Emerging market ETF investing has been quite rocky to start

2013. Funds like VWO and EEM,

which dominate the asset base for the emerging world, have seen

returns in the red on a year-to-date basis, although certain

regions have been able to do much better.

One of the top performing markets continues to be Southeast

Asia, as funds targeting nations like the Philippines, Thailand,

and Indonesia are setting the pace. However, investors have noticed

a big exception to this trend so far in 2013; Malaysia (read Time

to Buy Emerging Market ETFs?).

Although the country remains favorably positioned, it has lagged

behind its peers in the region by a pretty wide margin to start the

year. In fact, the main ETF targeting Malaysia,

EWM, has only added about 5% on the year, roughly

1,000 basis points less than IDX which follows

Indonesia, and THD which tracks the Thai market,

and nearly 2,000 basis points less than the Philippines’

EPHE.

What’s wrong with the Malaysia ETF?

The main reason for this underperformance though hasn’t been due

to economic factors but instead due to politics. The country had a

key election, and some believed that the outcome was in doubt.

This is very important as the ruling party, Barisan Nasional,

has been in power over the country since independence, so a loss

would mark a seismic shift in the nation. And, from an investment

perspective, it would also introduce a high level of uncertainty in

the mix, something that investors hate, and especially so in

emerging market nations (see Three Country ETFs Struggling in

2013).

So, while investors have largely scooped up Southeast Asian ETFs

throughout 2013, they have avoided Malaysia and EWM as this

political cloud hung over the market. Fortunately though, there

could be clear skies ahead for the country now that the election is

over and that there was a definitive result to the voting.

Status quo maintained... for the most part

In the recent election, the ruling coalition won a

relatively-close victory, obtaining 133 seats in the 222 seat

parliament, according to the WSJ. This marks roughly 60% of the

total, and far higher than the opposition’s 89 seat haul.

Still, the results weren’t a ‘total victory’ by any means and

some questions are likely to hang over the market. First, the

winning coalition has less than two-thirds of the seats, so it

could be a bit more difficult to pursue their legislative

agenda.

Furthermore, there are also some worries about fraud, with the

opposition broadly protesting the results in several districts. It

remains to be seen if this bubbles up into a new issue, but as of

now, it appears that many are shrugging off these concerns.

Impact on Malaysia ETF

Shares of EWM soared after the election results were known, with

the ETF jumping by over 6% on the day and going to a new all-time

high. Volume was also elevated as well, as the number of shares

that changed hands easily exceeded the normal daily level by the

midpoint in the day’s session (see Malaysia ETF: The Perfect

Emerging Market Fund?).

Clearly, investors like the fact that a huge level of

uncertainty has been removed from this market, and that the country

can finally rebound like its peers in the region. It also shows

that investors aren’t putting too much behind the fears of recounts

or electoral protests, and that smooth sailing could be ahead for

the country.

Bottom Line

Now that the election is behind Malaysia, it could be time to

take a closer look at EWM. Currently, we have a Zacks ETF Rank of 1

or ‘Strong Buy’ on the fund, so we believe that the nation has a

pretty good outlook in the near term (read Can Anything Stop These

Southeast Asia ETFs?).

So, for investors seeking an emerging market play in the region

that hasn’t surged so far in 2013, this could be an intriguing

pick. It has plenty of room to catch up to its counterparts in the

region, and now that a big portion of the worries hanging over the

country are gone, it may be poised to surge higher in the weeks and

months ahead.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Author is long VWO, EWM, IDX

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS PH IM (EPHE): ETF Research Reports

ISHARS-MALAYSIA (EWM): ETF Research Reports

MKT VEC-INDONES (IDX): ETF Research Reports

ISHRS-MSCI THAI (THD): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

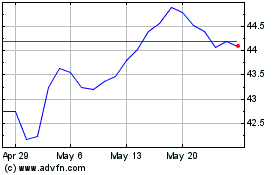

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

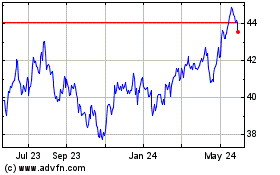

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2023 to Dec 2024