Forgotten Central Asia and Mongolia ETF in Focus - ETF News And Commentary

October 01 2013 - 7:01AM

Zacks

The long overlooked Central Asia & Mongolia zone has recently

caught investor's attention. This commodity-centric region is

getting all the attention thanks to an upsurge in natural resource

prices.

All the countries in this region are rich in deposits of various

resources including petroleum, natural gas and mining commodities

like Gold, Copper, Silver and Coal. Mongolia is one of the largest

coal-producing countries, Kazakhstan is one of the major oil

producing countries and Uzbekistan has the largest open-pit gold

mine in the world (read: 3 Forgotten Ways to Play Mining Sector

with ETFs).

When the taper talks began in May, market movement started to turn

around, infusing fresh blood into commodity-oriented ETFs. The

improving China data also helped in lifting these products as the

country is a major user of the said minerals and one of the biggest

importers of those commodities.

As per Global X, trade between the commodity depot Central Asia and

China grew approximately $500 million in 1992 to $30 billion in

2010 indicating the dependence of this zone on China’s

recovery.

Following diplomatic developments in Syria, Gold may not be a good

choice to bet on, but commodities like Coal are still offering good

entry points. Moody’s neutral to positive comment on Coal saying it

“does not expect industry fundamentals to deteriorate further over

the next 12 to 18 months, though business conditions remain very

weak” sent coal stocks rallying.

The rating agency also raised its coal industry outlook to stable

from negative (see Are Coal ETFs Back on Track?). In such a

scenario, one could ride on the commodity strength in Central Asia

& Mongolia.

ETF Impact

There is a new fund called

Global X Central Asia &

Mongolia Index ETF (AZIA) which serves up

exposure as a pure play in this forgotten region. The performance

of AZIA mirrors that of natural resources and their outlook.

With coal stocks heaving a sigh of relief on the expectation of

better pricing by next year, Mongolian exposure, albeit little,

might drive the fund higher. Kazakhstan's abundance of coal should

also be kept in mind.

Central Asia & Mongolia is a bit tricky part of the world to

invest in since very few and not all five counties of central Asia

(Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan)

get exposure in the emerging markets or frontier market funds. This

criterion brings AZIA in focus. In the last three months, the fund

gained 8.5% as of September 30, 2013.

AZIA in Details

Debuted in April 2013,

Global X Central Asia & Mongolia

Index ETF (AZIA) tracks the performance of the Central

Asia & Mongolia Index. The fund doles out exposure to 22

securities from the various nations that have exposure to the

central Asia and Mongolia region.

So far, the fund has been ignored in the emerging markets segment

with just about $1.5 million in AUM. This leaves the fund with

paltry trading volumes. Its daily trading volume of around 3,000 is

also quite light compared to better known emerging market ETFs like

VWO or EEM.

The product puts as much as 74.0% of its total assets in the top 10

holdings, suggesting a very high concentration risk. Centerra Gold

Inc. (12.04%), KAZAKHMYS (9.58%) and Bank of Georgia (9.47%) hold

the top three positions in the basket (see all the Asia Pacific

Emerging Market ETFs).

In terms of geographic exposure, the United Kingdom (41%), Canada

(19%), and Kazakhstan (13%) round out the top three as well as take

up the lion’s share of the fund's assets. Greater exposure to the

better-positioned United Kingdom in Europe also explains why it can

be a prudent bet in sluggish global recovery.

Further, almost exclusive focus on blend style also calls for lower

volatility in the fund. The choice is moderately expensive in the

space, as it charges 69 basis points a year in fees which is a bit

higher than the average expense ratio in the emerging market space,

though definitely lower than some of the high cost picks out

there.

Bottom Line

If mining rally holds up, in our opinion, investors can try

investing in AZIA since the fund is new and offers lucrative

valuation at the current level. Although the recent jobless claim

data in the U.S. and the unanticipated “Zero Taper” will likely

reverse investor attention again towards the stock market, the

Fed’s cut in GDP outlook implies that the picture is not as rosy as

perceived by the most (read 3 ETF Winners from the ‘No Taper’

Shocker).

This sentiment may provide a boost to commodity outlook though,

making natural resource picks interesting ones for the time being.

Also, we expect AZIA to remain stable as long as China keeps

staging a nice show, so this forgotten ETF might be worth a closer

look by some investors who have a high risk tolerance.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

GLBL-X CTL A&M (AZIA): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHRS-MSCI F100 (FM): ETF Research Reports

GUGG-FRONTR MKT (FRN): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

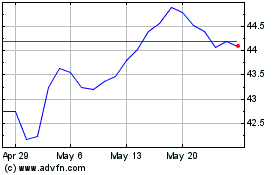

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

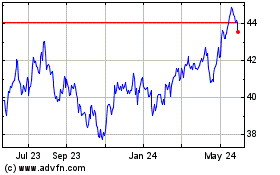

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2023 to Dec 2024