false

0000894158

0000894158

2024-02-07

2024-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 7, 2024

THERIVA BIOLOGICS, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-12584 |

|

13-3808303 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File No.) |

|

(IRS Employer Identification

No.) |

9605 Medical Center Drive, Suite 270

Rockville, Maryland 20850

(Address of principal executive offices and zip

code)

(301) 417-4364

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, par value $0.001 per share |

TOVX |

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On February 7, 2024,

Theriva Biologics, Inc. (the “Company”) issued a press release announcing that the Independent Data Monitoring Committee (IDMC)

recommended the continuation of enrollment as planned into VIRAGE, a multinational, Phase 2b, randomized, open-label, controlled clinical

trial evaluating VCN-01 in combination with standard-of-care chemotherapy (gemcitabine/nab-paclitaxel) as a first-line therapy for patients

with metastatic pancreatic ductal adenocarcinoma (PDAC).

According to the IDMC's

comprehensive assessment of clinical data from patients enrolled across 6 sites open in the U.S. and 9 sites open in Spain, the ongoing

Phase 2b trial will continue without any changes to the protocol. No safety concerns were raised based on the evaluation of data presented

at the IDMC meeting. Intravenous VCN-01 has been well tolerated and demonstrated a safety profile consistent with prior clinical trials.

Importantly, no additional toxicities were observed in patients receiving a second dose of VCN-01, providing the first clinical evidence

of the feasibility of repeated systemic dosing. VIRAGE remains on track to complete enrollment in the first half of 2024.

The information in this

Item 7.01 and in the press release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section

or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended and shall not be incorporated by reference into any filing with

the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general

incorporation language in such filing. The press release furnished as Exhibit 99.1 to this Current Report on Form 8-K includes “safe

harbor” language pursuant to the Private Securities Litigation Reform Act of 1995, as amended, indicating that certain statements

contained therein are “forward-looking” rather than historical.

Item 8.01. Other Events.

On February 7, 2024, the Company issued a press

release announcing that the Independent Data Monitoring Committee (IDMC) recommended the continuation of enrollment as planned into VIRAGE,

a multinational, Phase 2b, randomized, open-label, controlled clinical trial evaluating VCN-01 in combination with standard-of-care chemotherapy

(gemcitabine/nab-paclitaxel) as a first-line therapy for patients with metastatic pancreatic ductal adenocarcinoma (PDAC).

According to the

IDMC's comprehensive assessment of clinical data from patients enrolled across 6 sites open in the U.S. and 9 sites open in Spain, the

ongoing Phase 2b trial will continue without any changes to the protocol. No safety concerns were raised based on the evaluation of data

presented at the IDMC meeting. Intravenous VCN-01 has been well tolerated and demonstrated a safety profile consistent with prior clinical

trials. Importantly, no additional toxicities were observed in patients receiving a second dose of VCN-01, providing the first clinical

evidence of the feasibility of repeated systemic dosing. VIRAGE remains on track to complete enrollment in the first half of 2024.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: February 7, 2024 |

THERIVA BIOLOGICS, INC. |

| |

|

|

|

| |

By: |

/s/ Steven A. Shallcross |

| |

|

Name: |

Steven A. Shallcross |

| |

|

Title: |

Chief Executive Officer and Chief Financial Officer |

Exhibit 99.1

Theriva Biologics Announces Positive Recommendation

from the Independent Data Monitoring Committee of VIRAGE, the Phase 2b Clinical Trial of VCN-01 in Combination with Chemotherapy for Metastatic

Pancreatic Ductal Adenocarcinoma

– The independent data monitoring committee

(IDMC) recommended the continuation of VIRAGE with no safety concerns raised; VIRAGE remains on track to complete enrollment in the first

half of 2024–

Rockville,

MD, February 7, 2024 – Theriva™ Biologics (NYSE American: TOVX), a diversified clinical-stage company developing

therapeutics designed to treat cancer and related diseases in areas of high unmet need, today announced

that the Independent Data Monitoring Committee (IDMC) recommended the continuation of enrollment as planned into VIRAGE, a multinational,

Phase 2b, randomized, open-label, controlled clinical trial evaluating VCN-01 in combination with standard-of-care chemotherapy (gemcitabine/nab-paclitaxel)

as a first-line therapy for patients with metastatic pancreatic ductal adenocarcinoma (PDAC).

According to the IDMC's comprehensive assessment of clinical data from

patients enrolled across 6 sites open in the U.S. and 9 sites open in Spain, the ongoing Phase 2b trial will continue without any changes

to the protocol. No safety concerns were raised based on the evaluation of data presented at the IDMC meeting. Intravenous VCN-01 has

been well tolerated and demonstrated a safety profile consistent with prior clinical trials. Importantly, no additional toxicities were

observed in patients receiving a second dose of VCN-01, providing the first clinical evidence of the feasibility of repeated systemic

dosing. VIRAGE remains on track to complete enrollment in the first half of 2024.

"The positive IDMC review of VCN-01 safety following repeated

systemic dosing marks a significant step forward for our lead program. VCN-01 is a highly differentiated, systemic, selective, stroma-degrading

oncolytic adenovirus," said Steven A. Shallcross, Chief Executive Officer of Theriva Biologics. “With the IDMC’s recommendation,

we will continue to drive forward the VIRAGE study and explore the potential of VCN-01 to improve outcomes in first-line metastatic PDAC

patients treated with standard-of-care chemotherapy. We have shown that repeated systemic dosing of VCN-01 is feasible from a safety perspective,

and can now focus on whether the repeated-dose VCN-01 regimen may lead to improved clinical outcomes for patients with PDAC and other

solid cancers.”

About VIRAGE

VIRAGE is a two-arm Phase 2b open-label, randomized, controlled, multicenter

clinical trial in patients with histologically confirmed, newly-diagnosed metastatic PDAC. VIRAGE is expected to enroll up to 92 adult

participants at up to 25 sites across the US and Spain. In both the control and treatment arms, patients will receive gemcitabine/nab-paclitaxel

standard-of-care chemotherapy over 28-day cycles. In the treatment arm only, patients will also receive systemically administered VCN-01

seven-days prior to the first and fourth cycles of gemcitabine/nab-paclitaxel treatment. Primary endpoints for the trial include overall

survival and VCN-01 safety/tolerability. Additional endpoints include progression free survival, objective response rate, and measures

of biodistribution, VCN-01 replication, and immune response. Since this is an open-label trial, progress will be monitored very closely

and steps to accelerate the clinical program may be implemented if supported by the emerging data. More information about the trial is

available on Clinicaltrials.gov (NCT05673811), through the Spanish Clinical Trials Registry and European Union Drug Regulating Authorities

Clinical Trials Database (EudraCT Number: 2022-000897-24).

About VCN-01

VCN-01 is a systemically administered oncolytic adenovirus designed

to selectively and aggressively replicate within tumor cells and degrade the tumor stroma that serves as a significant physical and immunosuppressive

barrier to cancer treatment. This unique mode-of-action enables VCN-01 to exert multiple antitumor effects by (i) selectively infecting

and lysing tumor cells; (ii) enhancing the access and perfusion of co-administered chemotherapy products; and (iii) increasing tumor immunogenicity

and exposing the tumor to the patient’s immune system and co-administered immunotherapy products. Systemic administration enables

VCN-01 to exert its actions on both the primary tumor and metastases. VCN-01 has been administered to over 80 patients in Phase 1 and

investigator-sponsored clinical trials of different cancers, including PDAC (in combination with chemotherapy), head and neck squamous

cell carcinoma (with an immune checkpoint inhibitor), ovarian cancer (with CAR-T cell therapy), colorectal cancer, and retinoblastoma

(by intravitreal injection).

About Theriva™ Biologics, Inc.

Theriva™ Biologics (NYSE American: TOVX), is a diversified clinical-stage

company developing therapeutics designed to treat cancer and related diseases in areas of high unmet need. The Company is advancing a

new oncolytic adenovirus platform designed for intravenous (IV), intravitreal and antitumoral delivery to trigger tumor cell death, improve

access of co-administered cancer therapies to the tumor, and promote a robust and sustained anti-tumor response by the patient’s

immune system. The Company’s lead candidates are: (1) VCN-01, an oncolytic adenovirus designed to replicate selectively and aggressively

within tumor cells, and to degrade the tumor stroma barrier that serves as a significant physical and immunosuppressive barrier to cancer

treatment; (2) SYN-004 (ribaxamase) which is designed to degrade certain commonly used IV beta-lactam antibiotics within the gastrointestinal

(GI) tract to prevent microbiome damage, thereby limiting overgrowth of pathogenic organisms such as VRE (vancomycin resistant Enterococci)

and reducing the incidence and severity of acute graft-versus-host-disease (aGVHD) in allogeneic hematopoietic cell transplant (HCT) recipients;

and (3) SYN-020, a recombinant oral formulation of the enzyme intestinal alkaline phosphatase (IAP) produced under cGMP conditions and

intended to treat both local GI and systemic diseases. For more information, please visit Theriva Biologics’ website at www.therivabio.com.

Forward-Looking Statement

This release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. In some cases forward-looking statements can be identified by terminology such

as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,”

“intends,” “plans,” “believes,” “estimates,” and similar expressions, and include statements

regarding the ongoing Phase 2b trial continuing without any changes to the protocol, VIRAGE remaining on track to complete enrollment

in the first half of 2024, VCN-01 continuing to be well tolerated with a safety profile consistent with prior clinical trials, exploring

the potential of VCN-01 to improve outcomes in first-line metastatic PDAC patients treated with standard-of-care chemotherapy, and the

VIRAGE trial enrolling 92 patients. Important factors that could cause actual results to differ materially from current expectations include,

among others, the Company’s and VCN’s ability to reach clinical milestones when anticipated, including completion of enrollment

in Virage in the first half of 2024, generating clinical data that establishes VCN-01 being an adjunct to chemotherapy in pediatric patients

with advanced retinoblastoma and combining with immunotherapy products to treat solid tumors, the Company’s ability to successfully

combine and operate the business of the Theriva Biologics and VCN, the Company’s and VCN’s product candidates demonstrating

safety and effectiveness, as well as results that are consistent with prior results; the ability to complete clinical trials on time and

achieve the desired results and benefits, continuing clinical trial enrollment as expected; the ability to obtain regulatory approval

for commercialization of product candidates or to comply with ongoing regulatory requirements, regulatory limitations relating to the

Company’s and VCN’s ability to promote or commercialize their product candidates for the specific indications, acceptance

of product candidates in the marketplace and the successful development, marketing or sale of the Company’s and VCN’s products,

developments by competitors that render such products obsolete or non-competitive, the Company’s and VCN’s ability to maintain

license agreements, the continued maintenance and growth of the Company’s and VCN’s patent estate, the ability to continue

to remain well financed , and other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31,

2022 and its other filings with the SEC, including subsequent periodic reports on Forms 10-Q and current reports on Form 8-K. The information

in this release is provided only as of the date of this release, and Theriva Biologics undertakes no obligation to update any forward-looking

statements contained in this release on account of new information, future events, or otherwise, except as required by law.

For further information, please contact:

Investor Relations:

Chris Calabrese

LifeSci Advisors, LLC

ccalabrese@lifesciadvisors.com

917-680-5608

Source: Theriva Biologics, Inc.

v3.24.0.1

Cover

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity File Number |

001-12584

|

| Entity Registrant Name |

THERIVA BIOLOGICS, INC.

|

| Entity Central Index Key |

0000894158

|

| Entity Tax Identification Number |

13-3808303

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

9605 Medical Center Drive

|

| Entity Address, Address Line Two |

Suite 270

|

| Entity Address, City or Town |

Rockville

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20850

|

| City Area Code |

301

|

| Local Phone Number |

417-4364

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

TOVX

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

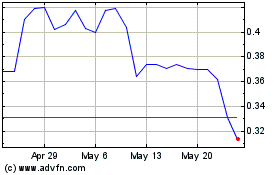

Theriva Biologics (AMEX:TOVX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Theriva Biologics (AMEX:TOVX)

Historical Stock Chart

From Feb 2024 to Feb 2025