Form 8-K - Current report

September 27 2024 - 4:01PM

Edgar (US Regulatory)

false

0001334933

0001334933

2024-09-27

2024-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 27, 2024

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

500 North Shoreline, Ste. 800,

Corpus Christi, Texas, U.S.A.

|

|

78401

|

|

(U.S. corporate headquarters)

|

|

(Zip Code)

|

| |

|

|

|

1830 – 1188 West Georgia Street

Vancouver, British Columbia, Canada

|

|

V6E 4A2

|

|

(Canadian corporate headquarters)

|

|

(Zip Code)

|

(Address of principal executive offices)

(361) 888-8235

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On September 27, 2024, Uranium Energy Corp. (the “Company” or “UEC”) issued a news release to report that it has filed its Annual Report on Form 10-K for the fiscal year ended July 31, 2024 with the U.S. Securities and Exchange Commission (the “SEC”). The Annual Report filing, which includes the Company’s audited consolidated financial statements, related notes thereto and management’s discussion and analysis for its fiscal year 2024, is available for viewing on the SEC’s website at www.sec.gov and on the Company's website at www.uraniumenergy.com.

Highlights:

| |

●

|

Successful startup of uranium production at the past-producing Christensen Ranch in-situ recovery (“ISR”) operations and Irigaray Central Processing Plant (“CPP”) in Wyoming’s Powder River Basin.

|

| |

●

|

South Texas hub-and-spoke ISR production platform making strong progress with increased resources at Burke Hollow Project and development plans for the construction of a satellite facility to the Hobson CPP.

|

| |

●

|

Advancing the Roughrider Project in Canada’s Eastern Athabasca Basin with environmental baseline, technical studies and positive drill results leading to the discovery of Roughrider North, 850 meters northeast of the Roughrider deposit.

|

| |

●

|

UEC’s attributable resources now total 230.0 million pounds U3O8 in the Measured and Indicated Categories and 102.7 million pounds U3O8 in the Inferred category across all its projects(1), cementing UEC’s status as one of the largest and diversified North American focused uranium companies.

|

| |

●

|

Over 1,466,000 pounds of U3O8 inventories as of July 31, 2024 valued at $125.3 million at market price(2). Taking deliveries of an additional 700,000 pounds of U3O8 at an average cost of $38.20 per pound through December 2025.

|

| |

●

|

Approximately $331.5 million of cash, equity holdings(3) and inventory(2) at market prices, and no debt, as of July 31, 2024.

|

| |

●

|

Landmark agreement with Rio Tinto America Inc. (“Rio Tinto”) to acquire 100% of Rio Tinto's Sweetwater Plant and a portfolio of uranium mining projects in Wyoming, creating a third U.S. hub-and-spoke ISR production platform within UEC’s pure-play uranium business.

|

| |

●

|

Achieved a Sustainalytics Rating of 23.8, placing UEC as the leading uranium mining company and in the top 5th percentile of the Diversified Metals and Mining Subindustry as rated by Morningstar Sustainalytics (as of September 2, 2024).

|

Amir Adnani, CEO and President, stated: “Fiscal 2024 proved to be a year of successful transformative growth for UEC with the restart of production at our Christensen Ranch ISR operations in Wyoming. At the same time, we continued to advance our Roughrider and Burke Hollow projects with resource expansions and development programs respectively.”

Mr. Adnani continued: “We are also thrilled with the recent acquisition from Rio Tinto of the fully-licensed Sweetwater Plant and a portfolio of uranium properties, which adds approximately 175 million pounds of historical uranium resources(4). These assets will unlock tremendous value, by establishing our third hub-and-spoke production platform, and cements UEC as the leading uranium developer in Wyoming and the U.S.”

Mr. Adnani concluded, “Global demand for nuclear energy and uranium is surging, highlighted by the proposed Three Mile Island Unit 1 restart to support Microsoft's AI data center expansion. The U.S. and European Union Russian uranium bans and Russia’s recent signaling of future export restrictions, emphasize the need for reliable domestic supply chains to meet Western nuclear fuel supply requirements. As the demand side pressure increases, UEC remains 100% unhedged. Our balance sheet is debt free with approximately $331.5 million in cash, equity holdings and inventory at market prices on July 31, 2024, providing the financial strength to rapidly expand and develop our U.S. ISR production platforms and Canadian assets, including the Roughrider Project.”

Notes:

|

(1)

|

The noted resource estimates represent the combined totals for the Company's uranium projects. Please see the Company's Annual Report on Form 10-K for the fiscal year ended July 31, 2024 for further information regarding such estimates, including the methodologies, assumptions and other important information.

|

|

(2)

|

Based on spot price quoted on UxC CVD as of July 31, 2024.

|

|

(3)

|

Based on closing prices as of July 31, 2024.

|

|

(4)

|

Based upon internal studies and other historic data prepared by prior owners in regards to the projects and dated between 1984 and 2019. Such estimates are being treated by the Company as historical in nature and a qualified person has not done sufficient work to classify the historical estimates as current mineral resources. The Company is not treating them as current resource estimates and is disclosing these historic estimates for illustrative purposes and to provide readers with relevant information regarding the projects. In addition, such estimates were not prepared for disclosure under S-K 1300 standards and the results of future estimates by the Company may vary from these historic estimates.

|

The technical information in the news release has been reviewed and approved by Chris Hamel, P.Geo., Vice President Exploration, Canada, for the Company, being a Qualified Person as defined by Regulation S-K 1300.

A copy of the news release is attached as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

| |

Exhibit

|

|

Description

|

| |

|

|

|

| |

99.1

|

|

|

| |

|

|

|

| |

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

URANIUM ENERGY CORP.

|

|

|

|

|

|

|

|

DATE: September 27, 2024.

|

By:

|

/s/ Pat Obara

|

|

|

|

|

Pat Obara, Secretary and

Chief Financial Officer

|

|

Exhibit 99.1

NYSE American: UEC

Uranium Energy Corp Files Fiscal 2024 Annual Report

Transformative Year with Wyoming ISR Production Restart, 100% Unhedged Uranium Exposure and Subsequent Accretive Acquisition of Rio Tinto’s Sweetwater Plant and Wyoming Uranium Assets

Highlights:

| |

●

|

Successful startup of uranium production at the past-producing Christensen Ranch in-situ recovery (“ISR”) operations and Irigaray Central Processing Plant (“CPP”) in Wyoming’s Powder River Basin.

|

| |

●

|

South Texas hub-and-spoke ISR production platform making strong progress with increased resources at Burke Hollow Project and development plans for the construction of a satellite facility to the Hobson CPP.

|

| |

●

|

Advancing the Roughrider Project in Canada’s Eastern Athabasca Basin with environmental baseline, technical studies and positive drill results leading to the discovery of Roughrider North, 850 meters northeast of the Roughrider deposit.

|

| |

●

|

UEC’s attributable resources now total 230.0 million pounds U3O8 in the Measured and Indicated Categories and 102.7 million pounds U3O8 in the Inferred category across all its projects(1), cementing UEC’s status as one of the largest and diversified North American focused uranium companies.

|

| |

●

|

Over 1,466,000 pounds of U3O8 inventories as of July 31, 2024 valued at $125.3 million at market price(2). Taking deliveries of an additional 700,000 pounds of U3O8 at an average cost of $38.20 per pound through December 2025.

|

| |

●

|

Approximately $331.5 million of cash, equity holdings(3) and inventory(2) at market prices, and no debt, as of July 31, 2024.

|

| |

●

|

Landmark agreement with Rio Tinto America Inc. (“Rio Tinto”) to acquire 100% of Rio Tinto's Sweetwater Plant and a portfolio of uranium mining projects in Wyoming, creating a third U.S. hub-and-spoke ISR production platform within UEC’s pure-play uranium business.

|

| |

●

|

Achieved a Sustainalytics Rating of 23.8, placing UEC as the leading uranium mining company and in the top 5th percentile of the Diversified Metals and Mining Subindustry as rated by Morningstar Sustainalytics (as of September 2, 2024).

|

Corpus Christi, TX, September 27, 2024 – Uranium Energy Corp (NYSE American: UEC, the “Company” or “UEC”) is pleased to report that it has filed its Annual Report on Form 10-K for the fiscal year ended July 31, 2024 with the U.S. Securities and Exchange Commission (the “SEC”). The Annual Report filing, which includes the Company’s audited consolidated financial statements, related notes thereto and management’s discussion and analysis for its fiscal year 2024, is available for viewing on the SEC’s website at www.sec.gov and on the Company's website at www.uraniumenergy.com.

Amir Adnani, CEO and President, stated: “Fiscal 2024 proved to be a year of successful transformative growth for UEC with the restart of production at our Christensen Ranch ISR operations in Wyoming. At the same time, we continued to advance our Roughrider and Burke Hollow projects with resource expansions and development programs respectively.”

Mr. Adnani continued: “We are also thrilled with the recent acquisition from Rio Tinto of the fully-licensed Sweetwater Plant and a portfolio of uranium properties, which adds approximately 175 million pounds of historical uranium resources(4). These assets will unlock tremendous value, by establishing our third hub-and-spoke production platform, and cements UEC as the leading uranium developer in Wyoming and the U.S.”

Mr. Adnani concluded, “Global demand for nuclear energy and uranium is surging, highlighted by the proposed Three Mile Island Unit 1 restart to support Microsoft's AI data center expansion. The U.S. and European Union Russian uranium bans and Russia’s recent signaling of future export restrictions, emphasize the need for reliable domestic supply chains to meet Western nuclear fuel supply requirements. As the demand side pressure increases, UEC remains 100% unhedged. Our balance sheet is debt free with approximately $331.5 million in cash, equity holdings and inventory at market prices on July 31, 2024, providing the financial strength to rapidly expand and develop our U.S. ISR production platforms and Canadian assets, including the Roughrider Project.”

Notes:

| |

(1)

|

The noted resource estimates represent the combined totals for the Company's uranium projects. Please see the Company's Annual Report on Form 10-K for the fiscal year ended July 31, 2024 for further information regarding such estimates, including the methodologies, assumptions and other important information.

|

| |

(2)

|

Based on spot price quoted on UxC CVD as of July 31, 2024.

|

| |

(3)

|

Based on closing prices as of July 31, 2024.

|

| |

(4)

|

Based upon internal studies and other historic data prepared by prior owners in regards to the projects and dated between 1984 and 2019. Such estimates are being treated by the Company as historical in nature and a qualified person has not done sufficient work to classify the historical estimates as current mineral resources. The Company is not treating them as current resource estimates and is disclosing these historic estimates for illustrative purposes and to provide readers with relevant information regarding the projects. In addition, such estimates were not prepared for disclosure under S-K 1300 standards and the results of future estimates by the Company may vary from these historic estimates.

|

The technical information in this news release has been reviewed and approved by Chris Hamel, P.Geo., Vice President Exploration, Canada, for the Company, being a Qualified Person as defined by Regulation S-K 1300.

About Uranium Energy Corp

Uranium Energy Corp is the fastest growing supplier of the fuel for the green energy transition to a low carbon future. UEC is the largest, diversified North American focused uranium company, advancing the next generation of low-cost, environmentally friendly ISR mining uranium projects in the United States and high-grade conventional projects in Canada. The Company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming. These two production platforms are anchored by fully operational Central Processing Plants (“CPPs”) and served by seven U.S. ISR uranium projects with all their major permits in place. In August 2024, production began at the Christensen Ranch project in Wyoming, sending uranium loaded resin to the CPP at Irigaray (Wyoming hub). Additionally, the Company has diversified uranium holdings including: (1) one of the largest physical uranium portfolios of U.S. warehoused U3O8; (2) a major equity stake in Uranium Royalty Corp., the only royalty company in the sector; and (3) a Western Hemisphere pipeline of resource stage uranium projects. The Company's operations are managed by professionals with decades of hands-on experience in the key facets of uranium exploration, development and mining.

Contact Uranium Energy Corp Investor Relations at:

Toll Free: (866) 748-1030

Fax: (361) 888-5041

E-mail: info@uraniumenergy.com

Stock Exchange Information:

NYSE American: UEC

WKN: AØJDRR

ISN: US916896103

Safe Harbor Statement

Except for the statements of historical fact contained herein, the information presented in this news release constitutes “forward-looking statements” as such term is used in applicable United States and Canadian securities laws. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as “forward-looking statements”. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of exploration activities, variations in the underlying assumptions associated with the estimation or realization of mineral resources, future mineral resource estimates may vary from historic estimates, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, title disputes or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Many of these factors are beyond the Company’s ability to control or predict. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company's filings with the Securities and Exchange Commission. For forward-looking statements in this news release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities.

v3.24.3

Document And Entity Information

|

Sep. 27, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

URANIUM ENERGY CORP.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 27, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-33706

|

| Entity, Tax Identification Number |

98-0399476

|

| Entity, Address, Address Line One |

500 North Shoreline

|

| Entity, Address, Address Line Two |

Ste. 800

|

| Entity, Address, City or Town |

Corpus Christi

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78401

|

| City Area Code |

361

|

| Local Phone Number |

888-8235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

UEC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001334933

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

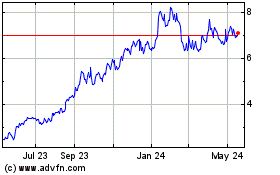

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Mar 2025 to Apr 2025

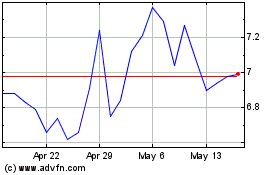

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Apr 2024 to Apr 2025