The U.S. Industrial sector is due for a trend reversal this year

mainly to reflect the reduced wage differential between developed

and emerging economies. It is widely believed that North America

and Western Europe are high-cost nations and Latin America, Eastern

Europe, and most of Asia — especially China — are low cost

destinations. However, the rising wages in emerging countries and

sluggish rise in hourly wages in developed nations have gradually

been filling the gap.

This has given birth to the trend of ‘reshoring’ which basically

means the return of manufacturing hubs to the U.S. BCG’s latest

reports shows that steep wage rises in emerging nations, sluggish

productivity growth, strengthening of the U.S. dollar against a

basket of emerging currencies and a sharp rise in energy costs in

those nations have marred the appeal for offshoring activities.

Narrowing Wage Differential

At the time of the launch of its Industrial Renaissance ETF (AIRR)

this year, First Trust provided some data issued by the Economic

Policy Institute which says, during the crucial recession period of

2007 to 2012, wages in the U.S. declined for the bottom 70% of U.S.

workforce despite productivity expansion of 7.7%.

Average hourly earnings in the U.S. are currently rising at a pace

of less than 2% while China – one of the greatest manufacturing

offshoring destinations – saw wage increases of about 10.7% last

year and looks to log another 10% or more rise in wages this

year.

Minimum wages should rise until the mark of 40% of average urban

salaries by 2015 is attained, according to a guideline issued by

the State Council in February 2013, to deal with the country’s

broadening wealth gap. As a result, China’s manufacturing-cost

advantage over the U.S. has fallen to less than 5%.

Not only this, but manufacturing costs in eastern European nations

– also offshoring havens – are at now equivalent to or above the

level in the U.S. Apart from the U.S., the U.K. and the Netherlands

in Western Europe and Mexico in Latin America can now be picked as

low cost manufacturers.

Manufacturing "Renaissance" in the U.S.

Wages aside, there are also other factors that positively influence

manufacturing or industrial activity in the U.S. Relatively low

energy prices when compared to many of its global competitors are

also playing a vital role in this boom (read: 3 ETFs for

Manufacturing "Renaissance").

The U.S. economy has now come a long way from the meltdown that

occurred five years back. All economic indicators are improving

from the pre-crisis level hinting at rising domestic demand for

industrial equipment.

The European revival has also contributed to industrial growth in

the U.S. As per Richard Bernstein Advisors (RBA), growing

availability of bank financing for manufacturers is also driving

the sector. All these factors should facilitate U.S. industrial and

manufacturing companies to gain market share.

While there are several other factors to consider before shifting

the manufacturing base from one nation, a company should also

consider the proximity of target customers from the manufacturing

base, as per BCG. But wage and currency are significant factors,

and are lately providing all the needed support to the U.S.

industrial sector (read: Play Surging U.S. Manufacturing

with These Industrial ETFs).

Funds discussed below offer targeted bets on the sector and can

help investors garner profits if the wage differential continues to

narrow down and if the U.S. continues to become a manufacturing

powerhouse once more:

Industrials/Producer Durables AlphaDEX Fund

(

FXR)

This fund follows the StrataQuant Industrials Index which is based

on the AlphaDEX stock picking methodology. Instead of focusing

solely on the market cap, this technique closely monitors the

stocks’ price appreciation/momentum, sales and earnings growth as

well as value factors and ranks (see all industrial ETFs here).

The ETF has managed assets worth $809.9 million. In total, the

product holds 102 securities, which are not at all concentrated on

its top 10 holdings.

In fact, not a single company accounts for more than 1.79% of the

basket. The strategy eases out the risk quotient of the fund.

Investors have to pay 70 bps in fees and expenses which is higher

than the average expenses charged by the industrial equities ETF.

FXR has gained 3.78% so far this year. The product has a Zacks ETF

Rank of 1 or ‘Strong Buy’ rating with a ‘Medium’ risk outlook.

Vanguard Industrials ETF

(VIS)

VIS tracks the MSCI US Investable Market Industrials 25/50 Index

and invests about $1.65 billion in 340 holdings. The fund has

moderate company specific concentrator risks with about 40%

exposure in top 10 assets.

The fund gained about 0.52% so far this year. It charges a dirt

cheap expense ratio of 14 bps a year. The fund has a Zacks ETF rank

of 2 or Buy rating with a medium risk outlook.

Guggenheim S&P 500 Equal Weight Industrials

ETF (

RGI)

Yet another tempting, but often overlooked, option is RGI. The fund

seeks to track the performance of the S&P 500 Equal Weight

Index Industrials. So far, the fund has amassed an asset base of

$91.7 million and is invested in 65 holdings.

In terms of performance, RGI is up about 1.43% year to date.

Moreover, RGI charges about 40 basis points a year. Being an

equal-weight product, RGI has a medium risk outlook while it

carries a Zacks ETF Rank #2 as well (read: Overweight These Equal

Weight ETFs in Your Portfolio).

Bottom Line

Although on a nominal basis daily wages in the emerging markets are

still lower than that in the U.S., the wage growth has been higher

in emerging nations than the developed ones with no sign of a

change in this fashion, at least for the near term.

So, investors looking for industrial exposure should consider these

products in their portfolio to book profits out of the ‘reshoring’

trend. These ETFs are the top-rated ones that have beaten similar

products thus far and could run higher in the course of 2014.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

FT-RBA AMER IND (AIRR): ETF Research Reports

FT-INDL/PROD (FXR): ETF Research Reports

GUGG-SP5 EW IND (RGI): ETF Research Reports

VIPERS-INDUS (VIS): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

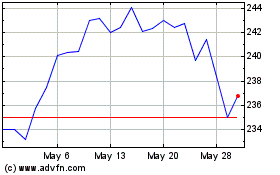

Vanguard Industrials ETF (AMEX:VIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

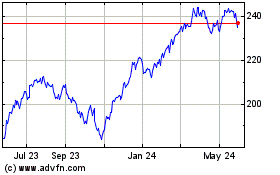

Vanguard Industrials ETF (AMEX:VIS)

Historical Stock Chart

From Dec 2023 to Dec 2024