added designation

of “.BC” to indicate the status of the Common Stock as “below compliance”. The notice does not affect the Company’s

ongoing business operations or its reporting requirements with the Securities and Exchange Commission.

If the Common Stock ultimately

were to be delisted for any reason, it could negatively impact the Company by (i) reducing the liquidity and market price of the Company’s

Common Stock; (ii) reducing the number of investors willing to hold or acquire the Common Stock, which could negatively impact the Company’s

ability to raise equity financing; (iii) limiting the Company’s ability to use a registration statement to offer and sell freely

tradable securities, thereby preventing the Company from accessing the public capital markets; and (iv) impairing the Company’s

ability to provide equity incentives to its employees

Safe Harbor

This Current Report on Form

8-K contains express or implied “forward-looking statements” within the meaning of the “safe harbor” provisions

of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,”

“believe,” “expect,” “will,” “may,” “anticipate,” “estimate,”

“would,” “positioned,” “future,” and other similar expressions that predict or indicate future events

or trends or that are not statements of historical matters. For example, when BiomX discusses its expectation to regain compliance with

NYSE American Continued Listing Standards, the timing of the upcoming stockholders meeting and approval of the relevant resolutions there

as well as the accounting reclassification of certain liabilities into equity it is using forward-looking statements. Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on BiomX management’s

current beliefs, expectations and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict and many of which are outside of BiomX’s control. These risks and

uncertainties include, but are not limited to, the following: BiomX’s ability to timely submit its Plan to the NYSE American, the

acceptance of its Plan by the NYSE American and BiomX’s ability to regain compliance with the listing standards set forth in the

Company Guide by November 23, 2025. Therefore, investors should not rely on any of these forward-looking statements and should review

the risks and uncertainties described under the caption “Risk Factors” in BiomX’s Annual Report on Form 10-K filed with

the Securities and Exchange Commission (the “SEC”) on April 4, 2024, and additional disclosures BiomX makes in its other filings

with the SEC, which are available on the SEC’s website at www.sec.gov. Forward-looking statements are made as of the date of this

Current Report on Form 8-K, and except as provided by law BiomX expressly disclaims any obligation or undertaking to update forward-looking

statements.

Item 5.02 Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensation Arrangements of Certain Officers.

Effective May 31, 2024, Mr.

Avraham Gabay’s term as Interim Chief Financial Officer of the Company will conclude, following Ms. Marina Wolfson’s return

from maternity leave. Biographical information for Ms. Wolfson is available in the Company’s Preliminary Proxy Statement on Schedule

14A filed with the Securities and Exchange Commission on May 28, 2024, and such information is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BIOMX INC. |

| |

|

|

| May 30, 2024 |

By: |

/s/ Avraham Gabay |

| |

|

Name: |

Avraham Gabay |

| |

|

Title: |

Interim Chief Financial Officer |

v3.24.1.1.u2

Cover

|

May 30, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 30, 2024

|

| Entity File Number |

001-38762

|

| Entity Registrant Name |

BiomX Inc.

|

| Entity Central Index Key |

0001739174

|

| Entity Tax Identification Number |

82-3364020

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

22 Einstein St.

|

| Entity Address, Address Line Two |

Floor 4

|

| Entity Address, City or Town |

Ness Ziona

|

| Entity Address, Country |

IL

|

| Entity Address, Postal Zip Code |

7414003

|

| City Area Code |

972

|

| Local Phone Number |

723942377

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Units, each consisting of one share of Common Stock, $0.0001 par value, and one warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Common Stock, $0.0001 par value, and one warrant

|

| Trading Symbol |

PHGE.U

|

| Security Exchange Name |

NYSEAMER

|

| Common Stock, $0.0001 par value |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

PHGE

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PHGE_UnitsEachConsistingOfOneShareOfCommonStock0.0001ParValueAndOneWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PHGE_CommonStock0.0001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

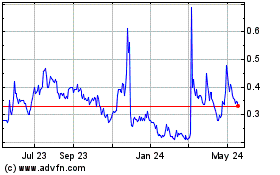

BiomX (AMEX:PHGE)

Historical Stock Chart

From Jan 2025 to Feb 2025

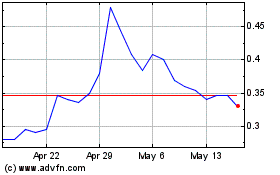

BiomX (AMEX:PHGE)

Historical Stock Chart

From Feb 2024 to Feb 2025