Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the

“Company”) today announced its unaudited financial results for the

quarter ended September 30, 2024, with cash totaling $19.0 million

at quarter-end. All dollar amounts in this press release are in

U.S. dollars.

Frederick H. Earnest, President and CEO of Vista, said, “During

the third quarter, we continued to successfully execute our

corporate strategy and demonstrated significant progress toward

achieving our 2024 goals and objectives. We announced positive

results from our ongoing drilling program, advanced technical

studies to support our evaluation of an alternative scale

development option at Mt Todd, continued to prioritize low overall

spending, and ended the quarter with $19.0 million of cash.

“We believe fundamentals for gold are strong, and we are

positioning Mt Todd as a leading development opportunity in the

current environment of a plus $2,600 gold price, diminishing major

deposit discoveries, and depleting gold reserves. We will continue

to prioritize the efficient use of our cash while we seek

opportunities to create long-term value for our shareholders and

execute our health, safety, and environmental initiatives.”

The Company is nearing completion of the planned 6,000 – 7,000

meter drilling program. Phase 1 and interim Phase 2 results were

announced in August and September, respectively. To date, the

drilling program has successfully confirmed the extension of the

core zone and the mineralized boundaries in the northern section of

the Batman deposit and identified multiple high-grade intercepts in

the South Cross Lode zone, a narrower mineralized structure

adjacent to the Batman deposit that extends up to 400 meters to the

northeast. The drilling program is expected to be completed by year

end.

Vista is finalizing trade-off studies and preliminary

evaluations for Mt Todd and anticipates moving forward with a

feasibility study targeting throughput in the range of 12,000 –

17,000 tonnes per day (“ktpd”) (4 – 6 million tonnes per annum),

with 150,000 to 200,000 ounces of annual gold production, an

initial capital cost of less than $400 million, and a mineral

reserve grade of approximately 1 gram gold per tonne. By using

contract mining, third-party power generation, and construction

practices commonly used in Australia, Vista believes there is

opportunity to maintain high capital efficiency at this project

scale. The feasibility study will leverage prior technical studies

and the work completed for the 50 ktpd feasibility study, preserve

the potential for future expansion, and demonstrate the opportunity

for Mt Todd to deliver substantial economic returns in a range of

development scenarios. A decision to commence the feasibility study

is expected prior to the end of the year.

On October 17, 2024, the Company filed a $50 million Shelf

Registration Statement on Form S-3 (“Shelf Registration”) with the

U.S. Securities and Exchange Commission. The Shelf Registration

will replace the previous $100 million Form S-3 filed on November

19, 2021 that will expire on December 3, 2024. The Company is under

no obligation to use the Shelf Registration and has filed the Shelf

Registration in the normal course of business, consistent with the

Company’s practice of maintaining a current Shelf Registration.

Summary of Financial Results

Vista reported a consolidated net loss of $1.6 million, or $0.01

per basic common share, for the quarter ended September 30, 2024,

compared to a consolidated net loss of $1.5 million, or $0.01 per

basic common share for the quarter ended September 30, 2023.

Cash and cash equivalents totaled $19.0 million at September 30,

2024, compared to $6.1 million at December 31, 2023. The Company

continued to have no debt.

Management Conference Call

Management’s conference call to review financial results for the

quarter ended September 30, 2024, and to discuss corporate and

project activities is scheduled for October 24, 2024, at 10:00 a.m.

MDT (12:00 p.m. EDT).

Participant Toll Free: +1 (800) 717-1738

Participant International: +1 (289) 514-5100

Conference ID: 59918

This call will be archived and available at www.vistagold.com

after October 24, 2024. An audio replay will also be available

through November 7, 2024, by calling toll-free in North America +1

(888) 660-6264 or +1 (289) 819-1325 using passcode 59918#.

If you are unable to access the audio or phone-in on the day of

the conference call, please email your questions to

ir@vistagold.com.

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a shovel-ready

development-stage gold deposit located in the Tier-1 mining

jurisdiction of Northern Territory, Australia. Vista is positioning

Mt Todd as a leading development opportunity within the gold

sector. Mt Todd offers significant scale, development optionality,

growth opportunities, advanced local infrastructure, community

support, and demonstrated economic feasibility. All major

environmental and operating permits necessary to initiate

development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently

position the project for development while exercising the

discipline necessary to best realize value at the right time. Vista

believes its strategy of advancing Mt Todd in this manner will

deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact

Pamela Solly, Vice President of Investor Relations, at (720)

981-1185 or visit the Company’s website at www.vistagold.com.

For further information about Vista’s recent drilling program

results, see the Company’s news release dated September 24, 2024

available on the Company’s website and at www.sedarplus.ca.

Forward Looking Statements

This news release contains forward-looking statements within the

meaning of the U.S. Securities Act of 1933, as amended, and U.S.

Securities Exchange Act of 1934, as amended, and forward-looking

information within the meaning of Canadian securities laws. All

statements, other than statements of historical facts, included in

this news release that address activities, events or developments

that we expect or anticipate will or may occur in the future,

including such things as our belief that during the third quarter,

we continued to successfully execute our corporate strategy and

demonstrated significant progress toward achieving our 2024 goals

and objectives; our belief that drill results from our ongoing

drill program are positive; our expectation that our technical

studies will support our evaluation of an alternative scale

development option at Mt Todd; that we will continue to prioritize

low overall spending; our belief that fundamentals for gold are

strong and that we are positioning Mt Todd as a leading development

opportunity in the current environment of a plus $2,600 gold price,

diminishing major deposit discoveries, and depleting gold reserves;

that we will continue to prioritize the efficient use of our cash,

while we seek opportunities to create long-term value for our

shareholders and execute our health, safety, and environmental

initiatives; our belief that all major environmental and operating

permits necessary to initiate development of Mt Todd are in place;

our belief that we are nearing completion of the planned 6,000 –

7,000 meter drilling program; our belief that to date, the drilling

program has successfully confirmed the extension of the core zone

and the mineralized boundaries in the northern section of the

Batman deposit and identified multiple high-grade intercepts in the

South Cross Lode zone; the expectation that the drilling program

will be completed by year end; Vista anticipates moving forward

with a feasibility study targeting throughput in the range of

12,000 – 17,000 tpd (4 – 6 million tonnes per annum), with 150,000

to 200,000 ounces of annual gold production, an initial capital

cost of less than $400 million, and a mineral reserve grade of

approximately 1 gram gold per tonne; our belief that by using

contract mining, third-party power generation, and construction

practices commonly used in Australia, there is opportunity to

maintain high capital efficiency at this project scale; our

expectation that the feasibility study will leverage prior

technical studies and the work completed for the 50 ktpd

feasibility study, preserve the potential for future expansion, and

demonstrate the opportunity for Mt Todd to deliver substantial

economic returns in a range of development scenarios; our believe

that a decision to commence a feasibility study is expected prior

to the end of the year; statements related to the Shelf

Registration Statement on Form-3, including that the Shelf

Registration Statement will replace the previous $100 million S-3

filed on November 19, 2021 that will expire on December 3, 2024;

that the Company is under no obligation to use the Shelf

Registration and has filed the Shelf Registration in the normal

course of business, consistent with the Company’s practice of

maintaining a current Shelf Registration; our belief that Mt Todd

is a shovel-ready development-stage gold deposit and that the

Northern Territory, Australia is a Tier-1 jurisdiction; our belief

that Mt Todd offers significant scale, development optionality,

growth opportunities, advanced local infrastructure, community

support, and demonstrated economic feasibility; statements related

to Vista’s strategy, including Vista’s strategy is to advance Mt

Todd in ways that efficiently position the project for development

while exercising the discipline necessary to best realize value at

the right time and Vista’s belief that its strategy of advancing Mt

Todd in this matter will deliver a more fully valued project to its

shareholders are forward-looking statements and forward-looking

information. The material factors and assumptions used to develop

the forward-looking statements and forward-looking information

contained in this news release include the following: our forecasts

and expected cash flows; our projected capital and operating costs;

our expectations regarding mining and metallurgical recoveries;

mine life and production rates; that laws or regulations impacting

mine development or mining activities will remain consistent; our

approved business plans, our mineral resource and reserve estimates

and results of preliminary economic assessments; preliminary

feasibility studies and feasibility studies on our projects, if

any; our experience with regulators; political and social support

of the mining industry in Australia; our experience and knowledge

of the Australian mining industry and our expectations of economic

conditions and the price of gold. When used in this news release,

the words “optimistic,” “potential,” “indicate,” “expect,”

“intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and

similar expressions are intended to identify forward-looking

statements and forward-looking information. These statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

statements. Such factors include, among others, uncertainty of

resource and reserve estimates, uncertainty as to the Company’s

future operating costs and ability to raise capital; risks relating

to cost increases for capital and operating costs; risks of

shortages and fluctuating costs of equipment or supplies; risks

relating to fluctuations in the price of gold; the inherently

hazardous nature of mining-related activities; potential effects on

our operations of environmental regulations in the countries in

which it operates; risks due to legal proceedings; risks relating

to political and economic instability in certain countries in which

it operates; uncertainty as to the results of bulk metallurgical

test work; and uncertainty as to completion of critical milestones

for Mt Todd; as well as those factors discussed under the headings

“Note Regarding Forward-Looking Statements” and “Risk Factors” in

the Company’s latest Annual Report on Form 10-K as filed in March

2024, and other documents filed with the U.S. Securities and

Exchange Commission and Canadian securities regulatory authorities.

Although we have attempted to identify important factors that could

cause actual results to differ materially from those described in

forward-looking statements and forward-looking information, there

may be other factors that cause results not to be as anticipated,

estimated or intended. Except as required by law, we assume no

obligation to publicly update any forward-looking statements or

forward-looking information whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023794882/en/

Pamela Solly, Vice President of Investor Relations (720)

981-1185 www.vistagold.com.

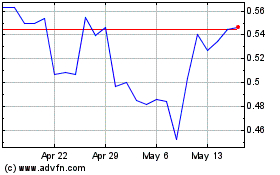

Vista Gold (AMEX:VGZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vista Gold (AMEX:VGZ)

Historical Stock Chart

From Jan 2024 to Jan 2025