The Vietnam ETF was the second worst performer last week in the

emerging market pack behind only the

VelocityShares Russia

Select DR ETF (RUDR).

This was in sharp contrast to its extremely impressive performance

in the first-two-and half months of the year when the fund tacked

on more than 17%. Sluggish growth was seen in the first quarter as

the government was unsuccessful in stoking more lending to

businesses thanks in part to banks’ rising bad debt.

Slowing GDP Growth: The nation’s GDP grew 4.96% in

Q1, falling short of 6.04% growth registered in 4Q13 and analysts’

estimate of 5.2%. Government cut its key policy rate in March to

bolster growth to the target of 5.8% while the World Bank expects

the nation to grow 5.4% this year and the Asian Development Bank

expects growth of 5.6%. Weak household consumption thanks to low

job growth as the manufacturing sector is operating at sub-par

level has hit the growth outlook.

Struggling Banking Sector: Another main concern in

Vietnam is the bad debt woes in the all-important banking sector.

Presently, the nation boasts the highest level of bad debt among

Southeast Asia’s largest economies which put a lid on its

lending, thus hurting corporates. As a result, the government

appears steadfast in creating a more positive environment for

foreign investment inflows which includes a plan to auction

bad-debt assets of banks.

Moderating but Still High Inflation: Like many

other emerging nations suffering from the dual crisis of sluggish

growth and rising inflation, Vietnam is also putting up with

inflationary pressure, though not too high.

Last March, the nation logged an inflation rate of 4.39%, a high

measure, but in many ways, a great achievement as the nation had

inflation rate at double digits two years back (read: Is The

Vietnam ETF Back On Track?).

For this year, HSBC projects an inflation forecast of 6.5% (though

tapered from 7.3%). Subdued domestic demand has probably kept

inflation under control for otherwise it might spring back to the

high single-digit level.

Time for an Escape?

While the aforementioned issues stir up concerns around the

nations, investors should also note that the outlook for this

frontier or small emerging market is still brighter among the big

EM bunch. The splendid run in this product in the start of the year

basically made the product little overvalued against the biggest

and diversified emerging market ETF, the

Vanguard

Emerging Markets Stock Index ETF

(VWO).

VWO’s trailing 12 month P/E stands at 11 times while the

P/E of pure play in on Vietnam –

Market Vectors Vietnam ETF

(VNM)

– is at 14 even after the sharp retreat in the

recent past (read: How Frontier Market ETFs Surged as EMs

Plunged

).

If we look past the valuation and dig into the nation itself, we

will get better vibes out of it. While the nation’s domestic demand

remains soft, slow-but-steady growth in its key export markets (one

of which is the U.S. itself) should propel growth ahead. Exports

grew 14% in Q1 while imports saw an uptick of 12%.

Disbursed foreign investment also rose 5.6% year over year, as per

Bloomberg. Also, with the migration of low-wage manufacturing hub

from China to Vietnam, the latter could surface as an outsourcing

center going forward (read: 3 Emerging Market ETFs Off to a Great

Start in 2014

).

Fitch Ratings in January upgraded its outlook on the nation from

stable to positive citing its slow-but-steady recovery trail. One

of the worries of the nation – inflation – also saw a steep decline

in two years. Its listless 1Q14 GDP growth was also a 2-year high

Q1 figure.

Thus, all Vietnam needs to do is to deal with its high

non-performing loan situation in the banking sector. If this can

happen, investors might want to look to the Vietnam ETF for

exposure.

While the product is risky now, it is certainly capable of

producing huge gains. So, investors with meager exposure in

emerging markets will find the below-mentioned Van Eck fund useful

in deciding whether Vietnam warrants a spot in your portfolio, at

least for the near term.

VNM in Detail

VNM looks to track the Market Vectors Vietnam Index, which provides

exposure to the publicly listed companies that are domiciled and

listed in Vietnam, or derive at least 50% of their revenues from

the country. Notably, Vietnam accounts for about 70% of the fund

followed by Thailand (8.7%) and the U.K. (7.9%) (read: Emerging

Market ETFs See Inflows: 3 ETFs to Pick).

The ETF currently holds $488.1 million in AUM and charges 76 basis

points to investors annually for expenses. The fund holds 28

securities with about 57% of holdings invested in top-10

companies. In terms of sector exposure, financials occupy the

top spot with about 33.2% weight. Energy (23.2%) and industrials

(14.4%) round out the top three positions.

Since one-third of the basket is attributed to financials, the fund

remains a risky bet as of now due to the poor health of the

country’s banking system. The fund’s focus is mainly on large cap

securities and offers a nice blend of growth, value and blend

style.

VNM currently has a Zacks ETF Rank of 3 or Hold rating with a

medium risk outlook.

Bottom Line

In short, though the nation displayed some signs of slowdown in the

latest quarter hurt mainly by a troubled banking system, other

indicators of recovery seem to be in place despite the broader

emerging market lull on QE wrap up.

So, VNM could be a good pick especially on its latest dip. Since

the banking system remains the country’s backbone, any trouble

there may put the nation’s ETF at risk. So, investors intending to

play the nation through VNM should have a strong stomach for risks,

though there is definitely some promise in this product going

forward.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

VELSH-RUSSIA SL (RUDR): ETF Research Reports

MKT VEC-VIETNAM (VNM): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

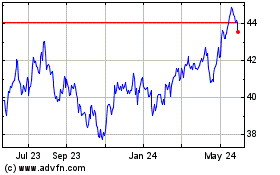

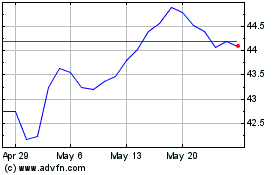

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Feb 2024 to Feb 2025