Westwater Resources Enters into Exclusivity for $150 million Secured Debt Facility with a Global Financial Institution

September 04 2024 - 5:30AM

Business Wire

Westwater Resources, Inc. (NYSE American: WWR), an energy

technology and battery-grade natural graphite development company,

announced today that it has executed a term sheet and agreed to

exclusivity with a global financial institution for a $150 million

secured debt facility, which would be used to complete the

construction of Phase I of the Kellyton Plant.

“Following the announcement of our second offtake agreement in

July, Westwater has reached another significant milestone by

entering into exclusivity with a global financial institution for a

debt facility that is expected to provide the necessary capital to

complete construction at the Kellyton Plant,” said Terence J.

Cryan, Westwater’s Executive Chairman. “We anticipate a busy and

active fall as we work through diligence, loan documentation, and

target closing in the fourth quarter of this year.”

In support of closing the debt financing, Westwater has engaged

McDermott Will & Emery as counsel and Cantor Fitzgerald as its

investment banker.

The progression from signing the term sheet to loan closing is

subject to customary agreement on final terms, due diligence, and

loan conditions.

Investor Presentation

Westwater announced in its second quarter press release that it

planned to provide an update to investors following Labor Day.

Westwater is providing this update by presenting at the 2024 Annual

Gateway Conference on Wednesday, September 4th at 12:30 p.m.

Pacific Time (PT).

The presentation will be accessible to investors via webcast

live and available for replay at the following link. Mr. Cryan and

Steve Cates, Chief Financial Officer, will be presenting at the

conference and available for one-on-one meetings throughout the

conference.

About Westwater Resources, Inc.

Westwater Resources is focused on developing battery-grade

natural graphite products. The Company’s primary project is the

Kellyton Graphite Plant that is under construction in east-central

Alabama. In addition, the Company’s Coosa graphite deposit is the

largest and most advanced natural flake graphite deposit in the

contiguous United States, which is located across 41,965 acres

(~17,000 hectares) in Coosa County, Alabama. For more information,

visit www.westwaterresources.net.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are subject to risks, uncertainties and

assumptions and are identified by words such as “anticipate,”

“expect,” “plan,” “target,” “would,” “update,” and other similar

words. Forward looking statements include, among other things,

statements concerning: off-take agreements with customers;

Westwater’s future sales of CSPG products to customers, including

the amounts, timing, and types of products included within those

sales; possible off-take agreements with other customers; potential

debt financing facilities including the amount and type of debt and

the schedule for closing; the anticipated annual production from

Phase I of Kellyton Graphite Plan; the construction and operation

of the Kellyton Graphite Plant and its qualification line, the

Company’s Coosa Graphite Deposit; and the costs, schedules,

production and economic projections associated with them. The

Company cautions that there are factors that could cause actual

results to differ materially from the forward-looking information

that has been provided. The reader is cautioned not to put undue

reliance on this forward-looking information, which is not a

guarantee of future performance and is subject to a number of

uncertainties and other factors, many of which are outside the

control of the Company; accordingly, there can be no assurance that

such suggested results will be realized. The following factors, in

addition to those discussed in Westwater’s Annual Report on Form

10-K for the year ended December 31, 2023, and subsequent

securities filings, could cause actual results to differ materially

from management expectations as suggested by such forward-looking

information: (a) the spot price and long‑term contract price of

graphite (both flake graphite feedstock and purified graphite

products) and vanadium, and the world-wide supply and demand of

graphite and vanadium; (b) the effects, extent and timing of the

entry additional competition in the markets in which we operate;

(c) our ability to obtain and to manage our contracts or other

agreements with customers; (d) available sources and transportation

of graphite feedstock; (e) the ability to control costs and avoid

cost and schedule overruns during the development, construction and

operation of the Kellyton Graphite Plant; (f) the ability to

construct and operate the Kellyton Graphite Plant in accordance

with the requirements of permits and licenses and the requirements

of tax credits and other incentives; (g) effects of inflation,

including labor shortages and supply chain disruptions; (h) rising

interest rates and the associated impact on the availability and

cost of financing sources; (i) the availability and supply of

equipment and materials needed to construct the Kellyton Graphite

Plant; (j) stock price volatility; (k) government regulation of the

mining and manufacturing industries in the United States; (l)

unanticipated geological, processing, regulatory and legal or other

problems we may encounter; (m) the results of our exploration

activities at the Coosa Graphite Deposit, and the possibility that

future exploration results may be materially less promising than

initial exploration results; (n) any graphite or vanadium

discoveries at the Coosa Graphite Deposit not being in high enough

concentration to make it economic to extract the minerals; (o) our

ability to finance growth plans; (p) our ability to obtain and

maintain rights of ownership or access to our mining properties;

(q) currently pending or new litigation or arbitration; (r) our

ability to maintain and timely receive mining, manufacturing, and

other permits from regulatory agencies; and (s) other factors which

are more fully described in our Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other filings with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904631126/en/

Westwater Resources, Inc. Email:

Info@WestwaterResources.net

Investor Relations Email:

Investorrelations@westwaterresources.net

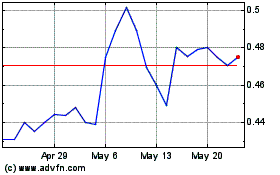

Westwater Resources (AMEX:WWR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Westwater Resources (AMEX:WWR)

Historical Stock Chart

From Feb 2024 to Feb 2025