Overall, 2012 has been a good one so far for the ETF industry,

particularly the third quarter where some funds witnessed

tremendous asset accumulation. In fact, the ETF industry currently

has over $1.3 trillion in assets, a figure that is roughly 34% more

than at the end of the third quarter in 2011 (as per ETF Industry

Association).

Also, the top 10 ETFs (in terms of asset accumulation for Q3)

witnessed a combined inflow of $27.65 billion which is an

astounding 95% increase from the second quarter of

this fiscal year, where the combined inflow for the top 10 funds

was just $14.13 billion.

This is a clear indication of restored confidence of investors

in the riskier asset segments, especially as dollars have come back

into high yield securities, American stock funds, and emerging

market stocks.

Moreover if the trend continues it could go a long way in

dismissing the International Monetary Fund’s (IMF) lackluster

prediction for global economic growth in its latest forecast which

could pose serious headwinds for the markets as we enter the final

quarter.

As you can see in the chart below, investors saw a number of

ETFs pull in over a billion dollars in assets during the quarter.

Furthermore, many of the funds are targeting similar segments,

although we continue to see some of the ‘safer’ bond products in

the top inflows once again for the third quarter:

Table 1 (Top 10 asset accumulating ETFs for

Q3)

|

ETF

|

Category

|

Inflow for Q3

|

Q3 Returns

|

|

SPY

|

Broad Market

|

$9,077.99 million

|

6.31%

|

|

VWO

|

Emerging Market

|

$4,024.44 million

|

5.78%

|

|

IWM

|

Small Caps

|

$3,061.42 million

|

5.30%

|

|

GLD

|

Commodities- Gold

|

$2,408.75 million

|

11.00%

|

|

HYG

|

Junk Bonds

|

$2,141.01 million

|

4.01%

|

|

IJH

|

Mid Caps

|

$1,616.14 million

|

5.41%

|

|

JNK

|

Junk Bonds

|

$1,425.67 million

|

4.30%

|

|

XLF

|

Financials

|

$1,422.98 million

|

6.89%

|

|

VNQ

|

REIT

|

$1,356.72 million

|

0.08%

|

|

OEF

|

Large Caps

|

$1,117.81 million

|

6.98%

|

Data as of 30th September, 2012 (From

indexuniverse.com)

As is evident from the table above, most of these ETFs are broad

market ETFs (including small and mid cap funds), high yield bond

ETFs and a commodity ETF — definitely riskier investment avenues,

reversing the trend from Q2 when safety was the name of the

game.

Behind some of the biggest gainers in

assets

The ultra low interest rate policy has also led the income

starved investors to place their bets on higher yielding

‘junk’ bond ETFs rather than lower yielding

investment grade ones at the expense of credit quality.

JNK and HYG, two such high

yielding ‘junk’ bond ETFs, witnessed a combined inflow of almost

$3.57 billion for the quarter.

Surprisingly, in the previous quarter JNK was one of the biggest

losers of assets leaking around $1.2 billion. In fact, the biggest

losers of assets in the third quarter are investment grade Treasury

bond ETFs. SHY, IEI, IEF and BIL - which are all in the government

bond space, have lost close to $4.52 billion cumulative in the

period. This goes to show how fed up income seeking investors have

become of the low yield policy followed by the Fed (read Long Term

Treasury ETFs: Ultimate QE3 Play?).

As was expected, the oldest Gold ETF, the SPDR Gold

Trust (GLD) witnessed a substantial inflow in its asset

base in the third quarter, amidst the build-up to the announcement

of a QE3 which was a very tricky one for the markets.

There had been much speculation in the commodities and bond

market over the likes of the monetary easing. Finally, on September

13th the Federal Reserve announced the launch of the

much anticipated open ended bond buying program. As a result

commodities (especially gold) rallied across the board.

However, the trend for GLD’s interest is expected to continue in

the near term especially considering the fact that just one week

into the fourth quarter, GLD has already amassed $1.05 billion in

the first seven days. GLD has returned an impressive 11% for the

third quarter (see Protect Against QE with these Precious Metal

ETFs).

Meanwhile, everybody’s favorite, SPY, has been leading the asset

accumulation race with an inflow of close to $9.08 billion. It was

one of the largest asset accumulators for Q2 as well. With an

already large asset base of $119.35 billion and an average daily

volume of 144 million shares, SPY still remains the most popular

option to play the large cap equity space.

Investors also have shown their appetite for broad market funds

from the mid and small cap space as demand for risk comes back

among investors. IWM, IJH and OEF all have low

expense ratios ranging from 20-23 basis points indicating that

expense ratio does play an important role in determining investment

decisions.

Also, these products have a fairly large average daily volume

with almost a million shares being traded daily for IJH and OEF and

47 million shares daily for IWM (see The Truth about Low Volume

ETFs).

Continuing the trend from the second quarter, Vanguard

MSCI Emerging Markets ETF (VWO) was one of the largest

accumulators this quarter as well. In fact the asset growth rate

for this product has been phenomenal – at 303% from the previous

quarter.

Thanks to its low expense ratio (0.20%) and bid ask spread, VWO

has comfortably beaten its emerging market counterpart EEM (expense

ratio of 0.67%) despite tracking the same indexes. EEM has added

about $945 million for the third quarter (read Track Market Gurus

with these ETFs).

XLF is pretty much the most cost-effective and

popular option to play large cap equity space from the financial

sector (read Inside the Top Zacks Ranked Financial ETF). In fact

the sector has been pretty much leading the market rally after a

disastrous performance last fiscal year. XLF has managed to

accumulate $1.4 billion in its asset base for the quarter and has

returned close to 7% in the time frame.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-IBX HYCB (HYG): ETF Research Reports

ISHARES TR-2000 (IWM): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

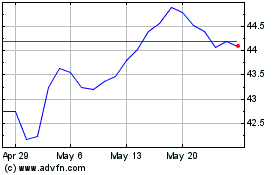

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Feb 2025 to Mar 2025

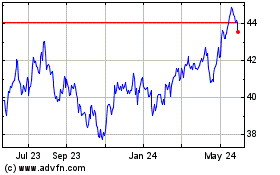

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Mar 2024 to Mar 2025