The ETF industry has come a long way from the time when the ETFs

were first launched as investment tools to gain exposure to

different asset classes. Since then, many ETFs came into existence,

of which many could not survive in the industry and had to be shut

down. So what could be the possible reason behind those ETFs which

were launched only to be shut down later?

We can say that ETFs are more about numbers like AUM, volume,

number of holdings, etc. So, which one of these numbers keeps an

ETF going? Is it asset under management which indicates whether the

fund will continue to exist or its average daily volume? (Ten

Biggest U.S. Equity Market ETFs)

Undoubtedly volume is an important consideration in the

investment process, especially for traders who get in and out of a

particular security very frequently. For these traders, high volume

levels can help keep bid-ask spreads low and thus reduce the total

cost of trading. (Guide to the 25 Most Liquid ETFs)

But it should be noted that a fund’s very existence depends to a

large extent on its asset under management. Generally, for a fund

asset under management of or over $100 million work as a threshold

for any sponsor’s profitability. While big fund houses may be able

to run their ETFs with low AUM for years, it becomes really

difficult for small fund house.

Although AUM and volume both play crucial roles in any fund’s

existence, it is finally the return from the fund which influences

any investor’s decision. Still, the funds that have managed to

attract a large amount of assets indicate that they are popular

with the investors due to their past performance and expectations

for future performance. Investors looking to invest in ETFs with

very high AUMs (more than 30 billion) as criteria have the

following options available.

SPDR S&P 500

(SPY)

Initiated in January 1993, SPY is the king in the ETF world,

with the highest asset under management. It manages an asset base

of $118.4 billion. The most popular fund among investors, SPY seeks

to invest its heavy asset base in a basket of 500 stocks and trades

with an average trading volume of about 135 million shares. The

fund also has an edge in expenses as it charges a fee of just 0.09%

annually. (Guide to the 25 Cheapest ETFs)

The weighting towards the top 10 holdings is also moderate as

just 21.4% of the huge asset base goes towards them. This implies

that the fund’s asset allocation is not limited to the top 10

holdings but is spread out among other companies as well.

Apple Inc. (AAPL) takes the top position in the top 10

holdings list with an asset allocation of 4.9%. Among others, the

fund does not invest more than 3.3% in any one holding.

Among sector allocation, the fund gives double-digit allocation

to the top 5 sectors with information technology being the most

preferred sector in the list with an asset allocation of 20.1%.

Vanguard MSCI Emerging Markets ETF (VWO)

This Vanguard ETF looks to tap the growing emerging markets

which not only have greater growth potential but also lower

correlation with their developed market counterparts. (Three

Overlooked Emerging Market ETFs)

This ETF tracks the MSCI Emerging Markets Index in order to

provide exposure to a basket of stocks across various developing

nations. The product has proven to be extremely popular with

investors.

The proof is in the $67.1 billion under management in the fund,

while trading volume is more than 18 million shares a day. Also,

the cost appears to be minimal at 20 basis points, especially when

compared to other emerging market ETFs.

In terms of a portfolio, VWO provides access to 902 securities

in its basket and does not allocate more than 3.9% to any one

stock. This suggests that the product is well diversified from an

individual security perspective and is unlikely to face company

specific risk. (Three Emerging Market ETFs to Limit BRIC

Exposure)

With regard to country exposure, China takes the top spot at

17.3% of assets, followed by 14.4% in Korea, 15.2% in Brazil, and a

10.7% allocation to Taiwan.

SPDR Gold Shares

(GLD)

For a bullion-backed approach to gold ETF investing, investors

can look to SPDR Gold Shares. GLD is the ETF which is backed by

physical metal and holds the metal in the form of bullion or

ingots.

Investing through GLD in gold represents a cost-effective and

suitable mode for investors. It is expected that the transaction

costs for buying and selling the shares will be lower than

purchasing, storing and insuring physical gold for most investors

(Has The Junior Gold Mining ETF Lost Its Luster?).

This ETF is designed to track the spot price of Gold bullion.

GLD is an ETF rich in AUM as it has $75.9 billion asset under

management and is one of the most liquid options available in gold

ETF investing trading with volumes of 7 million a day. The fund

charges a fee of 40 basis points annually.

iShares MSCI EAFE Index Fund ETF

(EFA)

For investors seeking a broad exposure to developed markets

around the world outside of the U.S. and Canada should invest in

EFA. EFA tracks the MSCI EAFE Index and provides exposure to

companies specifically in Europe, Australia, and the Far East

(Seven Biggest International Equity ETFs).

This product manages an asset base of $36.7 billion and is an

extremely liquid option available to investors as traded volume on

a normal day is more than 14 million. So this product is rich in

both AUM and volume.

The fund seeks to invest this asset base in a large basket of

926 stocks and is immune to company specific risk with just 13.4%

of assets in the top 10 holdings. Among sector breakdown, the fund

is a bit tilted towards financials in which it put in 23.4% of the

asset base. Among others the fund does not invest more than 12.3%

in any stock.

From a country perspective, United Kingdom takes the top spot at

22.8% of assets, just edging out Japan. The fund charges an expense

ratio of 34 basis points on an annual basis.

MSCI Emerging Markets Index Fund

(EEM)

For a broad play on the emerging market space, EEM presents a

compelling choice to the investors looking to tap the emerging

markets (Get True Emerging Market Exposure With These Three

ETFs).

The fund managed to build an impressive asset base of $37.4

billion and is also rich in volume trading with volumes of more

than 36 million on a normal day. The ETF charges investors 67 basis

points in fees for its services. .

It represents a solid pick for long-term investors as it has a

well diversified portfolio that doesn’t put more than 3.8% in any

one security. Sector exposure, however, is tilted towards

financials, information technology, energy and materials where each

of them accounts for double-digit allocation.

For countries, China takes the top spot at just about 17% of the

total, followed by a 15% allocation to South Korea and a 13%

holding in Brazilian firms.

iShares S&P 500 Index Fund

(IVV)

Investors seeking for exposure in the large capitalization

sector of the U.S. equity market or S&P 500 should look to

invest in IVV. IVV trades with an asset base of $32.8 billion.

This produces a product which is home to a large basket of 502

large cap stocks with a spread out holding pattern as it just

allocates 21.3% to the top 10 holdings. Apple takes the top spot in

the top 10 holdings closely followed by Exxon Mobil and General

Electric.

The fund does not appear to be biased towards any particular

sector and gives double-digit allocation to almost all the sectors

except the last four. The fund also has an edge in expenses as it

just charges 9 basis points annually.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report

>>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-EAFE (EFA): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-SP500 (IVV): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

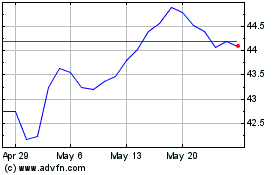

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

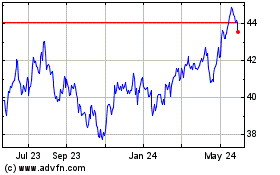

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2023 to Dec 2024