Rare Earth Metal ETF Jumps On WTO Tensions - ETF News And Commentary

March 14 2012 - 2:11AM

Zacks

While high tech applications continue to find their way into

more parts of our lives and become more ubiquitous, we still often

forget some of the key components that make these innovative

systems possible. This is especially true of rare earth metals, a

specific subset of the periodic table that has a variety of uses.

These elements, which include little-known metals such as tungsten,

cerium, and molybdenum, find their way into nearly everything in

our modern society from jet engines and guided missiles, to

televisions and cell phones. As a result, pretty much everyone

depends on rare earth metals in one way or another, whether they

realize it or not.

Yet although these metals are extremely important to the global

economy, many companies are almost entirely dependent on a single

national source for their supplies. In fact, at this point, China

accounts for roughly 90% of total rare earth metal production

(including 97% of 17 key metals), a level that could allow China to

pretty much strangle the high tech market. After all, without ample

rare earths, many products which we take for granted today would

either become far more expensive, or in many cases, downright

impossible.

This concern didn’t always used to be a big deal, as there were

plenty of exports from China as the country had little use for

these high tech focused products and many of these goods weren’t

mass produced as they are today. But as China’s economy has grown

at a relentless pace over the past decades, the Chinese government

has sought to protect its rare earth supplies from outside demand

and ensure that businesses based in the country would have rare

earth metals above all else. In fact, China cut its rare earth

exports to Japan in 2010, spiking fears over a more global export

crunch pretty much at China’s whims (read What Bubble? China ETFs

To Start 2012).

Thanks to this ongoing fear, and the lack of large amounts of

readily accessible supplies in other markets, the U.S., the EU, and

Japan have joined forces to launch a WTO case against China in

order to force it to export more rare earth metals. The claim marks

the first time that the three economic powers have teamed up in the

WTO, although first there is a 60-day process for the two sides to

try and hash out their differences. If this doesn’t work, the three

can then ask the WTO to establish a dispute-settlement panel to

decide the case although this can take as long as two years.

China seems unwilling to give in on this issue citing

environmental concerns and that its export limits aren’t directed

at any one country. Additionally, China points out that there are

supplies of rare earth metals around the world and that Western

powers should work to exploit these deposits instead of harassing

China. With this backdrop and the potential two year waiting

period, Western nations may have no choice but to develop their own

supplies of rare earths instead of relying on China for these

crucial elements (see Three Commodity ETFs That Have Not

Surged).

Unfortunately, finding companies that are concentrated in this

market segment can be hard to do; most large mining firms are

diversified into many categories leaving minimal exposure to rare

earths. Of the few pure rare earth miners, many are small or mid

caps and can be prone to large swings in a short period of time,

especially if the prices of the metals experience high levels of

volatility. However, there currently is one ETF targeting the

space which could be an interesting choice for those looking to

make a play on this potentially lucrative corner of the market, the

Rare Earth Metal ETF (REMX) from Van Eck (read

Time To Buy REMX?).

REMX In Focus

REMX tracks the Market Vectors Rare Earth/Strategic Metals

Index, which is a rules based, modified capitalization weighted,

float adjusted index intended to give investors a means of tracking

the overall performance of publicly traded companies primarily

engaged in a variety of activities that are related to the mining,

refining and manufacturing of rare earth/strategic metals. The

product charges investors 57 basis points a year for its services

but it does have more than $220 million in AUM and it also sees

more than 120,000 shares of volume a day, implying high levels of

liquidity (read Three ETFs With Incredible Diversification).

In terms of holdings, the ETF currently has 29 components with

assets spread around the globe. Australian and Canadian companies

each make up about 19% of the total, and then are closely followed

by U.S. companies which account for another 17% of assets.

Unsurprisingly given the risks of the sector, small and micro cap

securities combine to make up about 57% of total assets while mid

caps account for another 30%. As a result, the fund has a definite

tilt towards the smaller mining firms. Top individual holdings

include Irish firm Kenmare Resources at about 9%,

and then two Australian companies Iluka Resources

(ILKAF) and Lynas Corp (LYSCF) at 8.3%

and 6.9%, respectively.

REMX has had a rocky performance history in the relatively short

time it has been on the market. In 2011, the fund was crushed along

with a number of other products in the resource space, falling by

about 39.3% in the time frame. However, the fund has come back

strongly so far in 2012, adding almost 18.6% since the start of the

year while currently paying out a yield over 5.4%. This includes a

nearly 8.5% gain in the past week as tensions over rare earth

supplies have heated up and the market segment has been brought

back into focus (read Three Overlooked Emerging Market ETFs).

Should the tensions with China continue or if more export bans

become likely, REMX could be an interesting choice as it represents

some of the only non-Chinese rare earth metal miners in the world

(although Chinese firms do make up about 7% of the fund too). If

that happens, the sector could see continued inflows, especially if

governments start to stockpile the products in anticipation of

tight supplies. Just remember, the sector is extremely volatile and

can be prone to large swings in a short period of time; rare earth

metal ETF investing certainly isn’t for the faint of heart.

However, for those who believe there is something to this China

issue, huge gains could be had if the WTO looks to have a limited

impact on the rare earth giant’s policies in the near term, putting

a premium on alternative sources of production.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

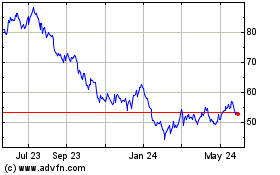

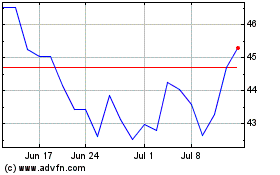

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Dec 2024 to Jan 2025

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Jan 2024 to Jan 2025