TIDMAAZ

RNS Number : 1312T

Anglo Asian Mining PLC

16 March 2023

16 March 2023

Anglo Asian Mining plc

Targeting 10,000 tonnes of annual copper production at Xarxar

following geological modelling and open pit optimisation study

Anglo Asian Mining plc ("Anglo Asian" or the "Company"), the AIM

listed gold, copper and silver producer primarily focused in

Azerbaijan, is pleased to announce it has completed an initial

geological block model and open pit optimisation study at the

Xarxar deposit. The Company now expects mining and processing of 3

million tonnes of ore per annum, with a production target of 10,000

tonnes of copper metal per annum over a 7-year period.

Since July 2022, an extensive geological exploration programme

has been carried out at the Xarxar deposit, targeting the central

copper mineralisation zone. Surface drill holes intercepted

significant high-grade and continuous grades of copper

mineralisation. The base case open pit optimisation study used a

copper price of $8,000 and showed over 93,000 tonnes of

economically extractable copper. The detailed results of the

geological exploration are set out below in appendix one. The

Company has used its own in-house estimate of resources and

economically extractable copper in this notification and these

figures are not based on a Standard, such as JORC. The Company

intends to carry out JORC reporting on completion of the ongoing

drilling and exploration programme.

An underground mining method trade-off study will be carried out

to assess the economics of underground mining. This will enable

preparation of the optimum mining plan for a combined open pit and

underground mine. An alternative approach utilising the option of

in-situ recovery is also being studied.

Exploration is continuing in the central mineralisation zone,

and further resource estimation will be carried out.

Anglo Asian Vice-President, Stephen Westhead, commented:

"These results represent an important step in our strategy of

transitioning to a mid-tier miner, as Xarxar is expected to

contribute a considerable amount of annual copper production to our

portfolio. The initial study and exploration have delivered

significant upside potential. The Company is enthused by the

positive results and potential for advancing a 100,000 tonne plus

copper metal project towards the production target. The project's

development options, including mining, processing and in-situ

recovery, are currently being assessed. The rock mass properties,

the presence of copper and molybdenum minerals and the geological

setting suggest a porphyry formation."

Block model of the Xarxar deposit

A preliminary three-dimensional dynamic block model has been

completed (Figure 1), which will be updated as further drilling

takes place. A drill hole database has been set up, consisting of

Anglo Asian and AzerGold CJSC drill results. The model shows that

copper mineralisation exhibits encouraging continuity.

Figure 1: Block model of Xarxar showing a cross-section through

the three-dimensional model

Mineralisation modelling was carried out within a 0.1 per cent.

copper shell and grade-tonnage estimates were made using various

cut-off grades. The range of the contained amounts of copper, based

on mineralisation above certain depths, is as follows:

Above level 1,200 Above level

metres 1,000 metres

------------------------- ---------- ------------- ------------------------- ---------- ---------

cut-off Mineralisation Resultant Metal cut-off Mineralisation Resultant Metal

(Cu (tonnes) (Cu %) (Cu tonnes) (Cu (tonnes) (Cu (Cu

%) %) %) tonnes)

--------------- ---------- ------------- -------- ---------- ---------

0.15 41,394,352 0.34 140,741 0.15 64,915,146 0.32 207,728

--------------- ---------- ------------- -------- --------------- ---------- ---------

0.30 17,095,640 0.53 90,607 0.30 23,428,520 0.51 119,485

--------------- ---------- ------------- -------- --------------- ---------- ---------

0.45 8,150,558 0.72 58,684 0.45 10,212,706 0.71 72,510

--------------- ---------- ------------- -------- --------------- ---------- ---------

Pit optimisation modelling

Preliminary optimisation modelling to test the economics for

various mining options is underway to initially assess the open pit

potential. The optimisation modelling shows that open pit mining

would be economically viable at the Xarxar deposit. Studies are

also ongoing to assess underground mining options to yield the

optimum mix of open pit and underground mining.

The base case for the open pit optimisation used a copper price

of $8,000. Copper metal prices within the range of $5,000 - $20,000

per tonne were used to test the sensitivity of the open pit to

copper metal prices and mineral zone geometry. Two pit depths were

used as a "minimum" and "maximum" elevation to establish the amount

of mineralisation located beneath the various intervening pit

floors. Significant mineralisation is located below the open pit

floor in the base case. This will allow for the optimisation of the

combined open pit and underground mining approach. The results of

these initial open pit evaluations are shown in Figure 2.

Figure 2: Cross section showing the various pit shell profiles

at various copper prices

The results of the initial open pit optimisation study (Base

Case 'OP 3' using a copper price of $8,000) and sensitivities are

shown in the following table:

OPTION ORE WASTE STRIPPING COPPER COPPER BOTTOM DEPTH

(copper price/tonne) (tonnes) (tonnes) RATIO (tonnes) (per (metres)

cent.)

OP1 - $5,000 7,362,221 21,685,157 2.9 51,513 0.70 150

----------- ------------ ---------- ---------- -------- -------------

OP2 - $7,500 17,334,016 29,376,561 1.7 85,573 0.49 190

----------- ------------ ---------- ---------- -------- -------------

Base Case OP3

- $8000 20,116,723 31,982,108 1.6 93,408 0.46 205

----------- ------------ ---------- ---------- -------- -------------

OP4 - $10,000 29,176,251 39,932,179 1.4 114,732 0.39 240

----------- ------------ ---------- ---------- -------- -------------

OP5 - $12,000 36,224,004 52,831,917 1.5 130,876 0.36 270

----------- ------------ ---------- ---------- -------- -------------

OP6 - $15,000 43,739,585 76,392,038 1.7 147,663 0.34 310

----------- ------------ ---------- ---------- -------- -------------

OP7 - $20,000 53,028,965 131,403,872 2.5 169,064 0.32 360

----------- ------------ ---------- ---------- -------- -------------

Further drilling targeting both infill and extension of

mineralisation is ongoing. In addition, a detailed metallurgical

study using the microscopic study of thin and polished sections of

rock, along with phase analysis, will be used to determine the

supergene and enrichment versus hypogene mineral assemblages. In

parallel, Anglo Asian is carrying out metallurgical test work to

assess processing options, which include flotation to produce

copper concentrate, or copper heap and bacterial leaching, followed

by solvent extraction and electrowinning (SX-EW) to produce cathode

copper metal.

Appendix One

Geological exploration work carried out at Xarxar

Exploration activity carried out to the end of February 2023 by

Anglo Asian on the Xarxar deposit include the following:

-- 12 surface trench and 36 outcrop samples

-- 19 diamond drill core holes with a total length of 6,696 metres

-- 9 reverse circulation holes with a total length of 830 metres

-- 472 metres of underground development with a section area 3.5 metres by 3.5 metres

-- 327 underground channel samples with total length of 333 metres

-- All drill holes and channel samples have been geologically

logged, sampled, assayed and loaded to the new database

-- All data (Anglo Asian and historical) converted to "new

standard" database system which will be imported to Seequent "MX

deposit" software

-- Geotechnical study of the deposit completed by an independent

engineering contractor, including geotechnical core logging,

laboratory analysis and surface structural mapping.

-- Mineralogical-petrological and X-ray diffraction (XRD) alteration studies and lithological-structural-alteration mapping of the deposit is in progress.

Utilising the geological model geometry, further drilling has

been planned to test extensions of mineralisation and refine the

understanding of the geological structure.

The Xarxar deposit hosts a range of copper minerals, including

malachite, azurite, chalcocite, bornite, neotocite, chalcopyrite,

rarely molybdenite and pyrite minerals associated with intense

argillic and phyllic alteration. The maximum and average grades of

copper by sample method are shown below:

Type of sampling Number of Maximum copper Average copper

assays percentage percentage

Surface trench 56 2.15 1.33

---------- --------------- ---------------

Reverse circulation drilling 830 1.28 0.49

---------- --------------- ---------------

Core drilling 6,661 7.39 0.49

---------- --------------- ---------------

Underground channel 327 2.57 0.57

---------- --------------- ---------------

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, which was incorporated into UK law by

the European Union (Withdrawal) Act 2018, until the release of this

announcement.

All references to "$" are to United States dollars.

For further information please contact:

Anglo Asian Mining plc

Tel: +994 12 596

Reza Vaziri, Chief Executive Officer 3350

Tel: +994 502 910

Bill Morgan, Chief Financial Officer 400

Tel: +994 502 916

Stephen Westhead, Vice President 894

SP Angel Corporate Finance LLP (Nominated Tel: +44 (0) 20

Adviser and Broker) 3470 0470

Ewan Leggat

Adam Cowl

Hudson Sandler (Financial PR) Tel: +44 0) 20 7796

Charlie Jack 4133

Harry Griffiths

Competent Person Statement

The information in the announcement that relates to exploration

results, minerals resources and ore reserves is based on

information compiled by Dr Stephen Westhead, who is a full-time

employee of Anglo Asian Mining with the position of Vice-President,

who is a Fellow of The Geological Society of London, a Chartered

Geologist, Fellow of the Society of Economic Geologists, Fellow of

the Institute of Materials, Minerals and Mining and a Member of the

Institute of Directors.

Stephen Westhead has sufficient experience that is relevant to

the style of mineralisation and type of deposit under consideration

and to the activity being undertaken to qualify as a Competent

Person as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Stephen Westhead consents to the inclusion in the

announcement of the matters based on his information in the form

and context in which it appears.

Stephen Westhead has sufficient experience, relevant to the

style of mineralisation and type of deposit under consideration and

to the activity that he is undertaking, to qualify as a "competent

person" as defined by the AIM rules. Stephen Westhead has reviewed

the mineral resources included in this announcement. For the

avoidance of doubt, resources and economically extractable copper

figures in this notification are not based on a Standard for the

reporting of reserves and resources, such as JORC, as defined in

the AIM Rules for Companies.

About Anglo Asian Mining

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer in south-west Asia with a broad portfolio of production

and exploration assets in Azerbaijan. The Company produced 57,618

gold equivalent ounces ("GEOs") for the year ended 31 December

2022.

In December 2021, the Company undertook a private placement

which acquired 19.8 per cent. of Libero Copper & Gold

Corporation ("Libero"). Libero is listed on the TSX Venture

Exchange in Canada and owns, or has the option to acquire, several

copper exploration properties in North and South America, including

Mocoa in Colombia, one of the world's largest undeveloped

copper-molybdenum resources. Two further follow-on investments have

been made in Libero to maintain the Company's shareholding at 19.8

per cent.

On 5 July 2022, the Parliament of Azerbaijan ratified amendments

to the Company's Production Sharing Agreement, which granted it

legal title to three additional concessions with a combined area of

882 square kilometres, including the Garadagh porphyry copper

deposit, with a Soviet classified resource of over 300,000 tonnes

of copper. https://www.angloasianmining.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLGZGMFRKZGFZM

(END) Dow Jones Newswires

March 16, 2023 03:00 ET (07:00 GMT)

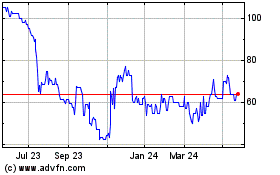

Anglo Asian (AQSE:AAZ.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

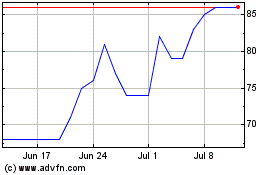

Anglo Asian (AQSE:AAZ.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025