false

0001667313

0001667313

2024-12-16

2024-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 16, 2024

Zedge,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-37782 |

|

26-3199071 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

1178 Broadway,

Ste. 1450 (3rd Floor)

New York, NY |

|

10001 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (330) 577-3424

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Class B common stock, par value $0.01 per share |

|

ZDGE |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition

On

December 16, 2024, Zedge, Inc. (the “Registrant”) issued a press release announcing its results of operations for its fiscal

quarter ended October 31, 2024. A copy of the press release issued by the Registrant concerning the foregoing results is furnished herewith

as Exhibit 99.1 and is incorporated herein by reference.

The

Registrant is furnishing the information contained in this Report, including Exhibit 99.1, pursuant to Item 2.02 of Form 8-K promulgated

by the Securities and Exchange Commission (the “SEC”). This information shall not be deemed to be “filed” with

the SEC or incorporated by reference into any other filing with the SEC unless otherwise expressly stated in such filing. In addition,

this Report and the press release contain statements intended as “forward-looking statements” that are subject to the cautionary

statements about forward-looking statements set forth in the press release.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ZEDGE, INC. |

| |

|

|

| |

By: |

/s/

Jonathan Reich |

| |

Name: |

Jonathan Reich |

| |

Title: |

Chief Executive Officer |

Dated:

December 16, 2024

EXHIBIT

INDEX

Exhibit 99.1

Zedge Announces First Quarter Fiscal 2025

Results

Zedge

Marketplace subscription revenue increased 21%

Zedge

Marketplace ARPMAU1 increased 22%

Zedge

Premium GTV1 increased 62%

New York, NY – December 16, 2024: Zedge,

Inc. (NYSE AMERICAN: ZDGE), $ZDGE, a leader in digital marketplaces and interactive games that provides

content, enables creativity, empowers self-expression and facilitates community, today announced results for its first quarter

fiscal 2025, ended October 31, 2024.

Jonathan Reich, Zedge’s

CEO, commented:

“We are encouraged

by the underlying trends in our business, which provide a strong foundation for future growth despite a mixed bag of results at the start

of the fiscal year.

“The Zedge Marketplace

continued to shine with subscription revenue growing 21% year-over-year and accelerated growth in lifetime subscriptions drove an 8% increase

in overall subscribers. Zedge Premium’s GTV (Gross Transaction Value) surged by 62%, fueled by the popularity of our parallax wallpapers

(3-D motion wallpapers), optimization of rewarded video CPMs and the expansion of pAInt, our AI image generator, demonstrating our ability

to fuel growth with innovative features. These achievements and a shift towards users with higher return profiles led to an impressive

22% increase in Average Revenue per Monthly Active User (ARPMAU). Additionally, Zedge Marketplace iOS growth continues to be a

bright spot for the Company with revenue up over 60% in the quarter. However, we did encounter some advertising challenges in the quarter,

including a now resolved coding error that limited our supply of selected ad inventory for a short period, a delay in an ad partner’s

testing of our platform, and start up complexities from adding a new advertising mediation platform to our mix. Additionally, we adopted

a more conservative short-term approach to user acquisition, prioritizing higher returns on ad spend (ROAS) over rapid scaling. Despite

these hurdles, we are confident in our ability to return to advertising revenue growth in the quarters ahead.

“Emojipedia

delivered an outstanding quarter with record revenue up 33% year-over-year, showcasing its continued appeal as the go-to resource for

emoji-related information and its strength as a revenue generator within our portfolio. We are thrilled to see Emojipedia’s sustained

growth, further validating its value to our ecosystem and validating our original acquisition thesis.

“GuruShots

remains in transition as we focus on initiatives aimed at attracting new users who will convert into recurring, paying players. We’re

currently rolling out Duels, a player-versus-player (PVP) game mechanic that will cap the new onboarding, economy and Missions enhancements

we introduced in 2024. Despite limiting marketing spend, we are seeing early signs of growth with higher engagement and retention among

new players. Our next area of focus relates to effectively monetizing new players and efficiently growing paid user acquisition, which

we believe will pave the way for sustainable growth.

“In summary, while

we had some near-term challenges, we remain focused on executing on our strategy, driving innovation and delivering value for our stockholders,

and the progress we’ve made reaffirms our confidence that we are headed in the right direction.”

Fiscal 2025 Outlook

“We anticipate significant

improvements in our second quarter driven by traditional holiday seasonal strength and the resolution of key challenges from the first

quarter. For the remainder of fiscal 2025, we are focused on leveraging our solid foundation to drive growth and scalability across all

business units. A critical part of this strategy is the ongoing integration of generative AI into our product portfolio, enriching the

user experience with cutting-edge features. Our recent beta launch of the AI Emoji Generator on Cyber Monday exemplifies this approach,

enabling Emojipedia users to design custom emojis and break free from standard device keyboards.

“Our top priority

for the Zedge Marketplace this year is to transform users from content consumers into content creators, aligning ourselves more

deeply within the Creator Economy. The continued rollout of pAInt 2.0 and the planned imminent addition of AI audio capabilities underscore

our commitment to innovation. Audio, in particular, represents an exciting opportunity to attract new users and deepen engagement with

existing ones, further solidifying our position in this dynamic space.

“Beyond product

advancements, our marketing team remains a critical revenue growth driver. After weathering the first quarter’s challenges, we are

confident in the team’s ability to accelerate ROAS-attractive user acquisition, particularly in well-developed economies, while

also building on our strong momentum with iOS users. This alignment of innovative products and strategic marketing positions us for continued

success.

“Emojipedia

continues to thrive, with the expansion of the ‘Emoji Playground’ in early December which now includes the AI-driven emoji creator. Our

next priority will be redesigning and upgrading Emojipedia’s website to improve engagement and reinforce its reputation as the premier

destination for emoji enthusiasts worldwide.

“For GuruShots,

our primary focus is returning to growth. To achieve this, we are allocating resources to new feature introductions and enhancements designed

to better attract and engage new users, versus previously relying mainly on legacy players to fuel the game’s growth. While this

transition may continue negatively impacting short-term revenue, we believe we are seeing the bottom of that curve. The changes we’ve

implemented—including an enhanced onboarding process, a coin-based in-game economy, and the launch of Missions—are already

showing promising early results. Looking ahead, the imminent release of Duels during the holiday season will add an exciting competitive

PvP layer to the game, driving further engagement and retention.

“Lastly, we remain

committed to introducing new products to drive long-term growth. Projects like Wishcraft and AI Art Master, currently in beta, highlight

our ability to foster innovation and agility. By centralizing our development platform, we can iterate quickly, prioritize initiatives

that show promise and scale successful concepts while promptly cutting offerings that show less promise. This approach positions us to

create incremental wins and breakthrough successes that will hopefully fuel Zedge’s sustained growth in the years ahead and make

$ZDGE a growth stock once again. In the meantime, we will continue to innovate in our offerings and take advantage of our value stock

status with the $5 million share repurchase program that the board authorized,” concluded Reich.

First Quarter Highlights

(fiscal 2025 versus fiscal 2024)

| ● | Revenue increased 1.6% to $7.2 million; |

| ● | GAAP operating loss of ($0.5) million, compared

to operating income of $0.3 million; |

| ● | GAAP net loss and loss per share (EPS) were

($0.3) million and ($0.02) compared to ($0.0) million and ($0.00), respectively; |

| ● | Non-GAAP net loss and EPS were ($0.0) million

($0.00) compared to non-GAAP net income and EPS of $0.5 million and $0.04, respectively; |

| ● | Adjusted EBITDA of $0.3 million; |

| ● | Zedge Premium’s GTV, increased 61.6%

to $0.7 million. |

| First Quarter Select Financial Metrics: FY25 versus FY24* | |

| (in $M except for EPS) | |

Q1 ’25 | | |

Q1 ’24 | | |

Change | |

| Total Revenue | |

$ | 7.2 | | |

$ | 7.1 | | |

| 1.6 | % |

| Advertising Revenue | |

$ | 4.9 | | |

$ | 4.9 | | |

| -1.3 | % |

| Digital goods and services | |

$ | 0.6 | | |

$ | 0.9 | | |

| -31.8 | % |

| Subscription Revenue | |

$ | 1.2 | | |

$ | 1.0 | | |

| 21.1 | % |

| Other Revenue | |

$ | 0.5 | | |

$ | 0.2 | | |

| 122.5 | % |

| GAAP Operating Income (Loss) | |

$ | (0.5 | ) | |

$ | 0.3 | | |

| -242.7 | % |

| Operating Margin | |

| -6.4 | % | |

| 4.5 | % | |

| | |

| GAAP Net Loss | |

$ | (0.3 | ) | |

$ | (0.0 | ) | |

| nm | |

| GAAP Diluted Loss Per Share | |

$ | (0.02 | ) | |

$ | (0.00 | ) | |

| nm | |

| Non-GAAP Net Income (Loss) | |

$ | (0.0 | ) | |

$ | 0.5 | | |

| nm | |

| Non- GAAP Diluted Earnings (Loss) Per Share | |

$ | (0.00 | ) | |

$ | 0.04 | | |

| nm | |

| Adjusted EBITDA | |

$ | 0.3 | | |

$ | 1.5 | | |

| -81.2 | % |

| Cash Flow from Operations | |

$ | 1.2 | | |

$ | 1.3 | | |

| -7.1 | % |

nm = not measurable/meaningful

| * | numbers may not add due to rounding |

| Select

Zedge Marketplace Metrics: FY25 versus FY24* | |

| (in MM except for ARPMAU and where noted) | |

Q1 ’25 | | |

Q1 ’24 | | |

Change | |

| Total Installs - Cumulative | |

| 685.5 | | |

| 625.3 | | |

| 9.6 | % |

| MAU | |

| 25.0 | | |

| 28.5 | | |

| -12.3 | % |

| Well-developed Markets | |

| 5.5 | | |

| 6.2 | | |

| -10.8 | % |

| Emerging Markets | |

| 19.5 | | |

| 22.3 | | |

| -12.7 | % |

| Active Subscriptions (in 000s) | |

| 698 | | |

| 648 | | |

| 7.7 | % |

| ARPMAU | |

$ | 0.077 | | |

$ | 0.063 | | |

| 22.1 | % |

| Zedge Premium - Gross Transaction Value (GTV) | |

$ | 0.7 | | |

$ | 0.4 | | |

| 61.6 | % |

| * | numbers may not add due to

rounding |

| 1 | We use the following business metrics in this release

because we believe they are useful in evaluating Zedge’s operational performance. |

| ● | Monthly active users, or MAU, captures

the number of unique users that used our Zedge App during the previous 30 days of the relevant period, is useful for evaluating consumer

engagement with our App, which correlates to advertising revenue as more users drive more ad impressions for sale. It also allows readers

and potential advertisers to evaluate the size of our user base. |

| ● | Zedge Premium Gross Transaction Value, or

GTV, is the total dollar amount of transactions conducted through Zedge Premium. As Zedge Premium is an internal focus for growth, we

believe this metric will help investors evaluate our progress in growing this part of our business. |

| | | |

| ● | Average Revenue Per Monthly Active User for

our Zedge App, or ARPMAU, is useful in evaluating how well we monetize our user base. |

| | | |

| ● | An Active Subscription is a subscription

that has commenced and not been canceled, including paused subscriptions and subscriptions in free trials, grace periods, or account hold.

This is important because it is a source of recurring revenue. |

| | | |

| ● | Total Installs – Cumulative measures

the number of times the Zedge App has been downloaded since inception. |

| 2 | Throughout this release, Non-GAAP Net Income, Non-GAAP

EPS and Adjusted EBITDA are non-GAAP financial measures intended to provide useful information that supplement Zedge’s results

in accordance with GAAP. Please refer to the Reconciliation of Non-GAAP Financial measures at the end of this release for an explanation

of Zedge’s formulations of Non-GAAP Net Income, Non-GAAP EPS and Adjusted EBITDA and reconciliations to the most directly comparable

GAAP measures. |

| Trended Financial Information* |

| (in $M except for EPS, ARPMAU, Paid Subscriptions) | |

Q123 | | |

Q223 | | |

Q323 | | |

Q423 | | |

Q124 | | |

Q224 | | |

Q324 | | |

Q424 | | |

Q125 | | |

FY23 | | |

FY24 | |

| Total Revenue | |

$ | 6.9 | | |

$ | 7.0 | | |

$ | 6.7 | | |

$ | 6.6 | | |

$ | 7.1 | | |

$ | 7.8 | | |

$ | 7.7 | | |

$ | 7.6 | | |

$ | 7.2 | | |

$ | 27.2 | | |

$ | 30.1 | |

| Advertising Revenue | |

$ | 4.5 | | |

$ | 4.6 | | |

$ | 4.6 | | |

$ | 4.6 | | |

$ | 4.9 | | |

$ | 5.5 | | |

$ | 5.5 | | |

$ | 5.2 | | |

$ | 4.9 | | |

$ | 18.3 | | |

$ | 21.0 | |

| Digital goods and services | |

$ | 1.3 | | |

$ | 1.2 | | |

$ | 1.1 | | |

$ | 1.0 | | |

$ | 0.9 | | |

$ | 0.9 | | |

$ | 0.9 | | |

$ | 0.7 | | |

$ | 0.6 | | |

$ | 4.6 | | |

$ | 3.5 | |

| Subscription Revenue | |

$ | 0.9 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 0.9 | | |

$ | 1.0 | | |

$ | 1.1 | | |

$ | 1.1 | | |

$ | 1.2 | | |

$ | 1.2 | | |

$ | 3.5 | | |

$ | 4.3 | |

| Other Revenue | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.3 | | |

$ | 0.2 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.8 | | |

$ | 1.2 | |

| GAAP Operating Income (Loss) | |

$ | (0.2 | ) | |

$ | 1.5 | | |

$ | (8.4 | ) | |

$ | 0.2 | | |

$ | 0.3 | | |

$ | (11.9 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.5 | ) | |

$ | (6.9 | ) | |

$ | (11.8 | ) |

| GAAP Net Income (Loss) | |

$ | (0.2 | ) | |

$ | 1.6 | | |

$ | (7.7 | ) | |

$ | 0.2 | | |

$ | (0.0 | ) | |

$ | (9.2 | ) | |

$ | 0.1 | | |

$ | (0.0 | ) | |

$ | (0.3 | ) | |

$ | (6.1 | ) | |

$ | (9.2 | ) |

| GAAP Diluted Earnings (Loss) Per Share | |

$ | (0.01 | ) | |

$ | 0.11 | | |

$ | (0.55 | ) | |

$ | 0.01 | | |

$ | 0.00 | | |

$ | (0.66 | ) | |

$ | 0.01 | | |

$ | (0.00 | ) | |

$ | (0.02 | ) | |

$ | (0.44 | ) | |

$ | (0.65 | ) |

| Non GAAP Net Income | |

$ | 0.2 | | |

$ | 0.8 | | |

$ | 0.3 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.3 | | |

$ | (0.0 | ) | |

$ | 1.9 | | |

$ | 1.8 | |

| Non-GAAP Diluted EPS | |

$ | 0.01 | | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.03 | | |

$ | 0.02 | | |

$ | (0.00 | ) | |

$ | 0.13 | | |

$ | 0.13 | |

| Adjusted EBITDA | |

$ | 1.0 | | |

$ | 1.4 | | |

$ | 1.7 | | |

$ | 1.6 | | |

$ | 1.5 | | |

$ | 1.5 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 0.3 | | |

$ | 5.7 | | |

$ | 4.7 | |

| Adjusted EBITDA Margin | |

| 13.8 | % | |

| 20.5 | % | |

| 25.4 | % | |

| 24.2 | % | |

| 21.7 | % | |

| 19.9 | % | |

| 11.1 | % | |

| 10.2 | % | |

| 4.0 | % | |

| 20.9 | % | |

| 15.6 | % |

| Cash Flow from Operations | |

$ | 1.1 | | |

$ | 0.0 | | |

$ | 1.6 | | |

$ | 0.4 | | |

$ | 1.3 | | |

$ | 1.6 | | |

$ | 2.3 | | |

$ | 1.2 | | |

$ | 1.2 | | |

$ | 3.2 | | |

$ | 6.3 | |

| MAU | |

| 31.9 | | |

| 32.2 | | |

| 32.0 | | |

| 30.9 | | |

| 28.5 | | |

| 28.7 | | |

| 27.7 | | |

| 26.1 | | |

| 25.0 | | |

| nm | | |

| nm | |

| Well-developed Markets | |

| 7.1 | | |

| 7.4 | | |

| 7.2 | | |

| 6.8 | | |

| 6.2 | | |

| 6.2 | | |

| 6.0 | | |

| 5.5 | | |

| 5.5 | | |

| nm | | |

| nm | |

| Emerging Markets | |

| 24.8 | | |

| 24.8 | | |

| 24.8 | | |

| 24.1 | | |

| 22.3 | | |

| 22.5 | | |

| 21.7 | | |

| 20.6 | | |

| 19.5 | | |

| nm | | |

| nm | |

| Active Subscriptions (in 000s) | |

| 674 | | |

| 654 | | |

| 631 | | |

| 647 | | |

| 648 | | |

| 648 | | |

| 654 | | |

| 669 | | |

| 698 | | |

| nm | | |

| nm | |

| ARPMAU | |

$ | 0.054 | | |

$ | 0.052 | | |

$ | 0.053 | | |

$ | 0.055 | | |

$ | 0.063 | | |

$ | 0.072 | | |

$ | 0.074 | | |

$ | 0.079 | | |

$ | 0.077 | | |

| nm | | |

| nm | |

| Zedge Premium – GTV | |

$ | 0.3 | | |

$ | 0.4 | | |

$ | 0.4 | | |

$ | 0.4 | | |

$ | 0.4 | | |

$ | 0.5 | | |

$ | 0.6 | | |

$ | 0.6 | | |

$ | 0.7 | | |

$ | 1.5 | | |

$ | 2.1 | |

nm = not measurable/meaningful

| * | numbers may not add due to rounding |

Earnings Announcement and Supplemental Information

Management will host an earnings conference call beginning

at 10:00 a.m. Eastern to discuss its results, outlook, and strategy, followed by a Q&A with investors.

Live Call-in Info:

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 118473

Webcast URL: https://www.webcaster4.com/Webcast/Page/2205/51726

Replay:

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 51726

About Zedge

Zedge empowers

tens of millions of consumers and creators each month with its suite of interconnected platforms that enable creativity, self-expression

and e-commerce and foster community through fun competitions. Zedge’s ecosystem of product offerings includes the Zedge Marketplace,

a freemium marketplace offering mobile phone wallpapers, video wallpapers, ringtones, notification sounds, and pAInt, a generative AI

image maker; GuruShots, “The World’s Greatest Photography Game,” a skill-based photo challenge game; and Emojipedia,

the #1 trusted source for ‘all things emoji.’ For more information, visit: investor.zedge.net

Follow us on X: @Zedge

Follow us on LinkedIn

Forward-Looking Statements

All statements above that are not purely about historical

facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,”

“plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current

judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements

due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks and should be consulted

along with this release. To the extent permitted under applicable law, we assume no obligation to update any forward-looking statements.

Contact:

Brian Siegel,

IRC, MBA

Senior Managing

Director

Hayden IR

(346) 396-8696

ir@zedge.net

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value data)

| | |

October 31, | | |

July 31, | |

| | |

2024 | | |

2024 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 20,196 | | |

$ | 19,998 | |

| Trade accounts receivable | |

| 3,213 | | |

| 3,406 | |

| Prepaid expenses and other receivables | |

| 754 | | |

| 593 | |

| Total current assets | |

| 24,163 | | |

| 23,997 | |

| Property and equipment, net | |

| 2,194 | | |

| 2,306 | |

| Intangible assets, net | |

| 5,257 | | |

| 5,369 | |

| Goodwill | |

| 1,812 | | |

| 1,824 | |

| Deferred tax assets, net | |

| 4,344 | | |

| 4,344 | |

| Other assets | |

| 428 | | |

| 355 | |

| Total assets | |

$ | 38,198 | | |

$ | 38,195 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Trade accounts payable | |

$ | 1,389 | | |

$ | 1,113 | |

| Accrued expenses and other current liabilities | |

| 2,865 | | |

| 2,969 | |

| Deferred revenues | |

| 2,425 | | |

| 2,168 | |

| Total current liabilities | |

| 6,679 | | |

| 6,250 | |

| Deferred revenues--non-current | |

| 1,266 | | |

| 931 | |

| Other liabilities | |

| 150 | | |

| 118 | |

| Total liabilities | |

| 8,095 | | |

| 7,299 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $.01 par value; authorized shares—2,400; no shares issued and outstanding | |

| - | | |

| - | |

| Class A common stock, $.01 par value; authorized shares—2,600; 525 shares issued and outstanding at October 31, 2024 and July 31, 2024 | |

| 5 | | |

| 5 | |

| Class B common stock, $.01 par value; authorized shares—40,000; 14,896 shares issued and 13,619 shares outstanding at October 31, 2024, and 14,866 shares issued and 13,815 outstanding at July 31, 2024 | |

| 149 | | |

| 149 | |

| Additional paid-in capital | |

| 48,642 | | |

| 48,263 | |

| Accumulated other comprehensive loss | |

| (1,861 | ) | |

| (1,832 | ) |

| Accumulated deficit | |

| (13,452 | ) | |

| (13,113 | ) |

| Treasury stock, 1,277 shares at October 31, 2024 and 1,051 shares at July 31, 2024, at cost | |

| (3,380 | ) | |

| (2,576 | ) |

| Total stockholders’ equity | |

| 30,103 | | |

| 30,896 | |

| Total liabilities and stockholders’ equity | |

$ | 38,198 | | |

$ | 38,195 | |

ZEDGE,

INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except

per share data)

| | |

Three Months Ended | |

| | |

October 31, | |

| | |

2024 | | |

2023 | |

| Revenues | |

$ | 7,194 | | |

$ | 7,081 | |

| Costs and expenses: | |

| | | |

| | |

| Direct cost of revenues (excluding amortization of capitalized software and technology development costs which is included below) | |

| 461 | | |

| 486 | |

| Selling, general and administrative | |

| 6,809 | | |

| 5,499 | |

| Depreciation and amortization | |

| 381 | | |

| 775 | |

| (Loss) income from operations | |

| (457 | ) | |

| 321 | |

| Interest and other income, net | |

| 181 | | |

| 81 | |

| Net loss resulting from foreign exchange transactions | |

| (14 | ) | |

| (219 | ) |

| (Loss) income before income taxes | |

| (290 | ) | |

| 183 | |

| Provision for income taxes | |

| 49 | | |

| 198 | |

| Net loss | |

$ | (339 | ) | |

$ | (15 | ) |

| Other comprehensive loss: | |

| | | |

| | |

| Changes in foreign currency translation adjustment | |

| (29 | ) | |

| (367 | ) |

| Total other comprehensive loss | |

| (29 | ) | |

| (367 | ) |

| Total comprehensive loss | |

$ | (368 | ) | |

$ | (382 | ) |

| Loss per share attributable to Zedge, Inc. common stockholders: | |

| | | |

| | |

| Basic | |

$ | (0.02 | ) | |

$ | 0.00 | |

| Diluted | |

$ | (0.02 | ) | |

$ | 0.00 | |

| Weighted-average number of shares used in calculation of loss per share: | |

| | | |

| | |

| Basic | |

| 14,086 | | |

| 13,975 | |

| Diluted | |

| 14,086 | | |

| 13,975 | |

ZEDGE, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(in thousands)

| | |

Three Months Ended | |

| | |

October 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Operating activities | |

| | |

| |

| Net loss | |

$ | (339 | ) | |

$ | (15 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 16 | | |

| 14 | |

| Amortization of intangible assets | |

| 112 | | |

| 579 | |

| Amortization of capitalized software and technology development costs | |

| 253 | | |

| 182 | |

| Amortization of deferred financing costs | |

| - | | |

| 1 | |

| Stock-based compensation | |

| 379 | | |

| 507 | |

| Impairment of investment in privately-held company | |

| - | | |

| 50 | |

| | |

| | | |

| | |

| Change in assets and liabilities: | |

| | | |

| | |

| Trade accounts receivable | |

| 193 | | |

| (300 | ) |

| Prepaid expenses and other current assets | |

| (161 | ) | |

| (66 | ) |

| Other assets | |

| (41 | ) | |

| 14 | |

| Trade accounts payable and accrued expenses | |

| 166 | | |

| 384 | |

| Deferred revenue | |

| 592 | | |

| (90 | ) |

| Net cash provided by operating activities | |

| 1,170 | | |

| 1,260 | |

| Investing activities | |

| | | |

| | |

| Capitalized software and technology development costs | |

| (146 | ) | |

| (423 | ) |

| Purchase of property and equipment | |

| (11 | ) | |

| (22 | ) |

| Net cash used in investing activities | |

| (157 | ) | |

| (445 | ) |

| Financing activities | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| - | | |

| 3 | |

| Purchase of treasury stock in connection with share buyback program and stock awards vesting | |

| (804 | ) | |

| (13 | ) |

| Net cash used in financing activities | |

| (804 | ) | |

| (10 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| (11 | ) | |

| (185 | ) |

| Net increase in cash and cash equivalents | |

| 198 | | |

| 620 | |

| Cash and cash equivalents at beginning of period | |

| 19,998 | | |

| 18,125 | |

| Cash and cash equivalents at end of period | |

$ | 20,196 | | |

$ | 18,745 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash payments made for income taxes | |

$ | 88 | | |

$ | 36 | |

| Cash payments made for interest expenses | |

$ | - | | |

$ | 46 | |

Use of Non-GAAP Measures

Adjusted EBITDA, defined as earnings (loss) before interest,

taxes, depreciation and amortization, stock compensation expense, transaction-related expenses and other non-recurring expenses, Adjusted

EBITDA Margin, and non-GAAP net income and EPS (which adjust out stock compensation expense, transaction-related expenses and other non-recurring

expenses from GAAP net income and EPS), represent measures that we believe are customarily used by investors and analysts to evaluate

the financial performance of companies in addition to the GAAP measures we present. Our management also believes these measures are useful

in evaluating our core operating results. However, these are not measures of financial performance under GAAP and should not be considered

an alternative to net income or operating income/margin as an indicator of our operating performance or to net cash provided by operating

activities as a measure of our liquidity.

| Reconciliation of Adjusted EBITDA to Net (Loss) Income | |

Q123 | | |

Q223 | | |

Q323 | | |

Q423 | | |

Q124 | | |

Q224 | | |

Q324 | | |

Q424 | | |

Q125 | | |

FY23 | | |

FY24 | |

| Net (Loss) Income | |

$ | (0.2 | ) | |

$ | 1.6 | | |

$ | (7.7 | ) | |

$ | 0.2 | | |

$ | (0.0 | ) | |

$ | (9.2 | ) | |

$ | 0.1 | | |

$ | (0.0 | ) | |

$ | (0.3 | ) | |

$ | (6.1 | ) | |

$ | (9.2 | ) |

| Excluding: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest and other income (expense), net | |

$ | (0.0 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.2 | ) | |

$ | (0.2 | ) | |

$ | (0.2 | ) | |

$ | (0.2 | ) | |

$ | (0.3 | ) | |

$ | (0.6 | ) |

| Provision for (benefit from) income taxes | |

$ | (0.1 | ) | |

$ | 0.1 | | |

$ | (0.7 | ) | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | (2.5 | ) | |

$ | (0.1 | ) | |

$ | 0.2 | | |

$ | 0.0 | | |

$ | (0.5 | ) | |

$ | (2.2 | ) |

| Depreciation and amortization | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 0.6 | | |

$ | 0.3 | | |

$ | 0.4 | | |

$ | 3.3 | | |

$ | 2.5 | |

| EBITDA | |

$ | 0.5 | | |

$ | 2.4 | | |

$ | (7.6 | ) | |

$ | 1.0 | | |

$ | 0.9 | | |

$ | (11.1 | ) | |

$ | 0.4 | | |

$ | 0.3 | | |

$ | (0.1 | ) | |

$ | (3.6 | ) | |

$ | (9.5 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GuruShots acquisition related write-offs | |

$ | (0.2 | ) | |

$ | (1.8 | ) | |

$ | 8.7 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 12.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 6.8 | | |

$ | 12.0 | |

| Stock-based compensation | |

$ | 0.6 | | |

$ | 0.8 | | |

$ | 0.6 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.7 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.4 | | |

$ | 2.5 | | |

$ | 2.1 | |

| Transaction costs related to business combination | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.2 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.2 | |

| Adjusted EBITDA | |

$ | 1.0 | | |

$ | 1.4 | | |

$ | 1.7 | | |

$ | 1.6 | | |

$ | 1.5 | | |

$ | 1.5 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 0.3 | | |

$ | 5.7 | | |

$ | 4.7 | |

| * | numbers may not add due to rounding |

| Reconciliation of GAAP Net (Loss) Income to Non-GAAP Net Income | |

Q123 | | |

Q223 | | |

Q323 | | |

Q423 | | |

Q124 | | |

Q224 | | |

Q324 | | |

Q424 | | |

Q125 | | |

FY23 | | |

FY24 | |

| GAAP Net (Loss) Income | |

$ | (0.2 | ) | |

$ | 1.6 | | |

$ | (7.7 | ) | |

$ | 0.2 | | |

$ | (0.0 | ) | |

$ | (9.2 | ) | |

$ | 0.1 | | |

$ | (0.0 | ) | |

$ | (0.3 | ) | |

$ | (6.1 | ) | |

$ | (9.2 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GuruShots acquisition related write-offs | |

$ | (0.2 | ) | |

$ | (1.8 | ) | |

$ | 8.7 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 12.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 6.8 | | |

$ | 12.0 | |

| Stock-based compensation | |

$ | 0.6 | | |

$ | 0.8 | | |

$ | 0.6 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.7 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.4 | | |

$ | 2.5 | | |

$ | 2.1 | |

| Transaction costs related to business combination | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.2 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.2 | |

| Income tax effect on non-GAAP items | |

$ | (0.1 | ) | |

$ | 0.2 | | |

$ | (1.3 | ) | |

$ | (0.1 | ) | |

$ | (0.2 | ) | |

$ | (2.9 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (1.3 | ) | |

$ | (3.3 | ) |

| Non-GAAP Net Income | |

$ | 0.2 | | |

$ | 0.8 | | |

$ | 0.3 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.3 | | |

$ | (0.0 | ) | |

$ | 1.9 | | |

$ | 1.8 | |

| Non-GAAP basic EPS | |

$ | 0.01 | | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.03 | | |

$ | 0.02 | | |

$ | (0.00 | ) | |

$ | 0.13 | | |

$ | 0.13 | |

| Non-GAAP diluted EPS | |

$ | 0.01 | | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.03 | | |

$ | 0.02 | | |

$ | (0.00 | ) | |

$ | 0.13 | | |

$ | 0.13 | |

| Weighted average shares used to compute Non-GAAP basic earnings per share | |

| 14.3 | | |

| 14.1 | | |

| 14.0 | | |

| 13.9 | | |

| 14.0 | | |

| 14.1 | | |

| 14.2 | | |

| 14.1 | | |

| 14.1 | | |

| 14.1 | | |

| 14.1 | |

| Weighted average shares used to compute Non-GAAP diluted earnings per share | |

| 14.3 | | |

| 14.3 | | |

| 14.0 | | |

| 13.9 | | |

| 14.0 | | |

| 14.1 | | |

| 14.5 | | |

| 14.5 | | |

| 14.1 | | |

| 14.1 | | |

| 14.1 | |

| * | numbers may not add due to rounding |

9

v3.24.4

Cover

|

Dec. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 16, 2024

|

| Entity File Number |

1-37782

|

| Entity Registrant Name |

Zedge,

Inc.

|

| Entity Central Index Key |

0001667313

|

| Entity Tax Identification Number |

26-3199071

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1178 Broadway

|

| Entity Address, Address Line Two |

Ste. 1450 (3rd Floor)

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

330

|

| Local Phone Number |

577-3424

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class B common stock, par value $0.01 per share

|

| Trading Symbol |

ZDGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

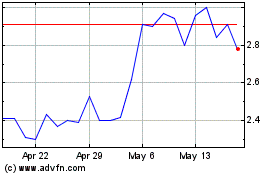

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Mar 2024 to Mar 2025