Westwater Resources Announces Update on Debt Financing and Feasibility Results for Phase II of Its Kellyton Graphite Processing Plant

January 28 2025 - 5:30AM

Business Wire

Westwater Resources, Inc. (NYSE American: WWR), an energy

technology and battery-grade natural graphite development company

(“Westwater” or the “Company”), announces that it has received

final investment committee approval from the lead lender (a global

financial institution), and the Company is working with Cantor

Fitzgerald to finalize the overall syndication and closing of the

debt financing for the Kellyton Plant. As a result, the estimated

timing to close a debt financing transaction has been delayed.

“Given the ‘first of its kind’ nature of the Kellyton Plant, the

due diligence process undertaken by the lead lender has been

significant, and we are pleased to have approval from the lead

lender,” said Steve Cates, Westwater’s SVP-Finance and CFO. “We are

focused on getting the other interested lenders through their

diligence and approval process and will provide further updates on

timing once we have a better line of sight to closing.”

Westwater notes the closing of the debt transaction is also

subject to customary agreement on final terms, completion of the

syndication, final due diligence, and loan conditions.

Kellyton Graphite Processing Plant - Phase II Definitive

Feasibility Study

The Company is also announcing the results of its completed

Definitive Feasibility Study (“DFS”) for Phase II and reminds

investors that a portion of the Phase II capacity is already

committed via the previously announced offtake agreements.

The estimated Phase II amounts below exclude contribution from

Phase I of the Kellyton Graphite Processing Plant.

- Estimated capital costs for Phase II is $453 million, including

a 20% contingency.

- Estimated pre-tax NPV of $1.4 billion (at an 8% discount

rate).

- Total estimated cumulative pre-tax cash flows of $6.3 billion

over an estimated operating life of 35-years.

- Estimated pre-tax IRR of approximately 31.8%.

- Estimated annual pre-tax, cash flow of $192.6 million.

- Planned annual production of CSPG to 37,500 metric tons (Total

Kellyton capacity projected as 50,000 MT including Phase I and

II).

Note the above amounts do not include any potential cost savings

or synergies from the Company’s Coosa Graphite Deposit. As

previously disclosed, the Coosa Graphite Deposit Initial Assessment

has a stand-alone estimated pre-tax NPV-8% of $229 million and an

estimated pre-tax free cash flow of $714 million.

About Westwater Resources, Inc.

Westwater Resources, Inc. (NYSE American: WWR), an energy

technology company, is focused on developing battery-grade natural

graphite. The Company’s primary project is the Kellyton Graphite

Processing Plant that is under construction in east-central

Alabama. In addition, the Company’s Coosa Graphite Deposit is the

most advanced natural flake graphite deposit in the contiguous

United States and located across 41,965 acres (~17,000 hectares) in

Coosa County, Alabama. For more information, visit

www.westwaterresources.net.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are subject to risks, uncertainties and

assumptions and are identified by words such as “working to

finalize,” “estimated timing,” “due diligence,” “line of sight,”

“estimated,” “planned,” “projected,” “potential,” “update” or

“further updates,” and other similar words or phrases. Forward

looking statements include, among other things, statements

concerning: off-take agreements with customers; Westwater’s future

sales of CSPG products to customers, including the amounts, timing,

and types of products included within those sales; possible

off-take agreements with other customers; potential debt financing

arrangements, including due diligence, the amount and type of debt,

its syndication, and the schedule for closing; the anticipated

annual production from Phase I and Phase II of Kellyton Graphite

Plan; the construction and operation of the Kellyton Graphite Plant

and its qualification line; the Company’s Coosa Graphite Deposit;

potential synergies or cost savings attendant to the Kellyton Plant

and the Coosa Deposit; and the costs, schedules, production and

economic projections associated with them. The Company cautions

that there are factors that could cause actual results to differ

materially from the forward-looking information that has been

provided. The reader is cautioned not to put undue reliance on this

forward-looking information, which is not a guarantee of future

performance and is subject to a number of uncertainties and other

factors, many of which are outside the control of the Company;

accordingly, there can be no assurance that such suggested results

will be realized. Those uncertainties and other factors are

discussed in Westwater’s Annual Report on Form 10-K for the year

ended December 31, 2023, and subsequent securities filings, and

they could cause actual results to differ materially from

management expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128178065/en/

Westwater Resources, Inc. Email:

Info@WestwaterResources.net

Investor Relations Email:

Investorrelations@westwaterresources.net

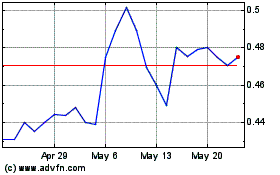

Westwater Resources (AMEX:WWR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Westwater Resources (AMEX:WWR)

Historical Stock Chart

From Feb 2024 to Feb 2025