Commodity investing has had a rocky road over the course of 2012

as many products have seen divergent returns in the space. Some,

such as corn and many of the other grains, have seen solid

performances while other natural resources have been under

significant pressure in year-to-date terms.

One such commodity segment that has had a 2012 to forget is

undoubtedly the rare earth metal space. These metals include key

products such as cerium, neodymium, and Ytterbium, which are vital

components in a number of high tech applications around the world

(see Rare Earth Metal ETF Jumps on WTO Tensions).

The year started off promising enough for the space, as worries

over a brewing supply shortage and a rebounding economy helped to

send prices for many of these key products much higher. In fact,

several countries squared-off against China at the WTO over the

country’s rare earth export restrictions (See Could This Be the

Year for These Mining ETFs?).

The current rare earth metal king, China, controls about 90% of

the market and has repeatedly threatened to close off even more

supplies to the outside world have riled the supply/demand balance

for years. Thanks to this overhang, many remain incredibly bullish

on rare earth metal producers, and this was evidenced by a strong

performance in the space to start 2012.

However, this did not last, especially when looking at the top

ETF option in the rare earth metal world, the Market

Vectors Rare Earth/Strategic Metal ETF (REMX).This

product, which tracks a group of companies that are engaged in some

aspect of the mining process for these metals, started the year up

23% in the first month but thanks to a horrendous six month period,

is now sporting a year-to-date loss of nearly 15%.

What Happened

Basically, the global slowdown has been absolutely devastating

on the ‘high beta’ mining segment of rare earth metals. Demand for

a number of products that are big users of rare earths—such as

consumer electronics, clean energy, and defense applications—have

seen their demand levels or outlooks fall apart in the past few

months.

Furthermore, according to mineralprices.com, only one of their

followed rare earths is actually in the green on the year from a

performance perspective. Instead, most have fallen by more than

17%, including four that have witnessed losses exceeding 40% from a

one year look (also see The Comprehensive Guide to Gold ETF

Investing).

In addition to the global slowdown, broad speculation of a rare

earth bubble being popped is also running through the market as

well. “We had a bubble last year – an anomalous speculative blip –

that ran REE prices to the sky. It happened just as the junior

miners were coming into full bloom” said Jack Lifton of Technology

Metals Research. “At that time, I would say most of the junior REE

exploration companies were overvaluing their projects something

fierce. Then the market herd jumped in and ran the prices way

up.”

Lifton also noted that of the 260 U.S. listed rare earth mining

firms, only one, Molycorp (MCP) is actually at

production stage. MCP isn’t exactly having a great year either, as

the stock is down almost 60% year-to-date, and is trading close to

its 52 week lows putting the stock down 80% over the past one year

(also see Time to Exit the South Africa ETF?).

Given this terrible performance from one of the American market

leaders, the situation could be pretty bad in the coming months for

those firms that are in the space, but haven’t yet produced

anything. This could be especially true if rare earth metal prices

stay depressed, making it unprofitable for many of these

exploration firms to bring their mines online, potentially casting

a gloomy tone over the entire market space.

Yet with all the doom and worries over the space, the fact

remains that rare earth metals are crucial to modern life. These

products are in everything from flat screen TVs and steel alloys,

to jet engines and hybrid cars, and in many cases, their

replacement by other minerals or substances is incredibly

expensive, impractical, or downright impossible.

Given this reality, a closer look at the aforementioned REMX

could be in order. The product offers broad exposure across the

rare earth metal industry, focusing in on various mid cap and small

cap producers (read Has The Junior Gold Mining ETF Lost Its

Luster?).

Furthermore, the fund is pretty well diversified from a country

perspective, putting no more than 25% of assets in any one country,

and instead allocating at least 5% to nine different nations. The

ETF is also well spread out from an individual security perspective

as no one company accounts for more than 7.5% while all of the top

ten make up at least 5% of assets.

Still, make no mistake about it, REMX has had a terrible run

over the past year, slumping by nearly 40% in the time period.

However, this could finally be making this important market segment

a decent choice for those with extremely long time

horizons and a stomach for volatility.

Rare earths will not disappear any time soon, and since many

valuations are now reasonable in the space, it could be time to

take a closer look at REMX for a new way to play commodity mining

that has the potential for an extremely robust future. The fund

could offer a more diversified way to target rare earths while

doing so at a reasonable cost and with tight bid ask spreads as

well.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

MOLYCORP INC (MCP): Free Stock Analysis Report

MKT VEC-RAR ERT (REMX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

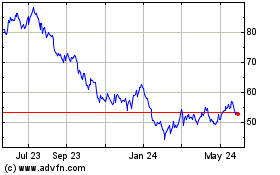

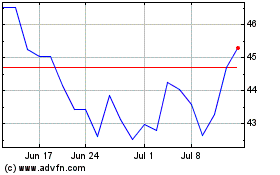

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Nov 2023 to Nov 2024